a.

To determine:

The true promised payment under contract including the deferred payments with interest.

Explanation:

The true promised payment under the contract including the deferred payment for 20 years is computed below:

| Year | Amount ($ in millions) |

|---|---|

| 1 | 18 |

| 2 | 19 |

| 3 | 19 |

| 4 | 19 |

| 5 | 21 |

| 6 | 19 |

| 7 | 23 |

| 8 | 27 |

| 9 | 27 |

| 10 | 27 |

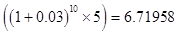

| 11 | 6.71958 |

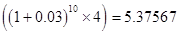

| 12 | 5.37567 |

| 13 | 4.03175 |

| 14 | 4.03175 |

| 15 | 4.03175 |

| 16 | 4.03175 |

| 17 | 4.03175 |

| 18 | 4.03175 |

| 19 | 4.03175 |

| 20 | 4.03175 |

| Total | 263.3488 |

Working note:

Computation of amount including bonus.

The amount including bonus amount is computed as below:

Year| Amount ($ in millions) | Bonus ($ in millions) | Total ($ in millions

|

|---|---|---|

| 16 | 2 | 18 |

| 17 | 2 | 19 |

| 17 | 2 | 19 |

| 17 | 2 | 19 |

| 19 | 2 | 21 |

| 19 | 19 | |

| 23 | 23 | |

| 27 | 27 | |

| 27 | 27 | |

| 27 | 27 |

Computation of amount including interest

The amount without interest and with interest is given below:

| Year | Amount without interest ($ in millions) | Amount with 3% interest ($ in millions) |

|---|---|---|

| 11 | 5 |  |

| 12 | 4 |  |

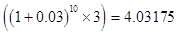

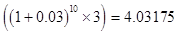

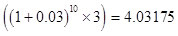

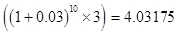

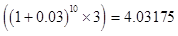

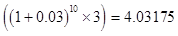

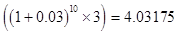

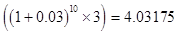

| 13 | 3 |  |

| 14 | 3 |  |

| 15 | 3 |  |

| 16 | 3 |  |

| 17 | 3 |  |

| 18 | 3 |  |

| 19 | 3 |  |

| 20 | 3 |  |

Conclusion:

Therefore, the total promised amount under the contract is $263.3488.

b.

To prepare: The timeline of all the payments.

c.

To determine:

The present value of the contract.

d.

To determine:

The difference after comparing present value of contract with quoted value.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Fundamentals of Corporate Finance (3rd Edition) (Pearson Series in Finance)

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education