Concept explainers

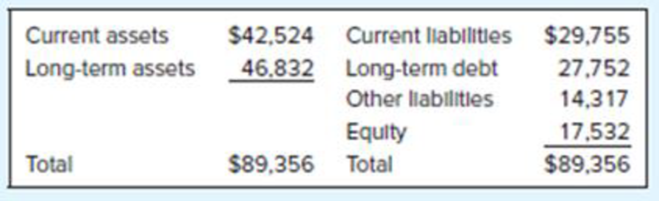

Market Value Added. Here is a simplified balance sheet for Locust Farming:

Locust has 657 million shares outstanding with a market price of $83 a share.

- a. Calculate the company’s market value added.

- b. Calculate the market-to-book ratio.

- c. How much value has the company created for its shareholders?

a.

To calculate: The added market value.

Explanation of Solution

Computation of the market value added:

Hence, the market value added is $36.999.

b.

To compute: The market to book ratio.

Explanation of Solution

Computation of the market to book ratio:

Hence, the market to book ratio is 3.11.

c.

To discuss: The value created by the company to their shareholders.

Explanation of Solution

The company has maximized the value of the investment in equity by 311%.

Want to see more full solutions like this?

Chapter 4 Solutions

EBK FUNDAMENTALS OF CORPORATE FINANCE

- Using the following data, calculate the firm’s price earnings ratio. Show your work and briefly explain what this means to an investor. Net Income $68.2 million Market Capitalization $620 million Earnings per share $8.20arrow_forward5. Profitability ratios Profitability ratios help in the analysis of the combined impact of liquidity ratios, asset management ratios, and debt management ratios on the operating performance of a firm. Your boss has asked you to calculate the profitability ratios of Diusitech Inc. and make comments on its second-year performance as compared with its first-year performance. The following shows Diusitech Inc.'s income statement for the last two years. The company had assets of $4,700 million in the first year and $7,518 million in the second year. Common equity was equal to $2,500 million in the first year, and the company distributed 100% of its earnings out as dividends during the first and the second years. In addition, the firm did not issue new stock during either year. Diusitech Inc. Income Statement For the Year Ending on December 31 (Millions of dollars) Year 2 Year 1 2,540 2,000 1,610 1,495 127 80 1,737 803 80 723 181 542 Net Sales Operating costs except depreciation and…arrow_forwardAnalyze and compare Bank of America and Wells Fargo Bank of America Corporation (BAC) and Wells Fargo Company (WFC) are two large financial services companies. The following data (in millions) were taken from a recent years financial statements for both companies: a. Compute the earnings per share for both companies. Round to the nearest cent. a. Which company appears to be more profitable on an earnings-per-share basis? b. Which company would you expect to have the larger quoted market price?arrow_forward

- Albion Inc. provided the following information for its most recent year of operations. The tax rate is 40%. Required: 1. Compute the following: (a) return on sales, (b) return on assets, (c) return on stockholders equity, (d) earnings per share, (e) price-earnings ratio, (f) dividend yield, and (g) dividend payout ratio. 2. CONCEPTUAL CONNECTION If you were considering purchasing stock in Albion, which of the above ratios would be of most interest to you? Explain.arrow_forwardAs the assistant to the CFO of Johnstone Inc., you must estimate its cost of common equity. You have been provided with the following data: D0 = $0.80; P0 = $22.50; and g = 8.00% (constant). Based on the DCF approach, what is the cost of common from retained earnings? Please show formula and answerarrow_forwardAccounting choose the correct answer: a) The analysis of a firm's profitably includes all of the following Except: 1- Return on Equity. 2- Receivable turnover. 3- Fixed asset turnover. b) If a company's P/E ratio is 12.5 and the company's share price is $17.50 per share what is the company's EPS? 1-$ 0.40 2-$ 5 3-$ 1.40arrow_forward

- using the table find the folloing for the four firms: Enterprise value to EBITDA Ratio Price-Earnings multiole PEG raio Cpmpany Market Value (OMR million) Net Income (OMR million) Earnings Growth Market Value of Equity (OMR million) Market Value of Debt (OMR million) Cash (OMR million) EBITDA (OMR million) Happy 117.95 22.5 4% 53.07 64.87 41.25 43.85 Smart 112.35 20.25 4.5% 59.53 52. 79 45 44.88 Kind 116.26 21 4.65% 69.76 46.5 63.95 28.20 Cheerful 120 24 5% 42 78 62.4 44.32arrow_forwardMartin Tucker Enterprises has total common equity of $645,500, sales of $1.15 million, and a profit margin of 3.6 percent. What is the return on equity? Can the calculator and excel solution be provided?arrow_forward1. The Wilson Corporation has the following relationships:Sales/Total assets 2.0Return on assets (ROA) 4.0%Return on equity (ROE) 6.0%What is Wilson’s profit margin and debt ratio?arrow_forward

- If we know that a firm has a net profit margin of 4.3%, total asset turnover of 0.77, and a financial leverage multiplier of 1.37, what is its ROE? What is the advantage to using the DuPont system to calculate ROE over the direct calculation of earnings available for common stockholders divided by common stock equity? The firm's ROE is %. (Round to two decimal places.) What is the advantage to using the DuPont system to calculate ROE over the direct calculation of earnings available for common stockholders divided by common stock equity? (Select from the drop-down menus.) Observe the modified DuPont formula (see) and notice that each component can be compared with industry standards to assess the firm's performance. Therefore, the advantage of using the Dupont system is that ROE is broken into three distinct components. Starting at the right we see how has increased assets over the owners' original equity. Next, moving to the left, we see how efficiently the firm used its sales. to…arrow_forwardA company hired you as a consultant to help estimate its cost of capital. You have obtained the following data: D0 = $2.45; P0 = $28.96; and g = 4.06% (constant). What is the cost of equity from retained earnings? Do not round your intermediate calculations. Express your answer as a percent rounded to two decimal places.arrow_forwardYou've collected the following information about Caccamisse, Incorporated: Sales Net income Dividends Total debt Total equity = a. Sustainable growth rate b. Additional borrowing c. Growth rate = = = = $ 330,000 $ 18,700 $ 7,500 $ 70,000 $ 101,000 a. What is the sustainable growth rate for the company? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. Assuming it grows at this rate, how much new borrowing will take place in the coming year, assuming a constant debt-equity ratio? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. What growth rate could be supported with no outside financing at all? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. % %arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage