Loose Leaf for Foundations of Financial Management Format: Loose-leaf

17th Edition

ISBN: 9781260464924

Author: BLOCK

Publisher: Mcgraw Hill Publishers

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 17P

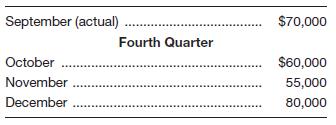

J. Lo’s Clothiers has

Experience has shown that 30 percent of sales are collected in the month of sale, 60 percent are collected in the following month, and 10 percent are never collected.

Prepare a schedule of cash receipts for J. Lo’s Clothiers covering the fourth quarter (October through December).

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

J. Lo's Clothiers has forecast credit sales for the fourth quarter of the year:

Fourth Quarter

September (actual)

October

November

December

Credit sales

Collections:

Experience has shown that 25 percent of sales are collected in the month of sale, 65 percent are collected in the following month, and

10 percent are never collected.

Prepare a schedule of cash receipts for J. Lo's Clothiers covering the fourth quarter (October through December).

In month of sales

One month after sales

$ 71,000

$ 61,000

56,000

81,000

Total cash receipts

J.Lo's Clothiers

September

October

November

December

J. Lo's Clothiers has forecast credit sales for the fourth quarter of the year:

September (actual)

October

November

December

Fourth Quarter

Credit sales

Collections:

Experience has shown that 15 percent of sales are collected in the month of sale, 65 percent are collected in the following month, and

20 percent are never collected.

Prepare a schedule of cash receipts for J. Lo's Clothiers covering the fourth quarter (October through December).

In month of sales

One month after sales

$ 51,000

$ 41,000

36,000

61,000

Total cash receipts

J. Lo's Clothiers

September

October

November

December

Marlin Company projects the follwoing sales for the first thre months of the year: $11500 in January; $10100 in February and $10400 in March. the company expects 60% of the sales to be cash and the remainder on accounts. Sales on account are collected 50% in the month of the sale and 50% in the following month. The Account Receivable account has a zero on January.

1. Prepare a schedule of cash receipts for Marlin for January, February and March. What is the balance in Accounts Receivable on March 31?

2. Prepare a revised schedule of cash receipts if receipts from sales on account are 70% in the month of the sale, 20% in the following month of the sale and 10% in the second month of the sale. What is the balance in Accounts Receivable on March 31?

Chapter 4 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

Ch. 4 - What are the basic benefits and purposes of...Ch. 4 - Explain how the collections and purchases...Ch. 4 - With inflation, what are the implications of using...Ch. 4 - Explain the relationship between inventory...Ch. 4 - Prob. 5DQCh. 4 - Discuss the advantage and disadvantage of level...Ch. 4 - What conditions would help make a percent-of-sales...Ch. 4 - Prob. 1PCh. 4 - Philip Morris expects the sales for his clothing...Ch. 4 - Galehouse Gas Stations Inc. expects sales to...

Ch. 4 - The Alliance Corp. expects to sell the following...Ch. 4 - Prob. 5PCh. 4 - Cyber Security Systems had sales of 3,500 units at...Ch. 4 - Dodge Ball Bearings had sales of 15,000 units at...Ch. 4 - Sales for Ross Pro’s Sports Equipment are expected...Ch. 4 - Vitale Hair Spray had sales of 13,000 units in...Ch. 4 - Delsing Plumbing Company has beginning inventory...Ch. 4 - On December 31 of last year, Wolfson Corporation...Ch. 4 - At the end of January, Higgins Data Systems had an...Ch. 4 - At the end of January, Mineral Labs had an...Ch. 4 - Convex Mechanical Supplies produces a product with...Ch. 4 - The Bradley Corporation produces a product with...Ch. 4 - Sprint Shoes Inc. had a beginning inventory of...Ch. 4 - J. Lo’s Clothiers has forecast credit sales for...Ch. 4 - Simpson Glove Company has made the following sales...Ch. 4 - Watt’s Lighting Stores made the following sales...Ch. 4 - Ultravision Inc. anticipates sales of $290,000...Ch. 4 - The Denver Corporation has forecast the following...Ch. 4 - Wright Lighting Fixtures forecasts its sales in...Ch. 4 - The Volt Battery Company has forecast its sales in...Ch. 4 - Graham Potato Company has projected sales of...Ch. 4 - Harry’s Carryout Stores has eight locations. The...Ch. 4 - Archer Electronics Company’s actual sales and...Ch. 4 - Prob. 27PCh. 4 - The Manning Company has financial statements as...Ch. 4 - Conn Man’s Shops, a national clothing chain, had...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Halifax Shoes has 30% of its sales in cash and the remainder on credit. Of the credit sales, 65% is collected in the month of sale, 25% is collected the month after the sale, and 5% is collected the second month after the sale. How much cash will be collected in August if sales are estimated as $75,000 in June, $65,000 in July, and $90,000 in August?arrow_forwardMy Aunts Closet Store collects 60% of its accounts receivable in the month of sale and 35% in the month after the sale. Given the following sales, how much cash will be collected in March?arrow_forwardEarthies Shoes has 55% of its sales in cash and the remainder on credit. Of the credit sales, 70% is collected in the month of sale, 15% is collected the month after the sale, and 10% is collected the second month after the sale. How much cash will be collected in June if sales are estimated as $75,000 in April, $65,000 in May, and $90,000 in June?arrow_forward

- Fitbands estimated sales are: What are the balances in accounts receivable for January, February, and March if 65% of sales is collected in the month of sale, 25% is collected the month after the sale, and 10% is second month after the sale?arrow_forwardNonnas Re-Appliance Store collects 55% of its accounts receivable in the month of sale and 40% in the month after the sale. Given the following sales, how much cash will be collected in February?arrow_forwardCash collections for Wax On Candles found that 60% of sales were collected in the month of the sale, 30% was collected the month after the sale, and 10% was collected the second month after the sale. Given the sales shown, how much cash will be collected in January and February?arrow_forward

- Amusement tickets estimated sales are: What are the balances in accounts receivable for April, May, and June if 60% of sales are collected in the month of sale, 30% are collected the month after the sale, and 10% are collected the second month after the sale?arrow_forwardAll Temps has a policy of always paying within the discount period, and each of its suppliers provides a discount of 2% if paid within 10 days of purchase. Because of the purchase policy, 80% of its payments are made in the month of purchase and 20% are made the following month. The direct materials budget provides for purchases of $23,812 in February, $23,127 in March, $21,836 in April, and $28,173 in May.What is the balance in accounts payable for April 30, and May 31?arrow_forwardSports Socks has a policy of always paying within the discount period and each of its suppliers provides a discount of 2% if paid within 10 days of purchase. Because of the purchase policy, 85% of its payments are made in the month of purchase and 15% are made the following month. The direct materials budget provides for purchases of $129,582 in November, $294,872 in December, $239,582 in January, and $234,837 in February. What is the balance in accounts payable for January 31, and February 28?arrow_forward

- Wells Company reports the following sales forecast: September, $55,000; October, $66,000; and November, $80,000. All sales are on account. Collections of credit sales are received as follows: 25% in the month of sale, 60% in the first month after sale, and 10% in the second month after sale. 5% of all credit sales are written off as uncollectible. Prepare a schedule of cash receipts for November.arrow_forwardJane MacDonald, Carroll Financial Analyst, prepared the following sales and cash disbursement estimates for the February-June period of this year. Month Sales Cash Disbursements February 500 400 March 600 300 April 400 600 May 200 500 June 200 200 MacDonald indicates that 30% of sales have been, historically, in cash. 70% of credit sales are collected one month after the sale, and the remaining 30% are collected two months after the sale. The company wants to keep a minimum final balance in its $ 25 cash account. Balances in excess of this amount will be invested in short-term government securities (marketable securities), while any deficits will be financed through short-term bank borrowing (payable securities). The cash balance initially on April 1 is $ 115. Prepare cash budgets for April, May, and June. How much, if any, of the maximum funding would Carroll require to meet its obligations within this three-month period?…arrow_forwardPower Ridge Corporation has forecast credit sales for the fourth quarter of the year as follows: September (actual) October November December Fourth Quarter $66,000 $56,000 51,000 76,000 Experience has shown 30 percent of sales are collected in the month of sale, 65 percent are collected in the following month, and 5 percent are never collected. Prepare a cash receipts schedule for Power Ridge Corporation covering the fourth quarter (October through December). Power ridge corporation Cash Receipts Schedule September $ Sales Collections of Current Sales Collections of prior month's Sales Total cash receipts October $ $ November $ $ December $ $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License