Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

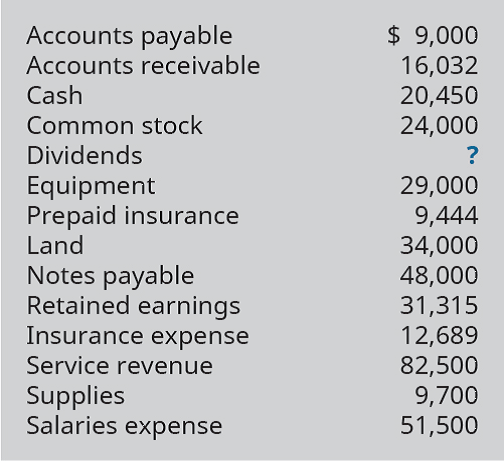

Chapter 4, Problem 14PB

Prepare an adjusted

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

To prepare to write your Portfolio Project, create an annotated bibliography by following these steps:

1. Find five credible external sources to support the ideas in your Module 2 Portfolio Milestone draft.

A credible source is defined as:

a scholarly or peer-reviewed journal article – searching for “intercultural communication theory” in the search box at the top of the CSU Global Library page will take you to a variety of sources that you can use; also, choose a specific theory from our textbook or interactive lectures and search for that term, as well. Some examples of theories you can research, along with research to help you get started, are

Hofstede’s Model of Cultural DimensionsLinks to an external site.

Face Negotiation TheoryLinks to an external site.

Communication Accommodation TheoryLinks to an external site.

Anxiety/Uncertainty Management TheoryLinks to an external site.

Integrative Communication Theory of Cross-Cultural AdaptationLinks to an external site.

Sapir-Whorf…

Building from the Module 2 Critical Thinking assignment about your company’s water purification product and target country market, research the components needed to build the product.

Use the following questions to guide your decisions about production and components, respond to the following topics for this week’s critical thinking assignment.

What does the target country produce and export?

What does the target country import; what are the imports used for?

To what degree does the target country have relevant and cost-effective component manufacturing capabilities?

Does the target country have relevant and cost-effective manufacturing/assembly capabilities to create products of acceptable quality?

If the target country does not have relevant component and manufacturing skills, where will the water purification components/devices be sourced from given the target country’s trade agreements?

How do trade profiles and trade relationships enter into your decision about manufacturing…

The actual cost of direct labor per hour is $17.20, and the standard cost of direct labor per hour is $16.80. The direct labor hours allowed per finished unit is 0.6 hour. During the current period, 6,200 units of finished goods were produced using 4,000 direct labor hours. How much is the direct labor efficiency variance? a. $4,320 favorable b. $4,320 unfavorable c. $4,800 favorable d. $4,800 unfavorable e. $4,704 unfavorable Answer this

Chapter 4 Solutions

Principles of Accounting Volume 1

Ch. 4 - Which of the following is any reporting period...Ch. 4 - Which of the following is the federal, independent...Ch. 4 - Revenues and expenses must be recorded in the...Ch. 4 - Which of the following breaks down company...Ch. 4 - Which of the following is a twelve-month reporting...Ch. 4 - Which type of adjustment occurs when cash is...Ch. 4 - Which type of adjustment occurs when cash is not...Ch. 4 - If an adjustment includes an entry to a payable or...Ch. 4 - If an adjustment includes an entry to Accumulated...Ch. 4 - Rent collected in advance is an example of which...

Ch. 4 - Rent paid in advance is an example of which of the...Ch. 4 - Salaries owed but not yet paid is an example of...Ch. 4 - Revenue earned but not yet collected is an example...Ch. 4 - What adjusting journal entry is needed to record...Ch. 4 - Which of these transactions requires an adjusting...Ch. 4 - What critical purpose does the adjusted trial...Ch. 4 - Which of the following accounts balance would be a...Ch. 4 - On which financial statement would the Supplies...Ch. 4 - On which financial statement would the Dividends...Ch. 4 - On which financial statement would the Accumulated...Ch. 4 - On which two financial statements would the...Ch. 4 - Describe the revenue recognition principle. Give...Ch. 4 - Describe the expense recognition principle...Ch. 4 - What parts of the accounting cycle require...Ch. 4 - Why is the adjusting process needed?Ch. 4 - Name two types of adjusting journal entries that...Ch. 4 - Are there any accounts that would never have an...Ch. 4 - Why do adjusting entries always include both...Ch. 4 - Why are adjusting journal entries needed?Ch. 4 - If the Supplies account had an ending balance of...Ch. 4 - When a company collects cash from customers before...Ch. 4 - If the Prepaid Insurance account had a balance of...Ch. 4 - If adjusting entries include these listed...Ch. 4 - What is the difference between the trial balance...Ch. 4 - Why is the adjusted trial balance trusted as a...Ch. 4 - Indicate on which financial statement the...Ch. 4 - Identify whether each of the following...Ch. 4 - Identify whether each of the following...Ch. 4 - Identify which type of adjustment is indicated by...Ch. 4 - The following accounts were used to make year-end...Ch. 4 - Reviewing insurance policies revealed that a...Ch. 4 - On July 1, a client paid an advance payment...Ch. 4 - Reviewing payroll records indicates that employee...Ch. 4 - Supplies were purchased on January 1, to be used...Ch. 4 - Prepare journal entries to record the following...Ch. 4 - Prepare journal entries to record the following...Ch. 4 - Prepare adjusting journal entries, as needed,...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - From the following Company A adjusted trial...Ch. 4 - Identify whether each of the following...Ch. 4 - Identify whether each of the following...Ch. 4 - Indicate what impact the following adjustments...Ch. 4 - What two accounts are affected by the needed...Ch. 4 - Reviewing insurance policies revealed that a...Ch. 4 - On September 1, a company received an advance...Ch. 4 - Reviewing payroll records indicates that one-fifth...Ch. 4 - On July 1, a client paid an advance payment...Ch. 4 - Prepare journal entries to record the business...Ch. 4 - Prepare journal entries to record the following...Ch. 4 - Prepare adjusting journal entries, as needed,...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - From the following Company B adjusted trial...Ch. 4 - Identify whether each of the following...Ch. 4 - To demonstrate the difference between cash account...Ch. 4 - Identify which type of adjustment is indicated by...Ch. 4 - Identify which type of adjustment is associated...Ch. 4 - Indicate what impact the following adjustments...Ch. 4 - What two accounts are affected by each of these...Ch. 4 - Using the following information: A. make the...Ch. 4 - Use the following account T-balances (assume...Ch. 4 - Use the following account T-balances (assume...Ch. 4 - Prepare journal entries to record the following...Ch. 4 - Prepare journal entries to record the following...Ch. 4 - Determine the amount of cash expended for Salaries...Ch. 4 - Prepare adjusting journal entries, as needed,...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Using the following Company W information, prepare...Ch. 4 - From the following Company Y adjusted trial...Ch. 4 - Identify whether each of the following...Ch. 4 - To demonstrate the difference between cash account...Ch. 4 - Identify which type of adjustment is indicated by...Ch. 4 - Identify which type of adjustment is associated...Ch. 4 - Indicate what impact the following adjustments...Ch. 4 - What two accounts are affected by each of these...Ch. 4 - Using the following information, A. Make the...Ch. 4 - Use the following account T-balances (assume...Ch. 4 - Use the following account T-balances (assume...Ch. 4 - Prepare journal entries to record the following...Ch. 4 - Prepare journal entries to record the following...Ch. 4 - Determine the amount of cash expended for...Ch. 4 - Prepare adjusting journal entries, as needed,...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Prepare an adjusted trial balance from the...Ch. 4 - Using the following Company X information, prepare...Ch. 4 - From the following Company Z adjusted trial...Ch. 4 - Assume you are the controller of a large...Ch. 4 - Assume you are employed as the chief financial...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Indefinite-Life Intangible Asset Impairment. Genius Auto Malls recently conducted its annual impairment review ...

Intermediate Accounting (2nd Edition)

Create an Excel spreadsheet on your own that can make combination forecasts for Problem 18. Create a combinatio...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Determine the FW of the following engineering project when the MARR is 15% per year. Is the project acceptable?...

Engineering Economy (17th Edition)

E2-13 Identifying increases and decreases in accounts and normal balances

Learning Objective 2

Insert the mis...

Horngren's Accounting (12th Edition)

Define cost pool, cost tracing, cost allocation, and cost-allocation base.

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

The cost of capital. Introduction: The cost of capital is the opportunity cost involved in making a specific in...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY