Concept explainers

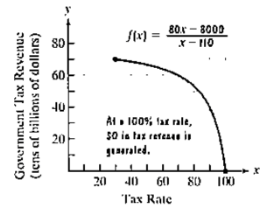

During the 1980s the controversial economist Arthur Laffer promoted the idea that tax increases tend to a reduction in government revenue. Called supply-side economies, the theory uses functions such as

This function models the government tax revenue, f(x). in tens of billions of dollars, in terms of the tax rate, x. The graph of the function is shown. It illustrates tax revenue decreasing quite dramatically as the tax rate increases. At a tax rate of (gasp) 100%. the government takes all our money and no one has an incentive to work. With no income earned, zero dollars in tax revenue is generated.

Use function f andits graph to solve Exercise 55-56

a. find and interpret f(40). identify the solution as a point on the graph of the function.

b. Rewrite the Function by Using long division to perform

Then use this new form of the function to find f(40). Do you obtain the same answer as you did in part (a)? c Is f a polynomial function? Explain your answer.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

College Algebra (Looseleaf) - With Access

- A company determines that its weekly profit from manufacturing and selling x units of a certain item is given by Px=-x3+3x2+2880x-500. Use a graphing utility to find the weekly production rate that will maximize the profit.arrow_forwardAre one-to-one functions either always increasing or always decreasing? Why or why not?arrow_forwardThe graph of fx=1/x is a .arrow_forward

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Trigonometry (MindTap Course List)TrigonometryISBN:9781337278461Author:Ron LarsonPublisher:Cengage Learning

Trigonometry (MindTap Course List)TrigonometryISBN:9781337278461Author:Ron LarsonPublisher:Cengage Learning Algebra for College StudentsAlgebraISBN:9781285195780Author:Jerome E. Kaufmann, Karen L. SchwittersPublisher:Cengage Learning

Algebra for College StudentsAlgebraISBN:9781285195780Author:Jerome E. Kaufmann, Karen L. SchwittersPublisher:Cengage Learning Intermediate AlgebraAlgebraISBN:9781285195728Author:Jerome E. Kaufmann, Karen L. SchwittersPublisher:Cengage LearningAlgebra & Trigonometry with Analytic GeometryAlgebraISBN:9781133382119Author:SwokowskiPublisher:Cengage

Intermediate AlgebraAlgebraISBN:9781285195728Author:Jerome E. Kaufmann, Karen L. SchwittersPublisher:Cengage LearningAlgebra & Trigonometry with Analytic GeometryAlgebraISBN:9781133382119Author:SwokowskiPublisher:Cengage