a.

What the central bank will do with every three primary tools to implement expansionary

a.

Explanation of Solution

The central bank of a country controls the amount of money in circulation in order to maintain the health of the economy. Central banks can regulate the amount of money in circulation by manipulating interest rates, creating a new currency, and imposing

Moreover, in difficult economic times, a central bank may implement an expansionist monetary policy to lower

Federal Reserve System: It is a central bank that looks after the banking system of the country along with the control of its monetary base. The monetary base is the sum of circulating currency and the reserves in the bank.

b.

The graph of the

b.

Explanation of Solution

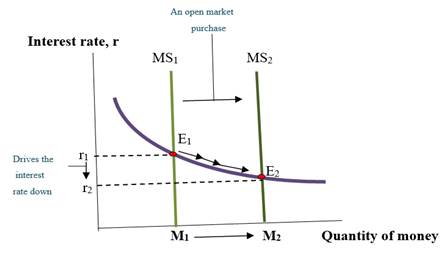

The graph of the money market that shows how the central bank uses expansionary monetary policy:

Graph 1 (pushing the interest rate down to the target rate)

As the above graph shows, the Fed can lower its interest rate to encourage banks to borrow more money if it wishes to give them greater reserves and by exchanging newly issued bank credit for debt instruments purchased on the open market, the Fed can cut interest rates, which maintains the equilibrium position unchanged.

Federal Reserve will purchase T-bills from open market operations so that interest rates can be brought down. This will reduce the interest rate keeping the equilibrium position unchanged.

Federal Reserve System: It is a central bank that looks after the banking system of the country along with the control of its monetary base. The monetary base is the sum of circulating currency and the reserves in the bank.

c.

How interest rates can change the graph which will affect the

c.

Explanation of Solution

A country's money supply does not increase when interest rates do since there is an inverse link between the two. High-interest rates cause the money supply to be low. As the money supply lowers, the price of borrowing rise, making debt more expensive for consumers.

Borrowing money gets more expensive when interest rates increase and therefore, consumer spending and capital investment decline since they would normally be funded by borrowed money. As a result, due to this, aggregate demand declines.

Federal Reserve System: It is a central bank that looks after the banking system of the country along with the control of its monetary base. The monetary base is the sum of circulating currency and the reserves in the bank.

d.

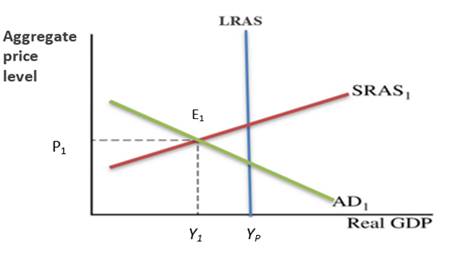

The graph of aggregate demand and supply that shows the effect of expansionary monetary policy on aggregate output in the short run.

d.

Explanation of Solution

In the graph, the horizontal axis represents the real

On the graph, the equilibrium is found at the point where the SRAS curve cuts the AD curve by labeling it E1.

From the graph it is clear that at least one price is rigid, aggregate supply slopes upward in the short run and secondly, SRAS indicates that unemployment and inflation have a short-term tradeoff. Because increasing output results in higher inflation.

Federal Reserve System: It is a central bank that looks after the banking system of the country along with the control of its monetary base. The monetary base is the sum of circulating currency and the reserves in the bank.

Chapter 31 Solutions

Krugman's Economics For The Ap® Course

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education