Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

12th Edition

ISBN: 9781259144387

Author: Richard A Brealey, Stewart C Myers, Franklin Allen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Question

Chapter 31, Problem 1PS

Summary Introduction

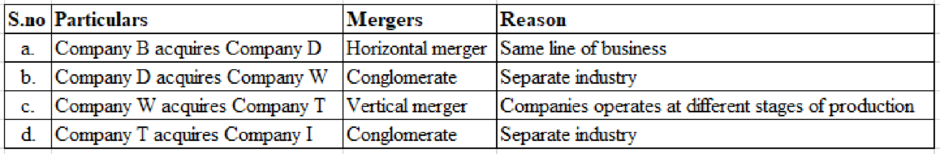

To determine: Whether the given hypothetical mergers vertical, horizontal and conglomerate.

Expert Solution & Answer

Explanation of Solution

Whether the given hypothetical mergers vertical, horizontal and conglomerate:

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

2. Types of mergers

Mergers often are classified according to the merger's participants and their lines of business. Identify each of the following four types of mergers:

Description

Motive for Merger

A merger between the manufacturer and its supplier of raw materials

A merger between an electrical appliance company and a personal hygiene company

A merger between two retail giants producing the same type of clothing

A merger between two technology firms that have no prior existing relationship and are

not competing with each other

If McDonald's were to merge with Burger King, the merger would be described as a:

O vertical merger

O horizontal merger

conglomerate merger

O congeneric merger

A(n) ________________ occurs when the management of the target company purchases a controlling interest in that company and the company incurs a significant amount of debt as a result.

a.

greenmail

b.

statutory merger

c.

poison pill

d.

leveraged buyout

Which of the following statements is most CORRECT?

Oa. The primary rationale for most operating mergers is synergy.

Ob. In most mergers, the benefits of synergy and the premium the acquirer pays over the market price are summed and then

divided equally between the shareholders of the acquiring and target firms.

Oc. Financial theory says that the choice of how to pay for a merger is really irrelevant because, although it may affect the

firm's capital structure, it will not affect its overall required rate of return.

Od. The basic rationale for any financial merger is synergy and, thus, the estimation of pro forma cash flows is the single most

important part of the analysis.

Oe. The acquiring firm's required rate of return in most horizontal mergers will not be affected, because the 2 firms will have

similar betas.

Chapter 31 Solutions

Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Ch. 31 - Prob. 1PSCh. 31 - Prob. 2PSCh. 31 - Prob. 3PSCh. 31 - Taxation Which of the following transactions are...Ch. 31 - Prob. 5PSCh. 31 - Prob. 6PSCh. 31 - Prob. 9PSCh. 31 - Merger gains and costs Sometimes the stock price...Ch. 31 - Merger motives Suppose you obtain special...Ch. 31 - Prob. 12PS

Knowledge Booster

Similar questions

- The following are sentences relating to types of mergers and acquisitions. Which is/are true? [S1] Both horizontal and product-extension types of M&A involve catering to the same market group before and after the M&A. [S2] A vertical M&A involves a supplier or buyer of the acting firm as the target firm.a. Only S1 is true.b. Only S2 is true.c. Neither is true.d. Both are true.arrow_forwardExplain how purchase accounting is implementedin a merger. Does the accounting profession nowrequire this method? How is any premium that theacquiring firm paid over the acquired firm’s bookvalue treated subsequent to a merger?arrow_forwardBMW Motors Corp. wants to acquire all the assets of MWB Corp. BMW plans to pay for the assets by issuing its own corporate stock. BMW’s board of directors has already approved the merger. In what circumstances would the approval of BMX’s shareholders be required for this merger?Is the approval of MWB’s shareholders necessary? Explain.arrow_forward

- Which one of the following statements correctly applies to a merger? Multiple Choice The acquiring firm does not have to seek approval for the merger from its shareholders. The shareholders of the target firm must approve the merger. The acquiring firm will acquire the assets but not the debt of the target firm. The merged firm will have a new company name. The titles to individual assets of the target firm must be transferred into the acquiring firm's name.arrow_forward1. Company S and Company T combine to form a new Company ST by pooling all their assets and liabilities and issuing new ST shares to all shareholders in proportion to their previous shareholdings. How this transaction should be categorised? a) Merger b) Acquisition c) Spin-off d) De-mergerarrow_forwardTRUE OR FALSE 1. The merger of two completely unrelated enterprises is referred to as a congeneric merger, however, the merger of somewhat related companies is referred to as a conglomerate merger of somewhat related companies is referred to as conglomerate merger. 2. if there is sufficient proof that the acquisition has been made for a business purpose and the shareholders of the target firm will be compensated with voting shareholders of the target firm will be compensated with voting shares in the acquiring firm, the acquisition will be non-taxable. 3. with cash consideration, the stockholders of the target firm share the gains and losses of acquisition and vice-versa. 4. A merger is the total absorption of one firm by another, however with a consolidation an entirely new firm is created. 5. A white knight is a friendly suitor that a target firm turns to as an alternative to a hostile bidder.arrow_forward

- What is the difference between an operating merger and a financial merger?arrow_forwardWhy might two companies choose to form a strategicalliance rather than pursue a merger or an acquisition?arrow_forwardDescribe some of the positives and negatives from the point of view of both the acquirer and the target in a merger. What is the usual impact on the stock prices of each?arrow_forward

- Consider the following data in relation to a proposed acquisition, where Firm B will take over Firm A in a horizontal takeover. Pre-merger Value A $550m Pre-merger Value B $420m Post-merger Value A + B $1,150m Cash Offer $580m Share Offer 52% of Shares in A + B Estimate the gains available from the merger. Estimate the value of the merger to firm A’s shareholders under both the cash and share offer. Estimate the value of the merger to firm B’s shareholders under both the cash and share offer. Which offer will predominate, cash or shares, if the shareholders of A are given the choice?arrow_forwardStanley works and Black & Deckers announced their merger on November 02, 2009. How antitrust laws and company's decision in terms of vertical and horizontal mergers played their part in the merger?arrow_forwardWhich of the following LEAST accurately describes the advantages of specific types of mergers and acquisitions?a. The catch-all term for the benefits from M&As is synergy.b. A diversified group of business may further acquire other businesses in a conglomerate type of acquisition.c. The acquisition of an entity outside the industry and supporting services will result to decrease in cost of production of the acquirer.d. Financial advantages of M&A include decreased operating costs, increased financial capacity, and combined sales.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning