Managerial Accounting

16th Edition

ISBN: 9781259995484

Author: Ray Garrison

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 3E

EXERCISE 3-3 Schedules of Cost of Goods Manufactured and Cost of Goods Sold LO3-3

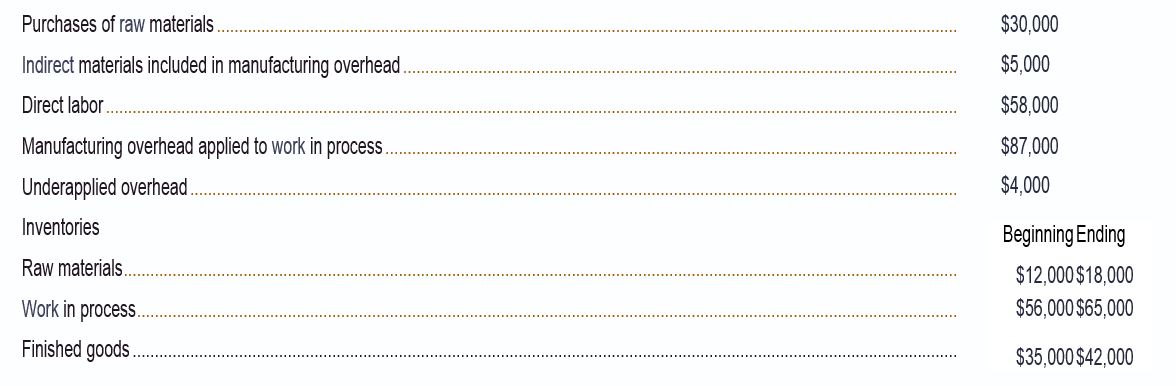

Primare Corporation has provided the following data concerning last month's manufacturing operations.

Required:

- Prepare a schedule of cost of goods manufactured for the month.

- Prepare a schedule of cost of goods sold for the month. Assume the underapplied or overapplied

overhead is closed to Cost of Goods Sold.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Schedules of Cost of Goods Manufactured and Cost of Goods Sold

Primare Corporation has provided the following data concerning last month’s manufacturing operations.

Required:

a. Prepare a schedule of cost of goods manufactured for the month.

b. Prepare a schedule of cost of goods sold for the month. Assume the underapplied or overapplied overhead is closed to Cost of Goods Sold.

Answer Problem #8 : items 27 & 28

Problem 3: Lederman Inc. has provided the following data for the month of April:

Beginning

$12,000

$27,000

Inventories

Work in process...

Finished goods....

Additional Information:

Direct materials..

Direct labor costs..

Manufacturing overhead cost incurred......

Manufacturing overhead cost applied to WIP

Required:

a. Determine costs of goods manufactured for april

b. Was the overhead underapplied or overapplied? By how much?

$51,000

$91,000

Ending

$16,000

$25,000

$60,000

$59,000

Chapter 3 Solutions

Managerial Accounting

Ch. 3.A - EXERCISE 3A-1 Transaction Analysis LO3-5 Carmen...Ch. 3.A - EXERCISE 3A-2 Transaction Analysis LO3-5 Adams...Ch. 3.A - EXERCISE 3A-3 Transaction Analysis LO3-5 Dixon...Ch. 3.A - PROBLEM 3A-4 Transaction Analysis LO3-5 Morrison...Ch. 3.A - PROBLEM 3A-5 Transaction Analysis LO3-5 Star...Ch. 3.A -

PROBLEM 3A-6 Transaction Analysis LO3-5

Brooks...Ch. 3 - Prob. 1QCh. 3 - Prob. 2QCh. 3 - What is underapplied overhead Overapplied...Ch. 3 - 3-4 Provide two reasons why overhead might be...

Ch. 3 - Prob. 5QCh. 3 - How do you compute the raw materials used in...Ch. 3 - Prob. 7QCh. 3 - How do you compute the cost of goods manufactured?Ch. 3 - Prob. 9QCh. 3 - Prob. 10QCh. 3 - Prob. 1AECh. 3 - Prob. 2AECh. 3 - Prob. 3AECh. 3 - Prob. 4AECh. 3 - Prob. 1F15Ch. 3 - Prob. 2F15Ch. 3 - Bunnell Corporation is a manufacturer that uses...Ch. 3 - Prob. 4F15Ch. 3 - Prob. 5F15Ch. 3 - Bunnell Corporation is a manufacturer that uses...Ch. 3 - Prob. 7F15Ch. 3 - Prob. 8F15Ch. 3 - Prob. 9F15Ch. 3 - Prob. 10F15Ch. 3 - Bunnell Corporation is a manufacturer that uses...Ch. 3 - Prob. 12F15Ch. 3 - Prob. 13F15Ch. 3 - Prob. 14F15Ch. 3 - Prob. 15F15Ch. 3 - EXERCISE 3-1 Prepare Journal Entries LO3-1 Lamed...Ch. 3 - Prob. 2ECh. 3 - EXERCISE 3-3 Schedules of Cost of Goods...Ch. 3 - EXERCISE 3-4 Underapplied and Overapplied Overhead...Ch. 3 - Prob. 5ECh. 3 - EXERCISE 3-6 Schedules of Cost of Goods...Ch. 3 - (

$

15,000...Ch. 3 - EXERCISE 3-8 Applying Overhead: Journal Entries;...Ch. 3 - Prob. 9ECh. 3 - Prob. 10ECh. 3 -

PROBLEM 3-11: T-Account Analysis of Cost Flows...Ch. 3 - Prob. 12PCh. 3 - PROBLEM 3-13 Schedules of Cost of Goods...Ch. 3 - Prob. 14PCh. 3 -

PROBLEM 3-15 Journal Entries; T-Accounts;...Ch. 3 - Prob. 16PCh. 3 - Prob. 17PCh. 3 - Prob. 18C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- (Appendix 3A) Method of Least Squares Using Computer Spreadsheet Program The controller for Beckham Company believes that the number of direct labor hours is associated with overhead cost. He collected the following data on the number of direct labor hours and associated factory overhead cost for the months of January through August. Required: 1. Using a computer spreadsheet program such as Excel, run a regression on these data. Print out your results. 2. Using your results from Requirement 1, write the cost formula for overhead cost. (Note: Round the fixed cost to the nearest dollar and the variable rate to the nearest cent.) 3. CONCEPTUAL CONNECTION What is R2 based on your results? Do you think that the number of direct labor hours is a good predictor of factory overhead cost? 4. Assuming that expected September direct labor hours are 700, what is expected factory overhead cost using the cost formula in Requirement 2?arrow_forwardPrimare Corporation has provided the following data concerning last month's manufacturing operations. Purchases of raw materials Indirect materials used in production $ 31,000 $ 4,570 Direct labor $ 59,000 Manufacturing overhead applied to work in process Underapplied overhead $ 88,200 $ 4,150 Inventories Beginning Raw materials $ 11,300 Ending $ 18,200 Work in process $ 54,200 $ 65,000 Finished goods $ 33,200 $ 42,900 Required: 1. Prepare a schedule of cost of goods manufactured for the month. 2. Prepare a schedule of cost of goods sold for the month. Assume the underapplied or overapplied overhead is closed to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a schedule of cost of goods manufactured for the month. Primare Corporation Schedule of Cost of Goods Manufactured Direct materials: Total raw materials available Raw materials used in production Direct materials used in production Total manufacturing costs added…arrow_forwardPrepare a schedule of cost of goods manufactured.arrow_forward

- Problem 1.b.: Computation of Costs of Goods Manufactured (COGM).Akari Inc. provided the following information for its work-in-process inventory account at the end of the current month.Work-in-process Inventory (WIP)Accounts $ Accounts $Beginning balance $19,500 COGM ?Direct materials (DM) $76,200Direct labor (DL) $120,000MOH allocated $72,000Ending Balance $24,300Required: Compute the Costs of Goods Manufactured (COGM) at the end of the current month.Solution: Formula:Beginning WIP+ TMC (total manufacturing costs) for the periodDM usedDL incurredMOH allocatedTMC in WIP- Ending WIP= COGMarrow_forwardQuestion 1 Zulfiqar Inc. has provided the following data for the month of September. There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month. Work in Process Finished Goods Cost of Goods Sold Total Direct materials 4,020 12,810 22,890 39,720 Direct labor 4,760 17,080 30,520 52,360 Manufacturing overhead applied 3,220 7,130 12,650 23,000 Total 12,000 37,020 66,060 115,080 Manufacturing overhead for the month was underapplied by Rs. 4,000. The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts. Calculate amount of work in process inventory at the end of September after allocation of any underapplied or overapplied manufacturing…arrow_forwardStatement of Cost of Goods Manufactured for a Manufacturing Company Cost data for Firetree Manufacturing Company for the month ended March 31 are as follows: Inventories March 31 Materials Work in process Finished goods March 1 $215,250 142,070 109,780 $185,120 122,180 124,030 Direct labor Materials purchased during March Factory overhead incurred during March: Indirect labor Machinery depreciation Heat, light, and power Supplies Property taxes Miscellaneous costs Costs Type $387,450 413,280 41,330 24,970 8,610 6,890 6,030 11,190 a. Prepare a cost of goods manufactured statement for March. Firetree Manufacturing Company Statement of Cost of Goods Manufactured For the Month Ended March 31 Amount Amount Amountarrow_forward

- Problem 2. Statement of Costs of Goods Manufactured and Income statement. The following information are gathered from the accounting records of Genet Inc. for the current month: Inventory information Beginning balance $ Ending balance $ Raw materials inventory $46,800 $43,600 Work-in-Process inventory $33,400 $35,700 Finished goods inventory $42,500 $31,800 Other information $ Revenue $800,000 Purchase of raw materials $72,100 Indirect materials costs $5,600 Indirect labor costs $20,000 Office staff salaries $28,000 Office equipment depreciation $2,000 Factory machinery maintenance costs $5,000 Environmental compliance costs - factory $1,200 Direct labor - Wages of production line workers $32,000 Sales staff salaries $12,000 Advertising costs $8,000 Miscellaneous manufacturing overhead costs $11,000 Required: a.…arrow_forwardaj.3arrow_forwardSchedules of Cost of Goods Manufactured and Cost of Goods Sold; Income Statement The following data from the just completed year are taken from the accounting records of Mason Company: Required: 1. Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials. 2. Prepare a schedule of cost of goods sold. Assume that the company’s underapplied or overapplied overhead is closed to Cost of Goods Sold. 3. Prepare an income statement.arrow_forward

- Cost of Goods Sold, Cost of Goods Manufactured Princeton 3 Company has the following information for May: Cost of direct materials used in production $17,300 Direct labor 44,700 Factory overhead 28,800 Work in process inventory, May 1 72,100 Work in process inventory, May 31 76,400 Finished goods inventory, May 1 30,300 Finished goods inventory, May 31 34,600 Question Content Area a. For May, using the data given, prepare a statement of Cost of Goods Manufactured. Princeton 3 CompanyStatement of Cost of Goods Manufacturedblank $Factory overhead $Cost of goods manufactured Direct labor Factory overhead Total manufacturing costs incurred during May fill in the blank 4bdba303aff9f91_9 Total manufacturing costs $fill in the blank 4bdba303aff9f91_10 Less factory overhead Cost of goods manufactured $fill in the blank 4bdba303aff9f91_13 b. For May, using the data given, prepare a…arrow_forwardCost of Goods Sold, Cost of Goods Manufactured Princeton 3 Company has the following information for May: Cost of direct materials used in production $17,300 Direct labor 44,700 Factory overhead 28,800 Work in process inventory, May 1 72,100 Work in process inventory, May 31 76,400 Finished goods inventory, May 1 30,300 Finished goods inventory, May 31 34,600 Question Content Area a. For May, using the data given, prepare a statement of Cost of Goods Manufactured. Princeton 3 CompanyStatement of Cost of Goods Manufacturedblank $- Select - $- Select - - Select - - Select - Total manufacturing costs incurred during May fill in the blank 22653a05d041061_9 Total manufacturing costs $fill in the blank 22653a05d041061_10 - Select - Cost of goods manufactured $fill in the blank 22653a05d041061_13 Question Content Area b. For May, using the data given, prepare a statement of Cost of Goods…arrow_forwardCost of Goods Manufactured for a Manufacturing Company The following information is available for Fuller Manufacturing Company for the month ending October 31 Cost of direct materials used in production Direct labor Work in process inventory, October 1 Work in process inventory, October 31 Total factory overhead Determine Fuller Manufacturing's cost of goods manufactured for the month ended October 31. Fuller Manufacturing Company Statement of Cost of Goods Manufactured For the Month Ended October 31 Manufacturing costs incurred during October: $155,300 186,400 69,900 94,700 85,400 Total manufacturing costs incurred Total manufacturing costs Cost of goods manufacturedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Job Cost Sheet - Job Cost Accounting System; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=ElD8nKNXE1I;License: Standard Youtube License