Concept explainers

At the end of April, the first month of operations, the following selected data were taken from the financial statements of Shelby Crawford, an attorney:

| Net income for April | $120,000 |

| Total assets at April 30 | 750,000 |

| Total liabilities at April 30 | 300,000 |

| Total stockholders’ equity at April30 | 450,000 |

In preparing the financial statements, adjustments for the following data were overlooked:

- Supplies used during April, $2,750.

- Unbilled fees earned at April30, $23,700.

- Depreciation of equipment for April, $1,800.

- Accrued wages at April 30, $1,400.

Instructions

1.

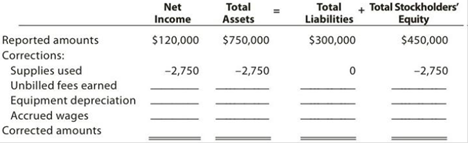

2. Determine the correct amount of net income for April and the total assets, liabilities, and Stockholders’ equity at April 30. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The adjustment for supplies used is presented as an example.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Financial & Managerial Accounting

Additional Business Textbook Solutions

Fundamentals of Financial Accounting

Financial Accounting, Student Value Edition (4th Edition)

Managerial Accounting: Tools for Business Decision Making

Managerial Accounting: Creating Value in a Dynamic Business Environment

Fundamentals of Cost Accounting

- Drafts of the condensed income statement and balance sheet of Allofe Co. for the current year are shown below. Shortly after preparing these draft financial statements, Allofe discovered that an error had been made in the year-end adjustment process. Overhead of 2,500 had not been applied to the ending work in process. REQUIRED 1. Identify all adjusting and closing entries that would be affected by this error and prepare the missing portions of the entries. 2. Prepare a revised condensed income statement for Allofe. (In solving this problem, assume that corporate income tax is not affected by the error.)arrow_forwardevables, Inc., has the following account balances at the end of the year before adjustments: Accounts Receivable $60,000 Allowance for Doubtful Accounts $100 debit balance Sales $600,000 Doubtful Accounts Expense $0 Management estimates that 13% of Accounts Receivable will be uncollectible. After the correct adjusting entry has been made, what is theAllowance for Doubtful Accounts balance on the balance sheet at year end?arrow_forwardMcKensie Company’s Accounts Receivable balance at December 31 was $100,000, and there was a negative balance of $600 in the Allowance for Uncollectible Accounts. The firm estimates that 3% of the Accounts Receivable will prove to be uncollectible. After the appropriate adjusting entry is made for credit losses, what is the net amount of accounts receivable included in the current assets at year-end? Select one: a. $87,900 b. $86,700 c. $97,000 d. $90,000 e. None of the abovearrow_forward

- At December 31, Hawke Company reports the following results for its calendar year. In addition, its unadjusted trial balance includes the following items. Cash sales. $1,905,000 Credit sales. $5,682,000 Accounts receivable. $1,270,100 debit Allowance for doubtful accounts. $16,580 debit Required 1. Prepare the adjusting entry to record bad debts under each separate assumption. a. Bad debts are estimated to be 1.5% of credit sales. b. Bad debts are estimated to be 1% of total sales. c. An aging analysis estimates that 5% of year-end accounts receivable are uncollectible. 2. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31 balance sheet given the facts in part 1a. 3. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31 balance sheet given the facts in part 1c.arrow_forwardAs Perry Materials Supply was preparing for the year-end close, their balances were as follows: Accounts Receivable - $146000 (dr) Allowance for uncollectible accounts - $6200 (dr) Uncollected Account Expense - $0 Perry Materials uses the aging method and has completed the following analysis of the accounts receivable: Customer 1-30 Days 31-60 Days 61-90 Days Over 90 Days Total Balance Johnson $4,600 $3,200 $7,800 Hot Pots, Inc. 800 1,000 1,800 Potter 40,000 550 40,550 Harrison 3,600 900 4,500 Marx 2,000 50 2,050 Younger 65,000 65,000 Merry Maids 5,900 5,900 Acher 12,000 6,400 18,400 Totals $127,500 $13,750 $3,700 $1,050 $146,000 Uncollectible percentage 2% 10% 20% 40% Estimated uncollectible amount $2,550 $1,375 $740 $420 $5,085 Required: How much will the…arrow_forwardOceanside Company uses the balance sheet approach in estimating uncollectible accounts expense. Its Allowance for Doubtful Accounts has a $2,400 credit balance prior to adjusting entries. It has just completed an aging analysis of accounts receivable at December 31, Year 1. This analysis disclosed the following information: Not yet due 1-30 days past due 31-60 past due Age Group Total $ 76,000 $ 36,000 $ 25,000 Percentage Considered Uncollectible 1% 2% 10% What is the appropriate balance for Oceanside's Allowance for Doubtful Accounts at December 31, Year 1?arrow_forward

- Van Hise Company’s Accounts Receivable balance at December 31 was $600,000, and there was a debit balance of $3,600 in the Allowance for Doubtful Accounts. Van Hise estimates that 3% of the Accounts Receivable will prove to be uncollectible. After the appropriate adjusting entry is made for credit losses, what is the net amount of accounts receivable included in the current assets at year-end? Select one: A. $540,000 B. $527,400 C. $582,000 D. $520,200arrow_forwardAt the end of the year a company has the following accounts receivable and estimates of uncollectible accounts: 1 Accounts not yet due = $72,000; estimated uncollectible = 3%. 2. Accounts 1-30 days past due $37,000; estimated uncollectible = 20%. 3. Accounts more than 30 days past due = $8,000; estimated uncollectible = 45%. Record the year-end adjustment for uncollectible accounts, assuming the current balance of the Allowance for Uncollectible Accounts is $1100 (debit). (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the bad debt expense. Note: Enter debits before credits. Event General Journal Debit Credit 1 Bad Debt Expense Allowance for Uncollectible Accounts Record entry Clear entry View general journalarrow_forwardAt the end of the prior year, Durney's Outdoor Outfitters reported the following information. Accounts Receivable, December 31, prior year Accounts Receivable (Gross) (A) Allowance for Doubtful Accounts (XA) Accounts Receivable (Net) (A) $ 48,151 8,419 $ 39,732 During the current year, sales on account were $305,298, collections on account were $290,200, write-offs of bad debts were $7,004, and the bad debt expense adjustment was $4,720. Required: 1-a. Complete the Accounts Receivable and Allowance for Doubtful Accounts T-accounts to determine the balance sheet values. 1-b. Complete the amounts related to Accounts Receivable and Bad Debt Expense that would be reported on the income statement for the current year. 1-c. Complete the amounts related to Accounts Receivable and Bad Debt Expense that would be reported on the balance sheet for the current year.arrow_forward

- At the end of the first year of operations mayberry advertising had account receivable of $21100. Management of the company estimates that 8% of the accounts will not be collected What adjustment would mayberry advertising record to establish allowance for accounts? Record the adjusting for allowance for uncollectibl accountsarrow_forwardAllowance for Doubtful Accounts has a debit balance of $2,300 at the end of the year (before adjustment). The company prepares an analysis of customers' accounts and estimates the amount of uncollectible accounts to be $31,900. Which of the following adjusting entries is needed for the bad debt expense for the year? Oa. debit Allowance for Doubtful Accounts, $34,200; credit Bad Debt Expense, $34,200 Ob. debit Allowance for Doubtful Accounts, $29,600; credit Bad Debt Expense, $29,600 Oc. debit Bad Debt Expense, $29,600; credit Allowance for Doubtful Accounts, $29,600 Od. debit Bad Debt Expense, $34,200; credit Allowance for Doubtful Accounts, $34,200arrow_forwardYates Company's records provide the following information concerning certain account balances and changes in these account balances during the current year. Accounts Receivable: Jan. 1, balance $41,000, Dec. 31, balance $55,000, uncollectible accounts written off during the year, $6,000; accounts receivable collected during the year, $159,000. Compute Sales revenue for the year.arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning