Financial Accounting

3rd Edition

ISBN: 9780078025549

Author: J. David Spiceland, Wayne M Thomas, Don Herrmann

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 3.6AP

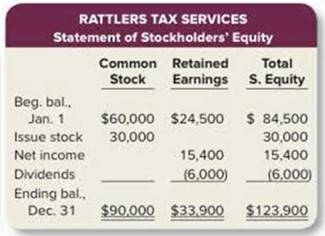

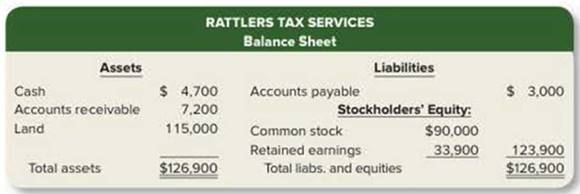

The year-end financial statements of Rattlers Tax Services are provided below.

| RATTLERS TAX SERVICES Income Statement |

||

| Service revenue | $77,500 | |

| Expenses: | ||

| Salaries | $46,000 | |

| Utilities | 8,200 | |

| Insurance | 5,800 | |

| Supplies | 2,100 | 62,100 |

| Net income | $15,400 | |

Required:

1. Record year-end closing entries.

2. Prepare a post-closing

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The adjusted trial balance for the year of Dreamer Corporation at July 31, 2021, follows.

(Click the icon to view the adjusted trial balance.)

Read the requirements

Requirement 1. Prepare Dreamer Corporation's 2021 single-step income statement, statement of retained earnings, and balance sheet.

Begin by preparing Dreamer's 2021 income statement.

Dreamer Corporation

Income Statement

Year Ended July 31, 2021

Income before tax

Data table

Dreamer Corporation

Adjusted Trial Balance

July 31, 2021

Account

Debit

Credit

Cash

$

17,000

Accounts receivable

18,800

Supplies

2,000

Prepaid rent

1,100

Equipment

37,000

Accumulated depreciation-equipment

4,300

Accounts payable

9,400

Interest payable

200

Unearned service revenue

900

Income tax payable

2,000

Note payable

18,000

Common stock

11,000

Retained earnings

4,000

Dividends

7,000

Service revenue

103,500

Depreciation expense-equipment

1,900

Salary expense

40,300

11,200

Interest expense

3,400

Insurance expense

Sunnline axnance

3,700

2.700

Now prepare…

A business like NetSolutions estimates customer refunds and allowances for each year’s sales that might be owed to customers the following year. The year-end balance is recorded on the ___________ as a ______________.

Group of answer choices

Statement of Owner's Equity; decrease in owner's equity

Income Statement; current liability (Customer Refunds Payable)

Balance Sheet; current liability (Customer Refunds Payable)

Statement of Cash Flows; Operating Activity

Selected accounts from Lue Co.'s adjusted trial balance for the year ended December 31 follow. Prepare a

classified balance sheet. Total equity.....

....$30,000 Employee federal income taxes payable

$9000

Equipment...

Salaries payable .....

40,000 Federal unemployment taxes payable ... 200

34,000 FICA–Medicare taxes payable...

5,100 FICA–Social Security taxes payable ..

. 50,000 Employee medical insurance payable ...

. 4,000 State unemployment taxes payable..

10,000 Sales tax payable (due in 2 weeks) .....

. 725

Accounts receivable .

.3,100

Cash...

.2,000

Curent portion of long-term debt.

Notes payable (due in 6 years) ..

1,800

.....

.......

.275

Chapter 3 Solutions

Financial Accounting

Ch. 3 - Prob. 1RQCh. 3 - 2.Discuss the major principle that describes...Ch. 3 - 3.Samantha is a first-year accounting student. She...Ch. 3 - 4.Describe when revenues and expenses are...Ch. 3 - Rip Side of Question 7 5.Executive Lawn provides...Ch. 3 - Prob. 6RQCh. 3 - Prob. 7RQCh. 3 - Consider the information in Question 7. Using...Ch. 3 - Prob. 9RQCh. 3 - There are two basic types of adjusting...

Ch. 3 - 11.Provide an example of a prepaid expense. The...Ch. 3 - Provide an example of a deferred revenue. The...Ch. 3 - 13.Provide an example of an accrued expense. The...Ch. 3 - Provide an example of an accrued revenue. The...Ch. 3 - Sequoya Printing purchases office supplies for 75...Ch. 3 - Jackson Rental receives its September utility bill...Ch. 3 - 17.Global Printing publishes several types of...Ch. 3 - At the end of May, Robertson Corporation has...Ch. 3 - Prob. 19RQCh. 3 - Prob. 20RQCh. 3 - Prob. 21RQCh. 3 - Prob. 22RQCh. 3 - Prob. 23RQCh. 3 - Prob. 24RQCh. 3 - Describe the debits and credits for the three...Ch. 3 - In its first four years of operations, Chance...Ch. 3 - Prob. 27RQCh. 3 - Prob. 28RQCh. 3 - Determine revenues to be recognized (LO31) Below...Ch. 3 - Prob. 3.2BECh. 3 - Prob. 3.3BECh. 3 - Analyze the impact of transactions on the balance...Ch. 3 - Prob. 3.5BECh. 3 - At the beginning of May, Golden Gopher Company...Ch. 3 - Record the adjusting entry for prepaid rent (LO33)...Ch. 3 - Prob. 3.8BECh. 3 - Prob. 3.9BECh. 3 - Prob. 3.10BECh. 3 - Prob. 3.11BECh. 3 - Prob. 3.12BECh. 3 - Prob. 3.13BECh. 3 - Prob. 3.14BECh. 3 - Prob. 3.15BECh. 3 - Prob. 3.16BECh. 3 - Prob. 3.17BECh. 3 - Prob. 3.18BECh. 3 - Prob. 3.19BECh. 3 - Prob. 3.20BECh. 3 - Consider the following situations: 1.American...Ch. 3 - Consider the following situations: 1.American...Ch. 3 - Refer to the situations discussed in E31....Ch. 3 - Differentiate cash-basis expenses from...Ch. 3 - Prob. 3.5ECh. 3 - Listed below are all the steps in the accounting...Ch. 3 - Prob. 3.7ECh. 3 - Prob. 3.8ECh. 3 - Prob. 3.9ECh. 3 - Prob. 3.10ECh. 3 - Prob. 3.11ECh. 3 - Prob. 3.12ECh. 3 - Prob. 3.13ECh. 3 - Prob. 3.14ECh. 3 - Prob. 3.15ECh. 3 - Prob. 3.16ECh. 3 - Prob. 3.17ECh. 3 - Prob. 3.18ECh. 3 - Prob. 3.19ECh. 3 - Prob. 3.20ECh. 3 - Consider the following transactions. Required: For...Ch. 3 - Prob. 3.2APCh. 3 - Prob. 3.3APCh. 3 - Prob. 3.4APCh. 3 - Prob. 3.5APCh. 3 - The year-end financial statements of Rattlers Tax...Ch. 3 - Prob. 3.7APCh. 3 - Prob. 3.8APCh. 3 - Consider the following transactions. Required: For...Ch. 3 - Prob. 3.2BPCh. 3 - Prob. 3.3BPCh. 3 - Prob. 3.4BPCh. 3 - Prob. 3.5BPCh. 3 - FIGHTING ILLINI Income Statement Service revenue...Ch. 3 - Prob. 3.7BPCh. 3 - Prob. 3.8BPCh. 3 - Prob. 3.1APCPCh. 3 - Prob. 3.2APFACh. 3 - Prob. 3.3APFACh. 3 - Prob. 3.4APCACh. 3 - Prob. 3.5APECh. 3 - Prob. 3.7APWC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- FedEx Corporation had the following revenue and expense account balances (in millions) for a recent year ending May 31: a.Prepare an income statement. b.Compare your income statement with the income statement that is available at the FedEx Corporation Web site, (http://investors.fedex.com). Click on Annual Report and Download Annual Report. What similarities and differences do you see?arrow_forwardCee & Co.’s fiscal year begins April 1. At the beginning of its fiscal year, Cee & Co. estimates that it will owe $17,400 in property taxes for the year. On June 1, its property taxes are assessed at $17,000, which it pays immediately. Required: 1. Prepare the related journal entries for April 1, May 1, and June 1. 2. Then compute the monthly property tax expense that Cee & Co. would record during July through March.arrow_forward1. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the following entries: Salaries: Sales salaries $625,000Warehouse salaries $240,000Office salaries $320,000 Total $1,185,000 Deductions: Federal income tax withheld $232,260Social security tax withheld $71,100Medicare tax withheld $17,775Retirement savings $35,500Group insurance $53,325 Total $409,960 Tax rates assumed: Social security, 6% Medicare, 1.5%State unemployment (employer only), 5.4% Federal unemployment (employer only), 0.6% Instructions 1. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the following entries: a. December 30, to record the payroll. b. December 30, to record the employer’s payroll taxes on the payroll to be paid on December…arrow_forward

- Selected accounts from Lue Co.'s adjusted trial balance for the year ended December 31 follow. Prepare a classified balance sheet. Total equity. .... .. $30,000 Employee federal income taxes payable $9,000 Equipment.... Salaries payable ... Accounts receivable. Cash ... Current portion of long-term debt Notes payable (due in 6 years) . 40,000 Federal unemployment taxes payable ... .00 . 34,000 FICA–Medicare taxes payable... 5,100 FICA–Social Security taxes payable ... 50,000 Employee medical insurance payable . . 4,000 State unemployment taxes payable . . 10,000 Sales tax payable (due in 2 weeks) . . 725 3,100 .2,000 1,800 ... .... .... ... •. 275arrow_forwardNix Company had the following balances in its general ledger before the entries for requirement (1) were made: Employee federal income tax payable $2,500 Social Security tax payable 2,008 Medicare tax payable 470 FUTA tax payable 520 SUTA tax payable 4,510 a. Prepare the journal entry for payment of the liabilities for federal income taxes and Social Security and Medicare taxes on April 15, 20--. b. Prepare the journal entry for payment of the liability for FUTA tax on April 30, 20--. c. Prepare the journal entry for payment of the liability for SUTA tax on April 30, 20--.arrow_forwardGrotto Ltd has already sent $19,600 to the ATO in respect to PAYG, and this figure shown as a debit in the Income Tax Expense account. The Profit and Loss account is then prepared and the Net Profit (before tax) is found to be $75,000. The current company tax rate is 30%. Required: Prepare general journal entries for the following Correct the Income Tax Expense account Close the Income Tax Expense account Transfer Net Profit (after tax) to Retained Earningsarrow_forward

- 5.) On February 1, the Acts Tax Service received a $3,600 cash retainer for tax preparation services to be provided rateably over the next 4 months. The full amount was credited to the liability account Unearned Service Revenue. Assuming that the revenue is recognized rateably over the 4 month period, what balance would be reported on the February 28 balance sheet for Unearned Service Revenue?arrow_forwardThe following selected accounts and their current balances appear in the ledger of Kanpur Co. for the fiscal year ended June 30, 2019: 1. Prepare a multiple-step income statement.2. Prepare a statement of owner’s equity.3. Prepare a balance sheet, assuming that the current portion of the note payable is$7,000.4. Briefly explain how multiple-step and single-step income statements differ.arrow_forwardRequired information [The following information applies to the questions displayed below.] Riverside Company completed the following two transactions. The annual accounting period ends December 31. a. On December 31, calculated the payroll, which indicates gross earnings for wages ($170,000), payroll deductions for income tax ($17,000), payroll deductions for FICA ($18,000), payroll deductions for United Way ($3,600), employer contributions for FICA (matching), and state and federal unemployment taxes ($2,100). Employees were paid in cash, but these payments and the corresponding payroll deductions and employer taxes have not yet been recorded. b. Collected rent revenue of $4,560 on December 10 for office space that Riverside rented to another business. The rent collected was for 30 days from December 11 to January 10 and was credited in full to Deferred Revenue. 3. Show how any liabilities related to these items should be reported on the company's balance sheet at December 31.…arrow_forward

- Betty Smith is the owner of Accurate Tax Service. For the year ending April 30, 2019, the following information is available for this service business. At the beginning of this accounting period, the balance in the Betty Smith, Capital account was $30.500. Following is a summary of activities during this accounting period: Betty Smith, capital withdrawn: $17,000 Revenue from income tax preparation: $71,200 Revenue from monthly clients: $42,400 Salaries expense: $12,300 Advertising expense: $610 Rent expense: $7,300 Automobile expense: $1,700 Office supplies expense: $7,200. Note: You should assume that all profit (or loss) accrued during this accounting period is absorbed into the Betty Smith, Capital account at the end of the period. Following are the account balances at the end of this accounting period (except Betty Smith, Capital): Cash: $62,500 Accounts receivable: $3,800 Office furniture and fixtures: $10,200 Office machines and computers: $17,000 Automobile: $8,500 Accounts…arrow_forwardLynden Company has the following balances in its general ledger as of June 1 of this year: a. FICA Social Security Tax Payable (employee and employer) is $1,393.50. FICA Medicare Tax Payable (employee and employer) is $325.90. b. Employees’ Federal Income Tax Payable (liability for May), $995.00. c. Federal Unemployment Tax Payable (liability for April and May), $380.00. d. State Unemployment Tax Payable (liability for April and May), $1,205.75. The company completed the following transactions involving the payroll during June and July: June and July Transactions: June 13 Issued check for $2,714.40, payable to Security Bank, for the monthly deposit of May FICA taxes and employees’ federal income tax withheld. 30 Recorded the payroll entry in the general journal from the payroll register for June.* 30 Recorded payroll taxes. FICA Social Security rates are 6.2 percent (employee) and 6.2 percent (employer). The employer matches the employee’s FICA…arrow_forwardLynden Company has the following balances in its general ledger as of June 1 of this year: a. FICA Social Security Tax Payable (employee and employer) is $1,393.50. FICA Medicare Tax Payable (employee and employer) is $325.90. b. Employees’ Federal Income Tax Payable (liability for May), $995.00. c. Federal Unemployment Tax Payable (liability for April and May), $380.00. d. State Unemployment Tax Payable (liability for April and May), $1,205.75. The company completed the following transactions involving the payroll during June and July: June and July Transactions: June 13 Issued check for $2,714.40, payable to Security Bank, for the monthly deposit of May FICA taxes and employees’ federal income tax withheld. 30 Recorded the payroll entry in the general journal from the payroll register for June.* 30 Recorded payroll taxes. FICA Social Security rates are 6.2 percent (employee) and 6.2 percent (employer). The employer matches the employee’s FICA…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY