Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

15th Edition

ISBN: 9780134476315

Author: Chad J. Zutter, Scott B. Smart

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 3.24P

Learning Goal 6

P3-24 Financial statement analysis The financial statements of Zach Industries for the year ended December 31, 2019, follow.

Zach Industries Income Statement for the Year Ended December 31 2019

| Sales revenue | $160,000 |

| Less: Cost of goods sold | 106,000 |

| Gross profits | $ 54,000 |

| Less: Operating expenses | |

| Selling expense | $ 16,000 |

| General and administrative expenses | 10,000 |

| Lease expense | 1,000 |

| Depreciation expense | 10,000 |

| Total operating expense | $37,000 |

| Operating profits | $ 17,000 |

| Less: Interest expense | 6,100 |

| Net profits before taxes | $10,900 |

| Less: Taxes | 4,360 |

| Net profits after taxes | $ 6,540 |

Zach Industries Balance Sheet December 31, 2019

| Assets | |

| Cash | $ 500 |

| Marketable securities | 1,000 |

| Accounts receivable | 25,000 |

| Inventories | 45,500 |

| Total current assets | $72,000 |

| Land | $ 26,000 |

| Buildings and equipment | 90,000 |

| Less: Accumulated depreciation | 38,000 |

| Net fixed assets | $78,000 |

| Total assets | $150,000 |

| Liabilities and Stockholders’ Equity | |

| Accounts payable | $ 22,000 |

| Notes payable | 47,000 |

| Total current liabilities | $ 69,000 |

| Long-term debt | 22,950 |

| Common stock | 31,500 |

| 26,550 | |

| Total liabilities and stockholders’ equity | $150,000 |

| The firm’s 3,000 outstanding shares of common stock closed 2019 at a price of $25 per share. | |

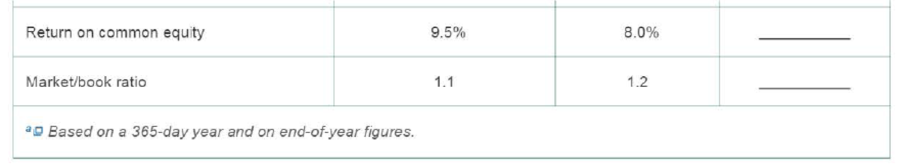

- a. Use the preceding financial statements to complete the following table. Assume that the industry averages given in the table are applicable for both 2018 and 2019.

- b. Analyze Zach Industries’ financial condition as it is related to (1) liquidity, (2) activity, (3) debt, (4) profitability, and (5) market. Summarize the company's overall financial condition.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

LOGIC COMPANYComparative Income StatementFor Years Ended December 31, 2019 and 2020

2020

2019

Gross sales

$

19,000

$

15,000

Sales returns and allowances

1,000

100

Net sales

$

18,000

$

14,900

Cost of merchandise (goods) sold

12,000

9,000

Gross profit

$

6,000

$

5,900

Operating expenses:

Depreciation

$

700

$

600

Selling and administrative

2,200

2,000

Research

550

500

Miscellaneous

360

300

Total operating expenses

$

3,810

$

3,400

Income before interest and taxes

$

2,190

$

2,500

Interest expense

560

500

Income before taxes

$

1,630

$

2,000

Provision for taxes

640

800

Net income

$

990

$

1,200

LOGIC COMPANYComparative Balance SheetDecember 31, 2019 and 2020

2020

2019

Assets

Current assets:

Cash

$

12,000

$

9,000

Accounts receivable

16,500

12,500

Merchandise inventory

8,500

14,000

Prepaid expenses

24,000

10,000

Total current assets

$

61,000

$

45,500

Plant and…

LOGIC COMPANYComparative Income StatementFor Years Ended December 31, 2019 and 2020

2020

2019

Gross sales

$

19,000

$

15,000

Sales returns and allowances

1,000

100

Net sales

$

18,000

$

14,900

Cost of merchandise (goods) sold

12,000

9,000

Gross profit

$

6,000

$

5,900

Operating expenses:

Depreciation

$

700

$

600

Selling and administrative

2,200

2,000

Research

550

500

Miscellaneous

360

300

Total operating expenses

$

3,810

$

3,400

Income before interest and taxes

$

2,190

$

2,500

Interest expense

560

500

Income before taxes

$

1,630

$

2,000

Provision for taxes

640

800

Net income

$

990

$

1,200

LOGIC COMPANYComparative Balance SheetDecember 31, 2019 and 2020

2020

2019

Assets

Current assets:

Cash

$

12,000

$

9,000

Accounts receivable

16,500

12,500

Merchandise inventory

8,500

14,000

Prepaid expenses

24,000

10,000

Total current assets

$

61,000

$

45,500

Plant and…

Problem 13-02A (Video)

The comparative statements of Cullumber Company are presented here:

Cullumber CompanyIncome StatementsFor the Years Ended December 31

2020

2019

Net sales

$1,891,640

$1,751,600

Cost of goods sold

1,059,640

1,007,100

Gross profit

832,000

744,500

Selling and administrative expenses

501,100

480,100

Income from operations

330,900

264,400

Other expenses and losses

Interest expense

23,700

21,700

Income before income taxes

307,200

242,700

Income tax expense

93,700

74,700

Net income

$213,500

$168,000

Cullumber CompanyBalance SheetsDecember 31

Assets

2020

2019

Current assets

Cash

$60,100

$64,200

Debt investments (short-term)

74,000

50,000

Accounts receivable

118,900

103,900

Inventory

127,700

117,200

Total current assets

380,700

335,300

Plant assets (net)…

Chapter 3 Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Ch. 3.1 - Prob. 3.1RQCh. 3.1 - Describe the purpose of each of the four major...Ch. 3.1 - Prob. 3.3RQCh. 3.1 - Prob. 3.4RQCh. 3.2 - With regard to financial ratio analysis, how do...Ch. 3.2 - What is the difference between cross-sectional and...Ch. 3.2 - Prob. 3.7RQCh. 3.2 - Prob. 3.8RQCh. 3.3 - Under what circumstances would the current ratio...Ch. 3.3 - In Table 3.5, most of the specific firms listed...

Ch. 3.4 - To assess the firms average collection period and...Ch. 3.5 - What is financial leverage?Ch. 3.5 - What ratio measures the firms degree of...Ch. 3.6 - What three ratios of profitability appear on a...Ch. 3.6 - Prob. 3.15RQCh. 3.6 - Prob. 3.16RQCh. 3.7 - What do the price/earnings (P/E) ratio and the...Ch. 3.8 - Financial ratio analysis is often divided into...Ch. 3.8 - Prob. 3.19RQCh. 3.8 - What three areas of analysis are combined in the...Ch. 3 - For the quarter ended January 28, 2017, Kroger...Ch. 3 - Learning Goals 3, 4, 5 ST3-1 Ratio formulas and...Ch. 3 - Prob. 3.2STPCh. 3 - Prob. 3.1WUECh. 3 - Learning Goal 1 E3-2 Explain why the income...Ch. 3 - Prob. 3.3WUECh. 3 - Learning Goal 3 E3-4 Bluestone Metals Inc. is a...Ch. 3 - Learning Goal 6 E3-5 If we know that a firm has a...Ch. 3 - Financial statement account identification Mark...Ch. 3 - Learning Goal 1 P3-2 1ncome statement preparation...Ch. 3 - Prob. 3.3PCh. 3 - Learning Goal 1 P3-4 Calculation of EPS and...Ch. 3 - Prob. 3.5PCh. 3 - Prob. 3.6PCh. 3 - Learning Goals 1 P3-7 Initial sale price of common...Ch. 3 - Prob. 3.8PCh. 3 - Learning Goal 1 P3-9 Changes In stockholders...Ch. 3 - Learning Goals 2, 3, 4, 5 P3-10 Ratio comparisons...Ch. 3 - Learning Goal 3 P3-11 Liquidity management Bauman...Ch. 3 - Prob. 3.12PCh. 3 - Inventory management Three companies that compete...Ch. 3 - Accounts receivable management The table below...Ch. 3 - Prob. 3.15PCh. 3 - Learning Goal 4 P3-16 Debt analysis Springfield...Ch. 3 - Prob. 3.17PCh. 3 - Learning Goals 2, 3, 4 P3-18 Using Tables 3.1,...Ch. 3 - Learning Goals 5 P3-19 Common-size statement...Ch. 3 - The relationship between financial leverage and...Ch. 3 - Learning Goal 4 P3-21 Analysis of debt ratios...Ch. 3 - Learning Goal 6 P3-22 Ratio proficiency McDougal...Ch. 3 - Learning Goal 6 P3-23 Cross-sectional ratio...Ch. 3 - Learning Goal 6 P3-24 Financial statement analysis...Ch. 3 - Learning Goals 6 P3- 25 Integrative: Complete...Ch. 3 - Learning Goal 6 P3-26 DuPont system of analysis...Ch. 3 - Learning Goal 6 P3-27 Complete ratio analysis,...Ch. 3 - Spreadsheet Exercise The income statement and...

Additional Business Textbook Solutions

Find more solutions based on key concepts

The price of a one year call option on ET stock. Introduction: A binomial model portrays the development of irr...

Corporate Finance

Explain what is meant by the statement “The use of current liabilities as opposed to long-term debt subjects th...

Foundations Of Finance

Preference for current ratio and quick ratio. Introduction: Current ratio explains the liquidity position of a ...

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

Define investors’ expected rate of return.

Foundations of Finance (9th Edition) (Pearson Series in Finance)

The meaning of straddle. Introduction: Option is a contract to purchase a financial asset from one party and se...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

The Warm and Toasty Heating Oil Company used to deliver heating oil by sending trucks that printed out a ticket...

Essentials of MIS (13th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- HIC GROUP OF Companies COMPARATIVE INCOME STATEMENT For years ended 3rd December 2019 2020 Revenue and gains Sales revenue 495,500 496,738.75 Interest revenue 278,500 279,196.25 Investment Income 71,700 71,879.25 Other revenue 101,500 101,753.75 Total revenue and gains 947,200 949,968 Expenses and losses Cost of good sold 450,000 447,750 Selling&administrative 185,000 184,075 Computer (operating) 42,500 42,288 Depreciation 50,000…arrow_forwardHIC GROUP OF Companies COMPARATIVE INCOME STATEMENT For years ended 3rd December 2019 2020 Revenue and gains Sales revenue 495,500 496,738.75 Interest revenue 278,500 279,196.25 Investment Income 71,700 71,879.25 Other revenue 101,500 101,753.75 Total revenue and gains 947,200 949,968 Expenses and losses Cost of good sold 450,000 447,750 Selling&administrative 185,000 184,075 Computer (operating) 42,500 42,288…arrow_forwardOperating data for Joshua Corporation are presented below. 2020 2019 Sales revenue $745,000 $595,000 Cost of goods sold 459,665 384,965 Selling expenses 114,730 67,235 Administrative expenses 55,130 48,790arrow_forward

- Atlantic Corporation reported the following financial statements: E (Click the icon to view the financial statements.) The company has 2,200 shares of common stock outstanding. What is Atlantic's earnings per share? (Round the earnings per share to two decimal places, X.XX. O A. $1.90 Financial Statements O B. $3.58 OC. $2.49 O D. 3.19 times Atlantic Corporation Comparative Balance Sheet December 31, 2019 and 2018 2019 2018 Assets Current Assets: Cash and Cash Equivalents 2,052 $ 1,655 Accounts Receivable 1,951 1,731 Merchandise Inventory 1,342 1,094 1,615 1,817 Prepaid Expenses Total Current Assets 6,960 6,297 18,240 16,174 Other Assets 2$ 25,200 $ 22,471 Total Assets Liabilities Current Liabilities 24 7.087 $ 8,158 4,698 3,844 Long-term Liabilities Total Liabilities 11,785 12,002 Stockholders' Equity Common Stock, no par 7,015 4,169 6,400 6,300 Retained Earnings Click to select your an Total Stockholders' Equity 13,415 10,469 24 25,200 $ 22,471 Clear Al All parts showing Total…arrow_forwardLOGIC COMPANY Comparative Income Statement For Years Ended December 31, 2019 and 2020 2020 2019 Gross sales $20,600 $16,200 Sales returns and allowances 800 100 Net sales $19,800 11,600 $ 8,200 $16,100 8,600 $ 7,500 Cost of merchandise (goods) sold Gross profit Operating expenses: Depreciation Selling and administrative Research Miscellaneous Total operating expenses Income before interest and taxes Interest expense 860 680 3,400 2,800 710 580 520 380 sa $5,490 $ 2,710 $ 4,440 $ 3,060 720 580 Income before taxes $ 1,990 $2,480 992 Provision for taxes 796 Net income $ 1,194 $ 1,488 LOGIC COMPANY Comparative Balance Sheet December 31, 2019 and 2020 2020 2019 Assets Current assets: Cash Accounts receivable Merchandise inventory Prepaid expenses Total current assets Plant and equipment: Building (net) $12,800 17,300 9,300 24,800 $64, 200 $ 48, 700 $ 9,800 13,300 14,800 10,800 $15,300 14,300 $11, 800 9,800 Land acer Σ %24 %24arrow_forwardModule pute Net Operating Profit after Tax Refer to the balance sheet information below for Home Depot. Feb. 3, 2019 Jan. 28, 2018 $35,891 $34,794 1,511 3,056 $37,402 $37,850 $14,177 $13,640 24,822 22,974 $38,999 $36,614 Operating assets Nonoperating assets Total assets $ millions Operating liabilities Nonoperating liabilities Total liabilities Net sales Operating expense before tax Net operating profit before tax (NOPBT) Other expense Income before tax Tax expense Net income Assume a statutory tax rate of 22%. a. Compute NOPAT for the year ended Feb. 3, 2019 using the formula: NOPAT = Net income + NNE Net income NNE NOPAT $ 9,453 $ $ $91,973 78,772 13,201 828 12,373 2,920 $9,453 7,361 * $ 16814 b. Compute NOPAT for the year ended Feb. 3, 2019 using the formula: NOPAT = NOPBT - Tax on operating profit NOPBT Tax on operating profit 7,361 * $ 10,296.78 x $ NOPAT -2936arrow_forward

- Financial statement analysis The financial statements of Zach Industries for the year ended December 31, 2019, follow . a. Use the financial statements to complete the following table E. Assume the industry averages given in the table are applicable for both 2018 and 2019. b. Analyze Zach Industries' financial condition as it is related to (1) liquidity, (2) activity, (3) debt, (4) profitability, and (5) market. Summarize the company's overall financial condition. ..... a. The current ratio is 1.04. (Round to two decimal places.) The quick ratio is .38. (Round to two decimal places.) The inventory turnover is 2.32. (Round to two decimal places.) The average collection period is 56.1 days. (Round to one decimal place.) The debt ratio is 61.7 %. (Round to one decimal place.) The times interest earned ratio is |. (Round to one decimal place.)arrow_forwardVeery Beery Company Statement of Comprehensive Income For the Year-ended December 31 2019 2020 Sales P 10,040,000 P 8,760,000 Cost of Goods Sold 5,680,000 5,860,000 Gross Profit 4,360,000 2,800,000 Operating Expenses Operating Income Interest Expense 1.160,000 1.680,000 1,220,000 3,200,000 100,000 28.000 Net Income P 3.1000,000 PI192,000 Veery Beery Company Statement of Financial For the Year-ended December 31 2019 2020 Cash P 400,000 180,000 Short-term investments 5,600,000 1,800,000 Accounts receivable 1,480,000 1,060,000 Inventory Other Current Assets Total Current Assets 1,380,000 1,640,000 8,860,000 4,680,000 10,860,000 5,040,000 Equipment 6,800,000 5,200,000 P 17,660,000 10,240,000 P 6,600,000 Total Assets Accounts Payable Notes Payable - long term Owner, Capital 2,620,000 2,460,000 2,120,000 8.600.000 5.500.000 Total liabilities and equity P 17,660,000 10,240,000 Requirements: a. Compute for the company's profitability and operating efficiency ratios for 2020. b. Compute for the…arrow_forwardExcerpts from the annual report of XYZ Corporation follow: 2019 $675,138 $241,154 $64,150 $93,650 $25,100 2020 Cost of goods sold Inventory Net income $754,661 $219,686 $31,185 $68,685 $26,900 Retained earnings LIFO reserve Tax rate 20% 20% If XYZ used FIFO, its net income for fiscal 2020 would be O a. $34,165 O b. $30,375 O c. $32,625 d. $36,545arrow_forward

- Question The income statement of Cheyenne Company is shown below. CHEYENNE COMPANYINCOME STATEMENTFOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $6,890,000 Cost of goods sold Beginning inventory $1,910,000 Purchases 4,410,000 Goods available for sale 6,320,000 Ending inventory 1,620,000 Cost of goods sold 4,700,000 Gross profit 2,190,000 Operating expenses Selling expenses 460,000 Administrative expenses 700,000 1,160,000 Net income $1,030,000 Additional information: 1. Accounts receivable decreased $350,000 during the year. 2. Prepaid expenses increased $160,000 during the year. 3. Accounts payable to suppliers of merchandise decreased $300,000 during the year. 4. Accrued expenses payable decreased $90,000 during the year. 5. Administrative expenses include depreciation expense of…arrow_forwardQUESTION 3 De Luna Bhd is a major retailer of branded cars in Peninsular Malaysia. The comparative Statement of Financial Position and Statement of Profit or Loss and Other Comprehensive Income for De Luna Bhd as of 30 June 2019 are as follows: De Luna Bhd Statement of Financial Position As at 30 June 2019 2019 2018 RM'000 RM'000 Non-Current Assets Building Less: Accumulated depreciation 728,000 182,000 598,000 125,000 473,000 546,000 Current Assets Inventory Accounts receivable 252,000 107,000 282,000 90,000 39,000 52.000 463,000 Prepayment Cash 41,000 55.250 455.250 L001.250 Total current asset Total Assets 936,000 Equity Share capital Retained earnings Total equity 402,000 204.000 606.000 312,000 184.000 496.000 Long-Term liability Bond 102,000 132,000 Current liabili ties Accounts payable Salary payable Interest payable Total current liabilities 147,000 155,000 79,250 59.000 293.250 104,000 57.000 308.000 Total Liabilities Total Equity and Liabilities 0.000 936.000 395.250…arrow_forwardIncome Statement: The income statement of Fairoz store Inc. is given for the years 2020 & 2019. 2020 2019 General and administrative expenses 21.600 24,000 Interest expense 1,500 1.500 Net sales $136.400 $138,000 Selling Expense 11.660 12,720 $1,023.0 5,230 Income taxes 99.000 95.000 COGS 770 450 Gain on Sale of landarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License