Concept explainers

Requirement – 1

To record: The

Requirement – 1

Explanation of Solution

Journal:

Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Journal entries for given transactions are as follows:

| Date | Account Title and Explanation | Debit($) | Credit($) |

| 2018 | Prepaid rent | 6,000 | |

| January 2 | Cash | 6,000 | |

| (To record advance rent received for one year) | |||

| 2018 | Supplies | 3,500 | |

| January 9 | Accounts payable | 3,500 | |

| (To record purchase of additional supplied) | |||

| 2018 | 25,500 | ||

| January 13 | Service revenue | 25,500 | |

| (To record service provided on account) | |||

| 2018 | Cash | 3,700 | |

| January 17 | Deferred revenue | 3,700 | |

| (To record cash received from customer for future service) | |||

| 2018 | Salaries expense | 11,500 | |

| January 20 | Cash | 11,500 | |

| (To record incurred of salaries expense) | |||

| 2018 | Cash | 24,100 | |

| January 22 | Accounts receivable | 24,100 | |

| (To record cash received from customer) | |||

| 2018 | Accounts payable | 4,000 | |

| January 29 | Cash | 4,000 | |

| (To record cash paid to suppliers) | |||

Table (1)

Requirement – 2 (a)

To record: The adjusting entry for prepaid rent.

Requirement – 2 (a)

Answer to Problem 3.21E

Adjusting entry for prepaid rent is as follows:

| Date | Accounts title and explanation | Post Ref. | Debit ($) | Credit ($) |

| January 31, 2018 | Rent expense | 500 | ||

| Prepaid rent | 500 | |||

| (To record the rent expense incurred at the end of the accounting year) |

Table (2)

Explanation of Solution

Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. The purpose of adjusting entries is to adjust the revenue, and the expenses during the period in which they actually occurs.

Following is the rules of debit and credit of above transaction:

- Rent expense is an expense, and it decreased the value of

stockholder’s equity. Therefore, it is debited. - Prepaid rent is an asset account. There is a decrease in assets, therefore it is credited.

Requirement – 2 (b)

To record: The adjusting entry for supplies expense.

Requirement – 2 (b)

Answer to Problem 3.21E

Adjusting entry for supplies expense is as follows:

| Date | Accounts title and explanation | Post Ref. | Debit ($) | Credit ($) |

| January 31, 2018 | Supplies expense (1) | 3,800 | ||

| Supplies | 3,800 | |||

| (To record the supplies expense incurred at the end of the accounting year) |

Table (3)

Explanation of Solution

Explanation:

Adjusting entries:

Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. The purpose of adjusting entries is to adjust the revenue, and the expenses during the period in which they actually occurs.

Following is the rules of debit and credit of above transaction:

- Supplies expense is an expense, and it decreased the value of stockholder’s equity. Therefore, it is debited.

- Supplies are an asset account. There is a decrease in assets, therefore it is credited.

Working note:

Calculate the value of supplies expense at end of the October month

Requirement – 2 (c)

To record: The adjusting entry for service revenue recognized at the end of the accounting year.

Requirement – 2 (c)

Answer to Problem 3.21E

Adjusting entry for service revenue is as follows:

| Date | Accounts title and explanation | Post Ref. | Debit ($) | Credit ($) |

| January 31, 2018 | Deferred revenue | 3,200 | ||

| Service revenue | 3,200 | |||

| (To record the service revenue recognized at the end of the accounting year) |

Table (4)

Explanation of Solution

Explanation:

Adjusting entries:

Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. The purpose of adjusting entries is to adjust the revenue, and the expenses during the period in which they actually occurs.

Following is the rules of debit and credit of above transaction:

- Deferred revenue is a liability account. There is a decrease in liability, therefore it is debited.

- Service revenue is revenue, and it increased the value of stockholder’s equity. Therefore, it is credited

Requirement – 2 (d)

To record: The adjusting entry for salaries expense.

Requirement – 2 (d)

Answer to Problem 3.21E

Adjusting entry for salaries expense is as follows:

| Date | Accounts title and explanation | Post Ref. | Debit ($) | Credit ($) |

| January 31, 2018 | Salaries expense | 5,800 | ||

| Salaries payable | 5,800 | |||

| (To record the salaries expense incurred at the end of the accounting year) |

Table (5)

Explanation of Solution

Adjusting entries:

Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. The purpose of adjusting entries is to adjust the revenue, and the expenses during the period in which they actually occurs.

Following is the rules of debit and credit of above transaction:

- Salaries expense is an expense, and it decreased the value of stockholder’s equity. Therefore, it is debited.

- Salaries payable is a liability account. There is a decrease in liability, therefore it is credited.

Requirement – 3

To prepare: The adjusted

Requirement – 3

Explanation of Solution

Adjusted trial balance:

Adjusted trial balance is a summary of all the ledger accounts, and it contains the balances of all the accounts after the adjustment entries are journalized, and posted.

The adjusted trial balance of Company D is as follows:

| Company D | ||

| Adjusted Trial Balance | ||

| January 31, 2018 | ||

| Accounts (Refer working note (2) ) | Debit | Credit |

| Cash | $30,100 | |

| Accounts Receivable | 6,600 | |

| Supplies | 2,800 | |

| Prepaid Rent | 5,500 | |

| Land | 50,000 | |

| Accounts Payable | $2,700 | |

| Deferred Revenue | 500 | |

| Salaries Payable | 5,800 | |

| Common Stock | 65,000 | |

| 13,900 | ||

| Service Revenue | 28,700 | |

| Salaries Expense | 17,300 | |

| Rent Expense | 500 | |

| Supplies Expense | 3,800 | |

| Totals | $116,600 | $116,600 |

Table (6)

Working note:

Calculate the ending balance of all accounts:

| Accounts | Beginning balance +Adjustment | Ending balance | ||

| Cash | = |

| = | 30,100 |

| Accounts Receivable | = |

| = | 6,600 |

| Supplies | = |

| = | 2,800 |

| Prepaid Rent | = |

| = | 5,500 |

| Land | = |

| = | 50,000 |

| Accounts Payable | = |

| = | 2,700 |

| Deferred Revenue | = |

| = | 500 |

| Salaries Payable | = |

| = | 5,800 |

| Common Stock | = |

| = | 65,000 |

| Retained Earnings | = |

| = | 13,900 |

| Service Revenue | = |

| = | 28,700 |

| Salaries Expense | = |

| = | 17,300 |

| Rent Expense | = |

| = | 500 |

| Supplies Expense | = |

| = | 3,800 |

(2)

Thus, the total of debit, and credit columns of an adjusted trial balance is $116,600 and agreed.

Requirement – 4

To prepare: The income statement of Company D for the year ended January 31, 2018.

Requirement – 4

Explanation of Solution

Income statement:

This is the financial statement of a company which shows all the revenues earned and expenses incurred by the company over a period of time.

The income statement of Company D for the year ended January 31, 2018 is as follows:

| Company D | ||

| Income statement | ||

| For the year ended January 31, 2018 | ||

| $ | $ | |

| Service revenue (A) | 28,700 | |

| Expenses: | ||

| Salaries expense | 17,300 | |

| Rent expense | 500 | |

| Supplies expense | 3,800 | |

| Total expense (B) | 21,600 | |

| Net income | 7,100 | |

Table (7)

Therefore, the net income of Company D is $7,100.

Requirement – 5

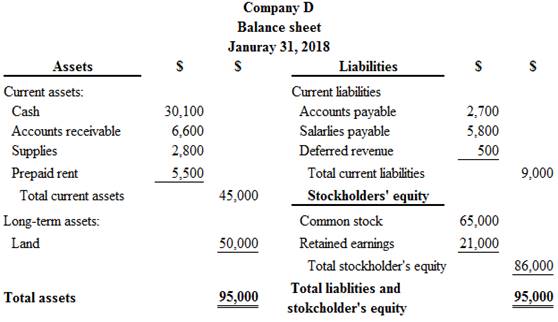

To prepare: The classified balance sheet of Company D at January 31, 2018.

Requirement – 5

Explanation of Solution

Classified balance sheet:

This is the financial statement of a company which shows the grouping of similar assets and liabilities under subheadings.

The classified balance sheet of Company D at January 31, 2018 is as follows:

Figure (1)

Therefore, the total assets of Company D are $95,000, and the total liabilities and stockholders’ equity are $95,000.

Requirement – 6

To record: The closing entries of Company D.

Requirement – 6

Answer to Problem 3.21E

The closing entries of Company D are as follows:

| Date | Account Title and Explanation | Debit($) | Credit($) |

| 2018 | Service revenue | 28,700 | |

| January 31 | Retained earnings | 28,700 | |

| (To close revenue account) | |||

| 2018 | Retained earnings | 21,600 | |

| January 31 | Salaries expense | 17,300 | |

| Rent expense | 500 | ||

| Supplies expense | 3,800 | ||

| (To close all expense account) | |||

Table (7)

Explanation of Solution

Closing entries:

Closing entries are those journal entries, which are passed to transfer the final balances of temporary accounts, (all revenues account, all expenses account and dividend) to the income summary account. Closing entries produce a zero balance in each temporary account.

Closing entry for revenue account:

In this closing entry, the service revenue account is closed by transferring the amount of service revenue to the retained earnings in order to bring the revenue accounts balance to zero.

Closing entry for expenses account:

In this closing entry, salaries expense, rent expense, and supplies expense are closed by transferring the amount of all expenses to the retained earnings in order to bring all the expense accounts balance to zero.

Requirement – 7 (a)

the amount of profit reported for the month of January.

Requirement – 7 (a)

Explanation of Solution

Net income:

Net income is the excess amount of revenue which is arises after deducting all the expenses of a company. In simply, it is the difference between total revenue and total expenses of the company.

The amount of reported profit is $7,100 (Refer Requirement – 4).

Requirement – 7 (b)

To calculate: The ratio of current assets to current liabilities at the end of January.

Requirement – 7 (b)

Explanation of Solution

A part of

Current ratio of the Company D is as follows:

Here,

Current assets is $45,000

Current liabilities is $9,000

Requirement – 7 (c)

To indicate: Whether Company D appears good or bad in financial condition.

Requirement – 7 (c)

Explanation of Solution

Financial condition of Company D is good, because profit is greater than zero and current assets is greater than its current liability. So, the company can earn revenue from its customer and able to pay obligation.

Want to see more full solutions like this?

Chapter 3 Solutions

Financial Accounting

- Starlight Enterprises has net credit sales for 2019 in the amount of $2,600,325, beginning accounts receivable balance of $844,260, and an ending accounts receivable balance of $604,930. Compute the accounts receivable turnover ratio and the number of days sales in receivables ratio for 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Starlight Enterprises if the industry average is 1.5 times and the number of days sales ratio is 175 days?arrow_forwardOn December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan. Refer to RE6-10. On December 31, Jordan Inc. received 50,000 on assigned accounts. Prepare Jordans journal entries to record the cash receipt and the payment to McLaughlin.arrow_forwardThe following information has been presented to you for 2018 by Wonder Projects Limited: September October November Rand Rand Rand Cash revenue 200 000 220 000 240 000 Credit revenue 120 000 180 000 190 000 Purchases (all credit) 130 000 140 000 120 000 Additional information: Collection of credit revenue: 50% in the month of invoice 30% one month after invoice 15% two months after invoice and the balance written off as irrecoverable. Purchases are on credit and are paid for one month after the purchase, less 5% Rent income amounts to R10 000 per The rent will increase by 8% on 1 October 2018. A fixed deposit of R150 000 will mature on 31 October 2018. Interest of R15 000 will also be received on this A new computer will be purchased on 3 September 2018 for R25 000 Salaries amount to R20 000 per A 10% increase will take effect on 1 October 2018. The owner is expected to take R5 000 cash from the business on 20 October…arrow_forward

- on november 1, 2018, Downtown Jewelers accepted a 3-month, 15% note for $6,000 in sttlement of an averdue account receivable. the account period ends on december 31. prepare the journal entry to record the accrued interest at the year end.arrow_forwardOn August 1, 2021, Avonette, Inc., sold equipment and accepted a six-month, 9%, $50,000 note receivable. Avonette's year-end is December 31. Which of the following accounts will Avonette credit in the journal entry at maturity on February 1, 2022, assuming collection in full? O A. Interest Receivable B. Cash OC. Interest Payable O D. Note Payablearrow_forwardOn March 1, Smith Company purchased equipment costing $14,792 by signing a 3-year, 6% note requiring monthly payments of $450 starting March 31. The journal entry to record the first payment would include a _______ to Notes Payable of debit; $376. credit; $74. credit; $376. debit; $74.arrow_forward

- On January 1, 2021, the general ledger of Big Blest Fireworks includes the following account balances: Accounts Debit Credit Cash $ 23, 308 Accounts Receivable Allowance for Uncollectible Accounts 48, B00 $ 4, 580 Inventory Land Accounts Payable Notes Payable (6%, due in 3 years) 37, e00 72,100 28,980 37,000 Comnon Stack Retained Earnings 63, eee 39,eee Totals $172,400 $172,400 The $37,000 beginning belance of inventory consists of 370 units, each costing S100. During Janusry 2021, Big Blast Fireworks had the following inventory transactions: January 3 Purchase 1,68e units for 168,088 on account ($10s cach). January 8 Purchase 1,78e units for $187, 880 on account ($110 cach). January 12 Purchase 1,88e units for $287,000 on account ($115 cach). January 15 Return 135 of the units purchased on 3anuary 12 because of defccts. January 19 Sell 5,2ee units on account for $788,8ee. The cost of the units sold is deternined using a FIFO perpetual inventory systen. January 22 Receive $753, eee…arrow_forwardOn January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:Accounts Debit CreditCash $ 25,100Accounts Receivable 46,200Allowance for Uncollectible Accounts $ 4,200Inventory 20,000Land 46,000Equipment 15,000Accumulated Depreciation 1,500Accounts Payable 28,500Notes Payable (6%, due April 1, 2022) 50,000Common Stock 35,000Retained Earnings…arrow_forwardThe following information is available for Reigen Company relating to 2019 operations: Accounts Receivable, January 1 4,000,000 Accounts receivable collected 8,400,000 Cash sales 2,000,000 Inventory, Jan. 1 4,800,000 Inventory, Dec. 31 4,400,000 Purchases 8,000,000 Gross Margin on Sales 4,200,000 What is the balance of accounts receivable on December 31, 2019?arrow_forward

- Calculate the average daily balance (in $) for October for a revolving credit account with a previous month's balance of $110 and the following activity. (Round your answer to the nearest cent.) Date Activity Amount October 3 Cash advance $50.00 October 7 Payment $75.00 October 10 Purchase $27.59 October 16 Credit $10.00 October 25 Purchase $123.60 average daily balance = $arrow_forwardOn January 1, 2021, the general ledger of TNT Fireworks includes the following account balances:Accounts Debit CreditCash $ 58,700Accounts Receivable 25,000Allowance for Uncollectible Accounts $ 2,200Inventory 36,300Notes Receivable (5%, due in 2 years) 12,000Land 155,000Accounts Payable 14,800Common Stock 220,000Retained Earnings 50,000Totals $ 287,000 $ 287,000During January 2021, the following transactions occur:January 1 Purchase equipment for $19,500. The company estimates a residual value of $1,500…arrow_forwardOn January 1, 2021, the general ledger of Big Blast Fireworks Includes the following account balances: Accounts Debit Credit Cash $ 23, 300 Accounts Receivable Allowance for Uncollectible Accounts 40, 000 $ 4,500 Inventory 37, 000 72,108 Land Accounts Payable Notes Payable (6%, due in 3 years) 28,900 37,e00 Common Stock 63,000 Retained Earnings 39,e00 Totals $172,480 $172,400 The $37,000 beginning balance of Inventory consists of 370 units, each costing $100. During January 2021. Big Blast Fireworks had the following Inventory transactions: January 3 Purchase 1,680 units for $168,8ee on account ($185 each). January 8 Purchase 1,700 units for $187,0ee on account ($11e each). January 12 Purchase 1,800 units for $207,0ee on account ($115 each). January 15 Return 135 of the units purchased on January 12 because of defects. January 19 Sell 5,200 units on account for $788,00e. The cost of the units sold is deternined using a FIF0 perpetual inventory system. January 22 Receive $753,80e from…arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning