Concept explainers

Kelly Jones is a financial analyst for Wolverine Manufacturing, a company that produces engine bearings for the automotive industry. Wolverine is in the process of hammering out a new labor agreement with its unionized workforce. One of the major concerns of the labor union is the funding of Wolverine’s retirement plan for its hourly employees. The union believes the company has not been contributing enough money to this fund to cover the benefits it will need to pay to retiring employees. Because of this, the union wants the company to contribute approximately $1.5 million dollars in additional money to this fund over the next 20 years. These extra contributions would begin with an extra payment of $20,000 at the end of 1 year with annual payments increasing by 12.35% per year for the next 19 years.

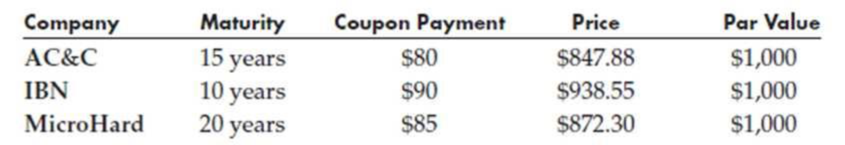

The union has asked the company to set up a sinking fund to cover the extra annual payments to the retirement fund. The Wolverines’ CFO and the union’s chief negotiator have agreed that AAA rated bonds recently issued by three different companies may be used to establish this fund. The following table summarizes the provisions of these bonds.

According to this table, Wolverine may buy bonds issued by AC&C for $847.88 per bond. Each AC&C bond will pay the bondholder $80 per year for the next 15 years, plus an extra payment of $1,000 (the par value) in the fifteenth year. Similar interpretations apply to the information for the IBN and MicroHard bonds. A

Wolverine’s CFO has asked Kelly to determine how much money the company would have to invest and which bonds the company should buy in order to meet the labor union’s demands.

If you were Kelly, what would you tell the CFO?

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Spreadsheet Modeling & Decision Analysis: A Practical Introduction to Business Analytics (MindTap Course List)

- Lu is 26 years old and single with a master's degree in education. he is paralyzed and confined to a wheel chair as a result of an auto accident. he earns $32,000 per year. instead of the tradition "one benefit package fits all," the company is allocating an additional 25 percent of each employee's annual pay to be used for discretionary benefits. those benefits and their annual cost are as follows: a) supplementary health care for employee: plan A (no deductible and pays 90 percent) =$3000, plan B ($200 deductible and pays 80 percent)=$2000, plan C ($1000 deductible and pays 70 percent)=$500, s supplementary health care for dependents (same deductibles and percentages as above): plan A=$2000, Plan B=$1500, plan C=$500, supplementary dental plan =$500, life insurance: plan A ($25000 coverage)=$500, plan B (50,000 coverage)= $1000, plan C(100,000 coverage) =$2000, plan D ($250000 coverage)= $3000 mental health plan =$500, prepaid legal assistance =$300, vacation =2 percent of annual pay…arrow_forwardConsolidated Energy (CE) is a public utility company that generates and distributes electricity throughout a large portion of the US. The company is involved in all kinds of projects, including construction of new electrical generating and transmission equipment and facilities, upgrade and repair of existing equipment and facilities, information technology for customer service, and energy research projects. Much of this project work is contracted out, although CE units handle about half of it with internal expertise in construction, equipment upgrade and maintenance, information technology, and research. The company has construction units and equipment specialists in five cities, information technology specialists in three cities, and research units in two cities.The research units work on projects initiated by the corporate office, but the construction, equipment upgrade and maintenance, and IT units work on projects initiated by the five regional offices. Each of the units is assigned to…arrow_forwardNicole, an athletic trainer, believes if she has evidence that her program of exercise works, she can recruit more clients. She is planning to conduct a study to determine if working out for one hour per day with her fitness program causes a person to lose weight. She will track the participants’ progress over a twelve-week period. Nicole mandates that her clients at the gym participate in her study, and she asks them to each find one friend who is not a member of the gym to also participate. Each of the participants weighs in at the start and again after the twelve-week period has ended. At the conclusion of the study, she will compare the results of both groups. Unfortunately, because she has not had any formal training in research methodology, she is not certain how to label the different components in her study or identify any potential flaws. Help Nicole with the following components of this study Identify the following factors. Independent Variable Operational Definition of…arrow_forward

- Nicole, an athletic trainer, believes if she has evidence that her program of exercise works, she can recruit more clients. She is planning to conduct a study to determine if working out for one hour per day with her fitness program causes a person to lose weight. She will track the participants’ progress over a twelve-week period. Nicole mandates that her clients at the gym participate in her study, and she asks them to each find one friend who is not a member of the gym to also participate. Each of the participants weighs in at the start and again after the twelve-week period has ended. At the conclusion of the study, she will compare the results of both groups. Unfortunately, because she has not had any formal training in research methodology, she is not certain how to label the different components in her study or identify any potential flaws. Help Nicole with the following components of this study. Identify the following issues with the study described. Ethical Concerns…arrow_forwardIn 2007 San Francisco began its Healthy San Francisco Plan designed to provide health care for all San Francisco citizens. In 2007, it was estimated that San Francisco had 82,000 uninsured citizens. Under the plan, all uninsured citizens residing in San Francisco can seek care at the city's public and private clinics and hospitals. The basic coverage includes lab work, x-rays, surgery, and preventative care. The city plans to pay for this $203 million coverage by rerouting the $104 million the city currently spends treating the uninsured in the emergency rooms, mandating business contributions, and requiring income-adjusted enrollment fees. The plan requires all businesses with more than 20 employees to contribute a percentage toward the plan. Many business owners consider this a burden and warn they will not stay in the city. The Mayor sees universal health access as a moral obligation for the city. Take one of the following positions. San Francisco has an obligation to provide its…arrow_forwardAn HR director is outsourcing recruiting efforts to a staffing organization and is charged with implementing the staffing organization project/initiative. The original plan had been to eliminate in-house staffing personnel, but, at the hiring managers' request, the HR director has decided to maintain a small in-house team of corporate recruiters who will work with the staffing organization. This will provide continuity for the hiring managers in the organization. The HR director must facilitate the integration of the staffing organization team with full-time personnel from the organization. The staffing organization team will consist of recruiters, sourcing professionals, and administrative assistants led by a staffing organization manager.The staffing organization recruiters manage the intake of open positions from the hiring managers. The in-house corporate recruiters assess open positions for fulfillment. The corporate recruiters often bypass the staffing organization manager to…arrow_forward

- An HR director is outsourcing recruiting efforts to a staffing organization and is charged with implementing the staffing organization project/initiative. The original plan had been to eliminate in-house staffing personnel, but, at the hiring managers' request, the HR director has decided to maintain a small in-house team of corporate recruiters who will work with the staffing organization. This will provide continuity for the hiring managers in the organization. The HR director must facilitate the integration of the staffing organization team with full-time personnel from the organization. The staffing organization team will consist of recruiters, sourcing professionals, and administrative assistants led by a staffing organization manager.The staffing organization recruiters manage the intake of open positions from the hiring managers. The in-house corporate recruiters assess open positions for fulfillment. The corporate recruiters often bypass the staffing organization manager to…arrow_forwardPaige Turner has been working in a law firm for the last two years and has been bullied by her manager ever since she joined. She is given targets that are impossible to complete within the given time frame. When she is unable to complete her work, her manager admonishes her in front of everyone. In addition, Paige is not invited to take part in discussions that involve making decisions about client's accounts, which are being attended by all other team members.Identify TWO (2) types of workplace discrimination that are evident in this scenario. Justify your answer.arrow_forwardMcGwire Aerospace expects to have net cash flow of $12 million. The company forecasts that its operating costs excluding depreciation and amortization will equal 75 percent of the company’s sales. Depreciation and amortization expenses are expected to be $5 million and the company has no interest expense. All of McGwire’s sales will be collected in cash, costs other than depreciation and amortization will be paid in cash during the year, and the company’s tax rate is 40 percent. What is the company’s expected sales?arrow_forward

- Sapphire Farm is a business that trains and boards horses and educates young riders about horse care, nutrition, and riding. The farm provides both a learning and a fun environment for young equestrians and their families. It also hosts horse shows for beginning riders to help them build confidence in the show ring and to prepare them for local horse shows by running shows in accordance with the rules and regulations of the National Hunter Jumper Association. Feedback from the horseshow judges are provided to all riders so they can do better at their next meet. In addition, all warm-up and training areas are fenced and monitored by adults for the children's safety. If the farm unintentionally hired someone to teach riding who was unable to deal effectively with small children, then a _____ would occur. A. service divergence B. quality underperformance C. performance breakdown D. product variation E. customer aberrationarrow_forwardSE STUDY John is a finance director of Nadim Product PLC, a company which manufactures and sells bathroom product such as baths, sinks and toilet. These product are sold through a selection of specialist shops and through larger store, customers include professional plumbers and also ordinary householder who are renovating their houses themselves. The company operates at the lower end of the market and does not have a strong reputation for service. Sales have been slowly declining whereas those of competitors have been improving. In order to encourage increased sales the board of directors has decided to pay senior staff a bonus if certain target is achieved. The two main targets are based on profit levels and annual sales. Two months before the end of the financial year the finance director asks one of his staff to check through the order and account to assess the current situation. He informed that without a sudden improvement in sales before the year end the important sales target…arrow_forwardJane operates a small IT consulting firm. Her company supplies services to a Fortune 500 company, Megacorp, through a regular contract. She estimates the costs of completing assignments for this company and tracks the costs of completing the various jobs. She finds that her estimates are generally on target-sometimes she is a bit high; sometimes a bit low. On average her estimated costs of completing work for her client match the actual costs. Megacorp reduces the number of assignments made to Jane's company and Jane decides to bid for new assignments with other clients. Jane wins bids to provide IT consulting services to three new clients and finds that her estimated costs of completing the jobs are well below that actual costs of completing the jobs. Please use auction concepts to explain this outcome. Briefly explain. (Hint: The correct answer to this question is much shorter than the question itself.)arrow_forward

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON

Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning

Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON

Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON

Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON