a)

To determine: Average tax rate and marginal tax rate of a single tax payer.

a)

Explanation of Solution

Given information:

The income of the single tax payer is $20,000.

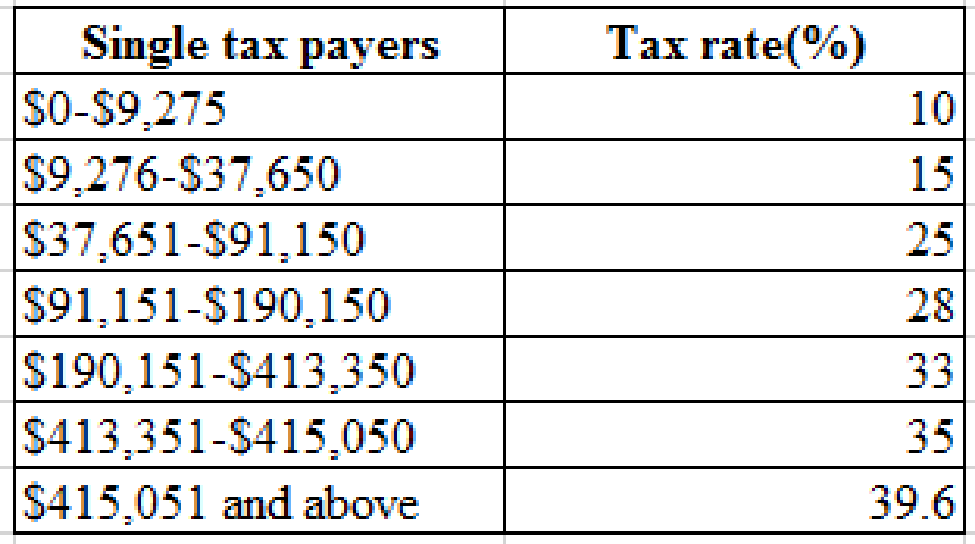

The slab rates of single tax payers are as follows, they are

If the taxable income is $20,000 then up to $9,275 the tax rate is 10% and after that remaining balance is charged under 15% tax rate.

Calculation of taxes:

Hence, taxes are $2,535.95.

Calculation of Average tax rate:

Hence, average tax rate is 12.70%.

The marginal rate of tax is the tax rate that a person is incurred on his income of each additional dollar. Here the marginal rate is 15% incurred on each additional dollar of his income.

b)

To determine: Average tax rate and marginal tax rate of a single tax payer.

b)

Explanation of Solution

Given information:

The income of the single tax payer is $50,000.

If the taxable income is $50,000 then up to $9,275 the tax rate is 10%, after that tax rate is 15% up to $37,650 then, after remaining balance is charged under 25% tax rate.

Calculation of taxes:

Hence, taxes are $8,270.75.

Calculation of Average tax rate:

Hence, average tax rate is 16.50%

The marginal rate of tax is the tax rate that a person is incurred on his income of each additional dollar. Here the marginal rate is 25% incurred on each additional dollar of his income.

c)

To determine: Average tax rate and marginal tax rate of a single tax payer.

c)

Explanation of Solution

Given information:

The income of the single tax payer is $300,000.

If the taxable income is $300,000 then up to $9,275 the tax rate is 10%, after that tax rate is 15% up to $37,650, up to $91,150 the tax rate is 25% and up to $190,150 the tax rate is 28% and up to $413,350 the tax rate is 33%, then the remaining balance is charged under 35% tax rate.

Calculation of taxes:

Hence, taxes are $82,528.59.

Calculation of Average tax rate:

Hence, average tax rate is 27.50%.

The marginal rate of tax is the tax rate that a person is incurred on his income of each additional dollar. Here the marginal rate is 33% incurred on each additional dollar of his income.

d)

To determine: Average tax rate and marginal tax rate of a single tax payer.

d)

Explanation of Solution

Given information:

The income of the single tax payer is $3,000,000.

Calculation of taxes:

Hence, taxes are $1,144,170.

Calculation of Average tax rate:

Hence, average tax rate is 38.1%

The marginal rate of tax is the tax rate that a person is incurred on his income of each additional dollar. Here the marginal rate is 39.6% incurred on each additional dollar of his income.

Want to see more full solutions like this?

Chapter 3 Solutions

EBK FUNDAMENTALS OF CORPORATE FINANCE

- If you have a taxable income of $372,570.00, what is your total tax bill? $ average tax rate? %arrow_forwardGiven the tax rate table below. For a person who has a taxable income of $70,000, what is the average tax rate this person will be charged? Taxable Income 16% 32% 14% 22% Tax Rate 0- 9,525 10% 9,525 38,700 12 38,700- 82,500 22 82,500- 157,500 24 157,500 200,000 32 200,000- 500,000 35 500,000+ 333arrow_forward4.An individual made $85,000 for the year. Using the tax given , answer the following questions: A.What is this person's marginal tax rate? B.How much tax does this person owe? C.What is the effective tax rate?arrow_forward

- Given the following tax structure: Total tax Salary $ 10,000 $ 20,000 Тахрayer Mae $ 600 Pedro ??? a. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable based on the tax rate paid? (Round your final answer to nearest whole dollar amount.) Minimum tax b. This would result in what type of tax rate structure? Tax rate structure Progressivearrow_forwardWhat would be the marginal tax rate for a single person who has the following taxable income? 1. $35,310 2. $67,710 3. $87,000 4. $111,750arrow_forwardFor the person below, calculate the FICA tax and income tax to obtain the total tax owed. Then find the overall tax rate on the gross income, including both FICA and income tax. Assume that the individual is single and takes the standard deduction. A man earned a salary of $27,000 and received $1250 in interest. Tax Rate Single 10% up to $9325 15% up to $37,950 25% up to $91,900 28% up to $191,650 33% up to $416,700 35% up to $418,400 39.6% above $418,400 Standard deduction $6350 Exemption (per person) $4050 Let FICA tax rates be 7.65%on the first $127,200 of income from wages, and 1.45% on any income from wages in excess of $127,200. His total FICA tax is $____.arrow_forward

- For the person below, calculate the FICA tax and income tax to obtain the total tax owed. Then find the overall tax rate on the gross income, including both FICA and income tax. Assume that the individual is single and takes the standard deduction. A womanearned a salary of $27,000 and received $1000 in interest. Tax Rate Single 10% up to $9325 15% up to $37,950 25% up to $91,900 28% up to $191,650 33% up to $416,700 35% up to $418,400 39.6% above $418,400 Standard deduction $6350 Exemption (per person) $4050 Let FICA tax rates be 7.65%on the first $127,200 of income from wages, and 1.45% on any income from wages in excess of $127,200. Her income tax is $_____.arrow_forwardA single individual pays $7,813 on a taxable income of $47,810 and $7,838 on a taxable income of $47,910. What is the marginal tax rate? a. 16% b. 50% c. 25% d. 15%arrow_forwardGiven the following tax structure: Taxpayer Salary Total tax $ 10,000 $ 600 $ 20,000 ??? Mae Pedro Required: a. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable based on the tax rate paid? Note: Round your final answer to nearest whole dollar amount. b. This would result in what type of tax rate structure?arrow_forward

- You earned $50,140 taxable income last year. What is your effective tax rate using the Single Filer Tax Bracket below (round percentage to two decimal places) {DO NOT INCLUDE % SIGN}? Type your responsearrow_forwardGiven that your gross income for 2020 was $180,000 and your taxable income was $140,000. Calculate: a. the marginal tax rate b. the average tax rate c. the effective tax rate. SHOW WORKarrow_forwardGiven the following tax structure: Taxpayer Salary Total tax Mae $ 14,000 $ 1,260 Pedro $ 52,000 ??? Required: What is the minimum tax that Pedro should pay to make the tax structure vertically equitable based on the tax rate paid? Note: Round your final answer to nearest whole dollar amount. This would result in what type of tax rate structure?arrow_forward

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning