a.

Calculate the contribution margin per unit.

a.

Explanation of Solution

The calculation of contribution margin per unit is as follows:

Hence, the contribution margin per unit is $63.

b.

Calculate the break-even points in dollars and units and prepare income statement using contribution margin format.

b.

Explanation of Solution

The calculation of break-even points in units is as follows:

Hence, the break-even units is 5,000 units.

The calculation of break-even point in dollars is as follows:

Hence, the break-even in dollars is $435,000.

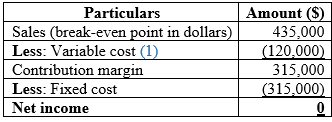

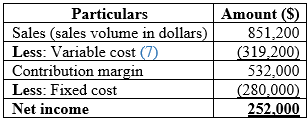

The calculation of income statement is as follows:

(Table 1)

Working note:

The calculation of variable cost is as follows:

Hence, the variable cost is $120,000.

(1)

c.

Calculate the sales volume in units and dollars that is required to earn profit and prepare income statement.

c.

Explanation of Solution

The calculation of sales volume in units is as follows:

Hence, the sales volume in units is 9,000 units.

The calculation of sales volume in dollars is as follows:

Hence, the sales volume in dollars is $783,000.

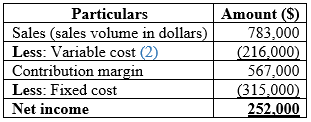

The calculation of income statement is as follows:

(Table 2)

Working note:

The calculation of variable cost is as follows:

Hence, the variable cost is $216,000.

(2)

d.

Calculate the level of sales that is necessary to earn profit in case of drop in sales price.

d.

Explanation of Solution

The calculation of sales volume in units is as follows:

Hence, the sales volume in units is 10,125 units.

The calculation of sales volume in dollars is as follows:

Hence, the sales volume in dollars is $810,000.

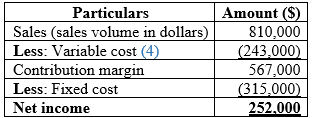

The calculation of income statement is as follows:

(Table 3)

Working note:

The calculation of contribution margin per unit is as follows:

Hence, the contribution margin per unit is $56.

(3)

The calculation of variable cost is as follows:

Hence, the variable cost is $243,000.

(4)

e.

Calculate the level of sales that is necessary to earn profit in case of drop in fixed cost.

e.

Explanation of Solution

The calculation of sales volume in units is as follows:

Hence, the sales volume in units is 9,500 units.

The calculation of sales volume in dollars is as follows:

Hence, the sales volume in dollars is $760,000.

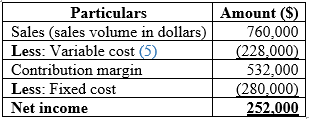

The calculation of income statement is as follows:

(Table 4)

Working note:

The calculation of variable cost is as follows:

Hence, the variable cost is $228,000.

(5)

f.

Calculate the level of sales that is necessary to earn profit in case of drop in variable cost.

f.

Explanation of Solution

The calculation of sales volume in units is as follows:

Hence, the sales volume in units is 10,640 units.

The calculation of sales volume in dollars is as follows:

Hence, the sales volume in dollars is $851,200.

The calculation of income statement is as follows:

(Table 5)

Working note:

The calculation of contribution margin per unit is as follows:

Hence, the contribution margin per unit is $50.

(6)

The calculation of variable cost is as follows:

Hence, the variable cost is $319,200.

(7)

g.

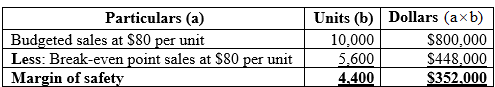

Calculate the margin of safety in dollars, units and as a percentage.

g.

Explanation of Solution

The calculation of break-even points in units is as follows:

Hence, the break-even units is 5,600 units.

The calculation of margin of safety in dollars and units is as follows:

(Table 6)

The calculation of margin of safety in percentage is as follows:

Hence, the margin of safety in percentage is 44%

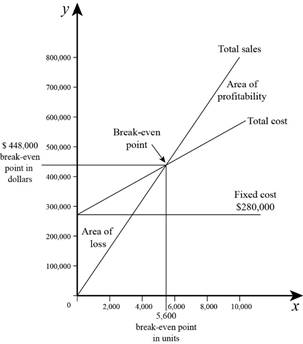

h.

Draw a break-even graph using the data in requirement (g).

h.

Explanation of Solution

The break-even graph is as follows:

(Figure 1)

Want to see more full solutions like this?

Chapter 3 Solutions

Fundamental Managerial Accounting Concepts

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education