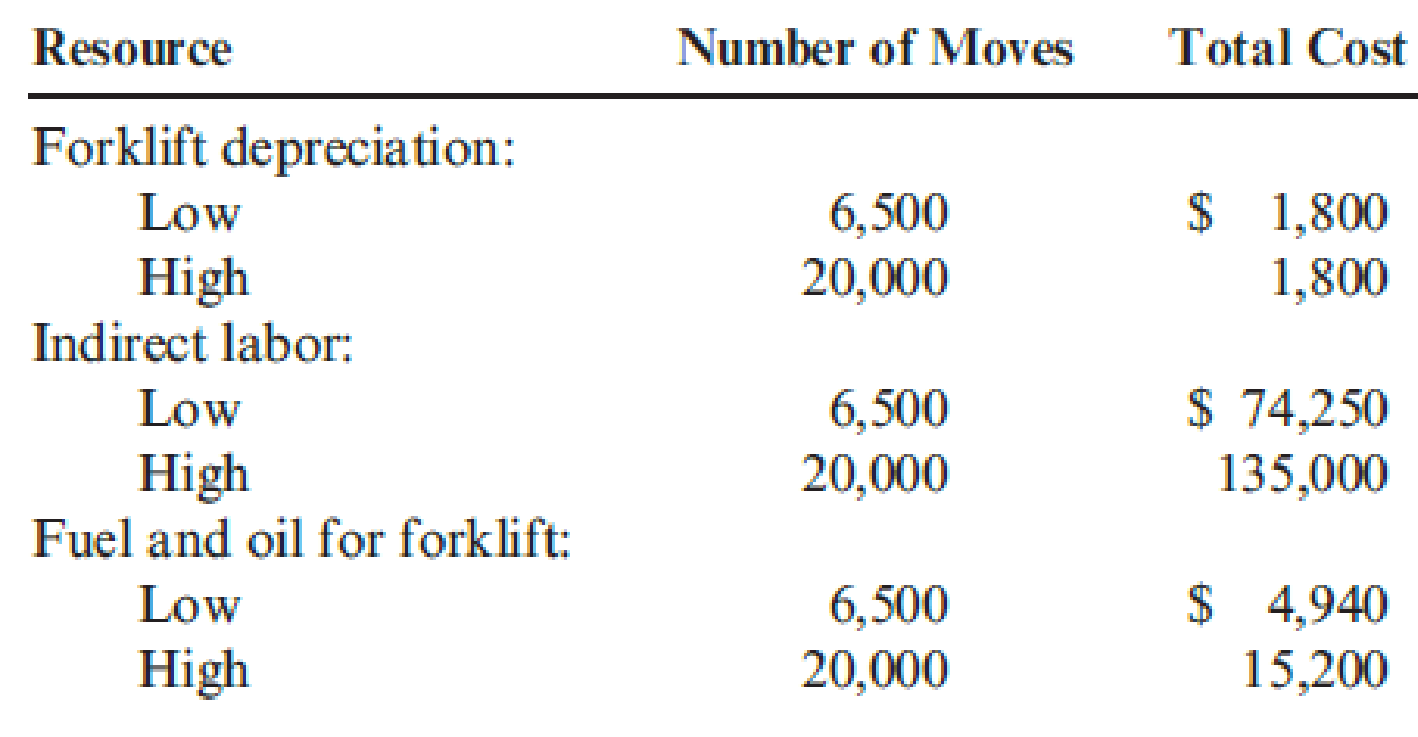

The controller of the South Charleston plant of Ravinia, Inc., monitored activities associated with materials handling costs. The high and low levels of resource usage occurred in September and March for three different resources associated with materials handling. The number of moves is the driver. The total costs of the three resources and the activity output, as measured by moves for the two different levels, are presented as follows:

Required:

- 1. Determine the cost behavior formula of each resource. Use the high-low method to assess the fixed and variable components.

- 2. Using your knowledge of cost behavior, predict the cost of each item for an activity output level of 9,000 moves.

- 3. Construct a cost formula that can be used to predict the total cost of the three resources combined. Using this formula, predict the total materials handling cost if activity output is 9,000 moves. In general, when can cost formulas be combined to form a single cost formula?

1.

Calculate the cost behavior formula of each resource use the high to low method to assess the fixed cost and variable components.

Explanation of Solution

High-low method: In the high-low method, the semi variable-cost approximation is calculated by using the exact data points. The high and low activity levels are selected from the data set that is available.

Calculate the cost behavior formula of each resource use the high to low method to assess the variable components.

Calculate variable cost per unit for fuel and oil forklift:

Therefore, variable cost per unit for forklift depreciation is $0 per unit.

Calculate fixed cost:

Note: Number of moves and total cost taken from high cost and high units.

Therefore, total fixed cost is $1,800.

Therefore, variable cost per unit for indirect labor is $4.50 per unit.

Calculate variable cost per unit for fuel and oil forklift:

Note: Number of moves and total cost taken from high cost and high units.

Therefore, total fixed cost is $45,000.

Calculate variable cost per unit for fuel and oil forklift:

Therefore, variable cost per unit for fuel and oil forklift is $0.76 per unit.

Calculate fixed cost.

Note: Number of moves and total cost taken from high cost and high units.

Therefore, total fixed cost is $0.

2.

Predict the cost of each item for an activity output level of 9,000 moves using the knowledge of cost behavior.

Explanation of Solution

Predict the cost of each item for an activity output level of 9,000 moves using the knowledge of cost behavior.

Calculate total cost for forklift depreciation.

Therefore, total cost for forklift depreciation is $1,800.

Calculate total cost for indirect labor.

Therefore, total cost for direct labor is $85,500.

Calculate total cost for fuel and oil for forklift.

Therefore, total cost for fuel and oil for forklift is $6,840.

3.

Construct the cost formula to predict the total cost of the three resources combined, using the formula predict the total material handling cost, if the activity output is 9,000 moves.

Explanation of Solution

Cost equation for material handling cost.

Calculate total cost for material handling if activity output is 9,000 moves.

Therefore, total cost for material handling is $94,140.

Want to see more full solutions like this?

Chapter 3 Solutions

Bundle: Cornerstones of Cost Management, Loose-Leaf Version, 4th + CengageNOWv2, 1 term Printed Access Card

- The management of Wheeler Company has decided to develop cost formulas for its major overhead activities. Wheeler uses a highly automated manufacturing process, and power costs are a significant manufacturing cost. Cost analysts have decided that power costs are mixed; thus, they must be broken into their fixed and variable elements so that the cost behavior of the power usage activity can be properly described. Machine hours have been selected as the activity driver for power costs. The following data for the past eight quarters have been collected: Required: 1. Prepare a scattergraph by plotting power costs against machine hours. Does the scatter-graph show a linear relationship between machine hours and power cost? 2. Using the high and low points, compute a power cost formula. 3. Use the method of least squares to compute a power cost formula. Evaluate the coefficient of determination. 4. Rerun the regression and drop the point (20,000; 26,000) as an outlier. Compare the results from this regression to those for the regression in Requirement 3. Which is better?arrow_forwardLarsen, Inc., produces two types of electronic parts and has provided the following data: There are four activities: machining, setting up, testing, and purchasing. Required: 1. Calculate the activity consumption ratios for each product. 2. Calculate the consumption ratios for the plantwide rate (direct labor hours). When compared with the activity ratios, what can you say about the relative accuracy of a plantwide rate? Which product is undercosted? 3. What if the machine hours were used for the plantwide rate? Would this remove the cost distortion of a plantwide rate?arrow_forwardThe management of Wheeler Company has decided to develop cost formulas for its major overhead activities. Wheeler uses a highly automated manufacturing process, and power costs are a significant manufacturing cost. Cost analysts have decided that power costs are mixed; thus, they must be broken into their fixed and variable elements so that the cost behavior of the power usage activity can be properly described. Machine hours have been selected as the activity driver for power costs. The following data for the past eight quarters have been collected: 2 25000 38000 3 30000 42500 4 22000 35000 5 21000 34000 6 18000 31400 7 24000 36000 8 28000 42000 Prompt Work with your group members to answer the following prompts: Prepare a scattergraph by plotting power costs against machine hours. Does the scattergraph show a linear relationship between machine hours and power cost? Use scattergraph method to draw a cost line that best fits the data and estimate the cost function. Using high and low…arrow_forward

- Shubelik Company is changing to an activity-based costing method. They have determined that they will use three cost pools: setups, inspections, and assembly. Which of the following would not be used as the activity base for any of these three activities? a.number of inspections b.number of setups c.number of direct labor hours d.number of units to be producedarrow_forwardMethod of Least Squares, Predicting Cost for Different Time Periods from the One Used to Develop a Cost Formula Farnsworth Company has gathered data on its overhead activities and associated costs for the past 10 months. Tracy Heppler, a member of the controller's department, has convinced management that overhead costs can be better estimated and controlled if the fixed and variable components of each overhead activity are known. One such activity is receiving raw materials (unloading incoming goods, counting goods, and inspecting goods), which she believes is driven by the number of receiving orders. Ten months of data have been gathered for the receiving activity and are as follows: Month Receiving Orders Receiving Cost 1 1,000 $18,000 2 700 $15,000 3 1,500 $28,000 4 1,200 $17,000 5 1,300 $25,000 6 1,100 $21,000 7 1,600 $29,000 8 1,400 $24,000 9 1,700 $27,000 10 900 $16,000 Assume that Tracy…arrow_forwardConsider the following data for two products of Vigano Manufacturing. Budgeted Cost Activity Machine setup Parts handling Quality inspections Total budgeted overhead Unit Information Units produced Direct materials cost Direct labor cost Direct labor hours Actual Activity Usage Setups Parts Inspections 1. Using a plantwide overhead rate based on 6,500 direct labor hours, compute the total product cost per unit for each product. 2. Consider the following additional information about these two products. If activity- based costing is used to allocate overhead cost, (a) compute overhead activity rates, (b) allocate overhead cost to Product A and Product B and compute overhead cost per unit for each, and (c) compute product cost per unit for each. Required 1 Required 2 Per Unit Product A Product B Activity Driver $ 26,000 (20 machine setups) 20,800 (16,000 parts) 31,200 (100 inspections) $ 78,000 Product A 2,600 units $36 per unit $ 56 per unit 2 per unit $ Direct Materials Complete this…arrow_forward

- The controller at Wesson Company's manufacturing plant has provided you with the following information for the first quarter's operations: Direct materials Fixed manufacturing overhead costs Sales price Variable manufacturing overhead Direct labor Fixed marketing and administrative costs Units produced and sold during the quarter Variable marketing and administrative costs Required: a. Determine the variable cost per unit. b. Determine the variable manufacturing cost per unit. c. Determine the full absorption cost per unit. d. Determine the full cost per unit. e. Determine the profit margin per unit. f. Determine the gross margin per unit. g. Determine the contribution margin per unit. Note: Round your answer to 2 decimal places. a. Variable cost per unit b. Variable manufacturing cost per unit c. Full absorption cost per unit d. Full cost per unit e. Profit margin per unit f. Gross margin per unit g. Contribution margin per unit $ 116 per unit $ 2,540,000 $ 525 per unit $57 per unit…arrow_forwardThe graphs below represent cost behavior patterns that might occur in acompany's cost structure. The vertical axis represents total cost, and thehorizontal axis represents activity output. Required:For each of the following situations, choose the graph from the group a-1 that best illustrates the cost pattern involved. Also, for each situation,identify the driver that measures activity output. 1. The cost of power when a fixed fee of $500 per month is chargedplus an additional charge of $0.12 per kilowatt-hour used2. Commissions paid to sales representatives. Commissions arepaid at the rate of 5 percent of sales made up to total annual salesof $500,000, and 7 percent of sales above $500,000.3. A part purchased from an outside supplier costs $12 per part for the first 3,000 parts and $10 per part for all parts purchased inexcess of 3,000 units.4. The cost of surgical gloves, which are purchased in incrementsof 100 units (gloves come in boxes of 100 pairs).5. The cost of tuition at a…arrow_forwardThe managers of Sandusky Inc. have decided to use the month of January to determine the cost of producing their widget for the year. This will help determine proper product pricing and is important for control purposes. Using the data from January, the managers can determine the costs associated with material and labor. However, fixed indirect costs must still be determined. Management intends to use the prior year’s data to determine overhead costs. It is assumed that management will allocate an equal amount of estimated costs each month. Is this an appropriate decision by management? Should January be used as the reference point for the whole year?arrow_forward

- High-Low Method, Cost Formulas The controller of the South Charleston plant of Ravinia, Inc., monitored activities associated with materials handling costs. The high and low levels of resource usage occurred in September and March for three different resources associated with materials handling. The number of moves is the driver. The total costs of the three resources and the activity output, as measured by moves for the two different levels, are presented as follows: Resource Forklift depreciation: Low High Indirect labor: Low High Fuel and oil for forklift: Number of Moves 6,500 20,000 6,500 20,000 6,500 20,000 Total Cost $ 1,800 1,800 $ 74,250 135,000 Low High Required: If required, round your answers to two decimal places. Enter a "0" if required. $ 4,940 15,200arrow_forwardSelect each of the items with the best description of its purpose. Description 1. Computes equivalent units only on production activity in the current period. 2. Combined costs of direct labor and overhead per equivalent unit. 3. Combines units and costs across two periods in computing equivalent units. 4. Used when materials move continuously through a manufacturing process. 5. Notifies the materials manager to send materials to a production department. 6. Holds indirect costs until assigned to production. 7. Holds production costs until products are transferred from production to finished goods (or another department) Itemsarrow_forwardCarter, Incorporated, produces two products, Product A and Product B. Carter uses a traditional volume-based costing system in which direct labor hours are the allocation base. Carter is considering switching to an ABC system by splitting its manufacturing overhead cost across three activities: Design, Production, and Inspection. The cost of each activity and usage of the cost drivers are as follows: Activity Pool (Driver) Design (engineering hours) Production (direct labor hours) Inspection (batches) Cost of Pool $ 300,000 500,000 200,000 300,000 100 Carter manufactures 10,000 units of Product A and 7,500 units of Product B per month. Required: a. Calculate the predetermined overhead rate under the traditional costing system. b. Calculate the activity rate for Design. c. Calculate the activity rate for Machining. d. Calculate the activity rate for Inspection. e. Calculate the indirect manufacturing costs assigned to each unit of Product A under the traditional costing system. f.…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning