Concept explainers

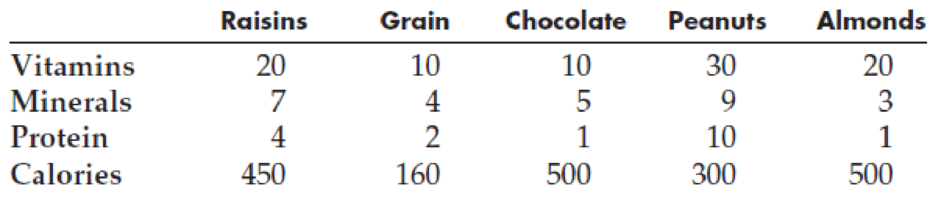

Tuckered Outfitters plans to market a custom brand of packaged trail mix. The ingredients for the trail mix will include Raisins, Grain, Chocolate Chips, Peanuts, and Almonds costing, respectively, $2.50, $1.50, $2.00, $3.50, and $3.00 per pound. The vitamin, mineral, and protein content of each of the ingredients (in grams per pound) is summarized in the following table along with the calories per pound of ingredient:

The company would like to identify the least costly mix of these ingredients that provides at least 40 grams of vitamins, 15 grams of minerals, 10 grams of protein, and 600 calories per two pound package. Additionally, they want each ingredient to account for at least 5% and no more than 50% of the weight of the package.

- a. Formulate a LP model for this problem.

- b. Implement your model in a spreadsheet and solve it.

- c. What is the optimal mix and how much is the total ingredient cost per package?

Trending nowThis is a popular solution!

Chapter 3 Solutions

Spreadsheet Modeling and Decision Analysis: A Practical Introduction to Business Analytics

- I need help What are the variables that influence an employee’s decision to leave or stay at an organization (Hint: It’s not just money.)arrow_forwardDistinguish how the three major types of CRM (strategic, operational, and analytical) can be used to provide successful relationships with customers in terms of acquisition, retention, and development.arrow_forwardAs done in the laboratory, show the circuit diagram and give all component values for your design of: A. A dc regulated power supply to convert line voltage to 10 V dc for a 50 ohm load. B. An input protection circuit for a CMOS gate.arrow_forward

- Why do most companies use workday as human resource information system (HRIS)? pros and cons?arrow_forwardCan you guys help me with this? Thank you! What did you learn this semester for Fall 2024? How do you plan to utilize this content in your real life in your professional and personal career? Please describe a concept and apply how you will use it in your professional career. Here are what I learned from this semester: Contingency Factors include size, organizational technology, the external environment, goals and strategy, and organizational culture. The Triple Bottom Line includes the three Ps: People, Planet, and Profit. Intergroup Conflict Here are three sources that help to work on this question: Article Influence of contingency factors on the socioeconomic performance of local governments by Clovis Fiirst & Ilse Maria Beuren Article Triple Bottom Line toward a Holistic Framework for Sustainability: A Systematic Review by Vittoria Loviscek The book chapter (5. Intergroup Conflict) from The Resolution of Conflict: Constructive and Destructive Processes from Morton Deutscharrow_forwardLate Night Cookies spends $160 on ingredients and boxes to make 100 boxed orders of cookies. This means that the variable cost per box of cookies is $1.60. It sells a single box for $8. Its monthly fixed cost is $653. Use the information above to help you fill out the break-even formula below. A blank formula to find break-even units Hint Submit HINT 1 First, identify your total fixed costs. It says in the problem that your fixed costs are $653.arrow_forward

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning