Concept explainers

Rework the sales budget assuming an 11 percent growth rate in sales and a 5 percent growth rate in sales. Assume a $135,000 target cash balance.

KEAFER MANUFACTURING

WORKING CAPITAL MANAGEMENT

You have recently been hired by Keafer Manufacturing to work in its established treasury department. Keafer Manufacturing is a small company that produces highly customized cardboard boxes in a variety of sizes for different purchasers. Adam Keafer, the owner of the company, works primarily in the sales and production areas of the company. Currently, the company basically puts all receivables in one pile and all payables in another, and a part-lime bookkeeper periodically comes in and attacks the piles. Because of this disorganized system, the finance area needs work, and that's what you've been brought in to do.

The company currently has a cash balance of $210,000, and it plans to purchase new machinery in the third quarter at a cost of 5390,000. The purchase of the machinery will be made with cash because of the discount offered for a cash purchase. Adam wants to maintain a minimum cash balance of $135,000 to guard against unforeseen contingencies. All of Keafer’s sales to customers and purchases from suppliers are made with credit, and no discounts are offered or taken.

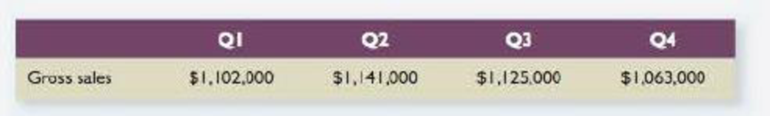

The company had the following sales each quarter of the year just ended:

After some research and discussions with customers, you’re projecting that sales will be 8 percent higher in each quarter next year. Sales for the first quarter of the following year are also expected to grow at 8 percent. You calculate that Keafer currently has an accounts receivable period of 57 days and an accounts receivable balance of $675,000. However, 10 percent of the accounts receivable balance is from a company that has just entered bankruptcy, and it is likely that this portion will never be collected.

You’ve also calculated that Keafer typically orders supplies each quarter in the amount of 50 percent of the next quarter’s projected gross sales, and suppliers are paid in 53 days on average. Wages, taxes, and other costs run about 25 percent of gross sales. The company has a quarterly interest payment of $185,000 on its long-term debt. Finally, the company uses a local bank for its short-term financial needs. It currently pays 1.2 percent per quarter on all short-term borrowing and maintains a

Adam has asked you to prepare a cash budget and short-term financial plan for the company under the current policies. He has also asked you to prepare additional plans based on changes in several inputs.

Want to see the full answer?

Check out a sample textbook solution

Chapter 26 Solutions

Corporate Finance

- Assume that you are starting your own coffee shop. You will need to develop budgeted income statement and balance sheet for the next three years. Your goal is to apply the budget concepts and formulate strategies for operational sustainability. Task: Model Financial Statement Budgets for a Coffee Shop a. Income statement budget model for 3 years. b. Balance sheet budget model for 3 years. Hints (USE $ as currency + make it a low budget business + see the attached tables as refrernce to the kind of required tables)arrow_forwardWhat is the equation budget for each of the following 1- The first transaction means that Safia (the owner) entered a capital of $ 10,000 in cash to start the business. An asset (cash) column is created to record this transaction. The effect of the deal is that the assets and equity will increase by $ 10,000 2- The second transaction states that the goods were purchased on credit from Anees (creditor / supplier). The effect will increase the business assets (stocks) as well as liabilities (creditor) by $ 300 because the company owes the money to Anis. 3- Salaries are work expenses. When the cash repayment is made, the asset (cash) will be reduced and the equity (equity) also becomes lower by $ 3000 due to this cash advance. 4- Borrowing is like a bank loan, as the business needs money in its operations. The effects of this transaction are that the assets (cash) and liabilities column (bank loan) are also increased by $ 2000. 5- The cash column will include when the company purchases $…arrow_forwardJana and Cindy are planning to launch UP-PACK, a business that upcycles disposable masks into high quality packaging material. They think it can be a viable business but they need your advice; they want to make sure they aren't taking too big of a risk. Use the information below to create a 6 month cash budget. Based on their research of the industry, they plan to provide credit terms to their customers of 35% payment during the month of sale and 65% payment in the month following sale. Manufacturing supply costs are relatively low since they can get free used disposable masks from health care facilities but there are costs incurred to clean and upcycle the masks. They project their costs of goods sold (COGS) to be 24% of each month's sales. They anticipate having to pay 60% of these costs in the month of purchase and 40% in the month following purchase. Fortunately, Jana's brother has a large empty garage that they can operate in for the first year which saves them from renting…arrow_forward

- What is the equation budget for each of the following 1- The first transaction means that Safia (the owner) entered a capital of $ 10,000 in cash to start the business. An asset (cash) column is created to record this transaction. The effect of the deal is that the assets and equity will increase by $ 10,000 2- The second transaction states that the goods were purchased on credit from Anees (creditor / supplier). The effect will increase the business assets (stocks) as well as liabilities (creditor) by $ 300 because the company owes the money to Anis. 3- Salaries are work expenses. When the cash repayment is made, the asset (cash) will be reduced and the equity (equity) also becomes lower by $ 3000 due to this cash advance. 4- Borrowing is like a bank loan, as the business needs money in its operations. The effects of this transaction are that the assets (cash) and liabilities column (bank loan) are also increased by $ 2000. 5- The cash column will include when the company purchases $…arrow_forwardVarsity Supplies & Things have indicated an industry requirement to maintain a minimum cash balance of $162,000 each month. He has also noted that management is very keen on keeping the gearing ratio of the business as low as possible and would therefore prefer to cushion any gaps internally using equity financing. Based on the budget prepared, will the business be achieving this desired target? What are three (3) internal strategies that may be employed by management to improve the organization's monthly cash flow and militate against or reduce any possible shortfall reflected in the budget prepared.arrow_forwardUpon receipt of the budget the team manager has now informed you that the management of Miller Merchandising & More have indicated a desire to maintain a minimum cash balance of $125,000 each month. Based on the budget prepared, will the business be achieving this desired target? Given that the management does not wish to borrow any funds from outside sources, suggest three (3) internal strategies that the business may employ in order to improve the organization’s monthly cash flow. Each strategy must be fully explained(in detailed).arrow_forward

- Please help solve all question Mega Empire Bhd. is in the inital stages of preparing the annual budget for next year. Danial, has recently joined the company as management accountant and is interested to learn as much as possible about the company’s budgeting process. After the recent meeting with the Sales Manager who is Zack and Aaron as the Production Manager, Danial initiated the following conversation Danial: Since I am new around here and I am going to be involved with the preparation of the annual budget. I’d be interested to learn how the two of you estimate sales and production numbers. Zack: We start out very methodically by looking at recent history, discussing what we know about current accounts, potential customers, and the general state of consumer spending. Then we add the usual dose of intuition to come up with the best forecast we can. Aaron: I usually take the sales projections as a basis for my projections. Of course we have to make estimate of what this year’s…arrow_forwardUpon receipt of the budget, the team manager, Damion Brownie, has now informed you that, in keeping with industry players, the management of Varsity Supplies & Things have indicated an industry requirement to maintain a minimum cash balance of $162,000 each month. He has also noted that management is very keen on keeping the gearing ratio of the business as low as possible and would therefore prefer to cushion any gaps internally using equity financing.Based on the budget prepared, will the business be achieving this desired target? Suggest three (3) internal strategies that may be employed by management to improve the organization’s monthly cash flow and militate against or reduce any possible shortfall reflected in the budget prepared. Each strategy must be fully explained.arrow_forwardRequired: (c) Upon receipt of the budget, the team manager, June Jackson, has now informed you that, in keeping with industry players, the management of Pelican Merchandising have indicated an industry requirement to maintain a minimum cash balance of $185,000 each month. She has also noted that management is very keen on keeping the gearing ratio of the business as low as possible and would therefore prefer to cushion any gaps internally using equity financing. Based on the budget prepared, will the business be achieving this desired target? Suggest three (3) internal strategies that may be employed by management to improve the organization’s monthly cash flow and militate against or reduce any possible shortfall reflected in the budget prepared. Each strategy must be fully explained.arrow_forward

- Accepting that there is now a greater need to plan properly for the future, Management has sought your help in revisiting their existing budgets, especially those affecting the cash flow of the company. It had been agreed that the company should maintain a balance of at least $ 40,000 at all times. The balance at the start of the year was $ 45,000. The current sales policy allows for all sales to be done on a credit basis with 50 % of the sales being collected in the month of sale; 40% in the next month and 10% in the second month after the sale. Sales projections for the first three months of 2021are as follows: January $ 150,000 February$ 160,000 March$ 180,000 You have also learnt that sales in the months of November and December 2020, were $ 130,000 and $ 140,000 respectively. The purchasing policy is also under scrutiny as the market gets more demanding. Currently all purchases are on credit also and payments are made with 30% in the month of purchase,…arrow_forwardAccepting that there is now a greater need to plan properly for the future, Management has sought your help in revisiting their existing budgets, especially those affecting the cash flow of the company. It had been agreed that the company should maintain a balance of at least $ 40,000 at all times. The balance at the start of the year was $ 45,000. The current sales policy allows for all sales to be done on a credit basis with 50 % of the sales being collected in the month of sale; 40% in the next month and 10% in the second month after the sale. Sales projections for the first three months of 2021 are as follows: January $ 150,000 February $ 160,000 March $ 180,000 You have also learnt that sales in the months of November and December 2020, were $ 130,000 and $ 140,000 respectively. The…arrow_forwardAccepting that there is now a greater need to plan properly for the future, Management has sought your help in revisiting their existing budgets, especially those affecting the cash flow of the company. It had been agreed that the company should maintain a balance of at least $ 40,000 at all times. The balance at the start of the year was $ 45,000. The current sales policy allows for all sales to be done on a credit basis with 50 % of the sales being collected in the month of sale; 40% in the next month and 10% in the second month after the sale. Sales projections for the first three months of 2021 are as follows: January $ 150,000 February $ 160,000 March $ 180,000 You have also learnt that sales in the months of November and December 2020, were $ 130,000 and $ 140,000 respectively. The…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College