College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 25, Problem 1SEA

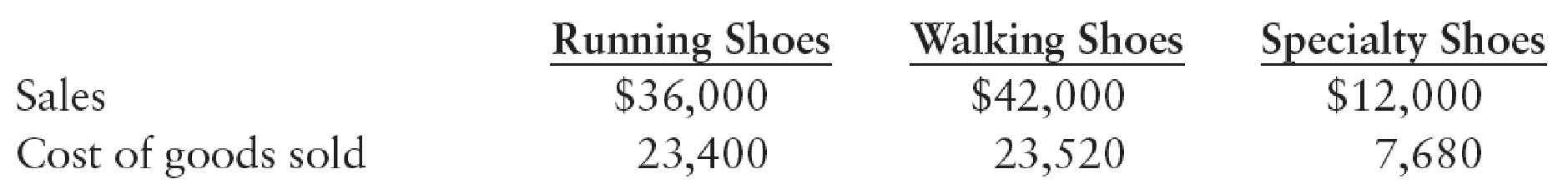

GROSS PROFIT SECTION OF DE PART MENT AL INCO ME ST ATE MENT Bill Walters and Alice Jennings are partners in a business called Walters and Jennings Sportswear that sells athletic footwear. They have organized the business on a departmental basis as follows: running shoes, walking shoes, and specialty shoes. At the end of the first year of operation, the sales and cost of goods sold for the three departments are as follows:

Prepare the gross profit section of a departmental income statement for the year ended December 31, 20--. Show the gross profit for each department and for the business in total.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the current price of the stock on these financial accounting question?

Don't use ai given answer accounting questions

Lenoci Inc. paid $310,000 for equipment three years ago. This year, it

sold the equipment for $200,000. Through the date of sale, accumulated

book depreciation was $93,840 and accumulated tax depreciation was

$147,327.

Which of the following statements is true?

A) The sale results in a $53,487 favorable temporary book/tax difference.

B) The sale results in a $53,487 unfavorable temporary book/tax

difference.

C) The sale results in a $53,487 unfavorable permanent book/tax

difference.

D) None of the above is true.

Chapter 25 Solutions

College Accounting, Chapters 1-27

Ch. 25 - A department that incurs costs and generates...Ch. 25 - Departmental gross profit is the difference...Ch. 25 - Prob. 3TFCh. 25 - Direct expenses are operating expenses incurred...Ch. 25 - Departmental direct operating margin is the...Ch. 25 - A department that incurs costs but does not...Ch. 25 - The difference between a departments net sales and...Ch. 25 - Prob. 3MCCh. 25 - The difference between a departments gross profit...Ch. 25 - The difference between a departments gross profit...

Ch. 25 - Prob. 1CECh. 25 - Prob. 2CECh. 25 - Prob. 3CECh. 25 - Prob. 1RQCh. 25 - Prob. 2RQCh. 25 - Prob. 3RQCh. 25 - Prob. 4RQCh. 25 - Prob. 5RQCh. 25 - Prob. 6RQCh. 25 - Prob. 7RQCh. 25 - Prob. 8RQCh. 25 - Distinguish between departmental gross profit,...Ch. 25 - Prob. 10RQCh. 25 - GROSS PROFIT SECTION OF DE PART MENT AL INCO ME ST...Ch. 25 - ALLOCATING OPERATING EXPENSESQUARE FEET Weaverling...Ch. 25 - ALLOCATING OPERATING EXPENSERELATIVE NET SALES...Ch. 25 - ALLOCATING OPERATING EXPENSEMILES DRIVEN Mercado...Ch. 25 - COMPUTING OPERATING INCOME The sales, cost of...Ch. 25 - Prob. 6SEACh. 25 - INCOME STATEMENT WITH DEPART MENTAL GROSS PROFIT...Ch. 25 - INCOME STATE MENT WITH DEPARTMENTAL OPERATING...Ch. 25 - INCOME STATEMENT WITH DEPART MENTAL DIRECT...Ch. 25 - Prob. 10SPACh. 25 - GROSS PROFIT SECTION OF DEPART MENTAL INCOME...Ch. 25 - Prob. 2SEBCh. 25 - ALLOCATING OPERATING EXPENSERELATIVE NET SALES...Ch. 25 - ALLOCATING OPERATING EXPENSEMILES DRIVEN Herbert...Ch. 25 - Prob. 5SEBCh. 25 - Prob. 6SEBCh. 25 - INCOME STATEMENT WITH DEPART MENTAL GROSS PROFIT...Ch. 25 - Prob. 8SPBCh. 25 - Prob. 9SPBCh. 25 - Prob. 10SPBCh. 25 - Prob. 1MYWCh. 25 - Prob. 1ECCh. 25 - MASTERY PROBLEM Bobs Acme Supermarket has been in...Ch. 25 - CHALLENGE PROBLEM This problem challenges you to...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ched The Plastic Flowerpots Company has two manufacturing departments, molding, and packaging. At the beginning of the month, the molding department has 2,400 units in inventory, 70% complete as to materials. During the month, the molding department started 20,000 units. At the end of the month, the molding department had 3,600 units in the ending inventory. 80% complete as to materials. Units completed in the molding department are transferred into the packaging department Cost information for the molding department for the month follows: Beginning work in process inventory (direct materials) Direct materials added during the month $1,600 $31,900 Using the weighted average method, compute the molding department's (a) equivalent units of production for materials and (b) cost per equivalent unit of production for materials for the month.arrow_forwardPlease provide this question solution general accountingarrow_forwardBuilder Products, Inc., uses the weighted average method in its process costing system. It manufactures a caulking compound that goes through three processing stages prior to completion. Information on work in the first department, Cooking, is given below for May: Production data: Pounds in process, May 1; materials 100% complete; conversion 90% complete Pounds started into production during May Pounds completed and transferred out 81,000 4,60,000 ? Pounds in process, May 31; materials 80% complete; conversion 20% complete 55,000 Cost data: Work in process inventory, May 1: Materials cost Conversion cost Cost added during May: $1,58,20 $50,500 Materials cost Conversion cost 1. Compute the equivalent units of production for materials and conversion for May. $ 8,22,30 $2,77,5 2. Compute the cost per equivalent unit for materials and conversion for May. 3. Compute the cost of ending work in process inventory for materials, conversion, and in total for May. 4. Compute the cost of units…arrow_forward

- Kindly help me with accounting questionsarrow_forwardplease provide general account answerarrow_forwardA company produces a single product. Variable production costs are $12 per unit, and variable selling and administrative expenses are $3 per unit. Fixed manufacturing overhead totals $36,000, and fixed selling and administration expenses total $40,000. Assuming a beginning inventory of zero, production of 4,000 units and sales of 3,600 units, the dollar value of the ending inventory under variable costing would be: a. $3,600 b. $8,400 c. $4,800 d.$6,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License