EBK PRINCIPLES OF CORPORATE FINANCE

12th Edition

ISBN: 9781259358487

Author: BREALEY

Publisher: MCGRAW HILL BOOK COMPANY

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 25, Problem 1PS

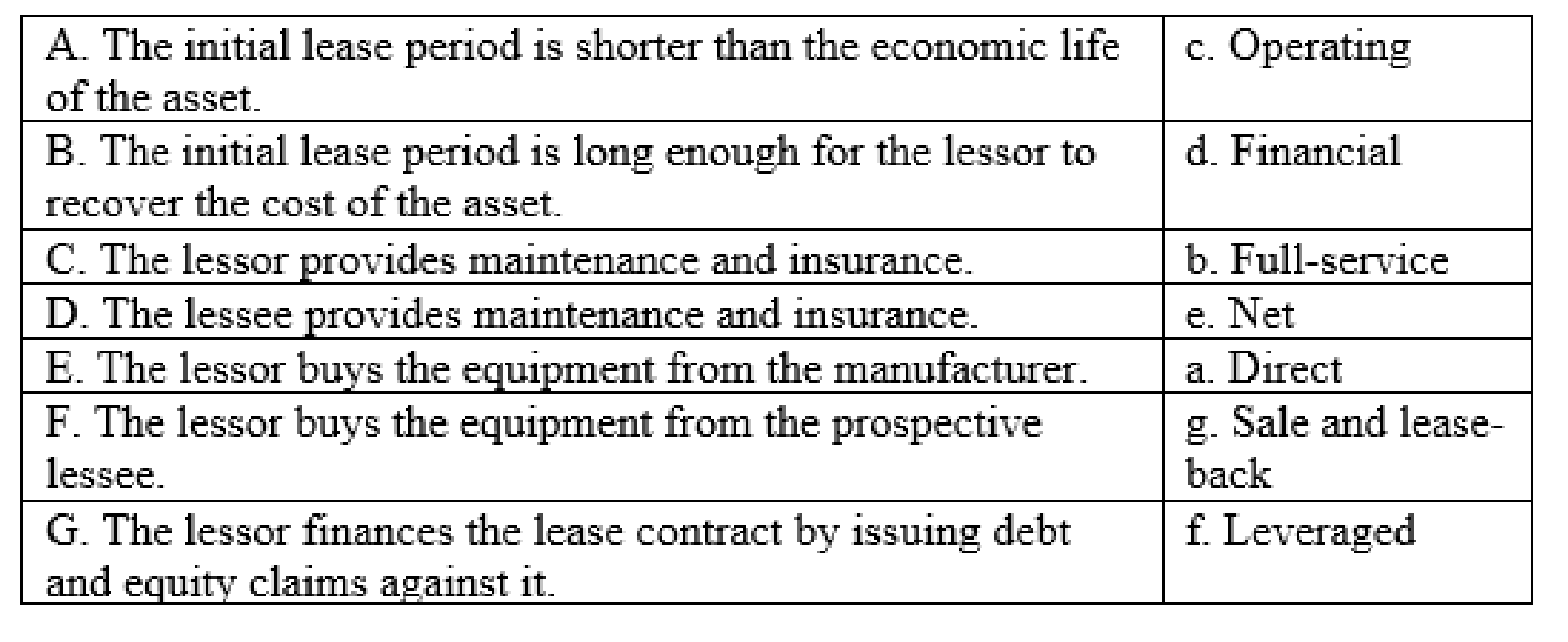

Types of lease* The following terms are often used to describe leases:

- a. Direct

- b. Full-service

- c. Operating

- d. Financial

- e. Net

- f. Leveraged

- g. Sale and lease-back

Match one or more of these terms with each of the following statements:

- A. The initial lease period is shorter than the economic life of the asset.

- B. The initial lease period is long enough for the lessor to recover the cost of the asset.

- C. The lessor provides maintenance and insurance.

- D. The lessee provides maintenance and insurance.

- E. The lessor buys the equipment from the manufacturer.

- F. The lessor buys the equipment from the prospective lessee.

- G. The lessor finances the lease contract by issuing debt and equity claims against it.

Expert Solution & Answer

Summary Introduction

To discuss: Match the given terms with the suitable statements.

Explanation of Solution

The given terms are matched with the appropriate statements as follows:

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

Which one of the following definitions is/are correct?

I.

A lease between a lessor and the manufacturer of the leased asset is

a direct lease.

I.

A leveraged lease is where the lessor has borrowed about 80% of the

asset's cost while the lender owns the asset.

I.

The lessor is the party which uses the leased asset.

IV.

A financial lease is a capital cancellable contractual agreement

between two parties.

V.

A sale and leaseback is the sale of an asset by Firm A to Firm B

followed by the lease of that asset by Firm C.

Select one:

O a. I and Il only

O b. Il only

O . I, Il and IV only

O d. I. only

O e. Il and IV only

A lease agreement whereby the lessor shall recognized gross profit at inception of the lease?

a. Multi-agreement lease

b. Direct finance lease

c. Operating lease

d. Dealers lease

The following are some of the characteristics of an asset available for lease.

E (Click the icon to view the lease characteristics.)

Required

a. Determine the amount of lease payment that the lessor would require to lease the asset.

b. Compute the lessor's net investment in the lease at initial recognition.

Lease characteristics

c. Compute the value of the lessee's ROU asset at initial recognition.

d. Compute the lessee's lease liability at initial recognition.

Fair value of leased asset

$

115,000

Lease term

7 years

Payment frequency

Annual

Requirement a. Determine the amount of lease payment that the lessor would require to lease the asset.

Payment timing

Beginning of year

Begin by calculating the present value of the residual value and the value to be recovered by the lessor from the annual lease payments. (Use

the nearest whole dollar.)

s rounded to

Guaranteed residual value

$

19,000

Amount expected to be paid out under the

guaranteed residual

Present value of guaranteed residual…

Chapter 25 Solutions

EBK PRINCIPLES OF CORPORATE FINANCE

Ch. 25 - Types of lease The following terms are often used...Ch. 25 - Reasons for leasing Some of the following reasons...Ch. 25 - Lease treatment in bankruptcy What happens if a...Ch. 25 - Lease treatment in bankruptcy How does the...Ch. 25 - Lease characteristics True or false? a. Lease...Ch. 25 - Operating leases Explain why the following...Ch. 25 - Inflation and operating leases In Problem 7, we...Ch. 25 - Technological change and operating leases Look at...Ch. 25 - Valuing financial leases Look again at Problem 7....Ch. 25 - Valuing Financial Leases Look again at the...

Ch. 25 - Valuing financial leases Look again at the bus...Ch. 25 - Valuing financial leases In Section 25-5, we...Ch. 25 - Valuing financial leases In Section 25-5, we...Ch. 25 - Valuing financial leases A lease with a varying...Ch. 25 - Valuing financial leases Nodhead College needs a...Ch. 25 - Valuing financial leases The Safety Razor Company...Ch. 25 - Nonrecourse debt Lenders to leveraged leases hold...Ch. 25 - Leveraged leases How would the lessee in Figure...Ch. 25 - Prob. 23PSCh. 25 - Valuing leases Suppose that the Greymare lease...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the following statements is most CORRECT? Oa. A key difference between a capital lease and an operating lease is that with a capital lease, the lease payments provide the lessor with a return of the funds invested in the asset plus a return on the invested funds, whereas with an operating lease the lessor depends on the residual value to realize a full return of and on the investment. Ob. Finance leases usually have a cancelation feature. Oc. Capital, or financial, leases generally provide for maintenance by the lessor. Od. Capitalizing a lease means that the firm issues equity capital in proportion to its current capital structure, in an amount sufficient to support the lease payment obligation. Oe. The fixed charges associated with a lease can be as high as, but never greater than, the fixed payments associated with a loan.arrow_forwardWhich of the following statements is characteristic of leases? a.If a lease is classified as an operating lease, the lessee records an asset on its statement of financial position. b.Lease agreements are not a popular form of financing the purchase of assets because leases require a large initial outlay of cash. c.If a lessor classifies a lease as a finance lease, the lessor records a lease liability on its statement of earnings. d.Accounting recognizes two types of leases—operating and finance.arrow_forwardThe following are some of the characteristics of an asset available for lease. (Click the icon to view the lease characteristics.) Required a. Determine the amount of lease payment that the lessor would require to lease the asset. b. Compute the lessor's net investment in the lease at initial recognition. c. Compute the value of the lessee's ROU asset at initial recognition. d. Compute the lessee's lease liability at initial recognition. Requirement a. Determine the amount of lease payment that the lessor would require to lease the asset. Begin by calculating the present value of the residual value and the value to be recovered by the lessor from the annual lease payments. (Use a financial calculator for all present value computations. Enter your final answers as positive amounts rounded to the nearest whole dollar.) Present value of guaranteed residual value Value to be recovered by annual lease payments Determine the amount of lease payment that the lessor would require to lease the…arrow_forward

- Initial direct costs incurred by the lessor under a sales-type lease should be a. Deferred and allocated over the economic life of the leased property. b. Expensed in the period incurred. c. Deferred and allocated over the term of the lease in proportion to the recognition of rental income. d. Added to the gross investment in the lease and amortized over the term of the lease as a yield adjustment.arrow_forwardWhat type(s) of leases result in an asset and a liability on the balance sheet? Select one: A. Operating Leases * B. Finance Leases C. Both Operating and Finance Leases D. Neither Operating and Finance Leasesarrow_forwardThe difference of gross investment in the lease and net investment in the lease of the lessor is? A. Total amount of interest that the lessee shall recognized as interest expense over the lease term. B. Interest income at inception of the lease. C. Total amount of interest that the lessor shall recognized as interest income over the lease term. D. Initial direct cost.arrow_forward

- See attached picture 1. Duscuss the nature of this lease in relation to the lessor and compute the amount of each of the following items: A. Lease receivable at inception of the lease B. Sales Price C. Cost of salesarrow_forwardThis type of lease involves recognition of a manufacturer’s or dealer’s profitor loss on the transfer of the asset to the lessee. A. Operating leaseB. Sale and leasebackC. Sales type leaseD. Direct financing lease.arrow_forwardA lessor will record interest income if a lease is classifi ed as:A . a capital lease.B . an operating lease.C . either a capital or an operating lease.arrow_forward

- The lessee normally measures the lease liability to be recorded as the: Select one: a. Present value of the minimum lease payments. b. The future value of the minimum lease payments c. The fair market value of the leased asset. d. The sum of the cash payments over the term of the lease.arrow_forwardIn a sale-leaseback transaction, the lease liability is equals to: A. PV of lease payments accruing to the lessor B. PV of lease payments accruing to the lessor plus any additional financing C. PV of lease payments accruing to the lessor less any prepayments D. PV of lease payments accruing to the lesseearrow_forwardAnswer True or False Initial direct costs are immediately recognized as an expense by the lessor when the cost incurred in conjunction with an operating lease. Both finance and operating leases are subject to capitalization. Under an operating lease, the lease bonus paid by the lessee to the lessor and amortized over the lease term as a reduction to lease income. When rental payments vary over the term of the operating lease, the lessor should recognize lease income on a straight-line basis, unless there is another method that is more appropriate Initial direct costs are immediately recognized as an expense by the lessor when the cost incurred in conjunction with an operating lease. The lessor uses the implicit interest rate in determining the present value of the lease payments Termination penalties are included in the lease payments if the lease term reflects the lessee exercising an option to terminate the lease. In a sale and leaseback transaction that qualifies as a sale under…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Accounting for Finance and Operating Leases | U.S. GAAP CPA Exams; Author: Maxwell CPA Review;https://www.youtube.com/watch?v=iMSaxzIqH9s;License: Standard Youtube License