Concept explainers

Valuing financial leases In Section 25-5, we listed four circumstances in which there are potential gains from leasing. Check them out by conducting a sensitivity analysis on the Greymare Bus Lines lease, assuming that Greymare does not pay tax. Try, in turn, (a) a lessor tax rate of 50% (rather than 21%), (b) straight-line

a)

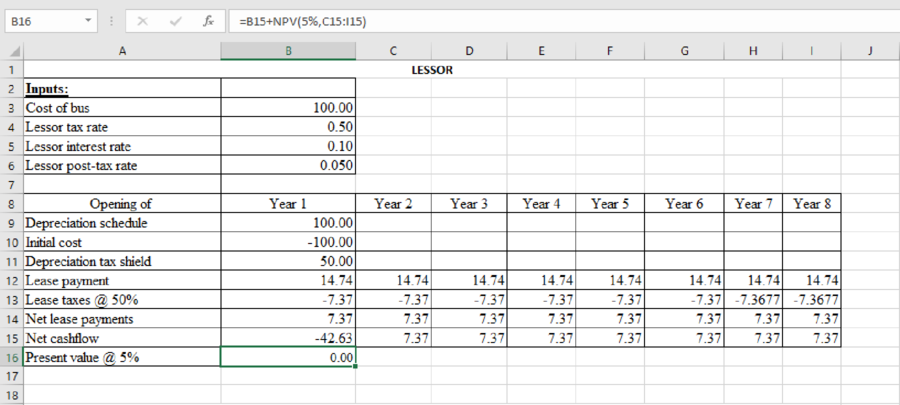

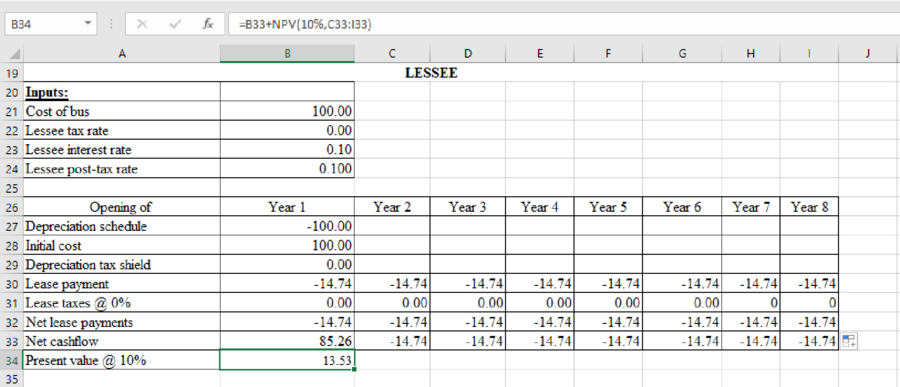

To determine: The minimum rental that would please the lessor and compute NPV to the lessee if a lessor tax rate is 50%.

Explanation of Solution

The NPV of the lessor’s cash flow contains of the cost of the bus, the PV of the depreciation tax shield, and the present value of the post-tax lease payments. To ascertain the minimum rental P, we set the NPV o zero and solve for P. we can then utilize this value for to calculate the value of the lease to the lessee.

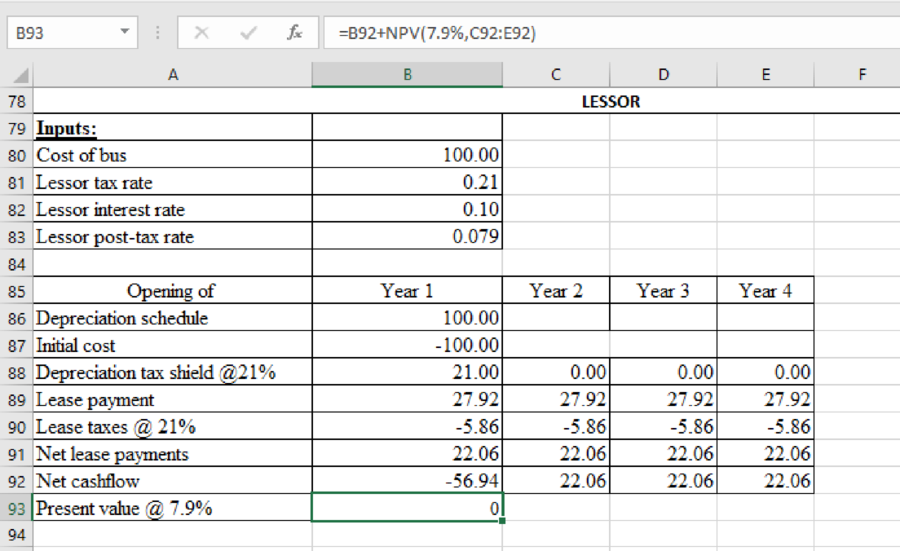

Computation of minimum rental that would satisfy the lessor and NPV to the lessee is as follows:

At a lessor tax rate of 50%, the cash flows for the lessor are:

For company G, the NPV of the cash flows is the cost of the bus saved (100) lesser the present value of the lease payments.

b)

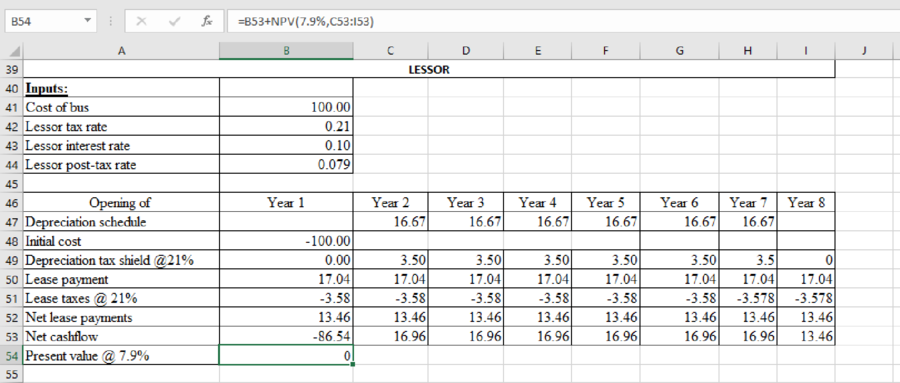

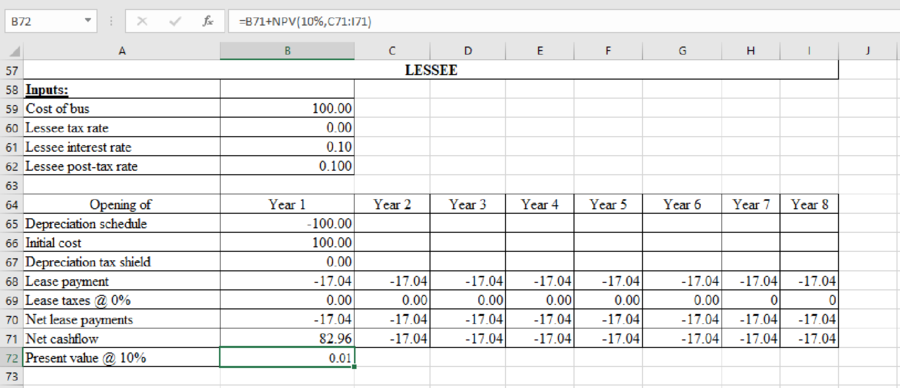

To determine: The minimum rental that would satisfy the lessor and calculate NPV to the lessee if straight line depreciation in year1 to 6.

Explanation of Solution

Computation of minimum rental that would satisfy the lessor and NPV to the lessee is as follows:

Lessor depreciation straight-line method over 6 years (tax rate back at 21%). Cash flow for the lessor are:

For company G, the NPV of the cash flow is:

c)

To determine: The minimum rental that would satisfy the lessor and calculate NPV to the lessee if a four-year lease with four annual rentals.

Explanation of Solution

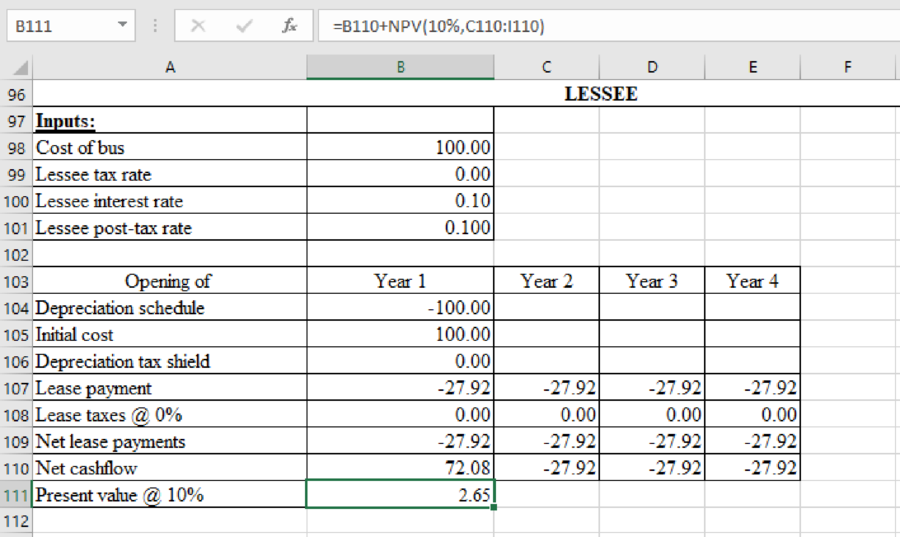

Computation of minimum rental that would satisfy the lessor and NPV to the lessee is as follows:

Four-year lease with four annual rental payments. Cash flows for the lessor are:

For company G, the NPV of cash flow is:

d)

To determine: The minimum rental that would satisfy the lessor and calculate NPV to the lessee if an interest rate of 20%.

Explanation of Solution

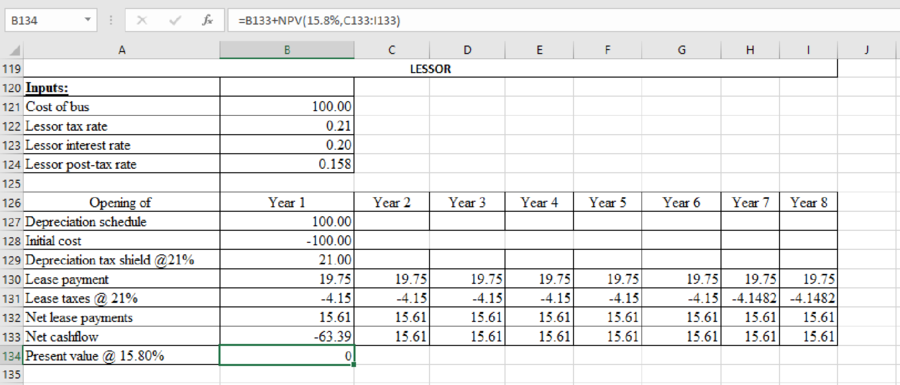

Computation of minimum rental that would satisfy the lessor and NPV to the lessee is as follows:

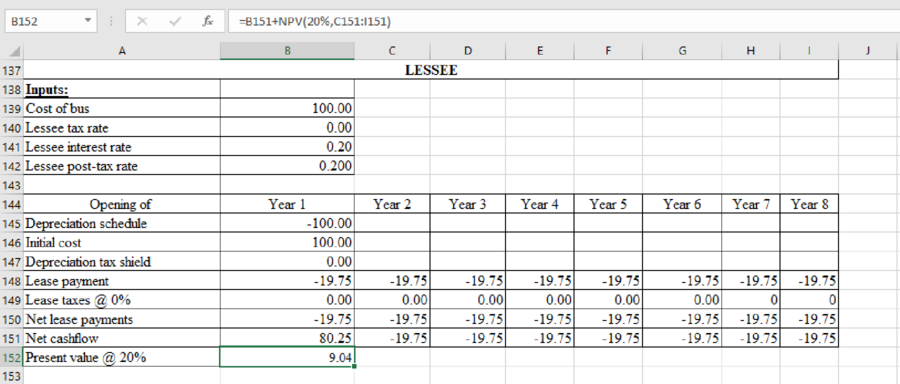

At an interest rate of 20% the cash flows for the lessor are:

For company G, the NPV of cash flow is:

Want to see more full solutions like this?

Chapter 25 Solutions

PRIN.OF CORP.FINANCE-CONNECT ACCESS

- Which of the statements is most correct? Select one: a. Some years ago leasing was called "off balance sheet financing" because the leased asset and the corresponding lease obligation did not appear directly on the balance sheet. Today, though, the situation has changed materially because all types of lease must be capitalized and reported on the balance sheet, along with the value of the leased asset. O b. In a lease-versus-purchase analysis, cash flows should generally be discounted at the WACC. O . Each of the statements is true. O d. Each of the statements is false.arrow_forwardThe following statements relate to the impact on the financial statements for operating vs. finance leases. Indicate all statements that are correct. Select one or more: a. Net Income is higher at first when a lease is classified as a finance lease. b. The right of use asset is shown at a higher amount for a finance lease. c. Operating Income is lower when a lease is classified as an operating lease. d. The lease liability is measured as the present value of future cash flows for both operating and finance leases. PreviousSave AnswersNextarrow_forwardWhich of the following statements is false regarding the accounting for leases? The lessor may not use the straight-line basis for recognizing lease income under an operating lease if another systematic basis is more representative of the pattern in which benefit from the use of the underlying asset is diminished. The amount of lease income recognized each year by the lessor under an operating lease is typically constant even though the contractual payments increase every year by a certain amount specified in the contract. A lessor includes initial direct costs incurred on the operating lease as part of the cost of the leased asset, and initial direct costs are to be recognized in profit or loss on the same basis as rent income is recognized. A lessor includes a rent collected in advance as part of the cost of the leased asset.arrow_forward

- Which of the following is not one of the criteria for determining whether a lease is a finance lease? A. The asset cost is greater than $100,000B. The lease grants the lessee an option to purchase the asset that the lessee is reasonably certain to exerciseC. The lease term is for the major part of the remaining economic life of the assetD. Alease that transdies ownership of the asset to the lessee by the end of the lease termarrow_forwardBradley Co. is expanding its operations and is in the process of selecting the method of financing this program.After some investigation, the company determines that it may (1) issue bonds and with the proceeds purchase the needed assets or (2) lease the assets on a long-term basis. Without knowing the comparative costs involved, answer these questions: (a) What might be the advantages of leasing the assetsinstead of owning them?(b) What might be the disadvantages of leasing the assets instead of owning them?(c) In what way will the balance sheet be differently affected by leasing the assets as opposed to issuing bonds and purchasing the assets?arrow_forwardWhich of the following statements is true about initial direct costs? A. Initial direct costs of a sales-type lease should be expensed at the commencement of the lease only if no selling profit or loss has been incurred. B. Initial direct costs are ownership-type costs such as insurance, maintenance, and taxes. C. Initial direct costs of an operating lease should be recorded by the lessor as a prepaid asset. D. Initial direct costs should always be debited against income by the lessor in the period of the inception of the lease.arrow_forward

- Under IFRS: lessees may use alternative measurement bases (e.g., revaluation accounting) for the right-of-use asset. different measurement bases may be used for the right-of-use asset but only for leases with terms less than one year. the same guidance on collectibility of the lease payments is used by lessors as in GAAP. lessors are required to defer gross profit on direct financing leasesarrow_forwardPart ILynbrook, Inc. is considering leasing a CAT Scan machine for its operations. As the Controller of Lynbrook, you have been asked to provide management with the lease information related to the CAT Scan. Lynbrook is considering leasing the machine from Capital Leasing, who in turn purchased the machine from the manufacturer, ScanHouse Corp. for $1,000,000. Required:Round your answers to the nearest whole dollar amounts.1. How should this lease be classified by Lynbrook and by Capital Leasing?2. Prepare appropriate entries for both Lynbrook and Capital Leasing from the beginning of the lease through the second rental payment on April 1, 2020. Depreciation and amortization are recorded at the end of each fiscal year (December 31).3. Assume Lynbrook leased the machine directly from the manufacturer, ScanHouse Corp., which produced the machine at a cost of $800,000. Prepare appropriate entries for ScanHouse from the beginning of the lease through the second rental payment on April 1,…arrow_forward4. Initial direct costs incurred by the lessor in connection with specific leasing activities as in negotiating and securing leasing arrangements in a direct finance lease would * a. result to an increase of the implicit interest rate. b. result to a decrease of the implicit interest rate. c. result to either an increase or a O decrease of the implicit interest rate depending on the given facts. d. be ignored if the lease qualifies as a dealer's lease.arrow_forward

- Bradley Co. is expanding its operations and is in the process of selecting the method of financing this program. After some investigation, the company determines that it may (1) issue bonds and with the proceeds purchase the needed assets, or (2) lease the assets on a long-term basis. Without knowing the comparative costs involved, answer these questions: a. What are the possible advantages of leasing the assets instead of owning them? b. What are the possible disadvantages of leasing the assets instead of owning them? c. How will the balance sheet be different if Bradley Co. leases the assets rather than purchasing them?arrow_forwardWhich of the following is not one of the procedures for accounting by the lessee for a decrease in lease scope? Decrease in the right of use asset equal to that of the peso decrease in finance lease liability to reflect decrease in scope both are required accounting procedures Adjustment of the decreased finance lease liability to the present value of future lease payments both are not required accounting proceduresarrow_forwardThere are two parties in any lease contract—the lessee and the lessor. To a lessor, a lease analysis involves a capital budgeting analysis of the property or equipment to be leased. The lessor’s decision is either to purchase and lease-out the asset, or not make the investment at all. Like any capital budgeting decision, the lessor needs to evaluate the rate of return expected to be earned from making the lease. Further, since the cost and other terms of leases involving high-cost items are negotiated, this rate of return information is also important information for a prospective lessee. From the following statements, identify the steps involved in lease analysis from a lessor’s perspective. Check all that apply. Determine the lease payments minus income taxes and any maintenance expenses that the lessor must incur as per the lease agreement. Determine the invoice price of the leased equipment minus any lease payments made in advance. Determine the periodic…arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning