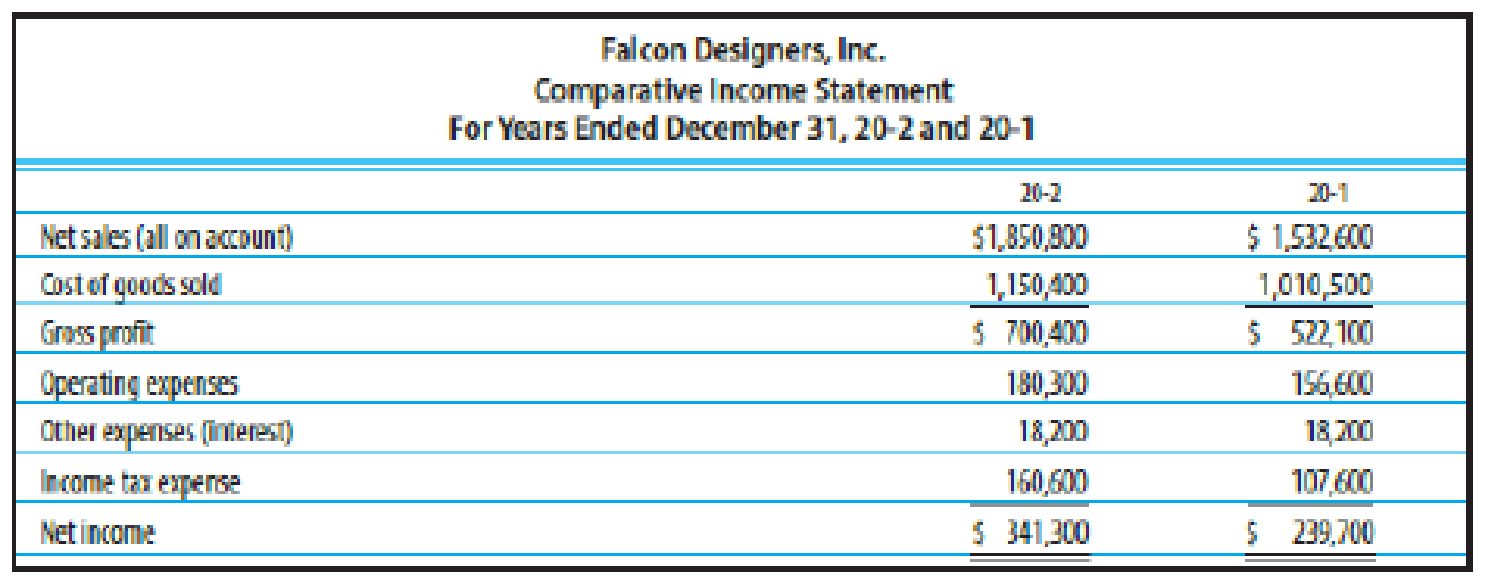

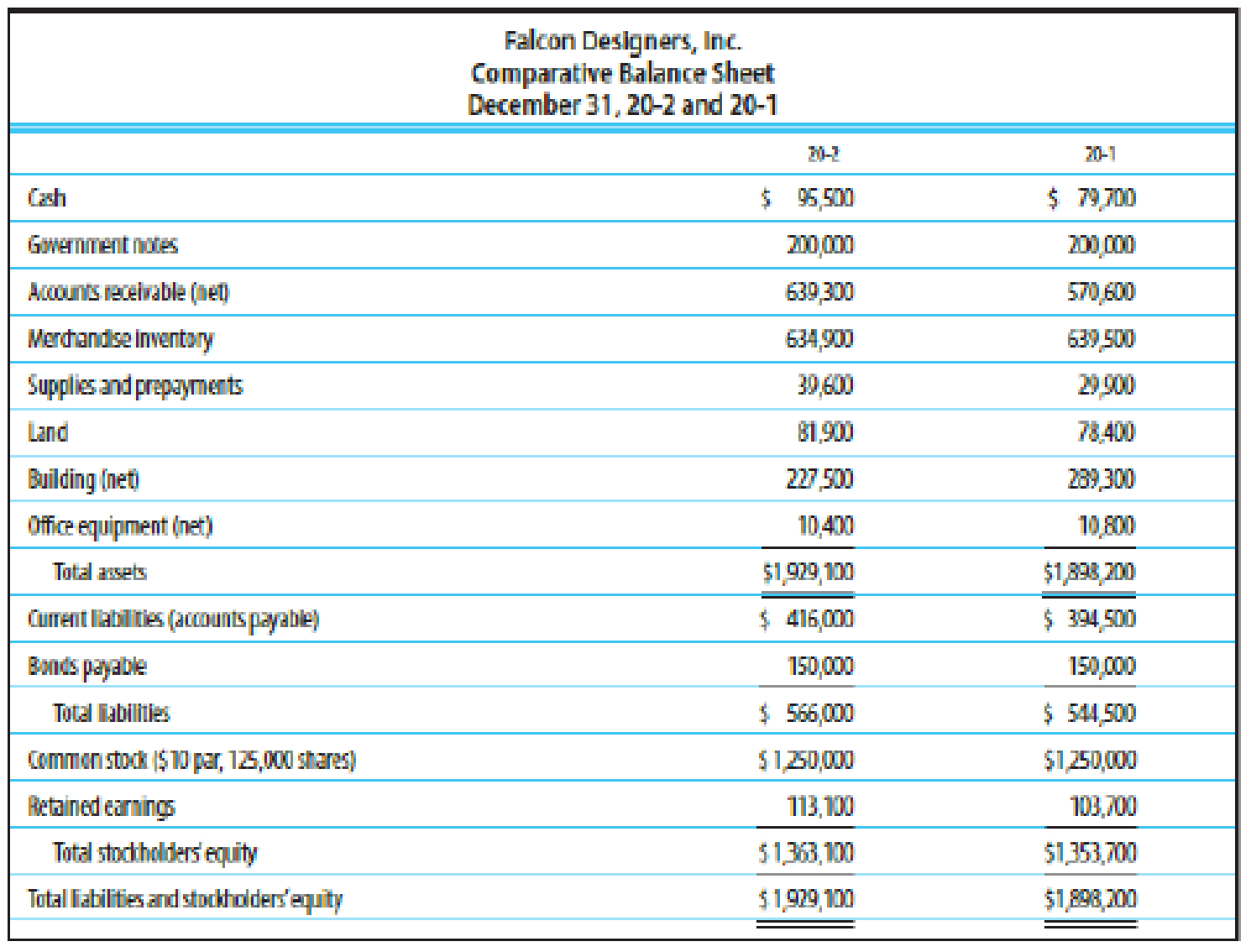

ANALYSIS OF ACTIVITY MEASURES Based on the financial statement data in Exercise 24-1B, compute the following activity measures for 20-2 (round all calculations to two decimal places):

- (a)

Accounts receivable turnover - (b) Merchandise inventory turnover

- (c) Asset turnover

(a)

Calculate accounts receivable turnover and average collection period for the period 20-2.

Explanation of Solution

Accounts receivable turnover:

Accounts receivable turnover is a liquidity measure of accounts receivable in times, which is calculated by dividing the net credit sales by the average amount of net accounts receivables. In other words, it indicates the number of times the average amount of net accounts receivables collected during a particular period.

Calculate accounts receivable turnover ratio for the period 20-2 as follows:

Therefore, accounts receivable turnover ratio for the period 20-2 is 3.06 times.

Average collection period:

Average collection period indicates the number of days taken by a business to collect its outstanding amount of accounts receivable on an average.

Calculate average collection period for the period 20-2.

Therefore, average collection period for the period 20-2 is 119.28 days.

b.

Calculate merchandise inventory turnover and average number of days to sell inventory.

Explanation of Solution

Inventory turnover ratio:

Inventory turnover ratio is used to determine the number of times inventory used or sold during the particular accounting period.

Calculate merchandise inventory for the period 20-2.

Therefore, inventory turnover ratio for the period 20-2 is 1.81 times.

Days’ sales in inventory:

Days’ sales in inventory are used to determine number of days a particular company takes to make sales of the inventory available with them.

Calculate average number of days to sell inventory for the period 20-2.

Therefore, average number of days to sell inventory during the period 20-2 is 201.66 days.

(c)

Calculate asset turnover ratio.

Explanation of Solution

Asset turnover:

Asset turnover is a ratio that measures the productive capacity of the fixed assets to generate the sales revenue for the company. Thus, it shows the relationship between the net sales and the average total fixed assets.

Calculate assets turnover ratio for the period 20-2.

Therefore, assets turnover ratio is 0.97 to 1.

Want to see more full solutions like this?

Chapter 24 Solutions

College Accounting, Chapters 1-9

- Calculate all from 1 to 15 the following ratios 1-Current Ratio 2-Quick Ratio 3-Cash Ratio 4-Receivables Turnover 5-Inventory Turnover 6-Payables Turnover 7-Debt-Equity Ratio 8-Debt Ratio 9-Total Asset Turnover 10-Fixed Asset Turnover 11-Equity Turnover 12-Gross Profit Margin 13-Operating Profit Margin 14-Net Profit Margin 15-ROA 16- ROE Balance sheet Group Parent Company 31 December 2018 31 March 2018 31 December 2018 31 March 2018 Notes RO RO RO RO ASSETS Non-current Property, plant and equipment 5 6,406,433 7,113,759 3,683,610 4,182,275 Investment in subsidiaries - - 515,750 515,750 Fixed deposit 9.1 1,048,399 - 1,048,399 - Deferred tax assets 27 675,393 537,722 727,632 602,078 Non-current assets 8,130,225 7,651,481 5,975,391 5,300,103 Current Inventories 6 4,481,209 3,832,010…arrow_forwardCompute the following the financial data for the year. 4. Average sale period 5. Operating cycle 6. Total asset turnoverarrow_forwardQuestion Calculate the following ratios for Megah Sdn. Bhd.: a)Inventories turnover (in days);Trade payables turnover ratio;Trade receivables turnover ratio.arrow_forward

- FINANCIAL RATIOS Use the work sheet and financial statements prepared in Problem 15-8B. All sales are credit sales. The Accounts Receivable balance on January 1 was 38,200. REQUIRED Prepare the following financial ratios: (a)Working capital (b)Current ratio (c)Quick ratio (d)Return on owners equity (e)Accounts receivable turnover and the average number of days required to collect receivables (f)Inventory turnover and the average number of days required to sell inventoryarrow_forwardA company reports the following: Determine the asset turnover ratio. Round to one decimal place.arrow_forwardFINANCIAL RATIOS Use the work sheet and financial statements prepared in Problem 15-8A. All sales are credit sales. The Accounts Receivable balance on January 1,20--, was 3,800. REQUIRED Prepare the following financial ratios: (a) Working capital (b) Current ratio (c) Quick ratio (d) Return on owners equity (e) Accounts receivable turnover and average number of days required to collect receivables (f) Inventory turnover and average number of days required to sell inventoryarrow_forward

- FINANCIAL RATIOS Use the work sheet and financial statements prepared in Problem 15-8B. All sales are credit sales. The Accounts Receivable balance on January 1 was 38,200. REQUIRED Prepare the following financial ratios: (a) Working capital (b) Current ratio (c) Quick ratio (d) Return on owners equity (e) Accounts receivable turnover and the average number of days required to collect receivables (f) Inventory turnover and the average number of days required to sell inventoryarrow_forwardAllowance method Using transactions listed in £6-S. indicate the effects of each transaction on the liquidity metric days’ sales in receivables and profiability metric return on sales.arrow_forwardFINANCIAL RATIOS Use the spreadsheet and financial statements prepared in Problem 15-8A. All sales are credit sales. The Accounts Receivable balance on January 1, 20--, was 10,200. REQUIRED Prepare the following financial ratios: (a) Current ratio (b) Quick ratio (c) Working capital (d) Return on owners equity (e) Accounts receivable turnover and average number of days required to collect receivables (f) Inventory turnover and average number of days required to sell inventoryarrow_forward

- Asset Efficiency Ratios Selected financial statement numbers for Rutherford Company follow. Required: 1. Using this information, calculate Rutherfords receivable turnover ratio (rounded to two decimal places.) 2. Using this information, calculate Rutherfords asset turnover ratio (rounded to two decimal places) and also convert the ratio into days (rounded to the nearest whole day).arrow_forwardThe following selected information is taken from the financial statements of Arnn Company for its most recent year of operations: During the year, Arnn had net sales of 2.45 million. The cost of goods sold was 1.3 million. Required: Note: Round all answers to two decimal places. 1. Compute the current ratio. 2. Compute the quick or acid-test ratio. 3. Compute the accounts receivable turnover ratio. 4. Compute the accounts receivable turnover in days. 5. Compute the inventory turnover ratio. 6. Compute the inventory turnover in days.arrow_forward

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub