PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 24, Problem 18PS

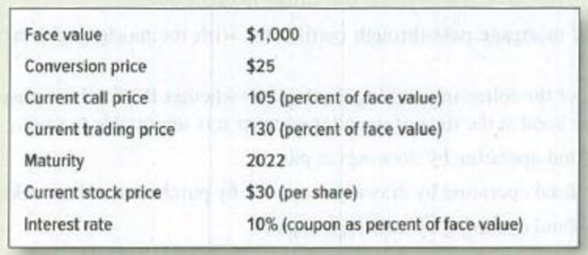

Convertible bonds The Surplus Value Company had $10 million (face value) of convertible bonds outstanding in 2015. Each bond has the following features.

- a. What is the bond’s conversion value?

- b. Can you explain why the bond is selling above conversion value?

- c. Should Surplus call? What will happen if it does so?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Exercise: Dirty/cleanPrice calculation

A bond has face value of $1000. The bond’s yield to maturityis 6% andthe annual coupon rate is 8% with semiannual coupon payments.The maturity of the bond is 5years. The bond was issued on 1/1/2017, and one bought on 4/1/2018.

Answer the following three questions:

a.What is the dirty price of the bond?

b.What is the accrual interest of the bond?

c.What is its clean price?

Q3)

Referring to the two corporate bonds' data at below table, answer the following:

If the market interest rate was 10%, what would the bonds prices be?

Would you consider both bonds to be selling at a discount, premium, or at par value and why?

Explain what it means when a bond is selling at a discount, a premium, or at its par value.

Bond A

Bond B

Maturity Years

20

30

Coupon Rate (Paid Semiannual)

12%

8%

Par Value (OMR)

1000

1000

From page 9-2 of the VLN, what is the first thing you want to identify when approaching a bond problem?

Group of answer choices

A. Annual bond or semiannual bond

B. Whether the market rate is different from the stated rate.

C. The cash flows provided by the bond.

D. The company's debt to equity ratio.

Chapter 24 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 24 - Bond terms Use Table 24.1 (but not the text) to...Ch. 24 - Bond terms Look at Table 24.1: a. The AMAT bond...Ch. 24 - Bond terms Select the most appropriate term from...Ch. 24 - Prob. 5PSCh. 24 - Bond terms Bond prices can fall either because of...Ch. 24 - Security and seniority a. As a senior bondholder,...Ch. 24 - Prob. 8PSCh. 24 - Prob. 9PSCh. 24 - Security and seniority a. Residential mortgages...Ch. 24 - Sinking funds For each of the following sinking...

Ch. 24 - Call provisions a. Look at Table 24.1. Suppose...Ch. 24 - Covenants Alpha Corp. is prohibited from issuing...Ch. 24 - Prob. 14PSCh. 24 - Private placements Explain the three principal...Ch. 24 - Convertible bonds True or false? a. Convertible...Ch. 24 - Convertible bonds Maple Aircraft has issued a 4%...Ch. 24 - Convertible bonds The Surplus Value Company had 10...Ch. 24 - Prob. 19PSCh. 24 - Convertible bonds Iota Microsystems 10%...Ch. 24 - Convertible bonds Zenco Inc. is financed by 3...Ch. 24 - Prob. 22PSCh. 24 - Prob. 23PSCh. 24 - Bank loans, commercial paper, and medium-term...Ch. 24 - Prob. 25PSCh. 24 - Tax benefits Dorlcote Milling has outstanding a 1...Ch. 24 - Convertible bonds This question illustrates that...Ch. 24 - Prob. 28PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- H5. Which of the following is the name of the semiannual payment of $20 that you receive on a bond you own? a. Face Value b. Discount c. Yield d. Call Premium e. Coupon Explain with details and also explain wrong optionsarrow_forwardComment on the attractiveness of the bonds in two ways: a) How does the yield compare to the benchmark? Market YTM: 3.62% YTM of bond: 3.72% b) How does the current price compare to the benchmark-yield implied price? Price: 100.875 Implied price: 100.923arrow_forwardThe time value of money is used in calculating bond prices because: Group of answer choices A - The company might choose to repay the bonds prior to their maturity date B - Bond investors receive future payments and purchase bonds with current dollars C - The amount to be repaid at maturity will change as market rates change D - Cash interest payments to bondholders will change as market rates changearrow_forward

- Calculating the risk premium on bonds The text presents a formula where (1+1) = (1-p)(1 +i+x) + p(0) where i is the nominal interest rate on a riskless bond x is the risk premium p is the probability of default (bankruptcy) If the probability of bankruptcy is zero, the rate of interest on the risky bond is When the nominal interest rate for a risky borrower is 8% and the nominal policy rate of interest is 3%, the probability of bankruptcy is %. (Round your response to two decimal places.) When the probability of bankruptcy is 6% and the nominal policy rate of interest is 4%, the nominal interest rate for a risky borrower is %. (Round your response to two decimal places.) When the probability of bankruptcy is 11% and the nominal policy rate of interest is 4%, the nominal interest rate for a risky borrower is %. (Round your response to two decimal places.) The formula assumes that payment upon default is zero. In fact, it is often positive. How would you change the formula in this case?…arrow_forwardHow do investors calculate the net present value of a bond? If a bond's coupon payment is C, the interest rate is R, and the bond's coupon payment is made in each period for T years at which time the original principal, P, is repaid, then the bond's present discounted value (PDV) is C A. PDV = + (1 + R) (1 + R? (1 + R)T B. PDV = C(1 + R) + C(1 + R)2 - + C(1 + R)T + P(1 + R)T + C P OC. PDV = - + R R2 RT RT C D. PDV = P + C C (1 + R) (1+R)2 (1 + R)T C E. PDV = + + + + (1 + R) (1+ R)2 (1 + R)T (1 + R)T If the interest rate is 9 percent, what is the present value of a perpetuity that pays $50,000 each year, forever? The perpetuity's value is $ (Enter a numeric response rounded to two decimal places.)arrow_forwarda. What is the price (expressed as a percentage of the face value) of a 1-year, zero-coupon corporate bond with a AAA rating and a face value of $1,000? b. What is the credit spread on AAA-rated corporate bonds? c. What is the credit spread on B-rated corporate bonds? d. How does the credit spread change with the bond rating? Why? Note: Assume annual compounding.arrow_forward

- Explain how a 1% increase/decrease in interest rates would affect the price of coropate bonds.arrow_forwardANSWER AS MANY QUESTIONS POSSIBLE THIS IS A STUDY GUIDE Ch 11 Bonds and LTL1. When will bonds sell at a premium and discount? 2. Calculate bond interest under SL method.3. Impact of amortization of bond premium/discount on interest expense.4. Give an example journal entry for amortization of bond premium/discount.5. What is the Gain/loss on redemption of bonds? How do you calculate?6. Understand method of calculating PV of future cash flows -specifically for a bond.7. Why are bonds a popular source of financing?8. Contract rate (market rate) is used for what calculation purpose?Ch 10 SE: Corporations1. What are Rights possessed by common stockholders?2. What are a journal entries for stock issuance, cash dividend, stock dividend?3. What is the calculation of dividends when cumulative preferred stock is outstanding?4. Journal entries for treasury stock, financial statement presentation. Gain/loss on reissue of treasury stock.5. Prior period adjustment - example of, accounting for?6.…arrow_forwardAcme Chemical, Inc. is a major manufacturer of chemical products for the agricultural ndustry, including pesticides, herbicides and other compounds. Due to a number of law suits elated to toxic wastes, Acme Chemical has recently experienced a market re-evaluation of its common stock. The firm also has a bond issue outstanding with 10 years to maturity and an annual coupon rate of 5 percent, with interest paid semi annually. The required nominal market annual interest rate on this bond has now risen to 10 percent due to the high risk level associated vith this firm. The bonds have a par or face value of $1,000. 1. Label each of the variables that you would use to determine the value of this bond in the market today: N (time periods until maturity) PMT (periodic interest payment) I per (periodic market interest rate) EV (future value to be received when the bond matures) = 2. Based on the variables that you have identified in Question #1, what is the market value. today (the present…arrow_forward

- A bond is currently selling for $980. This is a _____ bond which will ultimately experience a capital _____. Premium; gain Premium; loss Discount; gain Discount; lossarrow_forwarda. Assuming the bonds will be rated AA, what will the price of the AA-rated bonds be? b. How much total principal amount of these bonds must HMK issue to raise $9million today, assuming the bonds are AA rated? (Because HMK cannot issue a fraction of a bond, assume all fractions are rounded to the nearest whole number.) c. What must the rating of the bonds be for them to sell at par? d. Suppose that when the bonds are issued, the price of each bond is $970.43. What is the likely rating of the bonds?Are they junk bonds? Note: Assume annual compounding.arrow_forward2. Determine the purchase price and the amount of premium/discount of the given bonds. Face Value Coupon Rate Yield Rate Redemption Date Purchase Date Purchase Price ? a. $1000.00 5.25% 5.25% January 01, 2024 January 01, 2019 b. $5000.00 4.75% 6.75% October 20, 2028 October 20, 2018 ? c. $10,000.00 7.85% 4.15% August 16, 2034 August 16, 2014 ? Amount of Premium/Discount ? ? ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

What happens to my bond when interest rates rise?; Author: The Financial Pipeline;https://www.youtube.com/watch?v=6uaXlI4CLOs;License: Standard Youtube License