Concept explainers

Variance interpretation

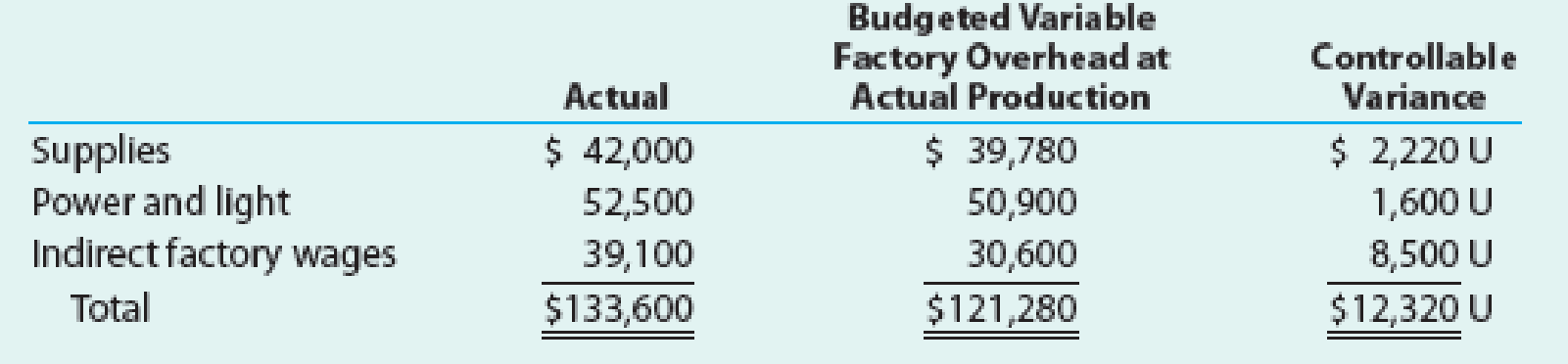

Vanadium Audio Inc. is a small manufacturer of electronic musical instruments. The plant manager received the following variable factory

Actual units produced: 15,000 (90% of practical capacity)

The plant manager is not pleased with the $12,320 unfavorable variable factory overhead controllable variance and has come to discuss the matter with the controller. The following discussion occurred:

Plant Manager: I just received this factory report for the latest month of operations. I’m not very pleased with these figures. Before these numbers go to headquarters, you and I need to reach an understanding.

Controller: Go ahead. What’s the problem?

Plant Manager: What’s the problem? Well, everything. Look at the variance. It’s too large. If I understand the accounting approach being used here, you are assuming that my costs are variable to the units produced. Thus, as the production volume declines, so should these costs. Well, I don’t believe these costs are variable at all. I think they are fixed costs. As a result, when we operate below capacity, the costs really don’t go down. I’m being penalized for costs I have no control over. I need this report to be redone to reflect this fact. If anything, the difference between actual and budget is essentially a volume variance. Listen, I know that you’re a team player. You really need to reconsider your assumptions on this one.

Assume you are the controller. Write a memo responding to the plant manager.

Trending nowThis is a popular solution!

Chapter 23 Solutions

Financial And Managerial Accounting

- If a firm experience decreases in the per-unit costs of production as its network increases, then this firm is experiencing:arrow_forwardits general account subject questions. please solve itarrow_forwardWhat should SA's dividend payout ratio be this year on these financial accounting question?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College