PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 23, Problem 3PS

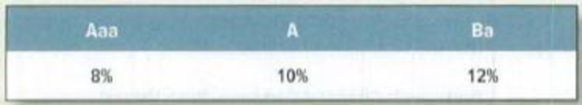

Bond ratings It is 2030 and the yields on corporate bonds are as follows:

Tau Corp wishes to raise $10 million by an issue of 9% 10-year bonds. What will be the likely issue price (as a percent of face value) if Tau is rated (a) Aaa, (b) A, or (c) Ba?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

GT Cap. Corp. will be issuing 5-year P20,000,000-face value bonds at an issue price equal to face. It has a nominal interest rate of 8%, due semi-annually. If it would incur issuance cost of P600,0000 and the tax rate is 30%, what is the effective cost of the bonds using the YTM formula?

4. On January 1, 2020, ABC Corporation invested in P2,000,000 bonds of DEF Company that will mature on December 31, 2022. The bond has a coupon rate of 10% and a required rate of return of 12%. What is the value of the investment on January 1, 2020?

Omega Corporation plans to issue $200 million of bonds, and wants these bonds to sell for their $

1,000 par value. Omega also has existing bonds maturing on March 12, 2037, paying a 6.80% semi-

annual coupon, and trading for $1,026.86 in the financial market. What should the coupon interest

rate be on these new bonds to ensure Omega receives the $1,000 par value? Group of answer choices

6.93% 6.80% 3.25 % 6.49 % 3.47%

Chapter 23 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 23 - Expected yield You own a 5% bond maturing in two...Ch. 23 - Bond ratings In February 2018, Aaa bonds yielded...Ch. 23 - Bond ratings It is 2030 and the yields on...Ch. 23 - Prob. 4PSCh. 23 - Default option Other things equal, would you...Ch. 23 - Prob. 6PSCh. 23 - Prob. 7PSCh. 23 - Default option Digital Organics has 10 million...Ch. 23 - Prob. 9PSCh. 23 - Prob. 10PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Sandhill Company is issuing eight-year bonds with a coupon rate of 6.8 percent and semiannual coupon payments. If the current market rate for similar bonds is 10 percent. Assume face value is $1,000. What will the bond price be? (Round intermediate calculations to 5 decimal places, e.g. 1.25145 and bond price to 2 decimal places, e.g. 15.25.) Bond price $ If company management wants to raise $1.25 million, how many bonds does the firm have to sell? (Round intermediate calculations to 5 decimal places, e.g. 1.25145 and number of bonds to O decimal places, e.g. 5,275.) Number of bondsarrow_forwardMarshall Company is issuing eight-year bonds with a coupon rate of 6.19 percent and semiannual coupon payments. If the current market rate for similar bonds is 9.23 percent. What will be the bond price? (Round intermediate calculations to 4 decimal places, e.g. 1.2514 and bond price to 2 decimal places, e.g. 15.25.) Bond price $ ___________ If the company wants to raise $1.25 million, how many bonds does the firm have to sell? (Round intermediate calculations to 4 decimal places, e.g. 1.2514 and number of bonds to 0 decimal places, e.g. 5,275.) Number of bonds _____________ Bondsarrow_forwardBased on the pro-forma statements prepared in question 2, Insignia Corporation Limited will need external financing in 2021. As such the company is considering issuing a $100,000,000 15-year bond, with an annual coupon rate of 10%, and semi-annualinterest payments. Required i. If the company anticipates that the bond will close at a yield to maturity of12%, given the company’s credit ratings and current market conditions, how much would an investor be willing to pay for $1,000 face value of this bond? ii. Compute the current yield of the bond at this price (from i).arrow_forward

- Suppose Lion Cage Multinational floated 5000 bonds on January 1, 2020 with a par value of 1500 at stated rate of 16%. Currently, the market is selling these bonds at 18%. The bonds are expected to paid back by December 2030 with an interest paid quarterly effective March 1, 2020. What would be the bond price? Group of answer choices A. 6,870,050 B. No choice given C. 7,584,000 D. 7,485,006 E. 6,708,900arrow_forwardHMK Enterprises would like to raise $10.0 million to invest in capital expenditures. The company plans to issue five-year bonds with a face value of $1,000 and a coupon rate of 6.50% (annual payments). The following table summarizes the yield to maturity for five-year (annual-payment) coupon corporate bonds of various ratings a. Assuming the bonds will be rated AA, what will be the price of the bonds? b. How much of the total principal amount of these bonds must HMK issue to raise $10.0 million today, assuming the bonds are AA rated? (Because HMK cannot issue a fraction of a bond assume that all fractions are rounded to the nearest whole number) c. What must be the rating of the bonds for them to sell at par? d. Suppose that when the bonds are issued, the price of each bond is $902.79 What is the likely rating of the bonds? Are they junk bonds? a. Assuming the bonds will be rated AA, what will be the price of the bonds? The price of the bonds will be $ (Round to the nearest cent.) Data…arrow_forwardDoha plc has some surplus funds that it wishes to invest in bonds. The company requires a return of 15% on bonds, and the finance director has asked you to analyse whether it should invest in either of the following bonds that are available:Company A: Expected profit 12% bonds, redeemable at par at the end of two more years, with a current market value of QAR 95 per QAR 100 bondCompany B: Expected profit 8% bonds, redeemable at QAR110 at the end of two more years, with a current market value of QAR 95 per QAR 100 bonda. Calculate the expected value (price) of the two bonds and evaluate if either offer an appropriate return for Doha Plc.b. Critically evaluate what would be the impact on the price of bonds if Doha Plc reduces their required return.c. Critically evaluate and discuss the factors that should be considered by the directors of a company when choosing whether to use debt or equity finance for a new projectd. Recently one director has attended a finance conference, on their…arrow_forward

- DEVCON INDUSTRIES LIMITED Income Statement For the years ended Dec. 31, 2018 and 2019 2018 2019 s000's so00's Sales 900000 1125000 Cost of Goods Sold 300000 306600 Gross Profit 600000 818400 Selling and Administrative Expenses 150000 156000 Depreciation Expense 54000 57000 Advertising Expenses 18000 21000 Earnings Before Interest and Taxes Interest Expense 378000 584400 3000 3000 Taxable Income 375000 581400 Taxation (35%) 131250 203490 Net Income 243750 377910 Dividends (40%) 97500 151164 Addition to Retained Earnings 146250 226746 Additional Information Share Price 21 27.3 Ordinary Shares Outstanding 120000000 144000000 DEVCON INDUSTRIES LIMITED Statement of Financial Position As at Dec. 31, 2018 and 2019 2019 s000's ASSETS 2018 LIABILITIES & EQUITY 2018 2019 Current Assets so00's Current Liabilities so00's s000's Inventories 264000 276000 Accounts Payables Notes Payables 138000 114000 Accounts Receivables 294000 330000 150900 132654 Cash and Equivalents 210900 270000 288900 246654…arrow_forwardThe following tutorial questions serve as practice questions on TVM and Bond Valuation. (Answer Both Questions 1 & 2) The face value for WICB Limited bonds is $250,000 and has a 6 percent annual coupon. The 6 percent annual coupon bonds matures in 2035, and it is now 2020. Interest on these bonds is paid annually on December 31 of each year, and new annual coupon bonds with similar risk and maturity are currently yielding 10 percent. How much should Karen sell her bonds today? What is the semi-annual coupon bond’s nominal yield to maturity (YTM), if the years to maturity is 15 years, and sells for 119% with coupons rate of 10%? Assume the par value of the bond is $1,000.arrow_forwardAC will be issuing bonds with a total face value of P10,000,000 at an issue price of P9,900,000. It will incur issuance cost of P600,000. The bonds have a term of 10 years and a coupon rate of 12% payable quarterly. If the tax rate is 30%, what is the effective cost of the bonds using the interpolation method? Use increments of 1%.arrow_forward

- (a) Micron Industries is considering issuing a $20,000,000 15-year bond in early 2022, with an annual coupon rate of 4%, and semiannual interest payments. Required:If the company anticipates that the yield to maturity on the date of issue is expected to be 4.5%, given the company’s credit ratings and current market conditions, how much would an investor be willing to pay for $1,000 face value of this bond? (b) Micron Industries is also considering a Class B issue of its common stock on the market via an Initial Public Offering (IPO) in late 2021. The company is expected to pay the following dividends over the next 4 years: $2.00, $3.00, $3.50 and $4.50. Thereafter, the company is expected to increase dividends by an annual rate of 6%. Required: Assuming investors would require a return of 12% on this riskier type of investment, how much would an investor pay for this share today? (c) Micron Industries is also assiduously finalising the issuance of its preference shares. The company…arrow_forward(a) Micron Industries is considering issuing a $20,000,000 15-year bond in early 2022, with an annual coupon rate of 4%, and semiannual interest payments. Required: If the company anticipates that the yield to maturity on the date of issue is expected to be 4.5%, given the company’s credit ratings and current market conditions, how much would an investor be willing to pay for $1,000 face value of this bond? (b) Micron Industries is also considering a Class B issue of its common stock on the market via an Initial Public Offering (IPO) in late 2021. The company is expected to pay the following dividends over the next 4 years: $2.00, $3.00, $3.50 and $4.50. Thereafter, the company is expected to increase dividends by an annual rate of 6%. Required: Assuming investors would require a return of 12% on this riskier type of investment, how much would an investor pay for this share today? (c) Micron Industries is also assiduously finalising the issuance of its preference shares. The…arrow_forwardKindly assist on those questions. Bayside Corporation has $1000 par value non-callable bonds with 9 years left to maturity. These bonds have a stated fixed annual coupon rate of 6.5% ( with semi annual interest payments) a) what are these bonds worth today if the required market rate of return is 4% ? b) what is the relationship between the coupon rate, changes in the market rate and the value of t?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

What happens to my bond when interest rates rise?; Author: The Financial Pipeline;https://www.youtube.com/watch?v=6uaXlI4CLOs;License: Standard Youtube License