Evaluating division performance over time

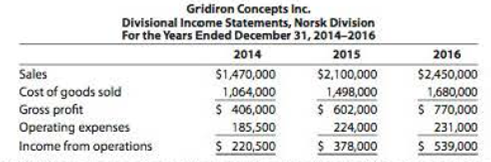

The Norsk Division of Gridiron Concepts Inc. has been experiencing revenue and profit growth during the years 2014-2016. The divisional income statements follow:

Assume that there are no charges from Service departments. The vice president of the division, Tom Yang, is proud of his division’s performance over the last three years. The president of Gridiron Concepts Inc., Anna Evans, is discussing the division’s performance with Tom, as follows:

Tom: As you can see, we’ve had a successful three years in the Norsk Division.

Anna: I’m not too sure.

Tom: What do you mean? Look at our results. Our income from operations has more than doubled, while our profit margins are improving.

Anna: I am looking at your results. However, your income statements fail to include one very important piece of information, namely, the invested assets. You have been investing a great deal of assets into the division. You had $735,000 in invested assets in 2014, $1,500,000 in 2014 and $3,500,000 in 2016.

Tom: You are right. I’ve needed the assets in order to upgrade our technologies and expand our operations. The additional assets are one reason we have been able to grow and improve our profit margins. I don’t see that this is a problem.

Anna: The problem is that we must maintain a 15%

- 1. Determine the profit margins for the Norsk Division for 2014-2016.

- 2. Compute the investment turn over for the Norsk Division for 2014-2016. Round to two decimal places.

- 3. Compute the rate of

return on investment for the Norsk Division for 2014-2016. - 4. Evaluate the division’s performance over the 2014-2016 time period. Why was Anna concerned about the performance?

(1)

Profit margin: This ratio gauges the operating profitability by quantifying the amount of income earned from business operations from the sales generated.

Formula of profit margin:

To compute: Profit margin of N Division for the years 2014 to 2016

Explanation of Solution

Determine profit margin of N Division for the year 2014.

Determine profit margin of N Division for the year 2015.

Determine profit margin of N Division for the year 2016.

(2)

Investment turnover: This ratio gauges the operating efficiency by quantifying the amount of sales generated from the assets invested.

Formula of investment turnover:

To compute: Investment turnover of N Division for the years 2014 to 2016.

Explanation of Solution

Determine investment turnover of N Division for the year 2014.

Determine investment turnover of N Division for the year 2015.

Determine investment turnover of N Division for the year 2016.

(3)

Return on investment (ROI): This financial ratio evaluates how efficiently the assets are used in earning income from operations. So, ROI is a tool used to measure and compare the performance of a units or divisions or a companies.

Formula of ROI:

To compute: Return on investment (ROI) of N Division for the years 2014 to 2016

Explanation of Solution

Determine ROI of N Division for the year 2014.

Determine ROI of N Division for the year 2015.

Determine ROI of N Division for the year 2016.

(4)

To evaluate: Division N’s performance

Explanation of Solution

Evaluation of N Division’s performance:

By observing the operating results of N Division, the gross profit, income from operations, and revenues, it can be concluded that the performance of the division has increased considerably from 2014 to 2016. To know the actual performance, RPOI is computed in an extended form by using the profit margin, investment turnover as follows:

For 2014:

For 2015:

For 2016:

These computations show that the profitability of the division deteriorated from 2014 to 2016, due to the drop in investment turnover. So, the investments could not earn the required income, leading to decreased ROI. The assets invested were unable to earn the enough revenue.

This is a decreasing trend in the division’s performance.

Want to see more full solutions like this?

Chapter 23 Solutions

Financial & Managerial Accounting

- Forchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).arrow_forwardCommunication The Norse Division of Gridiron Concepts Inc. experienced significant revenue and profit growth from 20Y4 to 20Y6 as shown in the following divisional income statements: There are no support department allocations, and the division operates as an investment center that must maintain a 15% return on invested assets. Determine the profit margin, investment turnover, and return on investment for the Norse Division for 20Y420Y6. Based on your computations, write a brief memo to the president of Gridiron Concepts Inc., Knute Holz, evaluating the divisions performance.arrow_forwardKent Tessman, manager of a Dairy Products Division, was pleased with his divisions performance over the past three years. Each year, divisional profits had increased, and he had earned a sizable bonus. (Bonuses are a linear function of the divisions reported income.) He had also received considerable attention from higher management. A vice president had told him in confidence that if his performance over the next three years matched his first three, he would be promoted to higher management. Determined to fulfill these expectations, Kent made sure that he personally reviewed every capital budget request. He wanted to be certain that any funds invested would provide good, solid returns. (The divisions cost of capital is 10 percent.) At the moment, he is reviewing two independent requests. Proposal A involves automating a manufacturing operation that is currently labor intensive. Proposal B centers on developing and marketing a new ice cream product. Proposal A requires an initial outlay of 250,000, and Proposal B requires 312,500. Both projects could be funded, given the status of the divisions capital budget. Both have an expected life of six years and have the following projected after-tax cash flows: After careful consideration of each investment, Kent approved funding of Proposal A and rejected Proposal B. Required: 1. Compute the NPV for each proposal. 2. Compute the payback period for each proposal. 3. According to your analysis, which proposal(s) should be accepted? Explain. 4. Explain why Kent accepted only Proposal A. Considering the possible reasons for rejection, would you judge his behavior to be ethical? Explain.arrow_forward

- The directors of Gaston Bridge plc (GB) are meeting to discuss the annual divisional performance statements produced by the company’s five divisions. The target ROI for all divisions is 10.7%, and the divisions have all managed to turn in performance in excess of that figure, with the highest ROI of 12.6% from Division X. One recently-appointed director is unimpressed by these figures. Before joining GB, he had been manufacturing director at Darron Smith plc, one of GB’s major competitors. He tells his fellow directors that they should be expecting a much better performance from their divisions: ‘ROI of 10.7% is too low a target. At Darron Smith, our divisional targets were always in excess of 20%, and divisions generally managed to meet them. We’re not setting our sights high enough’. Suggest reasons why the comparison between ROI in the two companies might be invalid.”arrow_forwardThe vice president of operations of Pavone Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year for each division are as follows: Business Division Consumer Division Sales $2,160,000 $2,520,000 Cost of goods sold 1,270,000 1,330,000 Operating expenses 652,400 837,200 Invested assets 744,828 2,100,000 Required: 1. Prepare condensed divisional income statements for the year ended December 31, assuming that there were no service department charges. 2. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for each division. If required, round your final answers to one decimal place. 3. If management wants a minimum acceptable return of 17.00%, determine the residual income for each division. Use the minus sign to indicate a negative income. Round final answers to nearest…arrow_forward“I know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings Company’s Office Products Division. “But I want to see the numbers before I make a decision. Our division’s return on investment (ROI) has led the company for three years, and I don’t want any letdown.” Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated using ROI, with year-end bonuses given to the divisional managers who have the highest ROIs. Operating results for the company’s Office Products Division for this year are given below: Sales $ 22,440,000 Variable expenses 14,094,600 Contribution margin 8,345,400 Fixed expenses 6,130,000 Net operating income $ 2,215,400 Divisional average operating assets $ 4,480,000 The company had an overall return on investment (ROI) of 18.00% this year (considering all divisions). Next year the Office Products Division has an opportunity to add a new product requiring $2,430,600 of…arrow_forward

- “I know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings Company’s Office Products Division. “But I want to see the numbers before I make a decision. Our division’s return on investment (ROI) has led the company for three years, and I don’t want any letdown.” Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated using ROI, with year-end bonuses given to the divisional managers who have the highest ROIs. Operating results for the company’s Office Products Division for this year are given below: Sales $ 22,440,000 Variable expenses 14,094,600 Contribution margin 8,345,400 Fixed expenses 6,130,000 Net operating income $ 2,215,400 Divisional average operating assets $ 4,480,000 The company had an overall return on investment (ROI) of 18.00% this year (considering all divisions). Next year the Office Products Division has an opportunity to add a new product requiring $2,430,600 of…arrow_forwardThe Deluxe Division, a profit center of Riley Manufacturing Company, reported the following data for the first quarter of 2016:Sales $9,000,000Variable costs 6,300,000Controllable direct fixed costs 1,200,000Noncontrollable direct fixed costs 530,000Indirect fixed costs 300,000Instructions(a) Prepare a performance report for the manager of the Deluxe Division.(b) What is the best measure of the manager’s performance? Why?(c) How would the responsibility report differ if the division was an investment center?arrow_forwardThe new chief executive officer (CEO) of Richard Manufacturing has asked for a variety of information about the operations of the firm from last year. The CEO is given the following information, but with some data missing: (Click the icon to view the variety of operations information.) Read the requirements, Requirement 1. Find (a) total sales revenue, (b) selling price, (c) rate of return on investment, and (d) markup percentage on full cost for this product. (a) The total sales revenue is (Round your answer to the nearest cent.) (b) The selling price per unit is (Round the retum on investment to the nearest whole percent, X%.) (c) The rate of return on investment is (d) Calculate the markup percentage on full cost for this product. (Round your intermediary calculations to the nearest cent and the markup to the nearest hundredth percent XXX%) The markup percentage on full cost for this product is Requirement 2. The new CEO has a plan to reduce fixed costs by $200,000 and variable…arrow_forward

- “I know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings Company’s Office Products Division. “But I want to see the numbers before I make a decision. Our division’s return on investment (ROI) has led the company for three years, and I don’t want any letdown.” Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated using ROI, with year-end bonuses given to the divisional managers who have the highest ROIs. Operating results for the company’s Office Products Division for this year are given below: Sales $ 22,440,000 Variable expenses 14,094,600 Contribution margin 8,345,400 Fixed expenses 6,130,000 Net operating income $ 2,215,400 Divisional average operating assets $ 4,480,000 The company had an overall return on investment (ROI) of 18.00% this year (considering all divisions). Next year the Office Products Division has an opportunity to add a new product requiring $2,430,600 of…arrow_forward“I know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings Company’s Office Products Division. “But I want to see the numbers before I make a decision. Our division’s return on investment (ROI) has led the company for three years, and I don’t want any letdown.” Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated using ROI, with year-end bonuses given to the divisional managers who have the highest ROIs. Operating results for the company’s Office Products Division for this year are given below: Sales $ 22,440,000 Variable expenses 14,094,600 Contribution margin 8,345,400 Fixed expenses 6,130,000 Net operating income $ 2,215,400 Divisional average operating assets $ 4,480,000 The company had an overall return on investment (ROI) of 18.00% this year (considering all divisions). Next year the Office Products Division has an opportunity to add a new product requiring $2,430,600 of…arrow_forwardThe vice president of operations of Scott Hall and Associates is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year for each division are as follows: Category Road Bike Division Mountain Bike Division Sales $1,750,000 $1,810,000 Cost of goods sold 1,300,000 1,440,000 Operating expenses 202,000 236,800 Invested assets 1,400,000 800,000 Prepare condensed divisional income statements for the year ended December 31, 2021, assuming that there were no service department charges. Using the DuPont formula for return on investment, determine the profit margin percentage, investment turnover, and return on investment for each division. (Round percentages and the investment turnover to two places behind the decimal.) If management’s minimum acceptable return on investment is 10%, determine the residual income for each division. In your own words…arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning