Equity as an Option and

a. What is the value of the firm’s equity and debt if Project A is undertaken? If Project B is undertaken?

b. Which project would the stockholders prefer? Can you reconcile your answer with the NPV rule?

c. Suppose the stockholders and bondholders are, in fact, the same group of investors. Would this affect your answer to (b)?

d. What does this problem suggest to you about stockholder incentives?

a.

To compute: Value of the firm’s equity and debt under project A and project B.

Option Pricing:

Option pricing helps in determining correct or fair price in the market. It is the value of one share on the basis of which option is traded. Black-Scholes is one of the pricing methods. Further, equity is also used as an option.

Explanation of Solution

Project A

Given,

Stock price is

Exercise price is 20,000.

Risk free rate is 0.05.

Time to expire is 1 year.

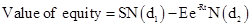

Formula to calculate the value of equity by using Black Scholes model is,

Where,

- S is stock price.

- E is exercise price.

- R is risk free rate.

- T is time to expire.

Substitute $22,900 for S, $20,000 for E, 0.05 for R, and 1 for T.

Formula to calculate the value of debt is,

Substitute $22,900 as value of firm and $9,019.78 as value of equity.

Project B

Given,

Stock price is $21,700.

Exercise price is 20,000.

Risk free rate is 0.05.

Time to expire is 1 year.

Formula to calculate the value of equity by using Black Scholes model is,

Where,

- S is stock price.

- E is exercise price.

- R is risk free rate.

- T is time to expire.

Substitute $21,700 for S, $20,000 for E, 0.05 for R, and 1 for T.

Formula to calculate the value of debt is,

Substitute $21,700 as value of firm and $4,285.82 as value of equity.

Working Note:

Formula to calculate

Calculation of

From normal distribution table

Calculation of

From normal distribution table

Formula to calculate

Calculation of

From normal distribution table

Calculation of

From normal distribution table

Hence, for Project A the value of firm’s equity is $9,019.78, value of firm’s debt is$13,880.22 and for Project B the value of firm’s equity is $4,285.82 and value of firm’s debt is $17,414.18.

b.

To identify: Project that would be preferred by stockholders.

Answer to Problem 22QP

- Here, equity’s value is higher in Project A than Project B.

- Project A does not create more bondholders.

Explanation of Solution

- If Project A is considered, it has increased the firm’s assets to$1,200.

- If Project B is considered, it has increased the firm’s assets to$1,600.

- NPV rules say Project B should be accepted, but value of equity is more in the case of Project A rather than Project B, which shows that Project A has less of bondholders.

- Thus, Project A is more attractive.

Hence, the stockholders prefer Project A.

c.

To identify: Project that would be preferred by stockholders if both stockholders and bondholders are same.

Answer to Problem 22QP

As Project B adds more value to the firm, this would be a good option.

Explanation of Solution

- If stockholders and bondholder would be the same, in that case their interest would also be the same and they can get benefits equally.

- Since Project A increases the firm’s assets to$1,200 and Project B increases the firm’s assets to$1,600.

- Thus, Project B is more attractive.

Hence, the stockholders prefer Project B.

d.

To explain: The effect on stockholders incentives.

Answer to Problem 22QP

In case of leveraged firm, stockholders would definitely prefer those projects, which would increase value of equity.

Explanation of Solution

- Reason for opting equity source is that in the case of debt source, risk is borne by the bondholders and benefits are limited to their debt value, which is not happening in the case of equity sources.

- All benefits after paying the debt, goes to the stockholders pocket.

- Thus, the stockholders incentive would relate to the project that adds more value to the equity.

Hence, stockholder’s incentives are more related with the project that contains equity.

Want to see more full solutions like this?

Chapter 22 Solutions

EBK CORPORATE FINANCE

- The risk-free rate is currently 3.3%, and the market return is 14.8%. Assume you are considering the following investments: Investment Beta A 1.54 B 1.16 C 0.51 D 0.11 E 2.14 . a. Which investment is most risky? Least risky? b. Use the capital asset pricing model (CAPM) to find the required return on each of the investments. c. Find the security market line (SML), using your findings in part b. d. On the basis of your findings in part c, what relationship exists between risk and return? Explain.arrow_forwardGiven the following variables: S = $50, E = $45, T = 1 year, r = 2 %, and P = $5; if the call option is selling for $11 (C = $11), what arbitrage opportunity exists? Outline the strategy and the profit to be realized.arrow_forward(Capital Asset Pricing Model) CSB, Inc. has a beta of 0.758. If the expected market return is 10.5 percent and the risk-free rate is 6.5 percent, what is the appropriate expected return of CSB (using the CAPM)? The appropriate expected return of CSB is%. (Round to two decimal places.)arrow_forward

- This question will compare two different arbitrage situations. Recall that arbitrage should equalize rates of return. We want to explore what this implies about equalizing prices. In the first situation, two assets, A and B, will each make a single guaranteed payment of $100 in 1 year. But asset A has a current price of $80 while asset B has a current price of $90.a. Which asset has the higher expected rate of return at current prices? Given their rates of return, which asset should investors be buying and which asset should they be selling?b. Assume that arbitrage continues until A and B have the same expected rate of return. When arbitrage ceases, will A and B have the same price?Next, consider another pair of assets, C and D. Asset C will make a single payment of $150 in one year while D will make a single payment of $200 in one year. Assume that the current price of C is $120 and that the current price of D is $180.c. Which asset has the higher expected rate of return at current…arrow_forwardSuppose all assumptions of the Capital Asset Pricing Model are true. Consider two firms A and B, which invest in the same type of risky projects. The asset side of both firms is worth $100 million. Firm A is purely equity financed, and firm B is financed with $60 million risk-free debt and $40 million equity. Suppose the risky project’s expected return is 8% and the risk-free interest rate is 2%. a) What is the expected return on firm A’s equity? b) What is the expected return on firm B’s equity? c) What is ratio of firm A’s equity beta to firm B’s equity beta? Consider a new project, which costs $1, 000 now and yields the expected cash flow $1,100 next period. Assume that the new project does not change the beta of either firm. d) Should firm A’s shareholders vote against the new project and WHY? e) Should firm B’s shareholders vote against the new project and WHY?arrow_forwardIn this problem we assume that the annual expected rate of return of the market portfolio is 22% and the annual risk-free rate is 2%. The standard deviation of the market portfolio returns is 22%. Assume the market is in equilibrium such that the Capital Asset Pricing Model (CAPM) holds: the market portfolio is efficient. If you have $1,000 to invest, how should you allocate it to achieve an annual expected return of 26%? Invest $260 in the risk-free asset and $740 in the market portfolio Invest $800 in the risk-free asset and $200 in the market portfolio Invest $1,200 in the risk-free asset and sell short $200 in the market portfolio Borrow $260 at the risk-free rate and invest $1,260 in the market portfolio Invest $200 in the risk-free asset and $800 in the market portfolio Borrow $200 at the risk-free rate and invest $1,200 in the market portfolioarrow_forward

- Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Cash Flow Today ($ millions) Project A -6 B с 2 25 L Cash Flow in One Year ($ millions) 22 5 - 8 <arrow_forward(Capital Asset Pricing Model) Breckenridge, Inc., has a beta of 0.79. If the expected market return is 10.0 percent and the risk-free rate is 6.0 percent, what is the appropriate expected return of Breckenridge (using the CAPM)? The appropriate expected return of Breckenridge is %. (Round to two decimal places.)arrow_forwardConsider the following two investment alternatives: The firm's MARR is known to be 15%.(a) Compute the IRR of Project B.(b) Compute the PW of Project A. (c) Suppose that Projects A and B are mutually exclusive. Using the IRR, whichproject would you select?arrow_forward

- An all-equity firm is considering the projects shown below. The T-bill rate is 4 percent and the market risk premium is 7 percent. If the firm uses its current WACC of 12 percent to evaluate the projects, which project(s), if any, will be incorrectly accepted? Expected Return Beta Project A 8.0% 0.5 Project B 19.0% 1.2 Project C 13.0% 1.4 Project D 17.0% 1.6arrow_forwardYour firm has a risk-free investment opportunity where it can invest $160,000 today and receive $170,000 in one year. For what level of interest rate is this project attractive? The project will be attractive when the interest rate is any positive value less than or equal to ____________%? (Round to two decimal places.)arrow_forwardYour firm has a risk-free investment opportunity with an initial investment of $162,000 today and receive $175,000 in one year. For what level of interest rates is this project attractive? The project will be attractive when the interest rate is any positive value less than or equal to _______% ?arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education