Finite Mathematics

7th Edition

ISBN: 9781337280426

Author: Stefan Waner, Steven Costenoble

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2.1, Problem 42E

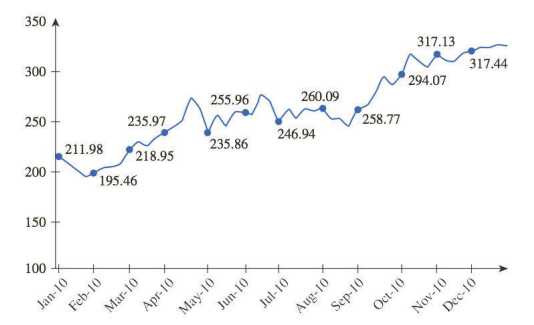

Stock Investments Exercises 37–42 are based on the following chart, which shows monthly figures for Apple stock in 2010:4

Marked are the following points on the chart:

| Jan. 10 | Feb. 110 | Mar. 10 | Apr. 10 | May 10 | June 10 |

| 211.98 | 195.46 | 218.95 | 235.97 | 235.86 | 255.96 |

| July 10 | Aug. 10 | Sep. 10 | Oct. 10 | Nov. 10 | Dec. 10 |

| 246,94 | 260.09 | 258.77 | 294.07 | 317.13 | 317.44 |

If Apple’s stock had undergone simple interest change from April to June at the same simple rate as from March to April, what would the price have been in June?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The table below shows the year open and year closing price of the S&P 500 Stock Index from 2005 to 2020:

Year

Year Open

Year Close

Annual Percent Change

2005

$ 1,202.08

$ 1,248.29

2006

$ 1,268.08

$ 1,418.30

2007

$ 1,416.60

$ 1,468.36

2008

$ 1,447.16

$ 903.25

2009

$ 931.80

$ 1,115.10

2010

$ 1,132.99

$ 1,257.64

2011

$ 1,271.87

$ 1,257.60

2012

$ 1,277.06

$ 1,426.19

2013

$ 1,462.42

$ 1,848.36

2014

$ 1,831.98

$ 2,058.90

2015

$ 2,058.20

$ 2,043.94

2016

$ 2,012.66

$ 2,238.83

2017

$ 2,257.83

$ 2,673.61

2018

$ 2,695.81

$ 2,506.85

2019

$ 2,510.03

$ 3,230.78

2020

$ 3,257.85

$ 3,756.07

Find the annual percent change for the S&P 500 from 2005 to 2020;

(Put those values in the table above)

Compute the mean,…

Monthly Sales

6267.19

7058.06

7119.5

7147.18

7198.52

7298.09

7325.7

7335.68

7355.97

7481.05

7490.23

7530.08

7616.09

7682.69

7684.14

7704.12

7704.98

7779.28

7798.23

7815.15

7844.16

7890.21

7977.6

7993.16

8021.03

8028.37

8068.86

8082.42

8096.17

8119.25

8129.21

8190.68

8255.28

8282.44

8376.31

8392.4

8400.95

8451.16

8456.66

8505.35

8539.25

8543.65

8573.05

8641.78

8667.48

8751.08

8777.97

8800.08

8888.65

8907.03

9096.87

9241.74

9411.68

9450.73

9484.62

9514.57

9521.4

9524.91

9733.44

10123.24

Given the company’s performance record and based on the empirical rule of normal distribution (also known as the 68%-95%-99.7% rule), what would be the lower bound of the range of sales values that contains 68% of the monthly sales? What would be the upper bound of the range of sales values that contains 68% of the monthly sales?

Monthly Sales

6267.19

7058.06

7119.5

7147.18

7198.52

7298.09

7325.7

7335.68

7355.97

7481.05

7490.23

7530.08

7616.09

7682.69

7684.14

7704.12

7704.98

7779.28

7798.23

7815.15

7844.16

7890.21

7977.6

7993.16

8021.03

8028.37

8068.86

8082.42

8096.17

8119.25

8129.21

8190.68

8255.28

8282.44

8376.31

8392.4

8400.95

8451.16

8456.66

8505.35

8539.25

8543.65

8573.05

8641.78

8667.48

8751.08

8777.97

8800.08

8888.65

8907.03

9096.87

9241.74

9411.68

9450.73

9484.62

9514.57

9521.4

9524.91

9733.44

10123.24

If you view the company’s performance record as a representative sample of its overall sales performance, and considering what you know about normal distribution, what is the dollar value for the lowest 25th percentile?

Chapter 2 Solutions

Finite Mathematics

Ch. 2.1 - In Exercises 110, compute the simple interest for...Ch. 2.1 - In Exercises 110, compute the simple interest for...Ch. 2.1 - In Exercises 110, compute the simple interest for...Ch. 2.1 - In Exercises 110, compute the simple interest for...Ch. 2.1 - In Exercises 110, compute the simple interest for...Ch. 2.1 - In Exercises 110, compute the simple interest for...Ch. 2.1 - In Exercises 110, compute the simple interest for...Ch. 2.1 - In Exercises 110, compute the simple interest for...Ch. 2.1 - In Exercises 110, compute the simple interest for...Ch. 2.1 - In Exercises 110, compute the simple interest for...

Ch. 2.1 - Prob. 11ECh. 2.1 - Prob. 12ECh. 2.1 - In Exercises 1116, find the present value of the...Ch. 2.1 - In Exercises 1116, find the present value of the...Ch. 2.1 - In Exercises 1116, find the present value of the...Ch. 2.1 - Prob. 16ECh. 2.1 - In Exercises 1736, compute the specified quantity....Ch. 2.1 - In Exercises 1736, compute the specified quantity....Ch. 2.1 - In Exercises 1736, compute the specified quantity....Ch. 2.1 - In Exercises 1736, compute the specified quantity....Ch. 2.1 - In Exercises 1736, compute the specified quantity....Ch. 2.1 - In Exercises 1736, compute the specified quantity....Ch. 2.1 - Exercises 2328 are based on the following table,...Ch. 2.1 - Exercises 2328 are based on the following table,...Ch. 2.1 - Exercises 2328 are based on the following table,...Ch. 2.1 - Exercises 2328 are based on the following table,...Ch. 2.1 - Exercises 2328 are based on the following table,...Ch. 2.1 - Exercises 2328 are based on the following table,...Ch. 2.1 - Prob. 29ECh. 2.1 - In Exercises 1736, compute the specified quantity....Ch. 2.1 - In Exercises 1736, compute the specified quantity....Ch. 2.1 - In Exercises 1736, compute the specified quantity....Ch. 2.1 - Prob. 33ECh. 2.1 - In Exercises 1736, compute the specified quantity....Ch. 2.1 - Prob. 35ECh. 2.1 - In Exercises 1736, compute the specified quantity....Ch. 2.1 - Stock Investments Exercises 3742 are based on the...Ch. 2.1 - Stock Investments Exercises 3742 are based on the...Ch. 2.1 - Stock Investments Exercises 3742 are based on the...Ch. 2.1 - Stock Investments Exercises 3742 are based on the...Ch. 2.1 - Stock Investments Exercises 3742 are based on the...Ch. 2.1 - Stock Investments Exercises 3742 are based on the...Ch. 2.1 - Prob. 43ECh. 2.1 - Prob. 44ECh. 2.1 - Prob. 45ECh. 2.1 - Prob. 46ECh. 2.1 - Prob. 47ECh. 2.1 - Prob. 48ECh. 2.1 - Prob. 49ECh. 2.1 - Prob. 50ECh. 2.1 - Treasury Bills At auction on August 18, 2005,...Ch. 2.1 - Treasury Bills At auction on August 18, 2005,...Ch. 2.1 - Prob. 53ECh. 2.1 - In the formula FV=PV(1+in), how is the slope of...Ch. 2.1 - Given that FV=0.5n+1,000, for what monthly...Ch. 2.1 - Given that FV=5t+400, for what annual interest...Ch. 2.1 - We said that the choice of which of the two...Ch. 2.1 - Refer to Exercise 57. Show that using the formula...Ch. 2.1 - Prob. 59ECh. 2.1 - Prob. 60ECh. 2.1 - Prob. 61ECh. 2.1 - Prob. 62ECh. 2.2 - In Exercises 110, calculate, to the nearest cent,...Ch. 2.2 - In Exercises 110, calculate, to the nearest cent,...Ch. 2.2 - In Exercises 110, calculate, to the nearest cent,...Ch. 2.2 - Prob. 4ECh. 2.2 - Prob. 5ECh. 2.2 - Prob. 6ECh. 2.2 - Prob. 7ECh. 2.2 - Prob. 8ECh. 2.2 - In Exercises 110, calculate, to the nearest cent,...Ch. 2.2 - In Exercises 110, calculate, to the nearest cent,...Ch. 2.2 - In Exercises 1116, calculate, to the nearest cent,...Ch. 2.2 - In Exercises 1116, calculate, to the nearest cent,...Ch. 2.2 - In Exercises 1116, calculate, to the nearest cent,...Ch. 2.2 - In Exercises 1116, calculate, to the nearest cent,...Ch. 2.2 - In Exercises 1116, calculate, to the nearest cent,...Ch. 2.2 - In Exercises 1116, calculate, to the nearest cent,...Ch. 2.2 - In Exercises 1722, find the effective annual...Ch. 2.2 - In Exercises 1722, find the effective annual...Ch. 2.2 - In Exercises 1722, find the effective annual...Ch. 2.2 - In Exercises 1722, find the effective annual...Ch. 2.2 - In Exercises 1722, find the effective annual...Ch. 2.2 - In Exercises 1722, find the effective annual...Ch. 2.2 - Savings You deposit $1,000 in an account at the...Ch. 2.2 - Investments You invest $10,000 in Rapid Growth...Ch. 2.2 - Depreciation: 2008 Financial Crisis During 2008...Ch. 2.2 - Depreciation: 2008 Financial Crisis During 2008...Ch. 2.2 - Bonds You want to buy a 10-year bond with a...Ch. 2.2 - Bonds You want to buy a 15-year bond with a...Ch. 2.2 - Investments When I was considering what to do with...Ch. 2.2 - Investments When I was considering what to do with...Ch. 2.2 - Depreciation During a prolonged recession,...Ch. 2.2 - Prob. 32ECh. 2.2 - Prob. 33ECh. 2.2 - Prob. 34ECh. 2.2 - Prob. 35ECh. 2.2 - Sales My recent marketing idea, the Miracle Algae...Ch. 2.2 - Exercises 3742 are based on the following table,...Ch. 2.2 - Exercises 3742 are based on the following table,...Ch. 2.2 - Exercises 3742 are based on the following table,...Ch. 2.2 - Exercises 3742 are based on the following table,...Ch. 2.2 - Exercises 3742 are based on the following table,...Ch. 2.2 - Exercises 3742 are based on the following table,...Ch. 2.2 - Retirement Planning I want to be earning an annual...Ch. 2.2 - Prob. 44ECh. 2.2 - Inflation Inflation has been running 2% per year....Ch. 2.2 - Prob. 46ECh. 2.2 - Inflation Housing prices have been rising 6% per...Ch. 2.2 - Prob. 48ECh. 2.2 - Constant Dollars Inflation is running 3% per year...Ch. 2.2 - Prob. 50ECh. 2.2 - Prob. 51ECh. 2.2 - Investments You are offered three investments. The...Ch. 2.2 - History Legend has it that a band of Lenape...Ch. 2.2 - History Repeat Exercise 53, assuming that the...Ch. 2.2 - Inflation Exercises 5562 are based on the...Ch. 2.2 - Inflation Exercises 5562 are based on the...Ch. 2.2 - Inflation Exercises 5562 are based on the...Ch. 2.2 - Inflation Exercises 5562 are based on the...Ch. 2.2 - Inflation Exercises 5562 are based on the...Ch. 2.2 - Inflation Exercises 5562 are based on the...Ch. 2.2 - Inflation Exercises 5562 are based on the...Ch. 2.2 - Inflation Exercises 5562 are based on the...Ch. 2.2 - tock Investments Exercises 6368 are based on the...Ch. 2.2 - tock Investments Exercises 6368 are based on the...Ch. 2.2 - Prob. 65ECh. 2.2 - tock Investments Exercises 6368 are based on the...Ch. 2.2 - tock Investments Exercises 6368 are based on the...Ch. 2.2 - tock Investments Exercises 6368 are based on the...Ch. 2.2 - Prob. 69ECh. 2.2 - Investments Determine when, to the nearest year,...Ch. 2.2 - Epidemics At the start of 1985 the incidence of...Ch. 2.2 - Depreciation My investment in Genetic Splicing,...Ch. 2.2 - Prob. 73ECh. 2.2 - Bonds Suppose that, in January 2040, you buy a...Ch. 2.2 - Prob. 75ECh. 2.2 - Prob. 76ECh. 2.2 - Prob. 77ECh. 2.2 - Prob. 78ECh. 2.2 - Prob. 79ECh. 2.2 - Prob. 80ECh. 2.2 - Prob. 81ECh. 2.2 - Prob. 82ECh. 2.2 - Prob. 83ECh. 2.2 - Prob. 84ECh. 2.2 - Prob. 85ECh. 2.2 - Prob. 86ECh. 2.3 - In Exercises 16, find the amount accumulated in...Ch. 2.3 - Prob. 2ECh. 2.3 - Prob. 3ECh. 2.3 - In Exercises 16, find the amount accumulated in...Ch. 2.3 - In Exercises 16, find the amount accumulated in...Ch. 2.3 - In Exercises 16, find the amount accumulated in...Ch. 2.3 - In Exercises 712, find the periodic payments...Ch. 2.3 - Prob. 8ECh. 2.3 - Prob. 9ECh. 2.3 - In Exercises 712, find the periodic payments...Ch. 2.3 - Prob. 11ECh. 2.3 - Prob. 12ECh. 2.3 - In Exercises 1318, find the present value of the...Ch. 2.3 - In Exercises 1318, find the present value of the...Ch. 2.3 - Prob. 15ECh. 2.3 - Prob. 16ECh. 2.3 - Prob. 17ECh. 2.3 - Prob. 18ECh. 2.3 - In Exercises 1924, find the periodic withdrawals...Ch. 2.3 - Prob. 20ECh. 2.3 - Prob. 21ECh. 2.3 - Prob. 22ECh. 2.3 - Prob. 23ECh. 2.3 - In Exercises 1924, find the periodic withdrawals...Ch. 2.3 - In Exercises 2532, determine the periodic payments...Ch. 2.3 - Prob. 26ECh. 2.3 - Prob. 27ECh. 2.3 - Prob. 28ECh. 2.3 - In Exercises 2532, determine the periodic payments...Ch. 2.3 - Prob. 30ECh. 2.3 - In Exercises 2532, determine the periodic payments...Ch. 2.3 - In Exercises 2532, determine the periodic payments...Ch. 2.3 - In Exercises 3338, determine the outstanding...Ch. 2.3 - In Exercises 3338, determine the outstanding...Ch. 2.3 - In Exercises 3338, determine the outstanding...Ch. 2.3 - In Exercises 3338, determine the outstanding...Ch. 2.3 - In Exercises 3338, determine the outstanding...Ch. 2.3 - In Exercises 3338, determine the outstanding...Ch. 2.3 - Prob. 39ECh. 2.3 - In Exercises 3944, determine the selling price,...Ch. 2.3 - Prob. 41ECh. 2.3 - Prob. 42ECh. 2.3 - Prob. 43ECh. 2.3 - Prob. 44ECh. 2.3 - Retirement Plans and Trusts Exercises 4554 are...Ch. 2.3 - Retirement Plans and Trusts Exercises 4554 are...Ch. 2.3 - Retirement Plans and Trusts Exercises 4554 are...Ch. 2.3 - Retirement Plans and Trusts Exercises 4554 are...Ch. 2.3 - Retirement Plans and Trusts Exercises 4554 are...Ch. 2.3 - Retirement Plans and Trusts Exercises 4554 are...Ch. 2.3 - Retirement Plans and Trusts Exercises 4554 are...Ch. 2.3 - Retirement Plans and Trusts Exercises 4554 are...Ch. 2.3 - Retirement Plans and Trusts Exercises 4554 are...Ch. 2.3 - Prob. 54ECh. 2.3 - Pensions Your pension plan is an annuity with a...Ch. 2.3 - Pensions Jennifers pension plan is an annuity with...Ch. 2.3 - Prob. 57ECh. 2.3 - Pensions Megs pension plan is an annuity with a...Ch. 2.3 - Life Insurance Exercises 5964 are based on the...Ch. 2.3 - Life Insurance Exercises 5964 are based on the...Ch. 2.3 - Life Insurance Exercises 5964 are based on the...Ch. 2.3 - Life Insurance Exercises 5964 are based on the...Ch. 2.3 - Life Insurance Exercises 5964 are based on the...Ch. 2.3 - Life Insurance Exercises 5964 are based on the...Ch. 2.3 - Exercises 6576 are based on the following table,...Ch. 2.3 - Exercises 6576 are based on the following table,...Ch. 2.3 - Exercises 6576 are based on the following table,...Ch. 2.3 - Exercises 6576 are based on the following table,...Ch. 2.3 - Exercises 6576 are based on the following table,...Ch. 2.3 - Exercises 6576 are based on the following table,...Ch. 2.3 - Exercises 6576 are based on the following table,...Ch. 2.3 - Prob. 72ECh. 2.3 - Exercises 6576 are based on the following table,...Ch. 2.3 - Exercises 6576 are based on the following table,...Ch. 2.3 - Exercises 6576 are based on the following table,...Ch. 2.3 - Exercises 6576 are based on the following table,...Ch. 2.3 - Car Loans While shopping for a car loan, you get...Ch. 2.3 - Prob. 78ECh. 2.3 - Refinancing Your original mortgage was a $96,000,...Ch. 2.3 - Refinancing Kara and Michael take out a $120,000,...Ch. 2.3 - Prob. 81ECh. 2.3 - Note: In Exercises 81 and 82 we suggest the use of...Ch. 2.3 - In Exercises 8390, use a time value of money...Ch. 2.3 - Prob. 84ECh. 2.3 - Prob. 85ECh. 2.3 - Prob. 86ECh. 2.3 - Prob. 87ECh. 2.3 - Prob. 88ECh. 2.3 - Prob. 89ECh. 2.3 - In Exercises 8390, use a time value of money...Ch. 2.3 - Prob. 91ECh. 2.3 - Prob. 92ECh. 2.3 - You make equal payments of $200 per month into...Ch. 2.3 - You make equal payments of $400 per month into...Ch. 2.3 - Prob. 95ECh. 2.3 - Prob. 96ECh. 2.3 - We have so far not taken advantage of the fact...Ch. 2.3 - Repeat Exercise 97 for a 10-year, 3.375% bond...Ch. 2.3 - Consider the formula for the future value of an...Ch. 2.3 - Give a non-algebraic justification for the result...Ch. 2 - In Exercises 16, find the future value of the...Ch. 2 - In Exercises 16, find the future value of the...Ch. 2 - Prob. 3RECh. 2 - Prob. 4RECh. 2 - Prob. 5RECh. 2 - Prob. 6RECh. 2 - Prob. 7RECh. 2 - Prob. 8RECh. 2 - Prob. 9RECh. 2 - In Exercises 712, find the present value of the...Ch. 2 - Prob. 11RECh. 2 - Prob. 12RECh. 2 - Prob. 13RECh. 2 - Prob. 14RECh. 2 - Prob. 15RECh. 2 - Prob. 16RECh. 2 - Prob. 17RECh. 2 - Prob. 18RECh. 2 - Prob. 19RECh. 2 - Prob. 20RECh. 2 - Prob. 21RECh. 2 - Prob. 22RECh. 2 - Prob. 23RECh. 2 - Prob. 24RECh. 2 - Prob. 25RECh. 2 - Prob. 26RECh. 2 - Prob. 27RECh. 2 - Prob. 28RECh. 2 - Prob. 29RECh. 2 - Prob. 30RECh. 2 - Prob. 31RECh. 2 - Stock Investments Exercises 2934 are based on the...Ch. 2 - Prob. 33RECh. 2 - Prob. 34RECh. 2 - Revenue Total online revenues at OHaganBooks.com...Ch. 2 - Net Income Unfortunately, the picture for net...Ch. 2 - Prob. 37RECh. 2 - Prob. 38RECh. 2 - Loans OHaganBooks.com is seeking a $250,000 loan...Ch. 2 - Prob. 40RECh. 2 - Prob. 41RECh. 2 - Prob. 42RECh. 2 - Prob. 43RECh. 2 - Prob. 44RECh. 2 - Retirement Planning OHaganBooks.com has just...Ch. 2 - Prob. 46RECh. 2 - Prob. 47RECh. 2 - Prob. 48RECh. 2 - Retirement Planning OHaganBooks.com has just...Ch. 2 - Retirement Planning OHaganBooks.com has just...Ch. 2 - Prob. 51RECh. 2 - Prob. 52RECh. 2 - Prob. 53RECh. 2 - Prob. 54RECh. 2 - Prob. 55RECh. 2 - Prob. 56RE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, subject and related others by exploring similar questions and additional content below.Similar questions

- Ten annual returns are listed in the following table: (Click on the following icon o in order to copy its contents into a spreadsheet.) - 19.3% 16.9% 18.5% - 49.9% 43.1% 1.9% - 16.9% 46.3% 45.3% - 3.2% a. What is the arithmetic average return over the 10-year period? b. What is the geometric average return over the 10-year period? c. If you invested $100 at the beginning, how much would you have at the end?arrow_forwardThe table below reports the annual stock price in September for Apple from 2005 to 2014. Develop a simple index for the change in earning per share over the period. Use 2005 as the base period. percentages (e.g. 131.32 instead of 1.31)) (Indexes should be rounded to 2 decimal places and be in Year Earnings Per Share ($) Simple Index 2005 4.32 2006 4.14 2007 4.86 2008 5.94 2009 6.76 2010 10.08 2011 16.51 2012 23.65 2013 26.21 2014 29.86 Click here for the Excel Data File, Data file should open in a new browswer window. Select "File" then "Save As" to download the file to your computer and be able to use it in Excel. a. By what percent have stock prices changed from 2005 to 2009? b. By what percent have stock prices changed from 2005 to 2014? c. By what percent have stock prices changed from 2009 to 2014?arrow_forwardThe following charts show the monthly S&P 500 index and the FTSE 100 index over approximately the last ten years FRED A - S&P 500 4,000 3,600 3,200 2,800 2,400 2,000 1,600 1,200 800 Jan 2012 Jan 2013 Jan 2014 Jan 2015 Jan 2016 Jan 2017 Jan 2018 Jan 2019 Jan 2020 U.S. recessions are shaded, the most recent end date is undecided. Source: S&P Dow Jones Indices LLC fred.stlouisfe 8,000.00 6,000.00 4,000.00 2,000.00 0.00 2012 2014 2016 2018 2020 The two indices relate to the USA and the UK, respectively. Both indices are I(1) a) Given that the two series are I(1), is it possible for there to be a causal relationship between them? If it is possible, how would you test for the existence of such a relationship?arrow_forward

- A stock has monthly returns of 9%, 22%, 15%, and 28%. What is the stock's geometric average return?arrow_forward16.6 Practice The following data show the daily closing prices (in dollars per share) for a stock. Date Nov. 3 82.92 Nov. 4 83.67 Nov. 82.36 Nov. 82.42 Nov. 82.79 Nov. 10 83.63 Nov. 11 84.21 Nov. 14 84.53 Nov. 15 85.42 Nov. 16 86.21 Nov. 17 86.70 Nov. 18 87.65 Nov. 21 87.37 Nov. 22 87.91 Nov. 23 88.41 Nov. 25 88.25 Nov. 28 89.60 Nov. 29 88.89 88.07 Nov. 30 Dec. 1 88.61 a. Define the independent variable Period, where Period 1 corresponds to the data for November 3, Period 2 corresponds to the data for November 4, and so on. Develop the estimated regression equation that can be used to predict the closing price given the value of Period (to 3 decimals). Price = Period b. At the 0.05 level of significance, test for any positive autocorrelation in the data. What is the value of the Durbin-Watson statistic (to 3 decimals)? Price ($) + Xarrow_forwardThe following table gives information on the Consumer Price Index (Base = 1982–84) and the monthly take-home pay of Bill Martin, an employee at Ford Motor Corporation, from 1982−84 and 2018. Consumer Price Index Mr. Martin’s Monthly Year (1982−84 = 100) Take-Home Pay 1982−84 100.0 $ 600 2018 251.107 7,000arrow_forward

- The folloving chart shows monthly figures for Apple stock in 2010. 350 317.13 300 317.44 294 07 255.96 260.09 250 235.97 258.77 246.94 211.98 235 86 218.95 200 195.46 150 100 Mar-10 May-10 Jul-10 Marked are the following points on the chart. Jan. 10 Feb. 10 Mar. 10 Apr. 10 May 10 June 10 211.98 195.46 218.95 235.97 235.86 255.96 July 10 Aug. 10 Sep. 10 Oct. 10 Nov. 10 Dec. 10 246.94 260.09 258.77 294.07 317.13 317.44 Calculate to the nearest 0.01% your monthly percentage return (on a simple interest basis) if you had bought Apple stock in August and sold in December. % Jae-10 Feb-10 Apr-10 Jun-10 Aug-10 Sep-10 Oct-10 Nov-10 Dee-10arrow_forwardGiven below are the monthly values of the S&P 500 Index. Suppose that in each month you had written an out-of-the-money put option on one unit of the index with an exercise price 5% lower than the current value of the index. End of month S&P 500 End of month S&P 500 End of month S&P 500 End of month S&P 500 September-77 96.53 April-80 106.29 November-82 138.53 July-85 191.85 October-77 92.34 May-80 111.24 December-82 140.64 August-85 190.92 November-77 94.83 June-80 114.24 January-83 145.30 September-85 188.63 December-77 95.10 July-80 121.67 February-83 148.06 October-85 182.08 January-78 89.25 August-80 122.38 March-83 152.96 November-85 189.82 February-78 87.04 September-80 125.46 April-83 164.43 December-85 202.17 March-78 89.21 October-80 127.47 May-83 162.39 January-86 211.28 April-78 96.83 November-80 140.52 June-83 167.64 February-86 226.92 May-78 97.24 December-80 135.76 July-83 162.56 March-86 238.90 June-78 95.53 January-81…arrow_forwardThe rate of return for the last 19 years of a certain segment of the stock market is given in the table. (The data is also provided below the table as a comma-separated list to make it easier to copy.) Market Segment Rate of Return, 2002-2020 Year Rate of Return (%) 2020 3.23 2019 6.14 2018 11.39 2017 15.99 2016 3.24 2015 -3.86 2014 -1.04 2013 8.49 2012 5.93 2011 6.96 2010 1.98 2009 3.13 2008 -6.55 2007 7.27 2006 3.02 2005 -1.34 2004 7.28 2003 6.27 2002 -0.76 Rate of Return (%): 3.23, 6.14, 11.39, 15.99, 3.24, -3.86, -1.04, 8.49, 5.93, 6.96, 1.98, 3.13, -6.55, 7.27, 3.02, -1.34, 7.28, 6.27, -0.76 Find the 34th percentile of the data. 6.46arrow_forward

- . If a startup churns 5.6% of its customers each month, then what is the average lifetime of a customer in months? 15.9 (rounded) 17.9 (rounded) 19.9 (rounded)arrow_forwardThe annual revenue of Amazon is given in the table below (sourceLinks to an external site.). Year Amazon Annual Revenue(Billions of US dollars) 2020 386.064 2019 280.522 2018 232.887 2017 177.866 2016 135.987 2015 107.006 2014 88.988 2013 74.452 2012 61.093 2011 48.077 2010 34.204 In what year will the estimated revenue of Amazon be 1,357 billion US dollars? Note: I am asking for the year, not the number of years since 2010. This may happen between two years. Round to the nearest year.arrow_forwardCoca-Cola Revenues ($ millions), 2014 to 2019 Quarter 2014 2015 2016 2017 2018 2019 Quarter 1 10.58 9.94 10.28 9.12 7.63 8.02 Quarter 2 12.57 11.63 11.54 9.70 9.42 10.00 Quarter 3 11.98 11.77 10.63 9.08 8.78 9.51 Quarter4 10.87 10.13 9.41 7.51 5.36 9.07 What is the trend model for the deseasonalized time series? (Round your answers to 2 decimal places.) State the model found when performing a regression using seasonal binaries. (A negative value should be indicated by a minus sign. Round your answers to 4 decimal places.) Use the regression equation to make a prediction for each quarter in 2020. (Enter your answers in millions rounded to 3 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Discrete Mathematics and Its Applications ( 8th I...MathISBN:9781259676512Author:Kenneth H RosenPublisher:McGraw-Hill Education

Discrete Mathematics and Its Applications ( 8th I...MathISBN:9781259676512Author:Kenneth H RosenPublisher:McGraw-Hill Education Mathematics for Elementary Teachers with Activiti...MathISBN:9780134392790Author:Beckmann, SybillaPublisher:PEARSON

Mathematics for Elementary Teachers with Activiti...MathISBN:9780134392790Author:Beckmann, SybillaPublisher:PEARSON

Thinking Mathematically (7th Edition)MathISBN:9780134683713Author:Robert F. BlitzerPublisher:PEARSON

Thinking Mathematically (7th Edition)MathISBN:9780134683713Author:Robert F. BlitzerPublisher:PEARSON Discrete Mathematics With ApplicationsMathISBN:9781337694193Author:EPP, Susanna S.Publisher:Cengage Learning,

Discrete Mathematics With ApplicationsMathISBN:9781337694193Author:EPP, Susanna S.Publisher:Cengage Learning, Pathways To Math Literacy (looseleaf)MathISBN:9781259985607Author:David Sobecki Professor, Brian A. MercerPublisher:McGraw-Hill Education

Pathways To Math Literacy (looseleaf)MathISBN:9781259985607Author:David Sobecki Professor, Brian A. MercerPublisher:McGraw-Hill Education

Discrete Mathematics and Its Applications ( 8th I...

Math

ISBN:9781259676512

Author:Kenneth H Rosen

Publisher:McGraw-Hill Education

Mathematics for Elementary Teachers with Activiti...

Math

ISBN:9780134392790

Author:Beckmann, Sybilla

Publisher:PEARSON

Thinking Mathematically (7th Edition)

Math

ISBN:9780134683713

Author:Robert F. Blitzer

Publisher:PEARSON

Discrete Mathematics With Applications

Math

ISBN:9781337694193

Author:EPP, Susanna S.

Publisher:Cengage Learning,

Pathways To Math Literacy (looseleaf)

Math

ISBN:9781259985607

Author:David Sobecki Professor, Brian A. Mercer

Publisher:McGraw-Hill Education

Introduction to Statistical Quality Control (SQC); Author: FORSEdu;https://www.youtube.com/watch?v=c18FKHUDZv8;License: Standard YouTube License, CC-BY

[DAXX] Introduction to Statistical Quality Control; Author: The Academician;https://www.youtube.com/watch?v=ypZGDxjSM60;License: Standard Youtube License