Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

6th Edition

ISBN: 9780134486857

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 21, Problem 33BP

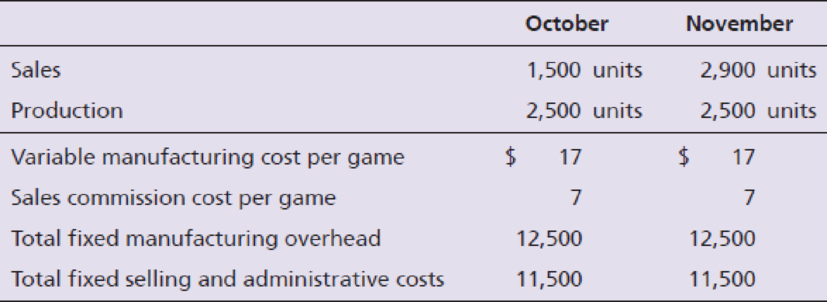

Game Source manufactures video games that it sells for $43 each. The company uses a fixed manufacturing

Requirements

- 1. Compute the product cost per game produced under absorption costing and under variable costing.

- 2. Prepare monthly income statements for October and November, including columns for each month and a total column, using these costing methods:

- a. absorption costing.

- b. variable costing.

- 3. Is operating income higher under absorption costing or variable costing in October? In November? Explain the pattern of differences in operating income based on absorption costing versus variable costing.

- 4. Determine the balance in Finished Goods Inventory on October 31 and November 30 under absorption costing and variable costing. Compare the differences in inventory balances and the differences in operating income. Explain the differences in inventory balances based on absorption costing versus variable costing.

Expert Solution & Answer

Learn your wayIncludes step-by-step video

schedule15:51

Students have asked these similar questions

I need this question answer general Accounting

Solve this question Financial accounting

I won't to this question answer general Accounting

Chapter 21 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Ch. 21 - Pierce Company had the following costs: Calculate...Ch. 21 - Hayden Company has 50 units in Finished Goods...Ch. 21 - The Stark Company manufactures a product that is...Ch. 21 - Chaney Company provides lawn care services....Ch. 21 - Prob. 1QCCh. 21 - Prob. 2QCCh. 21 - Donovan Company incurred the following costs while...Ch. 21 - Donovan Company incurred the following costs while...Ch. 21 - Donovan Company incurred the following costs while...Ch. 21 - Donovan Company incurred the following costs while...

Ch. 21 - Donovan Company incurred the following costs while...Ch. 21 - Prob. 8QCCh. 21 - Prob. 9QCCh. 21 - Prob. 10QCCh. 21 - What is absorption costing?Ch. 21 - What is variable costing?Ch. 21 - How are absorption costing and variable costing...Ch. 21 - Prob. 4RQCh. 21 - Prob. 5RQCh. 21 - When units produced are less than units sold, how...Ch. 21 - Explain why the fixed manufacturing overhead cost...Ch. 21 - Prob. 8RQCh. 21 - Prob. 9RQCh. 21 - Prob. 10RQCh. 21 - Why is it appropriate to use variable costing when...Ch. 21 - Prob. 12RQCh. 21 - Prob. 13RQCh. 21 - Prob. 14RQCh. 21 - Prob. 15RQCh. 21 - How can variable costing be used in service...Ch. 21 - Classify each cost by placing an X in the...Ch. 21 - Martin Company had the following costs: Calculate...Ch. 21 - Martin Company had the following costs: Calculate...Ch. 21 - Dracut Company reports the following information...Ch. 21 - Dracut Company reports the following information...Ch. 21 - Adamson, Inc. has the following cost data for...Ch. 21 - Refer to your answers to Short Exercise S21-6....Ch. 21 - Refer to your answers to Short Exercise S21-6....Ch. 21 - Prob. 9SECh. 21 - Prob. 10SECh. 21 - Prob. 11SECh. 21 - Prob. 12SECh. 21 - Meyer Company reports the following information...Ch. 21 - Concord, Inc. has collected the following data for...Ch. 21 - Concord, Inc. has collected the following data for...Ch. 21 - ReVitalAde produced 13,000 cases of powdered drink...Ch. 21 - Refer to Exercise E21-16. Requirements 1. Prepare...Ch. 21 - Prob. 18ECh. 21 - Refer to your answers to Exercise E21-16. In May...Ch. 21 - Refer to Exercise E21-19. Requirements 1. Prepare...Ch. 21 - The Sweet Treats Company manufactures candy that...Ch. 21 - Sampler Company sells two products, Sigma and...Ch. 21 - Prob. 23ECh. 21 - Prob. 24ECh. 21 - Sherman Company provides carpet cleaning services...Ch. 21 - Prob. 26ECh. 21 - Prob. 27APCh. 21 - Prob. 28APCh. 21 - Relative Furniture Company manufactures and sells...Ch. 21 - Prob. 30APCh. 21 - Professional Pool Cleaning Service provides pool...Ch. 21 - Prob. 32BPCh. 21 - Game Source manufactures video games that it sells...Ch. 21 - Prob. 34BPCh. 21 - The 2018 data that follow pertain to Elis Electric...Ch. 21 - Divine Pool Cleaning Service provides pool...Ch. 21 - Prob. 37PCh. 21 - This problem continues the Piedmont Computer...Ch. 21 - CF Industries Holdings, Inc. is one of the largest...Ch. 21 - The Hurley Hat Company manufactures baseball hats....Ch. 21 - Sampson Company operates a manufacturing facility...Ch. 21 - In 100 words or fewer, explain the main...

Additional Business Textbook Solutions

Find more solutions based on key concepts

1-13. Identify a product, either a good or a service, that will take advantage of this opportunity. Although yo...

Business Essentials (12th Edition) (What's New in Intro to Business)

•• B.4. Consider the following linear programming problem:

Operations Management

Coefficient of variation. Introduction: Risk: The risk can be defined as the uncertainty attached to an event s...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

The put option’s leverage ratio is -1.9. Introduction: Expected return is the method of finding the average ant...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Describe and evaluate what Pfizer is doing with its PfizerWorks.

Management (14th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Newman Corporation sells one product, its waterproof hiking boot. It began operations in the current year and had an ending inventory of 8,500 units. The company sold 20,000 units throughout the year. Fixed manufacturing overhead is $7 per unit, and total manufacturing cost per unit is $22.60 (including fixed manufacturing overhead costs). What is the difference in net income between absorption and variable costing?arrow_forwardIf 11 more dinners were sold?arrow_forwardStonier company has a materials price solve this questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY