Intermediate Financial Management

14th Edition

ISBN: 9780357516782

Author: Brigham, Eugene F., Daves, Phillip R.

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 21, Problem 17P

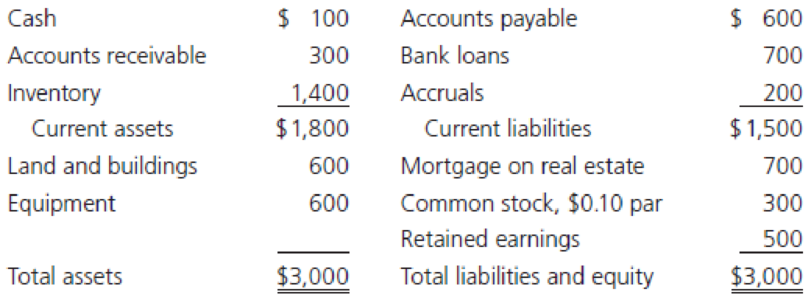

The Raattama Corporation had sales of $3.5 million last year, and it earned a 5% return (after taxes) on sales. Recently, the company has fallen behind in its accounts payable. Although its terms of purchase are net 30 days, its accounts payable represents 60 days’ purchases. The company’s treasurer is seeking to increase bank borrowing in order to become current in meeting its trade obligations (that is, to have 30 days’ payables outstanding). The company’s balance sheet is as follows (in thousands of dollars):

- a. How much bank financing is needed to eliminate the past-due accounts payable?

- b. Assume that the bank will lend the firm the amount calculated in part a. The terms of the loan offered are 8%, simple interest, and the bank uses a 360-day year for the interest calculation. What is the interest charge for 1 month? (Assume there are 30 days in a month.)

- c. Now ignore part b and assume that the bank will lend the firm the amount calculated in part a. The terms of the loan are 7.5%, add-on interest, to be repaid in 12 monthly installments.

- (1) What is the total loan amount?

- (2) What are the monthly installments?

- (3) What is the APR of the loan?

- (4) What is the effective rate of the loan?

- d. Would you, as a bank loan officer, make this loan? Why or why not?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The Raattama Corporation had sales of $3.5 million last year, and it earned a 5% return (after taxes) on sales. Recently, the company has fallen behind in its accounts payable. Although its terms of purchase are net 30 days, its accounts payable represents 60 days’ purchases. The company’s treasurer is seeking to increase bank borrowing in order to become current in meeting its trade obligations (that is, to have 30 days’ payables outstanding). The company’s balance sheet is as follows (in thousands of dollars):

How much bank financing is needed to eliminate the past-due accounts payable?

Assume that the bank will lend the firm the amount calculated in part a. The terms of the loan offered are 8%, simple interest, and the bank uses a 360-day year for the interest calculation. What is the interest charge for 1 month? (Assume there are 30 days in a month.)

(1)

What is the total loan amount?

(2)

What are the monthly installments?

(3)

What is the APR of the loan?

(4)

What is…

Brown Corporation had average days of sales outstanding of 19 days in the most recent fi scal year. Brown wants to improve its credit policies and collection practices and decrease its collection period in the next fi scal year to match the industry average of 15 days. Credit sales in the most recent fi scal year were $300 million, and Brown expects credit sales to increase to $390 million in the next fi scal year. To achieve Brown’s goal of decreasing the collection period, the change in the average accounts receivable balance that must occur is closest to: C . –$1.22 million.

Rose Company currently uses maximum trade credit by not taking discounts on its purchases. The standard industry credit terms offered by all its suppliers are 2/10 net 30 days, and the firm pays on time. The new CFO is considering borrowing from its bank, using short-term notes payable, and then taking discounts. The firm wants to determine the effect of this policy change on its net income. Its net purchases are P11,760 per day, using a 365-day year. The interest rate on the notes payable is 10%, and the tax rate is 40%. If the firm implements the plan, what is the expected change in net income?

P32,964

P40,370

P36,526

P34,699

P38,448

Chapter 21 Solutions

Intermediate Financial Management

Ch. 21 - a. Working capital; net working capital; net...Ch. 21 - Prob. 2QCh. 21 - Is it true that, when one firm sells to another on...Ch. 21 - What are the four elements of a firm’s credit...Ch. 21 - Prob. 5QCh. 21 - Prob. 6QCh. 21 - Prob. 7QCh. 21 - Is it true that most firms are able to obtain some...Ch. 21 - What kinds of firms use commercial paper?Ch. 21 - Prob. 1P

Ch. 21 - Medwig Corporation has a DSO of 17 days. The...Ch. 21 - What are the nominal and effective costs of trade...Ch. 21 - A large retailer obtains merchandise under the...Ch. 21 - A chain of appliance stores, APP Corporation,...Ch. 21 - Prob. 6PCh. 21 - Calculate the nominal annual cost of nonfree trade...Ch. 21 - Prob. 8PCh. 21 - Grunewald Industries sells on terms of 2/10, net...Ch. 21 - The D.J. Masson Corporation needs to raise...Ch. 21 - Negus Enterprises has an inventory conversion...Ch. 21 - Strickler Technology is considering changes in its...Ch. 21 - Dorothy Koehl recently leased space in the...Ch. 21 - Suppose a firm makes purchases of $3.65 million...Ch. 21 - The Thompson Corporation projects an increase in...Ch. 21 - The Raattama Corporation had sales of $3.5 million...Ch. 21 - Karen Johnson, CFO for Raucous Roasters (RR), a...Ch. 21 - Prob. 2MCCh. 21 - Prob. 3MCCh. 21 - Prob. 4MCCh. 21 - Prob. 5MCCh. 21 - Prob. 6MCCh. 21 - Prob. 7MCCh. 21 - Prob. 8MCCh. 21 - What is the impact of higher levels of accruals,...Ch. 21 - Prob. 10MCCh. 21 - Prob. 11MCCh. 21 - Prob. 12MCCh. 21 - Prob. 13MCCh. 21 - Prob. 14MCCh. 21 - Prob. 15MCCh. 21 - Prob. 16MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- ALei Industries has credit sales of $146 million a year. ALei's management reviewed its credit policy and decided that it wants to maintain an average collection period of 35 days. a. What is the maximum level of accounts receivable that ALei can carry and have a 35-day average collection period? b. If ALei's current accounts receivable collection period is 55 days, how much would it have to reduce its level of accounts receivable in order to achieve its goal of 35 days?arrow_forwardIndiana Jones Adventure Tours has the following year-end data; $775,000 in credit sales, $250,000 in accounts receivable, and a $10,000 debit balance in its allowance for doubtful accounts account. It estimates 6% of its accounts receivable will be uncollectible. During the year, the company writes off a $3,000 uncollectible account. What is the company’s bad debt expense for the year? Group of answer choices $15,000 $28,000 $18,000 $25,000arrow_forwardBrady and Sons uses accounts receivable as collateral to borrow money for operations and payroll when revenues are low. If the company borrows $1,950,000 now at a monthly interest rate of 1.5%, but the rate drops to 0.85 percent after 3 months, how much will the company owe after 1 year?arrow_forward

- Galambos Corporation had an average receivables collection period of 19 days in 2003.Galambos has stated that it wants to decrease its collection period in 2004 to match theindustry average of 15 days. Credit sales in 2003 were $300 million, and analysts expectcredit sales to increase to $400 million in 2004. To achieve the company’s goal of decreasing the collection period, the change in the average accounts receivable balance from 2003to 2004 that must occur is closest to:A . –$420,000.B . $420,000.C . $836,000.arrow_forwardDoD Ltd has an annual turnover of Tsh.30 million before taking into account bad debts of Tsh.0.2 million. All sales made by the business are on credit, and, at present, credit terms are negotiable by the customer. On average, the settlement period for trade receivables is 60 days. Trade receivables are financed by an overdraft bearing a 15% rate of interest per year. The business is currently reviewing its credit policies to see whether more efficient and profitable methods could be employed. Only one proposal has so far been put forward concerning the management of trade credit. The credit control department has proposed that customers should be given a 2% cash discount if they pay within 30 days. For those who do not pay within this period, a maximum of 45 days’ credit should be given. The credit department believes that 65% of customers will take advantage of the discount by paying at the end of the discount period, and the remainder will pay at the end of 45 days. The credit…arrow_forwardBulldogs Inc. had credit sales last year amounted to P18,600,000. The firm also had an average accounts receivable balance of P1,380,000. Credit terms are 2/10, n/30. Bulldogs’ average collection period last year was (Use 360-day year) 26.71 days. 27.32 days. 26.22 days. 33.45 days. Which is correct with regards to the effects of restricting credit standards? An increase in recognition of doubtful accounts expense will probably happen Positive impact on the net profit can be noted from decline in the quantity of goods sold Investment in accounts receivable will likely increase Quantity of units sold will probably decrease and will result to a lower sales revenuearrow_forward

- A company plans to tighten its credit policy. The new policy will decrease the average number of days in collection from 75 to 50 days and will reduce the ratio of credit sales to total revenue from 70% - 60%. The company estimates that projected sales would be 5% less if the proposed new credit policy is implemented. If projected sales for the coming year are P50 million, calculate the estimated peso change in the firm's account receivable balance caused by this proposed change in credit policy. Assume a 365-day year. [Answer format: INCREASE 1234567]arrow_forwardA firm's annual credit sales are $171 million, with 49.56% of its daily average paid out in purchases. It usually takes the company 34 days to meet its purchasing obligations. This payment pattern has not changed in recent years. However, the firm's commitment to accounts receivable has shifted based on its current annual net income of $28.6k which meets the 3.44% required return, anticipated by senior management a year earlier. Normally, the firm collects its accounts in 23 days, an average which remains unaffected. Required: In percentage terms, by how much are the firm's receivables greater (or less) than its payables? Note: The term "k" is used to represent thousands (x $1,000). % (ROUND YOUR ANSWER TO 2 DECIMAL PLACES. FOR EXAMPLE: 17.23)arrow_forwardAtlantic Northern Inc. currently has $715,000 in accounts receivable and generated $4,650,000 in sales (all on credit) during the year that just ended. The firm’s days sales outstanding (DSO) is days. Use 365 days as the length of a year in all calculations. Atlantic Northern Inc.’s CFO is unhappy with its DSO and wants to improve collections next year. Sales are expected to grow by 13% next year, and the CFO wants to lower the DSO to the industry average of 30 days. How much accounts receivable is the firm expected to carry? $453,471 $431,877 $410,283 $388,689arrow_forward

- Campbell Computing Inc. expects to have sales this year of $30 million under its current credit policy. The company offers a credit term of 2/8, net 20. Currently, 60 percent of paying customers take the discount and rest are paying on time. The bad debt loss is 2 percent. The company has a profit margin of 20%, and uses a 5% short-term bank loan to finance its accounts receivables. With 365-day a year assumption, please calculate the following items: a. The bad debt loss of the company this year b. The annual discount given to customers c. The accounts receivables level d. The financing cost of accounts receivablesarrow_forwardMcKinney & Co. estimates its uncollectible accounts as a percentage of credit sales. McKinney made credit sales of $2,400,000 in 2019. McKinney estimates 2.5% of its sales will be uncollectible At the end of the first quarter of 2020, McKinney & Co. reevaluates its receivables. McKinney's management decides that $7,300 due from Mangold Corporation will not be collectible. This amount was previously included in the allowance account. On April 23, 2020, McKinney & Co. receives a check from Mangold Corporation for $7,300. Required: Prepare the journal entries for McKinney to record the collection of the account previously written offarrow_forwardBennett Corp. has outstanding accounts receivable totaling $6.5 million as of December 31 and sales on credit during the year of $24 million. There is also a credit balance of $12,000 in the allowance for doubtful accounts. If the company estimates that 8% of its outstanding receivables will be uncollectible, what will be the amount of bad debt expense recognized for the year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

The management of receivables Introduction - ACCA Financial Management (FM); Author: OpenTuition;https://www.youtube.com/watch?v=tLmePnbC3ZQ;License: Standard YouTube License, CC-BY