South-Western Federal Taxation 2019: Individual Income Taxes (Intuit ProConnect Tax Online 2017 & RIA Checkpoint 1 term (6 months) Printed Access Card)

42nd Edition

ISBN: 9781337702546

Author: James C. Young, William H. Hoffman, William A. Raabe, David M. Maloney, Annette Nellen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 20, Problem 35CE

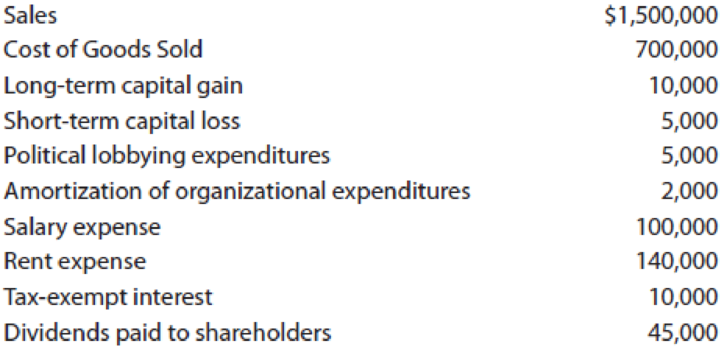

Drab Corporation, a calendar year S corporation, had the following transactions during 2018:

What is Drab’s ordinary business income for 2018?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Iris Company has provided the following information

regarding two of its items of inventory at year-end: There

are 200 units of Item A, having a cost of $10 per unit, a

selling price of $14 and a cost to sell of $6 per unit. There

are 150 units of Item B, having a cost of $40 per unit, a

selling price of $46 and a cost to sell of $4 per unit. How

much is the ending inventory using lower of cost or net

realizable value on an item-by-item basis?

a. $8,350.

b. $8,750.

c. $8,000.

d. $7,600.

Provide answer this general Accounting question

Do fast answer of this accounting questions

Chapter 20 Solutions

South-Western Federal Taxation 2019: Individual Income Taxes (Intuit ProConnect Tax Online 2017 & RIA Checkpoint 1 term (6 months) Printed Access Card)

Ch. 20 - Prob. 1DQCh. 20 - LO.1 Sylvia and Trang want to enter into business...Ch. 20 - Prob. 3DQCh. 20 - Prob. 4DQCh. 20 - Prob. 5DQCh. 20 - Prob. 6DQCh. 20 - LO.3, 4, 5 Contrast the income taxation of...Ch. 20 - LO.3, 8, 9 The taxpayer has generated excess...Ch. 20 - Prob. 9DQCh. 20 - Prob. 10DQ

Ch. 20 - Prob. 11DQCh. 20 - Prob. 12DQCh. 20 - Prob. 13DQCh. 20 - Prob. 14DQCh. 20 - Prob. 15DQCh. 20 - Prob. 16DQCh. 20 - Prob. 17DQCh. 20 - Prob. 18DQCh. 20 - Prob. 19DQCh. 20 - Prob. 20DQCh. 20 - Prob. 21DQCh. 20 - Prob. 22DQCh. 20 - Prob. 23DQCh. 20 - Blaine, Cassie, and Kirstin are equal partners in...Ch. 20 - Prob. 25DQCh. 20 - LO.3 Green Corporation, a calendar year taxpayer,...Ch. 20 - Prob. 27CECh. 20 - Banana Corporation is a May 31 fiscal year...Ch. 20 - LO.4 Gold and Silver are two unrelated calendar...Ch. 20 - Maroon Corporation is a calendar year taxpayer....Ch. 20 - Prob. 32CECh. 20 - Prob. 33CECh. 20 - Prob. 34CECh. 20 - Drab Corporation, a calendar year S corporation,...Ch. 20 - Kim is a 40% shareholder in Taupe Corporation, a...Ch. 20 - Prob. 37CECh. 20 - LO.3, 4, 5 Using the legend provided below,...Ch. 20 - LO.3 Garnet has the following capital asset...Ch. 20 - LO.3, 8 Citron, a calendar year taxpayer, began...Ch. 20 - LO.3 Taupe, a calendar year taxpayer, has a...Ch. 20 - LO.3, 8 Robin had the following capital...Ch. 20 - Prob. 43PCh. 20 - Prob. 44PCh. 20 - Prob. 45PCh. 20 - Prob. 46PCh. 20 - Prob. 47PCh. 20 - Prob. 48PCh. 20 - Prob. 49PCh. 20 - Prob. 50PCh. 20 - Prob. 51PCh. 20 - Prob. 52PCh. 20 - Prob. 53PCh. 20 - Prob. 54PCh. 20 - During the current year, Thrasher (a calendar...Ch. 20 - Prob. 56PCh. 20 - Jim Olsen owns all of the stock in Drake, a...Ch. 20 - Prob. 58PCh. 20 - Prob. 59PCh. 20 - LO.9 The Pheasant Partnership reported the...Ch. 20 - Prob. 61PCh. 20 - Prob. 62PCh. 20 - Prob. 63PCh. 20 - Prob. 1RPCh. 20 - Prob. 2RPCh. 20 - Prob. 3RPCh. 20 - Prob. 5RPCh. 20 - On January 1, year 5, Olinto Corp., an accrual...Ch. 20 - Prob. 2CPACh. 20 - Prob. 3CPACh. 20 - Prob. 4CPACh. 20 - Prob. 5CPACh. 20 - Prob. 6CPACh. 20 - Prob. 7CPA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the amount of gross profit on this accounting question?arrow_forwardQuestions:- On March 1, 2019, Alpha Company's beginning work-in-process inventory had 8,000 units. This is its only production department. Beginning WIP units were 50% completed to conversion costs. Alpha introduces direct materials at the beginning of the production process. During March, a total of 15,000 units were started and a total of 20,000 units were completed. Alpha's ending WIP inventory had 3,000 units which were 70% completed to conversion costs. Alpha uses the weighted average method. Use this information to determine for March 2019 the equivalent units of production for conversion costsarrow_forwardPlease give answer step by steparrow_forward

- What role should the precautionary principle play in the development and application of accounting standards? Discuss the potential tensions that may arise between the need for financial transparency and the desire to mitigate against excessive risk-taking or overly optimistic reporting.arrow_forwardThe Tin company uses the straight-line method to depreciate its equipment. On May 1, 2018, the company purchased some equipment for $200,000. The equipment is estimated to have a useful life of ten years and a salvage value of $20,000. How much depreciation expense should Tin record for the equipment in the adjusting entry on December 31, 2018?arrow_forwardPlease solve this Accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License