Concept explainers

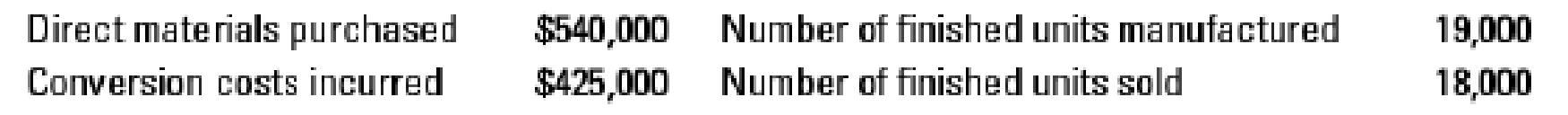

Backflush, two trigger points, materials purchase and sale (continuation of 20-37). Assume the same facts for Acton Corporation as in Problem 20-37, except that now assume Acton uses a JIT production system and backflush costing with two trigger points for making entries in the accounting system:

- Purchase of direct materials

- Sale of finished goods

The inventory account is confined solely to direct materials, whether these materials are in a storeroom, in work in process, or in finished goods. No conversion costs are inventoried. They are allocated to the units sold at standard costs. Any under- or overallocated conversion costs are written off monthly to Cost of Goods Sold.

- 1. Prepare summary

journal entries for August, including the disposition of under- or overallocated conversion costs. Acton has no direct materials variances.

Required

- 2.

Post the entries in requirement 1 to T-accounts for Inventory Control, Conversion Costs Control, Conversion Costs Allocated, and Cost of Goods Sold.

20-37 Backflush costing and JIT production. The Acton Corporation manufactures electrical meters. For August, there were no beginning inventories of direct materials and no beginning or ending work in process. Acton uses a JIT production system and backflush costing with three trigger points for making entries in the accounting system:

- Purchase of direct materials

- Completion of good finished units of product

- Sale of finished goods

Acton’s August

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Webster Company uses backflush costing to account for its manufacturing costs. The trigger points for recording inventory transactions are the purchase of materials, the completion of products, and the sale of completed products. Required: 1. Prepare journal entries, if needed, to account for the followingtransactions. a. Purchased raw materials on account, 135,000. b. Requisitioned raw materials to production, 135,000. c. Distributed direct labor costs, 20,000. d. Incurred manufacturing overhead costs, 80,000. (Use Various Credits for the credit part of the entry.) e. Cost of products completed, 235,000. f. Completed products sold for 355,000, on account. 2. Prepare any journal entries that would be different from theabove, if the only trigger points were the purchase of materialsand the sale of finished goods.arrow_forwardA manufacturer reports the information below. Finished goods inventory, beginning Finished goods inventory, ending Depreciation on factory equipment Direct labor Indirect labor Factory utilities Selling expenses Direct materials used Indirect materials used Office rent expense Work in process inventory, beginning Work in process inventory, ending Complete this question by entering your answers in the tabs below. Required A Required B Compute cost of goods sold for the period. Goods available for sale Cost of goods sold $ 8,200 9,140 4,800 84,000 36,700 3,200 750 55,900 700 1,200 1,600 2,400 $ 0arrow_forwardSchedules of Cost of Goods Manufactured and Cost of Goods Sold; Income Statement The following data from the just completed year are taken from the accounting records of Mason Company: Required: 1. Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials. 2. Prepare a schedule of cost of goods sold. Assume that the company’s underapplied or overapplied overhead is closed to Cost of Goods Sold. 3. Prepare an income statement.arrow_forward

- 26. Which of the following sentence not related to ‘purchasing by requirement’? a.Purchasing goods, which are not regularly required. b.Market situation is constantly studied. c.Purchase of emergency goods. d.Knowledge of the suppliers of such goods. 28. Identify the journal entry for normal wastage. a.Dr.Material inventory, Cr.Work in process inventory b.Dr.Material inventory, Cr.Production overheads c.Dr.Costing profit and loss account, Cr.Work in process inventory d.Dr.Production overheads, Cr.Work in process inventoryarrow_forwardCost of Goods Sold that are NOT part of Goods Available for Sale are included in A. Work-in-Process Inventory beginning balance B. Work-in Process Inventory ending balance C. Direct Labor D. Finished Goods Inventory ending balance Given the following data, what is the cost of goods manufactured? Beginning Raw Materials Inventory Ending Raw Materials Inventory Beginning Work-in-Process Inventory Ending Work-in-Process Inventory Beginning Finished Goods Inventory Ending Finished Goods Inventory Manufacturing Overhead Direct Labor Raw Materials used in production A. $125,000 B. $141,000 12:03 C. $146,000 D. $151,000 $6,000 9,000 12,000 17,000 3,000 5,000 21,000 30,000 95,000 12:03arrow_forwardWhen the sale of finished goods is recorded, the balance in which of the following accounts will decrease? None of the listed choices are correct Work-in-Process Sales Revenue Cost of Goods Sold Raw Materials Inventory Factory Overhead Finished Goods Inventoryarrow_forward

- Which of the following is/are true for the cost flow process? (check all that apply) Cost of goods sold is what leaves work in process When a company buys raw materials, the raw materials purchased will be recorded as an expense on the income statement at the time of purchase. A company doesn't need to have balances greater than $0 in all three accounts: raw materials, work in process, finished goods O Work in process, raw materials, and finished goods are all under 'inventory' in the asset section on the balance sheet Question 9 Assume Tsoi Company has the following sales and production budget for a line of shoes: January March 5,000 pair of shoes 6,500 pair of shoes 5,200 pair of shoes 6,700 pair of shoes Sales Production February 7,000 pair of shoes 7,400 pair of shoes Assume Tsoi Company uses 3 feet of string for laces per pair of shoes. Tsoi Company wants to have direct materials on hand at the end of each month equal to 7% of the following month's production needs. How many feet…arrow_forward3. What information might Tanaka use to change two items in requirement 2 to be direct-cost items rather than manufacturing overhead cost items? Exercise 5 (Cost of goods manufactured and sold) Compute cost of goods manufactured and cost of goods sold from the following account balances relating to 20X1 (in thousands): Property tax on plant building Marketing, distribution, and customer- service costs Finished goods inventory, January 1, 20X1 Plant utilities Work in process inventory December 31, 20X1 Depreciation of plant building P 3,000 37,000 27,000 17,000 26,000 9,000arrow_forward1. Prime Costs = Direct Labor + Direct Material a) True b) False 2. Conversion Costs = Direct Material + Manufacturing Overhead a) True b) False 3. Period costs are any costs that are not product costs like Commission Expense, Office rent Expense, Advertisement Expense, Office Salary Expense. a) True b) False 4. Manufacturers have three unique inventory categories: Raw Materials, Work in Process, and Finished Goods. But retailers have only an Inventory account. a) True b) Falsearrow_forward

- Cost accounting systems used by manufacturing companies are based on the: A. LIFO inventory system. B. Perpetual inventory system. C. Finished goods inventories. D. Weighted average inventories. E. Periodic inventory system. Reset Selectionarrow_forwardCompute cost of goods sold using the following information. Finished goods inventory, beginning Work in process inventory, beginning Work in process inventory, ending Cost of goods manufactured Finished goods inventory, ending Cost of Goods Sold is Computed as: Cost of goods sold $ 374,000 86,500 77,100 932,800 334,000 Minarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning