College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN: 9781305666160

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 8SPB

SERIES B PROBLEMS

THE

REQUIRED

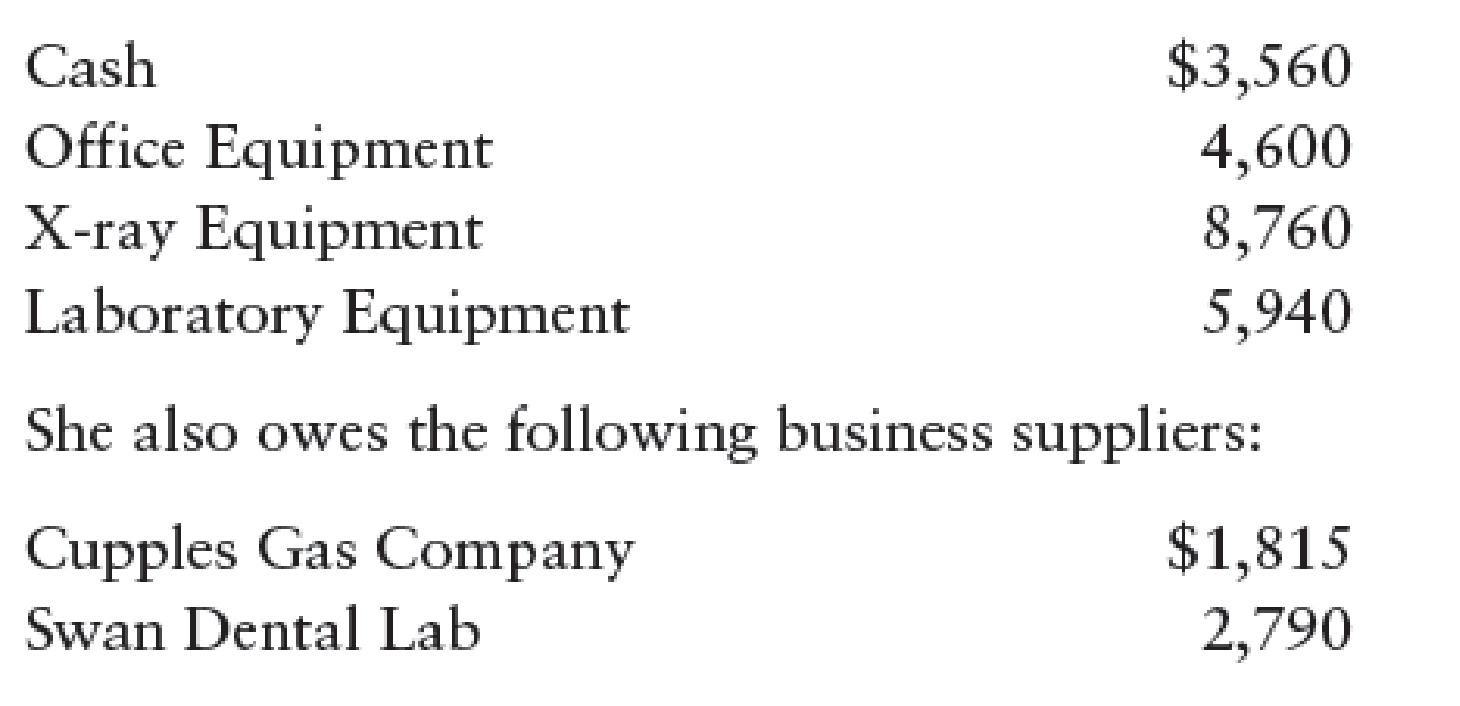

1. From the preceding information, compute the accounting elements and enter them in the accounting equation as shown below.

2. During February, the assets increase by $4,565, and the liabilities increase by $3,910. Compute the resulting accounting equation.

3. During March, the assets decrease by $2,190, and the liabilities increase by $1,650. Compute the resulting accounting equation.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Notes Receivable

Crowne Cleaning provides cleaning services for Amber Inc., a business with four buildings. Crowne assigned different cleaning charges for each building based on the amount of square feet to be cleaned. The charges for the four buildings are $87,600, $82,200, $102,000, and $62,400. Amber secured this amount by signing a note bearing 10% interest on June 1.

Required:

Question Content Area

1. Prepare the journal entry to record the sale on June 1. If an amount box does not require an entry, leave it blank.

blank

- Select -

- Select -

- Select -

- Select -

Question Content Area

2. Determine how much interest Crowne will receive if the note is repaid on December 1.$fill in the blank 59d6dd028fbe01b_1

Question Content Area

3. Prepare Crowne’s journal entry to record the cash received to pay off the note and interest on December 1. If an amount box does not require an entry, leave it blank.

blank

- Select -

- Select…

View transaction list

Journal entry worksheet

<

1

Transaction

b.

2

3

During the current year, office supplies amounting to $930 were purchased for

cash and debited in full to Supplies. At the end of last year, the count of

supplies remaining on hand was $320. The inventory of supplies counted on

hand at the end of the current year was $250.

Note: Enter debits before credits.

Record entry

4 5 6 7 8

General Journal

Property tax expense

Property tax payable

Accounts receivable

Service revenue

Insurance expense

Prepaid insurance

Clear entry

Debit

1,500

7,900

Credit

1,500

7,900

View general journal

T Account entries for Simple Construction:Bob Simple graduated from the BCIT Construction Management Program and decided to start his own construction company. We will record various entries that might be made in a T account sheet in order to account for his second year of operations. At the end of the first year, his income statement and balance sheet havethe following values:Balance Sheet Entries for Last Year:Cash: 365,000Accounts Receivable: $17,000Materials Inventory: $2000Equipment: $15,000Accumulated Amortization: $500Accounts Payable: $22,000Bank Loan –Long Term: $10,000Dividend Payable: $35,000Interest Payable: $500Wages Payable: $5,000Common Stock: $250,000Retained Earnings: $76,000Income statement Final Entries for Last Year:Revenue: $145,000Materials Expense: $20,000Wages Expense: $10,000Amortization Expense: $500Rental Expense: $2,500Interest Expense: $1000Net Income: $111,000

Question 1a.Enter the relevant amounts in the T sheet to start the current year, and designate…

Chapter 2 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

Ch. 2 - Prob. 1TFCh. 2 - Accounts Payable is an example of an asset...Ch. 2 - According to the business entity concept,...Ch. 2 - The accounting equation (Assets = Liabilities +...Ch. 2 - When an asset increases, a liability must also...Ch. 2 - Expenses represent outflows of assets or increases...Ch. 2 - When total revenues exceed total expenses, the...Ch. 2 - An increase to which of these accounts will...Ch. 2 - When delivery revenue is earned in cash, which...Ch. 2 - When delivery revenue is earned on account, which...

Ch. 2 - When payment is made on an existing debt, which...Ch. 2 - Which of the following accounts does not appear on...Ch. 2 - Checkpoint Exercises Label each of the following...Ch. 2 - What is missing from the accounting equation...Ch. 2 - What are the effects of the following transactions...Ch. 2 - Classify the following accounts as assets (A),...Ch. 2 - Name and define the six major elements of the...Ch. 2 - Name and define the six major elements of the...Ch. 2 - List the three basic questions that must be...Ch. 2 - Prob. 4RQCh. 2 - Prob. 5RQCh. 2 - Prob. 6RQCh. 2 - What are the three basic phases of the accounting...Ch. 2 - SERIES A EXERCISES ACCOUNTING ELE MENT S Label...Ch. 2 - Prob. 2SEACh. 2 - Assets following (d): 32,200 EFFECTS OF...Ch. 2 - EFFECTS OF TRANSACTIONS (BALANCE SHEET ACCOUNTS)...Ch. 2 - FINANCIAL STATEMENT ACCOUNTS Label each of the...Ch. 2 - STATEMENT OF OWNERS EQUITY REPORTING NET INCOME...Ch. 2 - STATEMENT OF OWNERS EQUITY REPORTING NET INCOME...Ch. 2 - SERIES A PROBLEMS THE ACCOUNTING EQUATION Dr. John...Ch. 2 - EFFECT OF TRANSACTIONS ON ACCOUNTING EQUATION Jay...Ch. 2 - EFFECT OF TRANSACTIONS ON ACCOUNTING EQUATION Jay...Ch. 2 - EFFECT OF TRANSACTIONS ON ACCOUNTING EQUATION Jay...Ch. 2 - EFFECT OF TRANSACTIONS ON ACCOUNTING EQUATION Jay...Ch. 2 - ACCOUNTING ELEMENTS Label each of the following...Ch. 2 - THE ACCOUNTING EQUATION Using the accounting...Ch. 2 - EFFECTS OF TRANSACTIONS (BALANCE SHEET ACCOUNTS)...Ch. 2 - EFFECTS OF TRANSACTIONS (BALANCE SHEET ACCOUNTS)...Ch. 2 - FINANCIAL STATEMENT ACCOUNTS Label each of the...Ch. 2 - STATEMENT OF OWNERS EQUITY REPORTING NET INCOME...Ch. 2 - STATEMENT OF OWNERS EQUITY REPORTING NET LOSS...Ch. 2 - SERIES B PROBLEMS THE ACCOUNTING EQUATION Dr....Ch. 2 - EFFECT OF TRANSACTIONS ON ACCOUNTING EQUATION...Ch. 2 - EFFECT OF TRANSACTIONS ON ACCOUNTING EQUATION...Ch. 2 - STATEMENT OF OWNERS EQUITY Based on Problem 2-9B,...Ch. 2 - BALANCE SHEET Based on Problem 2-9B, prepare a...Ch. 2 - Prob. 1MYWCh. 2 - Prob. 1MPCh. 2 - CHALLENGE PROBLEM In this chapter, you learned...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- list of employees and payroll calculations four to six depreciation schedules with comments competitive analysis Step 1: Research. Identify a small business idea. Do some research to ensure that you can find a publicly-traded competitor to your business and can find the cost of some equipment necessary to run your business.Step 2: Generate employees.Generate several (2-3) employees for your business, noting their marital status and number of with holdings. Step 3: Select wages.Select a weekly, bi-weekly, or monthly pay period. Research and decide on appropriate wages for your employees. Make sure to include at least two employees with different types of wages (salary, hourly wage, piecework, and commission).Step 4: Calculate payroll.Calculate payroll for one pay period, including taxes and with holdings. Submit a list of your employees and their tax statuses along with your payroll calculations. Calculate the mean and standard deviation of your employees' wages for the given pay…arrow_forwardINCOME STATEMENT, STATEMENT OF OWNERS EQUITY, AND BALANCE SHEET Backlund Farm Supply completed the work sheet on page 609 for the year ended December 31, 20--. Owners equity as of January 1, 20--, was 50.000. The current portion of Mortgage Payable is 1,000. REQUIRED 1. Prepare a multiple-step income statement. 2. Prepare a statement of owner s equity. 3. Prepare a balance sheet.arrow_forwardINCOME STATEMENT. STATEMENT OF OWNER S EQUITY, AND BALANCE SHEET Paulsons Pet Store completed the work sheet on page 602 for the year ended December 31, 20--. Owners equity as of January 1, 20--, was 21,900. The current portion of Mortgage Payable is 500. REQUIRED 1. Prepare a multiple-step income statement. 2. Prepare a statement of owners equity. 3. Prepare a balance sheet.arrow_forward

- Preparing financial statements. Hugo Garcia is preparing his balance sheet and income and expense statement for the year ending December 31, 2020. He is having difficulty classifying six items and sks for your help. Which, if any, of the following transactions are assets, liabilities, income, or expense items? a. Hugo rents a house for 1,350 a month. b. On June 21, 2020 Hugo bought diamond earrings for his wife and charged them using his Visa card. The earrings cost 900, but he hasnt yet received the bill. c. Hugo borrowed 3,500 from his parents last fall, but so far, he has made no payments to them. d. Hugo makes monthly payments of 225 on an installment loan; about half of it is interest, and the balance is repayment of principal. He has 20 payments left, totaling 4,500. e. Hugo paid 3,800 in taxes during the year and is due a tax refund of 650, which he hasnt yet received. f. Hugo invested 2,300 in a mutual fund. g. Hugos Aunt Lydia gave him a birthday gift of 300.arrow_forwardJournalize the transactions of John Daniel, M.D. Include an explation with each entry Jan 1 The business recieved $34,000 cash and gave capital to Daniel Jan 2 Purchasged medical supplies on account, $17,000 Jan 4 Performed servies for patients receiving $1,600 Jan 12 Paid monthly office rent of $3,000 Jan 15 Recorder $7,000 revenue for sercives rendered to patients on accountarrow_forwardFINANCIAL RATIOS Use the work sheet and financial statements prepared in Problem 15-8B. All sales are credit sales. The Accounts Receivable balance on January 1 was 38,200. REQUIRED Prepare the following financial ratios: (a)Working capital (b)Current ratio (c)Quick ratio (d)Return on owners equity (e)Accounts receivable turnover and the average number of days required to collect receivables (f)Inventory turnover and the average number of days required to sell inventoryarrow_forward

- Question Content Area Given the following data: Dec. 31, Year 2 Dec. 31, Year 1 Total liabilities $128,250 $120,000 Total owner's equity 95,000 80,000 Compute the ratio of liabilities to owner's equity for each year. Round to two decimal places.arrow_forwardO Page view A R You are employed as the office manager at Clover Point Pediatrics. Your job requires you to take on many responsibilities. One of these is to arrange for the annual employee party. This year, you have been given permission to rent a banquet room at a local hotel, hire a caterer, and hire a disc jockey for entertainment. There are 23 employees and each will be bringing one guest (46 total). Answer the following (all pricing includes tax and tip): 10. The caterer is charging $29.95 per person for a sit-down dinner. What will be the total cost for food? 11. Beer and wine will be served at a cost of $12.00 per person. What is the total cost for beverages? 12. The entertainment costs $100.00 an hour, and entertainment will be held from 7:00 p.m. to midnight. What will this cost? The banquet rental is $1,200.00 for the evening and this includes all set ups. What will the entire evening cost (food, beverages, entertainment, and rental)? 13.arrow_forwardRevenue Business expenses Investment expenses Short-term capital gains Short-term capital losses Mabel, Loretta, and Margaret are equal partners in a local restaurant. The restaurant reports the following items for the current year: Juunit $ 680,000 350,000 205,500 233,000 (303,700) Schedule A Schedule D Schedule E Check my work Each partner receives a Schedule K-1 with one-third of the preceding items reported to her. How must each individual report these results on her Form 1040? (Do not round any division. Round your final answer to the nearest whole dollar value. Negative amounts should be indicated by a minus sign.)arrow_forward

- Mastery Problem: Investments The Wellington Company You are working for The Wellington Company on temporary assignment while one of the accountants is on family leave. You have been asked to review the company’s investment journal entries and provide necessary information to the accountant preparing the financial statements. Journal Date Description Debit Credit Jan. 17 Investments-Red Rock Co. Stock 39,600 Cash 39,600 Feb. 5 Investments-Sunset Village Bonds 36,000 Interest Receivable 310 Cash 36,310 Feb. 23 Investments-Mays and Co. Stock 27,000 Cash 27,000 Mar. 31 Cash 360 Interest Receivable 310 Interest Revenue 50 Apr. 6 Investment in Minions Corp. Stock 180,000 Cash 180,000 Apr. 30 Cash 750 Dividend Revenue 750 Jul. 1 Cash 19,630 Loss…arrow_forward1 se A mortgage service office has the following four activities involved in approving a loan application. Note that a working day is 8 hours and there are 60 minutes in one hour. You Answered Correct Answer Activity A. Property survey B. Credit report C. Title search D. Final decision The office has three employees, activities A, B and C are combined together and assigned to two employees, while the other employee is responsible for the last activity D. What is the mortgage office's direct labor utilization (DLU) under this setting? 1.19 Time (minutes) 19 20 15 21 Numbers only (e.g.. 0.445 is acceptable, but NOT 44.5%) , keep three decimals if not exact, either round up or down is ok 0.926 margin of error +/-0.001arrow_forwardRobbie Nicholls commenced business offering landscaping and tree pruning services to clients. During the 2023 income year, Robbie recorded the following transactions: Cash received from clients $165,000 (incl. GST) Coffee machine received from client valued at $ 1,100 (incl. GST) Fees outstanding from clients as at 30 June 2023 $2,200 (incl. GST) Calculate Robbie's assessable income for the 2023 income year. Question 19Select one: $153, 000 $168, 300 $152, 000 $167, 200arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License