Contemporary Engineering Economics (6th Edition)

6th Edition

ISBN: 9780134105598

Author: Chan S. Park

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 4P

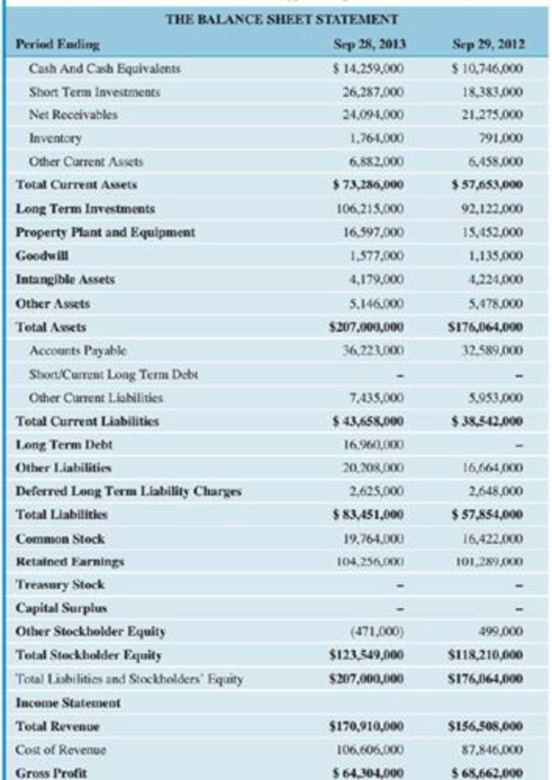

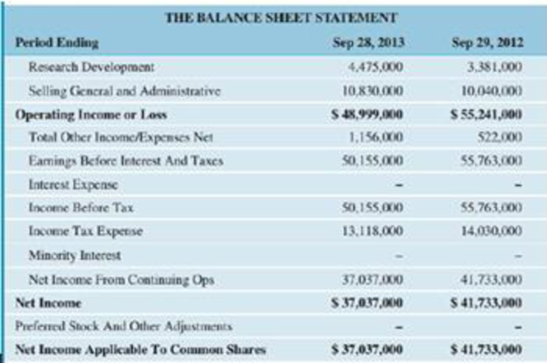

Table P2.4 shows financial statements for Apple Computer Corporation. The closing stock

- (a) Debt ratio

- (b) Times-interest-earned ratio

- (c) Current ratio

- (d) Quick (acid-test) ratio

- (e) Inventory-turnover ratio

- (f) Dav's-sales-outstandine

- (g) Total-assets turnover ratio

- (h) Profit margin on sales

- (i) Return on total assets

- (j) Return on common equity

- (k) Price/earnings ratio

- (l) Book value per share

TABLE P2.4 Financial Statements far Apple Computer (All numbers in thousands)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following table shows the total return and the number of funds for four categories of mutual funds.

Excel File: data03-17.xlsx

Type of Fund Number of Funds Total Return (%)

Domestic Equity 9,191 4.65

International Equity 2,621 18.15

Specialty Stock 1,419 11.36

Hybrid 2,900 6.75

a. Using the number of funds as weights, compute the weighted average total return for these mutual funds. (to 2 decimals)

b. Is there any difficulty associated with using the "number of funds" as the weights in computing the weighted average total return in part (a)? Discuss. What else might be used for weights?

(i) Using "number of funds" as weights will only be a good approximation if the amount invested in various funds is approximately equal. The amount invested in each fund could be used for weights.

(ii) Using "number of funds" as weights results in a good approximation regardless of the amount invested in various funds. There is no need to use a different weight.

(iii) Using "number of…

ECONOMICS

At the end of 2011 Home Depot's total capitalization amounted to $29,031 million. In 2012 debt investors received interest income of $648 million. Net income to shareholders was $4,487 million. (Assume a tax rate of 35%.) Calculate the economic value added assuming its cost of capital is 10%. (Do not round intermediate calculations. Give your answer in millions rounded to 2 decimal places.)

The following data are taken from the financial statements

of Wildhorse Co. The data are in alphabetical order.

Accounts payable $27,800

Net sales

$526,000

Accounts

Other current

$72,500

$22,500

receivable

liabilities

Average common

Salaries and

$23,000

$7,500

shares out.

wages payable

Stockholders'

Cash

$57,550

$146,400

equity

Gross profit

$170,000 Total assets

$305,000

Net income

$ 46,000

Compute the following:

a. Current ratio.

b. Working capital.

c. Earnings per share.

Chapter 2 Solutions

Contemporary Engineering Economics (6th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Give typing answer with explanation and conclusionarrow_forwardSeearrow_forwardA firm has net income of $134,502. There are 136,088 shares of stock outstanding at a price per share of $12.98. The price to book ratio is 5.74 and the firm has $117,799 in total liabilities. What is the firm's price-earnings ratio? Answer should be formatted as a number with 2 decimal places (e.g. 99.99).arrow_forward

- As part of an estate settlement Katie received S1 million. She decided to use the money to purchase a small business. Her business operates in a perfectly competitive industry. If Katie would have invested the $1 million in a risk free bond fund, she could have earned $100,000 worth of interest each year. She also quit her job to devote all her time to her new business. Her salary at her former job was $ 75,000 per year. At the end of the first year of operating her new business, Katie's accountant reported an accounting profs of S175,000. What was Katie's economic profit ? A.$ 50,000 B. $ 0 C. $25,000 D. $100,000arrow_forwardAs Financial Manager what would be your decision on assets and investment matters to meet profit maximization? Choose the best answer. 1. A financial manager must choose between four alternative Assets: 1, 2, 3, and 4. Each asset costs P35,000 and is expected to provide earnings over three years as described below. Based on the profit- maximization goal, the financial manager would choose ASSET YEAR YEAR 1 2 1 21,000 15,000 6,000 2 9,000 15,000 21,000 3 3,000 20,000 19,000 4 6,000 12,000 12,000 А. Asset 1 В. Asset 2 C. Asset 3 D. Asset 4 Why the financial manager should maximize their wealth? How would they prove that there was a transaction so that the demander will be able to repay the supplier on time and at the right amount? Do you think using those financial institutions would help the company to growarrow_forward36. Assume you have placed a value of operations on Champion Inc. of $3,500,000. The firm has marketable securities of $75,000. In addition, the firm recently reported total assets of $7 million along with long-term debt of $1.5 million and preferred stock of $250,000. If Champion has 500,000 shares outstanding, what is the intrinsic value of the firm’s common stock? Only typed answerarrow_forward

- A stock you are evaluating is expected to experience supernormal growth in dividends of 12 percent over the next three years. Following this period, dividends are expected to grow at a constant rate of 4 percent. The stock paid a dividend of $1.50 last year and the required rate of return on the stock is 11 percent. Calculate the stock's fair present value. (Do not round intermediate calculations.) Please show all the steps, including the equation(s).arrow_forwardRoss Corporation is a debtor in a reorganization proceeding under Chapter 11 of the Bankruptcy Code. By fair and proper valuation, its assets are worth $100,000. The indebtedness of the corporation is $105,000, and it has outstanding $100 par value preferred stock in the amount of $20,000 and $30 par value common stock in the amount of $75,000. The plan of reorganization submitted by the trustees would give nothing to the common shareholders and would issue new bonds in the face amount of $5,000 to the creditors and new common stock in the ratio of 84 percent to the creditors and 16 percent to the preferred shareholders. Should this plan be confirmed? Explain.arrow_forwardWhat are the key steps in refining oil. How does the refinery industry deploy capital to increase its yield in the refineries so it get more and more higher valued products and increase its yield? The midstream, both gas and oil, has a value chain and contract structure all its own. Provide an overview of the value chain and highlight the key differences between oil, gas and NGLs?arrow_forward

- 5. Sam & Ella's Fine Foods common stock sells for $44.05 a share and pays an annual dividend that increases by 5% annually. The market rate of return on this stock is 8%. What is the amount of the last dividend paid by Sam & Ella's Fine Foods?arrow_forwardsolvearrow_forwardLanni sells the software product to Microsoft, which will market it to the public under the Microsoft name. Lanni accepts payment in the form of 1,500 shares for $80 per share. Prepare the balance sheet after Lanni accepts the payment of shares from Microsoft. (Omit the "S" sign In your response.) C- 1. Assets Liabilities & Shareholders' Equity Microsoft shares Bank loan Computers Shareholders' equity Total Totalarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

DATA GEMS: How to Access Income Data Tables and Reports From the CPS ASEC; Author: U.S. Census Bureau;https://www.youtube.com/watch?v=BWpVC-Clczw;License: Standard Youtube License