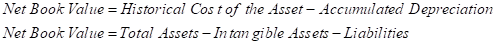

Book Value:

The book value of an asset refers to that value at which the asset is posted in the company’s financial statement, the

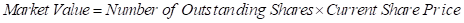

Market Value

The market keeps on changing every time. Market value refers to the value of the asset at which it is valued in the market at a particular time. The market value is also referred to as the market capitalization of those companies that are traded publically. It can be calculated as under:

To Identify:

The reasons for the difference in the book value and market value of the assets of a company.

Trending nowThis is a popular solution!

Chapter 2 Solutions

Fundamentals of Corporate Finance (4th Edition) (Berk, DeMarzo & Harford, The Corporate Finance Series)

- Don't used Ai solutionarrow_forwardllumina Inc. is expected to pay its next dividend of $0.4 two years from now. This dividend should then grow at a rate of 10% for 3 years (till the end of year 5), and at a reduced rate of 6% thereafter. The market required rate of return is 16%. The price of the company's shares today is: $4.15 $4.39 $3.79 $3.96arrow_forwardA bank has made a loan charging a base lending rate of 8%. It expects a probability of default of 5%. If the loan is defaulted, it expects to recover 50% of its money through the sale of its collateral. The expected return on this loan is _____% (rounded to two decimal places).arrow_forward

- Ch 26: Assignment - Mergers and Corporate Control Widget Corp., which is considering the acquisition of Exteter Enterprise Inc., estimates that acquiring Exteter will result in an incremental value for the firm. The analysts involved in the deal have collected the following information from the projected financial statements of the target company: Data Collected (in millions of dollars) Year 1 Year 2 Year 3 EBIT $13.0 $15.6 $19.5 Interest expense 5.0 5.5 6.0 Debt 35.2 41.6 44.8 Total net operating capital 107.1 109.2 111.3 Exteter Enterprise Inc. is a publicly traded company, and its market-determined pre-merger beta is 1.00. You also have the following information about the company and the projected statements: •Exteter currently has a $38.00 million market value of equity and $24.70 million in debt. The risk-free rate is 3.5%, there is a 5.60% market risk premium, and the Capital Asset Pricing Model produces a pre-merger required rate of return on equity ISL of 9.10%. •Exteter's cost…arrow_forward3. Problem 30-03 (Plan Funding) Plan Funding eBook Consolidated Industries is planning to operate for 10 more years and then cease operations. At that time (in 10 years), it expects to have the following pension benefit obligations: Year 11-15 16-20 21-25 Annual Total Payment $3,480,000 2,980,000 26-30 31-35 2,480,000 1,980,000 1,480,000 The current value of the firm's pension fund is $5.6 million. Assume that all cash flows occur at year-end. a. Consolidated's expected return on pension assets is 11%, and it uses 11% to discount the expected pension benefit payments. What is the present value of the firm's pension fund benefits? Do not round intermediate calculations. Round your answer to the nearest dollar. $ b. Is the plan underfunded or overfunded? Do not round intermediate calculations. Round your answer to two decimal places. Funding ratio= which means the assets are select than the PV of benefits and the plan is select Less or greater Select underfunded overfundedarrow_forwardPlan Funding Consolidated Industries is planning to operate for 10 more years and then cease operations. At that time (in 10 years), it expects to have the following pension benefit obligations: Year 11-15 16-20 21-25 Annual Total Payment $3,500,000 3,000,000 2,500,000 26-30 31-35 2,000,000 1,500,000 The current value of the firm's pension fund is $6.1 million. Assume that all cash flows occur at year-end. a. Consolidated's expected return on pension assets is 12%, and it uses 12% to discount the expected pension benefit payments. What is the present value of the firm's pension fund benefits? Do not round intermediate calculations. Round your answer to the nearest dollar. $ b. Is the plan underfunded or overfunded? Do not round intermediate calculations. Round your answer to two decimal places. Funding ratio = which means the assets are -Select- than the PV of benefits and the plan is -Select- ☑. Less or Greater Overfunded or Underfundedarrow_forward

- Benefits and Contributions The Certainty Company (CC) operates in a world of certainty. It has just hired Mr. Jones, age 27, who will retire at age 65, draw retirement benefits for 14 years, and die at age 79. Mr. Jones' salary is $21,000 per year, but wages are expected to increase at the 6% annual rate of inflation. CC has a defined benefit plan in which workers receive 1% of the final year's wage for each year employed. The retirement benefit, once started, does not have a cost-of-living adjustment. CC earns 12% annually on its pension fund assets and uses a 10% rate to discount its expected future benefit payments. Assume that pension contribution and benefit cash flows occur at year-end. Do not round intermediate calculations. Round your answers to the nearest dollar. a. How much will Mr. Jones receive in annual retirement benefits? $ b. What is CC's required annual contribution to fully fund Mr. Jones' retirement benefits? $ c. Assume now that CC hires Mr. Smith at the same…arrow_forwardlab.infoseclearning.com/console/5061763/3047 310-win10 Project Three Milestone - GNS3 File Edit View Control Node Annotate Tools Help e 41 Sales_PC1 0000 Sales_PC2 Sales_PC3 Enforce US Keyboard Layout View Fullscreen Send Ctrl+Alt+Delete Reboot To exit full screen, press and hold esc ■C00/6@ Q Sales_Switch Human Resources_Switch Office_Router Sales PC4 Customer_Service_Switch X: -299.0 Y: -136.0 Z: 1.0 H Type here to search CS_FTP_Server HR_PC2 HR_PC1 7:19 PM 12/14/2024 Barrow_forwardAGG is a US multinational that manufactures specialist high tech parts in the airline engine industry. AGG is an established company with steady growth in turnover and dividends over the last 10 years. The company is undertaking a projected titled Project Big as a strategic response to the changing market scene. AGG will develop a new state of the art highly automated plant located in Cambodia which is expected to result in cost advantages if it is implemented. The details about the project are below • Initital investment has been estimated at $500m • • The annual pre tax savings in operating costs at current exchange rates has been calculated at $150m for the first four years (starting in the first year) The residual value of the project at the end of the four years is estimated to be $250m The initial investment, net of residual value, qualifies for capital allowance and can be claimed back on a straight line basis over the four years of the project. Current AGG's cost of capital is…arrow_forward

- You have just won the Strayer Lottery jackpot of $11,000,000. You will be paid in twenty-six equal annual installments beginning immediately. If you had the money now, you could invest it in an account with a quoted annual interest rate of 9% with monthly compounding of interest. Calculate the present value of the payments you will receive. Show your calculations using formulas in your paper or provide how to do the calculations in Excel. Explain why there is a difference between the present value of the Strayer lottery jackpot and the future value of the twenty-six annual payments based on your calculations and the information provided.arrow_forwardYou have just won the Strayer Lottery jackpot of $11,000,000. You will be paid in twenty-six equal annual installments beginning immediately. If you had the money now, you could invest it in an account with a quoted annual interest rate of 9% with monthly compounding of interest. Calculate the present value of the payments you will receive. Show your calculations using formulas in your paper or in an attached spreadsheet file.arrow_forwardThe approach uses a weighted average cost of capital that is unique to a particular project while determining the appropriate discount rate.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education