Prepare the transactions in general ledger accounts under the

Explanation of Solution

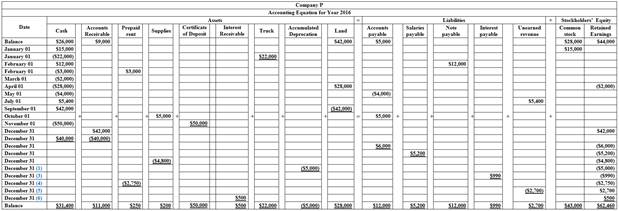

Prepare general ledger accounts under the accounting equation as given below:

Table (1)

Working Note:

Determine the amount of depreciation expense for Year 2016.

Determine the amount of total interest payable.

Determine the amount of interest payable on note that would be recognized.

Determine the amount of prepaid rent to be recognized.

Determine the amount of recognized revenue.

Determine the amount of interest earned:

a.

Identify the four additional adjustments and explain them.

a.

Explanation of Solution

The five additional adjustments are as follows:

- 1. Company P has acquired a truck on January 01 for that acquired truck depreciation expense.

- 2. On February 01, Company P issued note payable. Accrued interest expense on note payable should be recognized using

adjusting entry . - 3. On February 01, Company P paid rent in advance. Rent paid in advance should be recognized as rent expense for 11 months using adjusting entry.

- 4. On July 01, Company P received cash in advance. Unearned revenue should be recognized as revenue for 6 months using adjusting entry.

- 5. On November 01, Company P purchased a certificate of deposit with an interest of 7%. Hence, interest expense should be recognized for 7% using the adjusting entry

b.

Identify the amount of interest expense that would be reported on the income statement.

b.

Explanation of Solution

The amount of interest expense would be reported on the income statement is $990 (3).

c.

Identify the amount of net cash flow from operating activities that would be reported on the statement of

c.

Explanation of Solution

The net cash flow from operating activities would be reported on the statement of cash flows amounts to $38,400 (6).

Determine the amount of net cash flow from operating activities.

d.

Identify the amount of rent expense that would be reported on the income statement.

d.

Explanation of Solution

The amount of rent expense that would be reported on the income statement is $2,750 (4).

e.

Identify the amount of total liabilities that would be reported on the balance sheet.

e.

Explanation of Solution

The amount of total liabilities would be reported on the balance sheet $32,890

f.

Identify the amount of supplies expense that would be reported on the balance sheet.

f.

Explanation of Solution

The amount of supplies expense that would be reported on the income statement is $4,800

g.

Identify the amount of unearned revenue that would be reported on the balance sheet.

g.

Explanation of Solution

The amount of unearned revenue that would be reported on the balance sheet is $2,700 (5).

h.

Identify the amount of net cash flow from investing activities that would be reported on the statement of cash flows.

h.

Explanation of Solution

The net cash flow from investing activities that would be reported on the statement of cash flows is ($8,000) (7).

Determine the amount of net cash flow from investing activities.

i.

Identify the amount of interest payable that would be reported on the balance sheet.

i.

Explanation of Solution

The amount of interest payable that would be reported on the balance sheet is $990 (3).

j.

Identify the amount of total expense that would be reported on the income statement.

j.

Explanation of Solution

The amount of total expense that would be reported on the income statement is $24,740

k.

Identify the amount of

k.

Explanation of Solution

The retained earnings that would be reported on the balance sheet amounts to $62,460 (8).

Determine the amount of retained earnings.

l.

Identify the amount of service revenue that would be reported on the income statement.

l.

Explanation of Solution

The amount of service revenue that would be reported on the income statement is $44,700

m.

Identify the amount of net cash flow from financing activities that would be reported on the statement of cash flows.

m.

Explanation of Solution

The net cash flow from financing activities that would be reported on the statement of cash flows is $25,000 (9).

Determine the amount of net cash flow from financing activities.

n.

Identify the amount of net income that would be reported on the income statement.

n.

Explanation of Solution

The net income that would be reported on the income statement is $20,460

Want to see more full solutions like this?

Chapter 2 Solutions

Fundamental Financial Accounting Concepts, 9th Edition

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education