a.

To determine: The present value at the end of each year.

a.

Answer to Problem 25PS

The present value at the end of each year is $12.50 billion.

Explanation of Solution

Determine the present value at the end of each year

Therefore the present value at the end of each year is $12.50 billion.

b.

To determine: The present value at the end of first year if the growth rate is 4%.

b.

Answer to Problem 25PS

The present value at the end of first year if the growth rate is 4% is $25 billion.

Explanation of Solution

Determine the present value at the end of first year if the growth rate is 4%

Therefore the present value at the end of first year if the growth rate is 4% is $25 billion.

c.

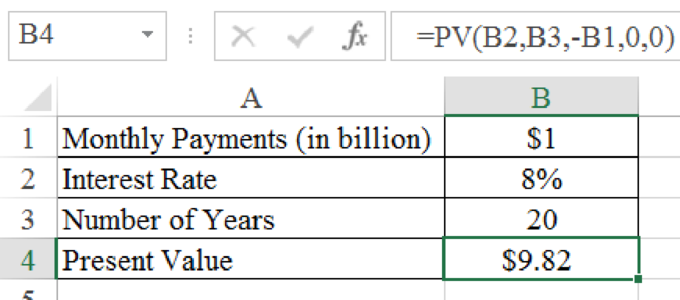

To determine: The present value at the end of 20 years.

c.

Answer to Problem 25PS

The present value at the end of 20 years is $9.82 billion.

Explanation of Solution

Determine the present value at the end of 20 years

Excel Spreadsheet:

Therefore the present value at the end of 20 years is $9.82 billion.

d.

To determine: The present value if spread evenly for 20 years.

d.

Answer to Problem 25PS

The present value if spread evenly for 20 years is $10.20 billion.

Explanation of Solution

Determine the continuous compounded rate

Therefore the continuous compounded rate is 7.70%.

Determine the present value if spread evenly for 20 years

Therefore the present value if spread evenly for 20 years is $10.20 billion.

Want to see more full solutions like this?

Chapter 2 Solutions

Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- An ordinary annuity paying P1,811 at the end of each year for 15 years, is to be converted to an annuity paying an amount at the beginning of each month for 15 years. Money is worth 10% compounded annually. Determine the following: a.) Present Value of the Payment. b.) Amount being paid at the beginning of each month for 15 years. Note: Don't use excel. Use or draw some cashflows.arrow_forwardWhat is the present value of an ordinary annuity that pays $1,000 per year for 4 years, assuming the annual discount rate is 7 percent? a. $3,051.58 b. $762.90 c. $3,624.32 d. $3,738.32 e. $3,387.21arrow_forwardCompute the present value of a perpetuity that pays $6,744 annually given a required rate of return of 9 percent per annum. Round your answer to 2 decimal places; record your answer without commas and without a dollar sign. Answer Question 4 Assume that you deposit $3,956 each year for the next 15 years into an account that pays 20 percent per annum. The first deposit will occur one year from today (that is, at t = 1) and the last deposit will occur 15 years from today (that is, at t = 15). How much money will be in the account 15 years from today? Round your answer to 2 decimal places; record your answer without commas and without a dollar sign.arrow_forward

- Two annuities have equal present values and an applicable discount rate of 7 percent. One annuity pays RM2,500 on the first day of each year for 15 years. How much does the second annuity pay each year for 15 years if it pays at the end of each year? Select one: A. RM2,266.67 B. RM2,331.00 C. RM2,675.00 D. RM2,500.00arrow_forwardHow much will be the future value of a 5-year ordinary annuity which has annual payments of $200, evaluated at a 7.5% semi-annual interest rate? a. $3,828.34 b. $287.13 c. $1,161.68 d. $1,348.48arrow_forwardsuppose that $2700 is set aside each year and invested in a savings account that pays 8% interest per year, componded continously, part a: determined the accumuluated savings in this account at teh end of 25 yrs. part b: in part a,suppose that an annuity will be withdrawn from savings that have been accumulated at the EOY 25. The annuity will extend from teh EOY 26 to EOY 33, what is the value of this annuity if teh interest rate and componding frquency in part a do not changearrow_forward

- What are the annual cash flows (in $) of an annuity for 19 years, which costs $48,783 today, if the discount rate is 7.76 percent? Answer to two decimals.arrow_forwardWhat is the present value of an annuity that pays $536 at the end of each year in years 4 through 12? The discount rate (opportunity cost) is 3.5%.arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College