Corporate Finance

12th Edition

ISBN: 9781259918940

Author: Ross, Stephen A.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 23QAP

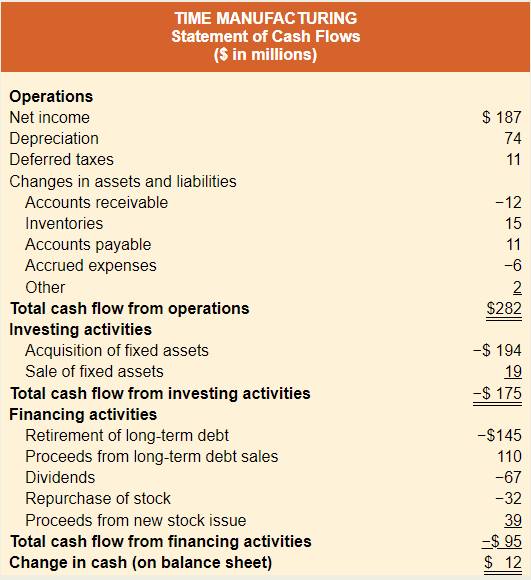

Cash Flows You are researching Time Manufacturing and have found the following accounting statement of cash flows for the most recent year. You also know that the company paid $81 million in current taxes and had an interest expense of $38 million. Use the accounting statement of cash flows to construct the financial statement of cash flows.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

You are researching Time Manufacturing and have found the following accounting statement of cash flows for the most recent year.

You also know that the company paid $98.1 million in current taxes and had an interest expense of $48.1 million.

Operations

Net income

Depreciation

TIME MANUFACTURING

Statement of Cash Flows

(in millions)

Deferred taxes

Changes in assets and liabilities

Accounts receivable

Inventories

Accounts payable

Accrued expenses

Other

Total cash flow from operations

Investing activities

Acquisition of fixed assets

Sale of fixed assets

Total cash flow from investing activities

Financing activities

Retirement of long-term debt

Proceeds from long-term debt sales

Dividends

Repurchase of stock

Proceeds from new stock issue

Total cash flow from financing activities

Change in cash (on balance sheet)

a. Calculate the operating cash flow.

b. Calculate the net capital spending.

c. Calculate the change in net working capital.

d. Calculate the cash flow to creditors.

e. Calculate…

You are researching Time Manufacturing and have found the following accounting statement of cash flows for the most recent year. You also know that the company paid $98.9 million in current taxes and had an interest expense of $48.9 million.

TIME MANUFACTURINGStatement of Cash Flows($ in millions)

Operations

Net income

$

182.0

Depreciation

94.9

Deferred taxes

19.9

Changes in assets and liabilities

Accounts receivable

–

18.9

Inventories

22.9

Accounts payable

17.9

Accrued expenses

–

9.9

Other

3.9

Total cash flow from operations

$

312.7

Investing activities

Acquisition of fixed assets

–$

206.0

Sale of fixed assets

23.9

Total cash flow from investing activities

–$

182.1

Financing activities

Retirement of long-term debt

–$

171.0

Proceeds from long-term debt sales

128.0

Dividends

–

95.0…

You are researching Time Manufacturing and have found the following accounting statement of cash flows for the most recent year. You also know that the company paid $98.9 million in current taxes and had an interest expense of $48.9 million.

TIME MANUFACTURINGStatement of Cash Flows($ in millions)

Operations

Net income

$

182.0

Depreciation

94.9

Deferred taxes

19.9

Changes in assets and liabilities

Accounts receivable

–

18.9

Inventories

22.9

Accounts payable

17.9

Accrued expenses

–

9.9

Other

3.9

Total cash flow from operations

$

312.7

Investing activities

Acquisition of fixed assets

–$

206.0

Sale of fixed assets

23.9

Total cash flow from investing activities

–$

182.1

Financing activities

Retirement of long-term debt

–$

171.0

Proceeds from long-term debt sales

128.0

Dividends

–

95.0…

Chapter 2 Solutions

Corporate Finance

Ch. 2 - Prob. 1CQCh. 2 - Prob. 2CQCh. 2 - Prob. 3CQCh. 2 - Prob. 4CQCh. 2 - Prob. 5CQCh. 2 - Cash Flow from Assets Why is it not necessarily...Ch. 2 - Operating Cash flow Why is it not necessarily bad...Ch. 2 - Net Working Capital and Capital Spending Could a...Ch. 2 - Cash Flow to Stockholders and Creditors Could a...Ch. 2 - Prob. 10CQ

Ch. 2 - Building a Balance Sheet Alesha, Inc., has current...Ch. 2 - Building an Income Statement Gia, Inc, has sales...Ch. 2 - Market Values and Book Values Klingon Cruisers,...Ch. 2 - Calculating Taxes Terri Simmons is single and had...Ch. 2 - Calculating OCF Sheaves, Inc., has sales of...Ch. 2 - Prob. 6QAPCh. 2 - Prob. 7QAPCh. 2 - Prob. 8QAPCh. 2 - Prob. 9QAPCh. 2 - Prob. 10QAPCh. 2 - Cash Flows Ritter Corporations accountants...Ch. 2 - Financial Cash Flows The Stancil Corporation...Ch. 2 - Building an Income Statement During the year, the...Ch. 2 - Prob. 14QAPCh. 2 - Prob. 15QAPCh. 2 - Residual Claims Stark: Inc., is obligated to pay...Ch. 2 - Net Income and OCF During 2019, Rainbow Umbrella...Ch. 2 - Prob. 18QAPCh. 2 - Prob. 19QAPCh. 2 - Prob. 20QAPCh. 2 - Prob. 21QAPCh. 2 - Prob. 22QAPCh. 2 - Cash Flows You are researching Time Manufacturing...Ch. 2 - Prob. 24QAPCh. 2 - Prob. 1MCCh. 2 - Prob. 2MCCh. 2 - Prob. 3MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Use a spreadsheet and the following financial information from Mineola Companys financial statements to build a template that automatically calculates the net operating cash flow. It should be suitable for use in preparing the operating section of the statement of cash flows (indirect method) for the year 2018.arrow_forwardFinancial data for Otto Company follow: a. Compute the ratio of cash to monthly cash expenses. b. Interpret the results computed in (a).arrow_forwardUse the following information from Birch Companys balance sheets to determine net cash flows from operating activities (indirect method), assuming net income for 2018 of $122,000.arrow_forward

- Tifton Co. had the following cash transactions during the current year: Prepare the investing activities section of Tiftons statement of cash flows.arrow_forwardUse the following excerpts from Swahilia Companys financial information to prepare a statement of cash flows (direct method) for the year 2018.arrow_forwardUse the following excerpts from Yardley Companys financial information to prepare a statement of cash flows (indirect method) for the year 2018.arrow_forward

- Use the following excerpts from Zowleski Companys financial information to prepare a statement of cash flows (indirect method) for the year 2018.arrow_forwardUse the following excerpts from Swansea Companys financial information to prepare the operating section of the statement of cash flows (direct method) for the year 2018.arrow_forwardPREPARING A CASH FLOW STATEMTMET (INDIREECT METHOD) Use the following balance sheet to prepare a cash flow statement for the current year. Net Income for the year was $40,000. ASSETS Cash and Cash Equivalents Accounts Receivables, Net Inventories Prepaid Expenses Equipment Accumulated Depreciation Total Assets LIABILITIES AND STOCKHOLDERS' EQUITY Accounts Payable Accrued Liabilities Long-Term Debt Common Stock Retained Earnings Total Liabilities And Stockholders' Equity Current Year $92,000 57,000 51,000 12,000 145,000 ($51,000) $306,000 $35,000 31,000 80,000 2,000 158,000 $306,000 Prior Year $84,000 40,000 45,000 13,000 134,000 ($37,000) $279,000 $17,000 36,000 100,000 1,000 125,000 $279,000 Change $8,000 $17,000 $6,000 ($1,000) $11,000 ($14,000) $27,000 $18,000 ($5,000) ($20,000) $1,000 $33,000 $27,000arrow_forward

- The cash flows from operating activities are reported by the direct method on the statement of cash flows. Determine the following:a. If sales for the current year were $753,500 and accounts receivable decreased by $48,400 during the year, what was the amount of cash received from customers?b. If income tax expense for the current year was $50,600 and income tax payable decreased by $5,500 during the year, what was the amount of cash payments for income taxes?c. Briefly explain why the cash received from customers in (a) is different from sales.arrow_forwardThe cash flows from operating activities are reported by the direct method on the statement of cash flows. Determine the following: a. If sales for the current year were $375,000 and accounts receivable increased by $29,000 during the year, what was the amount of cash received from customers?$fill in the blank 1 b. If income tax expense for the current year was $39,000 and income tax payable decreased by $21,000 during the year, what was the amount of cash payments for income tax?$fill in the blank 2arrow_forwardFinding operating and free cash flows Consider the balance sheets and selected data from the income statement of Keith Corporation that follow. a. Calculate the firm's net operating profit after taxes (NOPAT) for this year. b. Calculate the firm's operating cash flow (OCF) for the year. c. Calculate the firm's free cash flow (FCF) for the year. d. Interpret, compare and contrast your cash flow estimate in parts (b) and (c). Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Assets Cash Marketable securities Accounts receivable Inventories Total current assets Gross fixed assets Less: Accumulated depreciation Net fixed assets Total assets Liabilities and Stockholders' Equity Accounts payable Notes payable Accruals Keith Corporation Balance Sheets Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity December 31 Income…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Accounting Basics Explained Through a Story; Author: Leila Gharani;https://www.youtube.com/watch?v=VYNTBWBqncU;License: Standard Youtube License