Concept explainers

Khan Products Company uses a

The sales department is unhappy because fluctuating unit production costs significantly affect selling prices. Sales personnel complain that this has caused excessive customer complaints and the loss of considerable orders for TC-1.

The production department maintains that each job order must be fully costed on the basis of the costs incurred during the period in which the goods are produced. Production personnel maintain that the only real solution is for the sales department to increase sales in the slack periods.

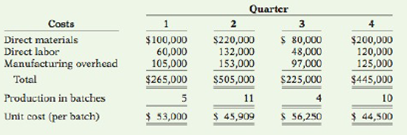

Andrea Parley, president of the company, asks you as the company accountant to collect quarterly data for the past year on TC-1. From the cost accounting system, you accumulate the following production quantity and cost data.

Instructions

With the class divided into groups, answer the following questions.

(a) What

(b) What is your recommended solution to the problem of fluctuating unit cost?

(c) Restate the quarterly data on the basis of your recommended solution.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Managerial Accounting: Tools for Business Decision Making

Additional Business Textbook Solutions

Operations Management

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Marketing: An Introduction (13th Edition)

Engineering Economy (17th Edition)

Fundamentals of Management (10th Edition)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub