ADVANCED FIN. ACCT. LL W/ACCESS>CUSTOM<

12th Edition

ISBN: 9781265074623

Author: Christensen

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 2.19P

Investments Carried at Fair Value and Equity Method

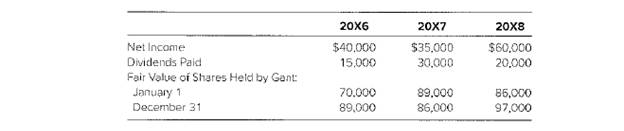

Gant Company purchased 20 percent of the outstanding shares of Temp Company for $70,000 onJanuary 1, 20X6. The following results are reported for Temp Company:

Required

Determine the amounts reported by Gant s income from its investment in Temp for each year andthe balance in Gant’s investment in Temp at the end of each year assuming that Gant uses the following options in accounting for its investment in Temp:

a. Carries the investment at fair value.

b. Uses he equity method

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Gant Company purchased 30 percent of the outstanding shares of Temp Company for $76,000 on January 1, 20X6. The following

results are reported for Temp Company:

Net income

Dividends paid

Fair value of shares held by Gant:

January 1

December 31

a. Carries the investment at fair value.

b. Uses the equity method.

Required A Required B

20X6

$ 47,000

14,000

76,000

95,000

Income from investment

Balance in investment

Required:

Determine the amounts reported by Gant as income from its investment in Temp for each year and the balance in Gant's investment in

Temp at the end of each year assuming that Gant uses the following options in accounting for its investment in Temp:

Complete this question by entering your answers in the tabs below.

20X6

20X7

$ 42,000

30,000

95,000

92,000

20X7

Determine the amounts reported by Gant as income from its investment in Temp for each year and the balance in Gant's

investment in Temp at the end of each year assuming that Gant uses the equity method in accounting…

Question: The carrying amount of the investment on December 31, 2020?

On January 1, 2019, an entity purchased 15,000 shares of another entity representing a 12% interest for P2,500,000. The entity elected to measure the investment at FVOCI. The investee reported net income of P3,000,000 and paid dividends of P15 per share in 2019. The fair value of the investment was P2.800.000 on December 31, 2019. On January 1, 2020, the entity paid P3,000,000 for 16.250 additional shares of the investee. The fair value of the 12% interest did not change on this date. The fair values of the identifiable net assets of the investee equal carrying amount of P15,000,000 on such date except for land whose fair value exceeded carrying amount by P3,000,000. For the year ended December 31, 2020, the investee reported net income of P6,000,000 and paid dividends of P20 per share.

Question: The total amount reported in 2019 profit or loss is?

On January 1, 2019, an entity purchased 15,000 shares of another entity representing a 12% interest for P2,500,000. The entity elected to measure the investment at FVOCI. The investee reported net income of P3,000,000 and paid dividends of P15 per share in 2019. The fair value of the investment was P2.800.000 on December 31, 2019. On January 1, 2020, the entity paid P3,000,000 for 16.250 additional shares of the investee. The fair value of the 12% interest did not change on this date. The fair values of the identifiable net assets of the investee equal carrying amount of P15,000,000 on such date except for land whose fair value exceeded carrying amount by P3,000,000. For the year ended December 31, 2020, the investee reported net income of P6,000,000 and paid dividends of P20 per share.

Chapter 2 Solutions

ADVANCED FIN. ACCT. LL W/ACCESS>CUSTOM<

Ch. 2 - What types of investments in common stock normally...Ch. 2 - Prob. 2.2QCh. 2 - Describe an investor’s treatment of an investment...Ch. 2 - How is the receipt of a dividend recorded under...Ch. 2 - How does carrying securities at fair value...Ch. 2 - Prob. 2.6QCh. 2 - Prob. 2.7QCh. 2 - Prob. 2.8QCh. 2 - Prob. 2.9QCh. 2 - Prob. 2.10Q

Ch. 2 - How are a subsidiary’s dividend declarations...Ch. 2 - Prob. 2.12QCh. 2 - Give a definition of consolidated retained...Ch. 2 - Prob. 2.14QCh. 2 - Prob. 2.15QCh. 2 - Prob. 2.16AQCh. 2 - When is equity method reporting considered...Ch. 2 - How does the fully adjusted equity method differ...Ch. 2 - What is the modified equity method? When might a...Ch. 2 - Choice of Accounting Method Slanted Building...Ch. 2 - Prob. 2.2CCh. 2 - Prob. 2.3CCh. 2 - Prob. 2.4CCh. 2 - Prob. 2.5CCh. 2 - Prob. 2.6CCh. 2 - Prob. 2.1.1ECh. 2 - Multiple-Choice Questions on Accounting for Equity...Ch. 2 - Prob. 2.1.3ECh. 2 - Prob. 2.1.4ECh. 2 - Multiple-Choice Questions on Intercorporate...Ch. 2 - Prob. 2.2.2ECh. 2 - Prob. 2.3.1ECh. 2 - Prob. 2.3.2ECh. 2 - Prob. 2.3.3ECh. 2 - Prob. 2.4ECh. 2 - Acquisition Price Phillips Company bought 40...Ch. 2 - Prob. 2.6ECh. 2 - Prob. 2.7ECh. 2 - Carrying an investment at Fair Value versus Equity...Ch. 2 - Carrying an Investment at Fair Value versus Equity...Ch. 2 - Prob. 2.10ECh. 2 - Prob. 2.11ECh. 2 - Prob. 2.12ECh. 2 - Prob. 2.13ECh. 2 - Income Reporting Grandview Company purchased 40...Ch. 2 - Investee with Preferred Stock Outstanding Reden...Ch. 2 - Prob. 2.16AECh. 2 - Prob. 2.17AECh. 2 - Changes ¡n the Number of Shares Held Idle...Ch. 2 - Investments Carried at Fair Value and Equity...Ch. 2 - Carried at Fair Value Journal Entries Marlow...Ch. 2 - Consolidated Worksheet at End of the First Year of...Ch. 2 - Consolidated Worksheet at End of the Second Year...Ch. 2 - Prob. 2.23PCh. 2 - Prob. 2.24PCh. 2 - Prob. 2.25APCh. 2 - Equity-Method income Statement Wealthy...Ch. 2 - Prob. 2.27BPCh. 2 - Prob. 2.28BP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During 2021, Anthony Company purchased debt securities as a long-term investment and classified them as trading. All securities were purchased at par value. Pertinent data are as follows: The net holding gain or loss included in Anthonys income statement for the year should be: a. 0 b. 3,000 gain c. 9,000 loss d. 12,000 lossarrow_forwardGant Company purchased 30 percent of the outstanding shares of Temp Company for $76,000 on January 1, 20X6. The following results are reported for Temp Company: Net income Dividends paid Fair value of shares held by Gant: January 1 December 31 a. Carries the investment at fair value. b. Uses the equity method. Required A Required B 20X6 $ 47,000 14,000 Required: Gant Determine the amounts reported by Gant as income from its investment in Temp for each year and the balance in Gant's investment in Temp at the end of each year assuming that Gant uses the following options in accounting for its investment in Temp: Complete this question by entering your answers in the tabs below. Income from investment Balance in investment 76,000 95,000 20X6 20X7 $ 42,000 30,000 95,000 92,000 20X7arrow_forwardINVESTMENT IN ASSOCIATE 1. On January 1, 2021 Dona Company purchased 10% of another entity’s outstanding ordinary shares for P6,000,000. The investment classified as nonmarketable equity security and accounted for under the cost method. The following data pertain to investee’s operations for 2021 and 2022:2021 2022Net income 3,000,000 4,000,000Dividend paid none 9,000,000 What amount should Dona Company report as dividend income in its 2022 income statement?arrow_forward

- Recording Entries for Equity Investment: FV-NI and Equity Method On January 1, 2020, Allen Corporation purchased 30% of the 66,000 outstanding common shares of Towne Corporation at $17 per share as a long-term investment. On the date of purchase, the book value and the fair value of the net assets of Towne Corporation were equal. During the year, Towne Corporation reported net income of $52,800 and declared and paid dividends of $17,600. As of December 31, 2020, common shares of Towne Corporation were trading at $20 per share. Journal Entries with Significant Influence Journal Entries without Significant Influence Financial Statement Presentation c. Indicate the amount of income that would be reported on the 2020 income statement and the investment balance on the 2020 year-end balance sheet under requirement (a) and requirement (b). Income Investment Net Balance 2020 Dec. 31, 2020 a. Investment accounted for under the equity method Answer Answer b. Investment…arrow_forwardGant Company purchased 30 percent of the outstanding shares of Temp Company for $87,000 on January 1, 20X6. The following results are reported for Temp Company: Net income Dividends paid Fair value of shares held by Gant: January 1 December 31 a. Carries the investment at fair value. b. Uses the equity method. 20X6 $ 43,000 14,000 Income from investment Balance in investment S $ 87,000 106,000 Required: Determine the amounts reported by Gant as income from its investment in Temp for each year and the balance in Gant's investment in Temp at the end of each year assuming that Gant uses the following options in accounting for its investment in Temp: Complete this question by entering your answers in the tabs below. 20X7 $ 38,000 28,000 20X6 106,000 103,000 20X7 (800) $ 39,400 95,700 $ 109,000 Answer is complete but not entirely correct. Required A Required B Determine the amounts reported by Gant as income from its investment in Temp for each year and the balance in Gant's investment in…arrow_forwardRequired information On January 1, 20X2, Power Company acquired 80 percent of Strong Company's outstanding stock for cash. The fair value of the noncontrolling interest was equal to a proportionate share of the book value of Strong Company's net assets at the date of acquisition. Selected balance sheet data at December 31, 20X2 are as follows: Total Assets Liabilities Common Stock Retained Earnings Total Liabilities & Stockholders' Equity Multiple Choice O $35,200 Based on the preceding information, what amount should be reported as noncontrolling interest in net assets in Power Company's December 31, 20X2, consolidated balance sheet? $48,200 $76,800 Power $ 564,000 O $112,800 180,000 150,000 234,000 $ 564,000 Strong $ 216,000 65,000 80,000 96,000 $ 241,000arrow_forward

- Jon company owns two financial investments in the shares of listed companies. With the following details: Investment 1 - Acquired on september 1, 2020 at a cost of $50,000 with a fair value of $60,000 at year end for the purpose of trading. Investment 2 - Acquired on august 1, 2020 at a cost of $25,000 to hold indefinitely. Its fair value at year end is $20,000. What are the amounts to appear in the statement of Comprehensive Income for the year ended september 30, 2020?arrow_forwardBlush Company has the ability to exercise significant when the fair value of net assets was P20,000,000. outstanding ordinary shares of an investee for P4,000,000 On July 1, 2020 Blush Company purchased 20% of the influence over the operating and financial policies of the investee. The following data concerning the investee are available: 12 months ended December 31, 2020 December 31, 2020 6 months ended Net income Dividend declared and paid 3,000,000 1,900,000 1,600,000 1,000,000 in the income statement for the year ended December 31, o020, what amount of income should be reported from the investment?arrow_forwardAccounting for Asset and Stock Purchases Assume an investor purchases an investee's net assets with a cash payment of $800 and issuance to the investee's shareholders of 160 shares of $1 par value common stock with a current fair value of $19.00 per share. In addition, we assume the purchaser paid an additional $40 of transaction costs to a third party (e.g., appraiser or broker) and provided the seller with contingent consideration with a fair value of $160 at the date of acquisition. The investee has the following net assets at current appraised fair value and historical book value: Plant and equipment Land Patent Total Required Investee Fair Value Investee Book Value $320 $600 840 600 960 80 $2,400 $1,000 a. Provide the journal entry on the investor's books for the purchase of the individual net assets of the investee. Assume the acquired net assets do not qualify as a business. b. Provide the journal entry on the investor's books for the purchase of the individual net assets of the…arrow_forward

- Armadillo Enterprises acquired the following equity investmentsat the beginning of year 1 as trading investments. Description Number of shares Market price per share Total price Finestra Company 15,000 x $25 $387,500 BVD Company 20,000 X$18 $360,000 Market values at theend of Years 1 &2 are presented below: Market/Fair Value End of year 1 End of year 2 Finestra Company $19 $23 BVD Company |$22 $28 REQUIREMENTS: Prepare the journal entry to record the acquisition of theinvestments. Prepare the adjusting journal entry required at the end of year1. Armadillo Enterprises sells 15,000 shares of BVD Company for $16at the beginning of year 2. Prepare the journal entry to record thesale. Prepare the adjusting journal entry required at the end of year2. Assume that ArmadilloEnterprises now holds these investments asavailable-for-sale. Prepare the journal entry to record the acquisition of theinvestments. Prepare the adjusting journal entry required at the end of year1. Armadillo Enterprises…arrow_forwardJacobson Company is considering an investment in the common stock of Biltrite Company. What are the accounting issues surrounding the recording of income in future periods if Jacobson purchases: a. 15% of Biltrite’s outstanding shares. b. 40% of Biltrite’s outstanding shares. c. 100% of Biltrite’s outstanding shares. d. 80% of Biltrite’s outstanding shares.arrow_forwardZ Corporation has the following transactions relating to its investment during 2020: Jan 5 Acquired 16,000 shares of Y company for P1,500,000 paying an additional P10,000 for brokerage and P5,000 for commission. Feb 14 Received dividends from Y company declared January 10,2020 to the stockholders of records January 31,2020, P16,000. Required:prepare all the necessary entries assuming the investment is 1. Financial asset at Fair Value through profit and loss 2. Financial asset at Fair Value through other comprehensive incomearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial instruments products; Author: fi-compass;https://www.youtube.com/watch?v=gvxozM3TUIg;License: Standard Youtube License