ADVANCED FINANCIAL ACCT.(LL) >CUSTOM<

12th Edition

ISBN: 9781260824292

Author: Christensen

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 2.18P

Changes ¡n the Number of Shares Held

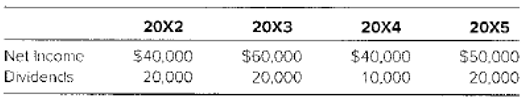

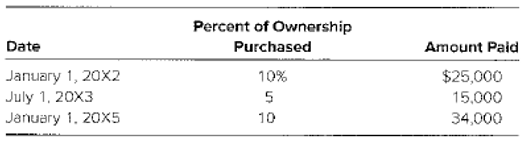

Idle Corporation hasbeen acquiring shares of Fast Track Enterprises at book value forthe last several years Fast Track provided data including the following:

Fast Track declares hind pays its annual dividend on November 1 5 each year. Its net book value on

January 1, 20X2, was $250,000. Idle purchased shares of Fast Track on three occasions:

Required

Give the journalentries to be recorded on Idle’s hooks in 20X5 related to its investment in FastTrack.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Required information

[The following information applies to the questions displayed below.]

a. On March 22, purchased 1,000 shares of RPI Company stock at $10 per share. Duke's stock investment results in

it having an insignificant influence over RPI.

b. On July 1, received a $1 per share cash dividend on the RPI stock purchased in part a.

c. On October 8, sold 50 shares of RPI stock for $15 per share.

Prepare journal entries to record the given transactions involving the short-term stock investments of Duke Company, all of which

occurred during the current year.

View transaction list

Journal entry worksheet

On March 22, purchased 1,000 shares of RPI Company stock at $10 per share.

Duke's stock investment results in it having an insignificant influence over RPI.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

a.

▸

Prepare journal entries to record the following transactions involving the short-term stock investments of Duke Co., all of which occurred during the current year. a. On March 22, purchased 1,000 shares of RPI Company stock at $10 per share. Duke’s stock investment results in it having an insignificant influence over RPI. b. On July 1, received a $1 per share cash dividend on the RPI stock purchased in part a. c. On October 8, sold 50 shares of RPI stock for $15 per share.

Required information

[The following information applies to the questions displayed below.]

Company T had 35,000 outstanding shares of common stock, par value $12 per share. On January 1 of the current year,

Company P purchased some of Company T's shares as a long-term investment at $25 per share. At the end of the current

year, Company T reported the following: income, $51,000, and cash dividends declared during the year, $22,500. The fair

value of Company T stock at the end of the current year was $22 per share.

Required:

1. For each of the following situations, identify the method of accounting that Company P should use.

4,200 shares purchased

10,500 shares purchased

Accounting Method

Chapter 2 Solutions

ADVANCED FINANCIAL ACCT.(LL) >CUSTOM<

Ch. 2 - What types of investments in common stock normally...Ch. 2 - Prob. 2.2QCh. 2 - Describe an investor’s treatment of an investment...Ch. 2 - How is the receipt of a dividend recorded under...Ch. 2 - How does carrying securities at fair value...Ch. 2 - Prob. 2.6QCh. 2 - Prob. 2.7QCh. 2 - Prob. 2.8QCh. 2 - Prob. 2.9QCh. 2 - Prob. 2.10Q

Ch. 2 - How are a subsidiary’s dividend declarations...Ch. 2 - Prob. 2.12QCh. 2 - Give a definition of consolidated retained...Ch. 2 - Prob. 2.14QCh. 2 - Prob. 2.15QCh. 2 - Prob. 2.16AQCh. 2 - When is equity method reporting considered...Ch. 2 - How does the fully adjusted equity method differ...Ch. 2 - What is the modified equity method? When might a...Ch. 2 - Choice of Accounting Method Slanted Building...Ch. 2 - Prob. 2.2CCh. 2 - Prob. 2.3CCh. 2 - Prob. 2.4CCh. 2 - Prob. 2.5CCh. 2 - Prob. 2.6CCh. 2 - Prob. 2.1.1ECh. 2 - Multiple-Choice Questions on Accounting for Equity...Ch. 2 - Prob. 2.1.3ECh. 2 - Prob. 2.1.4ECh. 2 - Multiple-Choice Questions on Intercorporate...Ch. 2 - Prob. 2.2.2ECh. 2 - Prob. 2.3.1ECh. 2 - Prob. 2.3.2ECh. 2 - Prob. 2.3.3ECh. 2 - Prob. 2.4ECh. 2 - Acquisition Price Phillips Company bought 40...Ch. 2 - Prob. 2.6ECh. 2 - Prob. 2.7ECh. 2 - Carrying an investment at Fair Value versus Equity...Ch. 2 - Carrying an Investment at Fair Value versus Equity...Ch. 2 - Prob. 2.10ECh. 2 - Prob. 2.11ECh. 2 - Prob. 2.12ECh. 2 - Prob. 2.13ECh. 2 - Income Reporting Grandview Company purchased 40...Ch. 2 - Investee with Preferred Stock Outstanding Reden...Ch. 2 - Prob. 2.16AECh. 2 - Prob. 2.17AECh. 2 - Changes ¡n the Number of Shares Held Idle...Ch. 2 - Investments Carried at Fair Value and Equity...Ch. 2 - Carried at Fair Value Journal Entries Marlow...Ch. 2 - Consolidated Worksheet at End of the First Year of...Ch. 2 - Consolidated Worksheet at End of the Second Year...Ch. 2 - Prob. 2.23PCh. 2 - Prob. 2.24PCh. 2 - Prob. 2.25APCh. 2 - Equity-Method income Statement Wealthy...Ch. 2 - Prob. 2.27BPCh. 2 - Prob. 2.28BP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ayayai Corporation purchased 300 common shares of Sigma Inc. for trading purposes for $9,300 on September 8 and accounted for the investment under ASPE at FV-NI. In December, Sigma declared and paid a cash dividend of $1.65 per share. At year end, December 31, Sigma shares were selling for $35.60 per share. In late January, Ayayai sold the Sigma shares for $34.60 per share. Prepare Ayayai Corporation’s journal entry to record the purchase of the investment. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit September 8 enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount Prepare Ayayai Corporation’s journal entry to record the dividends received. (Credit…arrow_forwardWW Corp. resells 500 shares of its own common stock for $22 per share. WW had acquired these shares two months before for $25 per share. The resale of this stock would be recorded with a: Select one: a. Debit to Cash for $12,500 b. Credit to Additional Paid-In Capital for $1,500 c. Debit to Common Stock for $12,500 d. Debit to Additional Paid-In Capital for $1,800 e. Credit to Treasury Stock for $12,500arrow_forwardShow Me How Entries for investment in stock, receipt of dividends, and sale of shares eBook Instructions On February 22, Stewart Corporation acquired 7,200 shares of the 200,000 outstanding shares of Edwards Co. common stock at $42 plus commission charges of $170. On June 1, a cash dividend of $1.85 per share was received. On November 12, 3,100 shares were sold at $49 less commission charges of $165. Journal 1 Using the cost method, journalize the entries for (a) the purchase of stock, (b) the receipt of dividends, and (c) the sale of 3,100 shares. Refer to the Chart of Accounts for exact wording of account titles. When required, round your answers to the nearest dollar. 2 3 4 Instructions Chart of Accounts !Journal 5 6 7 DATE Feb. 22 Jun. 1 ✓ Income of Edwards Co. Interest Revenue Print Item Cash Cash Dividend Revenue Nov. 12 Cash DESCRIPTION JOURNAL Unrealized Gain (Loss) on Available-for-Sale Investments heck My Work 1 more Check My Work uses remaining. ✓ POST. REF. DEBIT 302,400.00…arrow_forward

- Entries for investment in stock, receipt of dividends, and sale of sharesThe following equity investment transactions were completed byRomero Company during a recent year: Apr. 10. Purchased 5,000 shares of Dixon Company for a price of $25 pershare plus a brokerage commission of $75.July 8. Received a quarterly dividend of $0.60 per share on the Dixon Company investment.Sept 10. Sold 2,000 shares for a price of $22 per share less a brokeragecommission of $120. Journalize the entries for these transactions.arrow_forwardOn September 1, 1,500 shares of M Company stock are acquired at a price of $24 per share plus a $40 brokerage commission. This was less than 20% ownership in the stock of M Company. On September 1, when recording the journal entry for this transaction, what account would be credited and for what amount for the acquisition of the 1,500 shares of M Company stock? Journal DATE DESCRIPTION PREF DEBIT CREDIT Sept. 1 (?) (?) Credit Investments-M Company Stock, $36,040 Credit Cash, $36,040 Credit Investments-M Company Stock, $36,000 Credit Cash, $36,000arrow_forward1. Record, in journal entry form, the following transactions, assuming the company plans on holding the investments for trading purposes: April 16 - Purchased 300 shares of Ameco for $25 per share. • May 2 - Purchased 1,000 shares of Rattle Inc. for $12.50 per share. • June 19 - Sold 100 Ameco shares for $32.75 per share. • October 7 - Purchased 550 shares of BMC for $27.80 per share. • November 30 - Received a dividend of $0.25 per share from Rattle. • December 12 - Sold half the shares in BMC for $21.00 per share. 2. Record any required journal entries on December 31, the company's year-end.arrow_forward

- Journalize the entries to record the following selected equity investment transactions completed by Perry Company during the current year. Perry accounts for this investment using the cost method. Feb. 2 Purchased for cash 900 shares of Dexter Co. stock for $54 per share plus a $450 brokerage commission. This represents a less than 10% ownership interest in the company. Apr. 16 Received dividends of $0.25 per share on Dexter Co. stock. June 17 Sold 200 shares of Dexter Co. stock for $70 per share less a $500 brokerage commission. Aug. 19 Purchased 600 shares of Dexter Co. stock for $65 per share plus a $300 brokerage commission. Nov. 14 Received dividends of $0.30 per share on Dexter Co. stock. If an amount box does not require an entry, leave it blank. Feb. 2 fill in the blank 2 fill in the blank 4 Apr. 16 fill in the blank 6 fill in the blank 8 June 17 fill in the blank 10 fill in the blank 11 fill in the blank 13 fill in the…arrow_forwardJournalize the entries for these transactions. In your computations, round per share amounts to two decimal places. When required, round final answers to the nearest dollar. If an amount box does not require an entry, leave it blank. Feb. 24 Notes Receivable May 16 July 14 Aug. 12 Oct. 31 Cash Dividends Receivable Unrealized Gain on Equity Investments Unrealized Loss on Equity Investments Dec. 31 Valuation Allowance for Equity Investments Valuation Allowance for Equity Investments 000arrow_forwardCurrent Attempt in Progress The outstanding capital stock of Bramble Corporation consists of 1,800 shares of $100 par value, 7% preferred, and 4,500 shares of $50 par value common. Assuming that the company has retained earnings of $86,500, all of which is to be paid out in dividends, and that preferred dividends were not paid during the 2 years preceding the current year, state how much each class of stock should receive under each of the following conditions. a. The preferred stock is noncumulative and nonparticipating. (Round answers to 0 decimal places, e.g. 38,487.) LA Preferred b. The preferred stock is cumulative and nonparticipating. (Round answers to 0 decimal places, e.g. 38,487.) LA Preferred Common c. The preferred stock is cumulative and participating. (Round the rate of participation to 4 decimal places, e.g.1.4278%. Round answers to 0 decimal places, e.g. 38,487.) Preferred tA Common Commonarrow_forward

- Journalize the entries to record the following selected equity investment transactions completed by Perry Company during the current year. Perry accounts for this investment using the cost method. Feb. 2 Purchased for cash 900 shares of Dexter Co. stock for $54 per share plus a $450 brokerage commission. This represents a less than 10% ownership interest in the company. Apr. 16 Received dividends of $0.25 per share on Dexter Co. stock. June 17 Sold 200 shares of Dexter Co. stock for $70 per share less a $500 brokerage commission. Aug. 19 Purchased 600 shares of Dexter Co. stock for $65 per share plus a $300 brokerage commission. Nov. 14 Received dividends of $0.30 per share on Dexter Co. stock.arrow_forwardInstructions ait of AC Journal On February 22, Stewart Corporation acquired 7,200 shares of the 200,000 outstanding shares of Edwards Co. common stock at $42 plus commission charges of $170. On June 1, a cash dividend of $1.85 per share was received. On November 12, 3,100 shares were sold at $49 less commission charges of $165. Using the cost method, journalize the entries for (a) the purchase of stock, (b) the receipt of dividends, and (c) the sale of 3,100 shares. Refer to the Chart of Accounts for exact wording of account titles. When required, round your answers to the nearest dollar.arrow_forwardJournalize the entries to record the following selected equity investment transactions completed by Flurry Company during the current year. Flury's purchase represents less than 20% of the total outstanding Braxter Co. stock. Feb. 2 Purchased for cash 500 shares of Braxter Co. stock for $34 per share plus a $250 brokerage commission. Apr. 16 Received dividends of $0.35 per share on Braxter Co. stock. June 17 Sold 100 shares of Braxter Co. stock for $40 per share less a $100 brokerage commission. If an amount box does not require an entry, leave it blank. Feb. 2 Apr. 16 June 17arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Financial instruments products; Author: fi-compass;https://www.youtube.com/watch?v=gvxozM3TUIg;License: Standard Youtube License