Governmental and Nonprofit Accounting (11th Edition)

11th Edition

ISBN: 9780133799569

Author: Robert J. Freeman, Craig D. Shoulders, Dwayne N. McSwain, Robert B. Scott

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 1P

- a. Analyze the effects of each of the following transactions on each of the funds and/or the nonfund accounts of the city of Nancy. Identify the fund that typically would be used to record the transaction. (For any borrowing transactions, reflect any necessary year-end interest accruals in your responses.)

- b. Indicate how each transaction would be reported in the operating statement for each fund affected.

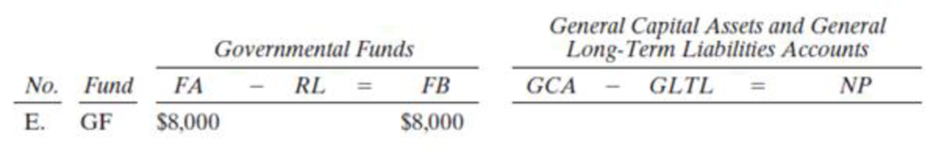

Example: Cash received for licenses during 20X1, $8,000.

Answer:

Revenues of $8,000 are reported in the General Fund statement of revenues, expenditures, and changes in fund balance.

- 1. Salaries and wages for firefighters and police officers incurred but not paid. $75,000.

- 2. The city borrowed $9,000,000 to finance construction of a new city executive office building by issuing bonds at par.

- 3. The city paid $5,000,000 to the office building contractor for work performed during the fiscal year.

- 4. The city purchased several notebook computers by issuing a $60,000, 6%, 6-month note to the vendor. The note is due March 1 of the next fiscal year, which is the calendar year. (The note is considered a fund liability.)

- 5. General Fund resources of $8,000,000 were paid to a newly established Airport Enterprise Fund to provide initial start-up capital.

- 6. A $3,000,000 personal injury lawsuit has been filed against the city. The comptroller determines that it is probable that a judgment in that amount will be made in the future but does not expect to have to pay the judgment for another 3 years. The incident relates to general government activities.

- 7. The city repaid one-half ($10,000,000) of general obligation bonds that had been issued several years before to finance construction of a school building. Interest of $1,000,000 matured and was paid.

- 8. The city sold general capital assets with an original cost of $50,000 and a $1,000 book value for $1,500. There are no restrictions on the use of the money.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Indicate (i) how each of the following transactions impacts the fund balance of the general fund, and its classifications, for fund financial statements and (ii) what impact each transaction has on the net position balance of the Government Activities on the government-wide financial statements.a. Issue a five-year bond for $6 million to finance general operations.b. Pay cash of $149,000 for a truck to be used by the police department.c. The fire department pays $17,000 to a government motor pool that services the vehicles of only the police and fire departments. Work was done on several department vehicles. d. Levy property taxes of $75,000 for the current year that will not be collected until four months into the subsequent year.e. Receive a grant for $7,000 that must be returned unless the money is spent according to the stipulations of the conveyance. That is expected to happen in the future.f. Businesses make sales of $20 million during the current year. The…

Prepare journal entries to record each of these transactions in the general fund. Based on your entries, prepare a balance sheet and statement of revenues, expenditures, and changes in fund balance for the general fund.

The Authority issued $2.5 million in long-term bonds.

· The Authority purchased 4 acres of land for $500,000 in cash.

· It sold one of the 4 acres of land for $125,000 in cash.

· It made a $325,000 payment on the debt, consisting of $75,000 of interest and $250,000 of principal.

· It lost a lawsuit filed by one of its renters and was ordered to pay $1 million in damages over 5 years. It made its first cash payment of $200,000.

Prepare the journal entries for the following transactions to consolidate financial statements from fund-level statements to government-wide statements.

1...Compensated absences earned during the year was $225.

2....At the beginning of the year, long term liabilities was $2,200.

3....During the year, new long-term liabilities were incurred for $275.

Chapter 2 Solutions

Governmental and Nonprofit Accounting (11th Edition)

Ch. 2 - Governmental accounting systems are different from...Ch. 2 - Funds used in state and local government...Ch. 2 - Prob. 3QCh. 2 - Why are a municipalitys general capital assets and...Ch. 2 - Prob. 5QCh. 2 - Under what circumstances should a government use a...Ch. 2 - Identify the fund types that are classified as...Ch. 2 - Prob. 8QCh. 2 - Prob. 9QCh. 2 - Prob. 10Q

Ch. 2 - Define interfund loans and interfund transfers,...Ch. 2 - Prob. 12QCh. 2 - Prob. 13QCh. 2 - What is the accounting equation for a governmental...Ch. 2 - Prob. 15QCh. 2 - Prob. 16QCh. 2 - Prob. 17QCh. 2 - Prob. 18QCh. 2 - Prob. 1.1ECh. 2 - Financial assets include a. capital assets that...Ch. 2 - All of the following are considered governmental...Ch. 2 - Each of the following is a fiduciary fund except...Ch. 2 - Prob. 1.5ECh. 2 - Which of the following transactions would not be...Ch. 2 - The transactions associated with a Community...Ch. 2 - The city of Hannah has established a trust to...Ch. 2 - A transaction in which a municipal electric...Ch. 2 - Prob. 1.10ECh. 2 - The operations of a municipal governments public...Ch. 2 - The proceeds of a federal grant made to assist in...Ch. 2 - The receipts from a special tax levy to retire and...Ch. 2 - The operations of a municipal swimming pool with...Ch. 2 - Prob. 2.5ECh. 2 - A municipalitys issuance of general obligation...Ch. 2 - Expenditures of 200,000 were made during the year...Ch. 2 - The activities of a central motor pool that...Ch. 2 - A city collects property taxes on behalf of the...Ch. 2 - A transaction in which a municipal electric...Ch. 2 - (Fund and Nonfund Accounts Identification)...Ch. 2 - Prob. 4ECh. 2 - Prob. 5ECh. 2 - Prob. 6ECh. 2 - Prob. 7ECh. 2 - Prob. 8ECh. 2 - Prob. 9ECh. 2 - Prob. 10ECh. 2 - a. Analyze the effects of each of the following...Ch. 2 - a. Analyze the effects of the following...Ch. 2 - Prob. 3PCh. 2 - Prob. 4PCh. 2 - Prob. 5PCh. 2 - Prob. 6PCh. 2 - (State of CaliforniaFund Identification) The...Ch. 2 - a. Analyze the effects of the following...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare the journal entries for the following transactions to consolidate financial statements from fund-level statements to government-wide statements. 1....An internal service fund had a loss of $50 2.....An internal service fund had interest expense of $30arrow_forwardThe General Fund of the Town of Mashpee transfers $115,000 to the debt service fund for a $100,000 principal and $15,000 interest payment. The recording of this transaction would include: a. A debit to Interest Expenditures in the General Fund. b. A debit to Interest Expenditures in the governmental activities accounts. c. A credit to Other Financing Sources - Interfund Transfers In in the debt service fund only. d. A credit to Other Financing Sources - Interfund Transfers In in both the debt service fund and governmental activities accounts.arrow_forwardThe general fund pays rent for two months. Which of the following is not correct? Choose the correct.a. Rent expense should be reported in the government-wide financial statements.b. Rent expense should be reported in the general fund.c. An expenditure should be reported in the fund financial statements.d. If one month of rent is in the first year with the other month in the next year, either the purchases method or the consumption method can be used in fund statements.arrow_forward

- Prepare the journal entries for the following transactions to consolidate financial statements from fund-level statements to government-wide statements. 1....Beginning accumulated depreciation was $500. 2....Depreciation during the year was $169 3....Beginning compensated absences was 500.arrow_forwardThe following is a Statement of Cash Flows for the risk management internal service fund of the City of Wrightville. An inexperienced accountant prepared the statement using the FASB format rather than the format required by GASB. All long-term debt was issued to purchase capital assets. The transfer from the General Fund was to establish the internal service fund and provide the initial working capital necessary for operations. CITY OF WRIGHTVILLE Risk Management Internal Service Fund Statement of Cash Flows For the Year Ended June 30, 2024 Cash flows from operating activities: Cash received from other departments Cash paid for suppliers and employees Cash paid on insurance claims Transfer from General Fund Investment income received Interest paid on long-term debt Cash flows from operating activities Cash flows from investing activities: Acquisition of property, plant, and equipment Purchase of investments Sale of property, plant, and equipment Cash flows from investing activities…arrow_forwardBased upon the flow information provided below for the year ending December 31, 2014, prepare a cash flow statement for Muscat City, an internal service fundarrow_forward

- Prepare journal entries for a local government to record the following transactions, first for fund financial statements and then for government-wide financial statements.a. The government sells $900,000 in bonds at face value to finance construction of a warehouse.b. A $1.1 million contract is signed for construction of the warehouse. The commitment is required, if allowed.c. A $130,000 transfer of unrestricted funds was made for the eventual payment of the debt in (a).d. Equipment for the fire department is received with a cost of $12,000. When it was ordered, an anticipated cost of $11,800 had been recorded.e. Supplies to be used in the schools are bought for $2,000 cash. The consumption method is used.f. A state grant of $90,000 is awarded to supplement police salaries. The money will be paid to reimburse the government after the supplement payments have been made to the police officers.g. Property tax assessments are mailed to citizens of the government. The total assessment is…arrow_forwardWhen preparing government-wide financial statements, the modified accrual based governments funds are adjusted. Please show the adjustments (in journal entry form with debits and credits) that would be made for the following General Fund transactions when converting to the government-wide statements: 3. $10,000 in interest was due and paid on that revenue bond during the fiscal year ($5,000 due every six months).arrow_forwardRequired information [The following information applies to the questions displayed below.] The Village of Seaside Pines prepared the following enterprise fund Trial Balance as of December 31, 2024, the last day of its fiscal year. The enterprise fund was established this year through a transfer from the General Fund. Accounts payable Accounts receivable Accrued interest payable Accumulated depreciation Administrative and selling expenses Allowance for uncollectible accounts Capital assets Cash Charges for sales and services Cost of sales and services Depreciation expense Due from General Fund Interest expense Interest revenue Transfer in from General Fund Bank note payable Supplies inventory Totals Debits Adjustments: $ 29,400 53,000 VILLAGE OF SEASIDE PINES ENTERPRISE FUND Reconciliation of Operating Income to Net Cash Provided by Operating Activities For the year ended December 31, 2024 722,000 98,000 504,000 51,000 17,700 40,900 19,700 $ 1,535,700 Credits $ 112,000 32,600 51,000…arrow_forward

- Prepare the entries to record the following general fund transactions for the village of Del Valley for the year ended September 30, 2018:a. Revenues are estimated at $520,000; expenditures are estimated at $515,000.b. A tax levy is set at $378,788, of which 1% will likely be uncollectible.c. Purchase orders amounting to $240,000 are authorized.d. Tax receipts total $280,000.e. Invoices totaling $225,000 are received and vouchered for orders originally estimated at $223,000.f. Salaries amounting to $135,000 are approved for payment.g. A state grant-in-aid of $100,000 is received.h. Fines and penalties of $10,000 are collected.i. Property for a village park is purchased, costing $120,000. No encumbrance had been made for this item.j. Additional recreational property valued at $88,000 is donated.k. Amounts of $12,000 due to other village funds are approved for payment. (Note: To establish the liability to other funds, credit Due to Other Funds.)l. The village’s share of sales tax due…arrow_forwardJournal entries for General Fund financial transactions for Croton City Prepare journal entries, as appropriate, to record these transactions. (We suggest you post the journal entries to general ledger T-accounts.) Of the $800 in property taxes receivable at January 1, $780 was collected in cash. The remaining $20 was written off as uncollectible. Deferred property taxes at the beginning of the year were recognized as revenue ($300). Accrued salaries from the previous year ($700) were paid. Property taxes in the amount of $9,030 were levied in order to provide revenues of $9,000. Tax bills were sent to the property owners. An allowance for uncollectible taxes was established. During the year, property taxes of $8,100 were collected in cash. The state collects personal income taxes on behalf of the city. During the year, Croton received personal income taxes of $4,600 from the state. The Parks Department collected $700 in recreation fees during the year. Croton paid salaries of…arrow_forward4. Izki City borrowed OMR1,800,000 secured by an 8-year mortgage note. The cash from the note was used to purchase a building for vehicle and equipment maintenance. Show how these two transactions should be recorded in the General Fund.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License