Corporate Finance: A Focused Approach (mindtap Course List)

7th Edition

ISBN: 9781337909747

Author: Michael C. Ehrhardt, Eugene F. Brigham

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 1MC

Jenny Cochran, a graduate of the University of Tennessee with 4 years of experience as an equities analyst, was recently brought in as assistant to the chairman of the board of Computron Industries, a manufacturer of computer components.

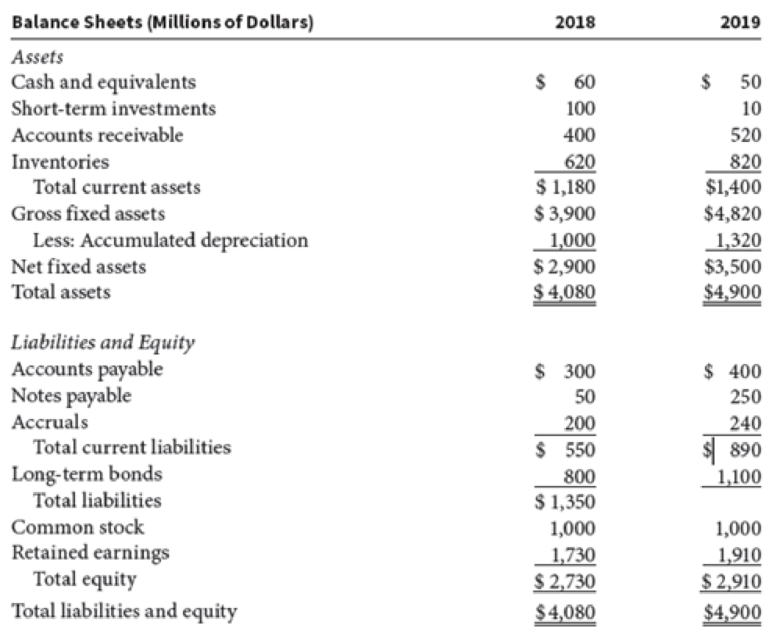

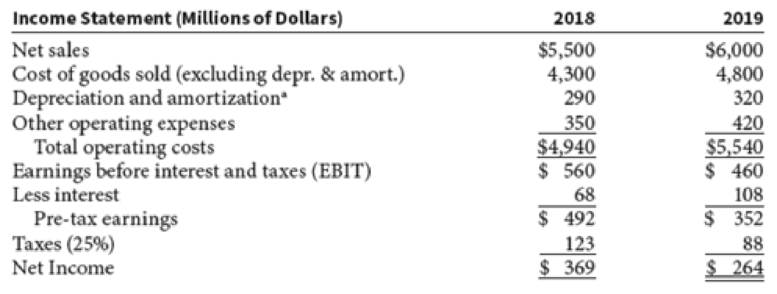

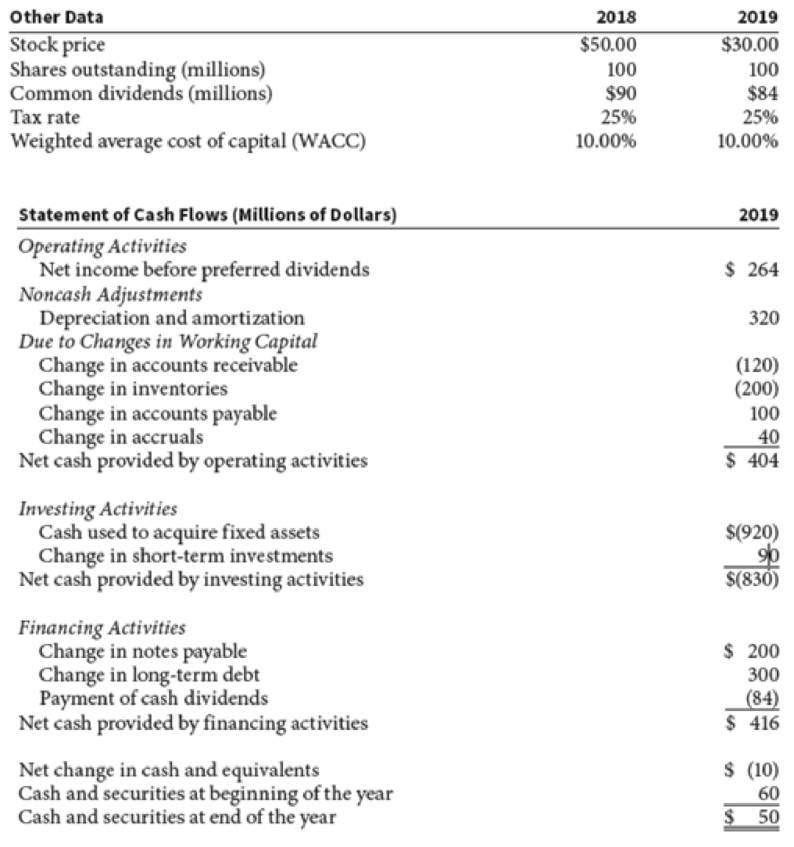

During the previous year, Computron had doubled its plant capacity, opened new sales offices outside its home territory, and launched an expensive advertising campaign. Cochran was assigned to evaluate the impact of the changes. She began by gathering financial statements and other data.

Assume that you are Cochran’s assistant and that you must help her answer the following questions:

- a. What effect did the expansion have on sales and net income? What effect did the expansion have on the asset side of the

balance sheet ? What effect did it have on liabilities and equity?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Jenny Cochran, a graduate of The University of Tennessee with 4 years of experience as an equities analyst, was recently brought in as assistant to the chairman of the board of Computron Industries, a manufacturer of computer components.

During the previous year, Computron had doubled its plant capacity, opened new sales offices outside its home territory, and launched an expensive advertising campaign. Cochran was assigned to evaluate the impact of the changes. She began by gathering financial statements and other data. (Data Attached)

What is Computron’s free cash flow (FCF)?

What are Computron’s “net uses” of its FCF?

Calculate Computron’s return on invested capital (ROIC). Computron has a 10% cost of capital (WACC).

What caused the decline in the ROIC? Was it due to operating profitability or capital utilization? Do you think Computron’s growth added value?

What is Computron's EVA? The cost of capital was 10% in both years.

Assume that a corporation has $200,000 of taxable income…

Jenny Cochran, a graduate of The University of Tennessee with 4 years of experience as an equities analyst, was recently brought in as assistant to the chairman of the board of Computron Industries, a manufacturer of computer components.

During the previous year, Computron had doubled its plant capacity, opened new sales offices outside its home territory, and launched an expensive advertising campaign. Cochran was assigned to evaluate the impact of the changes. She began by gathering financial statements and other data. (Data Attached)

What caused the decline in the ROIC?

Was it due to operating profitability or capital utilization?

Do you think Computron’s growth added value?

What is Computron's EVA? The cost of capital was 10% in both years.

Assume that a corporation has $200,000 of taxable income from operations. What is the company's federal tax liability?

Assume that you are in the 25% marginal tax bracket and that you have $50,000 to invest. You have narrowed your investment…

'Jenny Cochran, a graduate of The University of Tennessee with 4 years of experience as an equities analyst, was recently brought in as assistant to the chairman of the board of Computron Industries, a manufacturer of computer components.

During the previous year, Computron had doubled its plant capacity, opened new sales offices outside its home territory, and launched an expensive advertising campaign. Cochran was assigned to evaluate the impact of the changes. She began by gathering financial statements and other data. (Data Attached)

What effect did the expansion have on sales and net income? What effect did the expansion have on the asset side of the balance sheet? What do you conclude from the statement of cash flows?

What is Computron’s net operating profit after taxes (NOPAT)? What are operating current assets? What are operating current liabilities? How much net operating working capital and total net operating capital does Computron have?

What is Computron’s free cash flow…

Chapter 2 Solutions

Corporate Finance: A Focused Approach (mindtap Course List)

Ch. 2 - Prob. 1QCh. 2 - Prob. 2QCh. 2 - Prob. 3QCh. 2 - Prob. 4QCh. 2 - Prob. 5QCh. 2 - Prob. 6QCh. 2 - Prob. 7QCh. 2 - Prob. 8QCh. 2 - Prob. 1PCh. 2 - Prob. 2P

Ch. 2 - Hollys Art Galleries recently reported 7.9 million...Ch. 2 - Prob. 4PCh. 2 - Prob. 5PCh. 2 - Prob. 6PCh. 2 - Zucker Inc. recently reported 4 million in...Ch. 2 - Prob. 8PCh. 2 - Prob. 9PCh. 2 - Prob. 10PCh. 2 - Prob. 11PCh. 2 - Prob. 12PCh. 2 - Prob. 13PCh. 2 - Prob. 14PCh. 2 - Prob. 15PCh. 2 - Prob. 16PCh. 2 - Prob. 17PCh. 2 - Rhodes Corporations financial statements are shown...Ch. 2 - The Bookbinder Company had 500,000 cumulative...Ch. 2 - Jenny Cochran, a graduate of the University of...Ch. 2 - Prob. 2MCCh. 2 - Prob. 3MCCh. 2 - Prob. 4MCCh. 2 - Prob. 5MCCh. 2 - Prob. 6MCCh. 2 - Prob. 7MCCh. 2 - Prob. 8MCCh. 2 - Prob. 9MCCh. 2 - Prob. 10MCCh. 2 - Prob. 12MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Relco Industries recently purchased Arbeck, Inc., a manufacturer of electrical components that the construction industry uses. Roland Ford has been appointed as chief financial officer of Arbeck, and the president of Relco, Martha Sanderson, has asked him to prepare an organizational chart for his department at Arbeck. The chart that Ford has prepared is shown in the figure. Ford believes that the treasurer’s department should include the following employees: assistant treasurer, manager of accounts receivable and four subordinates, manager of investments and three subordinates, and manager of stockholder relations and two subordinates—a total of 13 employees besides the treasurer.The controller’s department should consist of an assistant controller, a manager of general accounting and four subordinates, a manager of fixed asset control and three subordinates, and a manager of cost accounting with four subordinates—a total of 15 employees besides the controller.When Ford presented his…arrow_forwardDuring the previous year, Computron had doubled its plant capacity, opened new sales offices outside its home territory, and launched an expensive advertising campaign. Cochran was assigned to evaluate the impact of the changes. She began by gathering financial statements and other data. Assume that you are Cochran’s assistant and that you must help her answer the following questions: What effect did the expansion have on sales and net income? What effect did the expansion have on the asset side of the balance sheet? What effect did it have on liabilities and equity? What do you conclude from the statement of cash flows?arrow_forwardGinnian and Fitch, a regional accounting firm, performs yearly audits on a number of different for-profit and not-for-profit entities. Two years ago, Luisa Mellina, Ginnians partner in charge of operations, became concerned about the amount of audit time required by not-for-profit entities. As a result, she instituted a series of training programs focusing on the auditing of not-forprofit entities. Now, she would like to see if the training seemed to work. So, she ran a multiple regression on 22 months of data for Ginnian for three variables: the total monthly cost of audit professional time, the number of not-for-profit audits, and the hours of training in the audit of not-for-profit entities. The following printout was obtained: Required: 1. Write out the cost equation for Ginnians audit professional time. 2. If Ginnian expects to have 9 audits of not-for-profits next month and expects that audit professionals will have a total of 130 hours of not-for-profit training, what is the anticipated cost of professional time? 3. Are the hours spent auditing not-for-profit entities positively or negatively correlated with audit professional costs? Is percentage of experienced team members positively or negatively correlated with audit professional cost? 4. What does R2 mean in this equation? Overall, what is your evaluation of the cost equation that was developed for the cost of audit professionals?arrow_forward

- Malone Industries has been in business for five years and has been very successful. In the past year, it expanded operations by buying Hot Metal Manufacturing for a price greater than the value of the net assets purchased. In the past year, the customer base has expanded much more than expected, and the companys owners want to increase the goodwill account. Your CPA firm has been hired to help Malone prepare year-end financial statements, and your boss has asked you to talk to Malones managers about goodwill and whether an adjustment can be made to the goodwill account. How do you respond to the owners and managers?arrow_forwardBernice Mountaindog was glad to be back at Sea Shore Salt. Employees were treated well. When she had asked a year ago for a leave of absence to complete her degree in finance, top management promptly agreed. When she returned with a honors degree, she was promoted form administrative assistant (she had been secretary to Joe-Bob Brinepool, the president) to treasury analyst.Bernice thought the company’s prospect were good. Sure, table salt was a mature business, but Sea Shore Salt had grown steadily at the expense of its less well known competitors. The company’s brand name was an important advantage, despite the difficulty most customers had in pronouncing it rapidly.Bernice started work on January 2, 2009. The first 2 weeks went smoothly. Then Mr. Brinepool’s cost of capital to other managers. The memo came as a surprise to Bernice, so she stayed late to prepare for the questions that would surely come the next day. The company’s bank charged interest at current market rates, and the…arrow_forwardRichmond, Inc., operates a chain of 44 department stores. Two years ago, the board of directors of Richmond approved a large-scale remodeling of its stores to attract a more upscale clientele. Before finalizing these plans, two stores were remodeled as a test. Linda Perlman, assistant controller, was asked to oversee the financial reporting for these test stores, and she and other management personnel were offered bonuses based on the sales growth and profitability of these stores. While completing the financial reports, Perlman discovered a sizable inventory of outdated goods that should have been discounted for sale or returned to the manufacturer. She discussed the Situation with her management colleagues; the consensus was to ignore reporting this inventory as obsolete because reporting it would diminish the financial results and their bonuses. Required: According to the IMA’s Statement of Ethical Professional Practice, would it be ethical for Perlman not to report the inventory…arrow_forward

- You work for a firm of management consultants that offers assistance to new businesses. One of your clients is Blossom Manufacturing, a company that manufactures a small, but vital, component for the specialized lighting industry. Blossom is a new company (and a new client for your employer) and you have been assigned the task of advising it of its options for financing its inventory during the first few months. The marketing experts have told you that Blossom should have at least three months of inventory on hand so it can meet all demands from its customers. The annual production of the Blossom component is projected to be 140,400 units. Annual direct labour and direct material costs together are estimated at $351,000 per year. Variable manufacturing costs are estimated to be $210,600 per year; fixed manufacturing costs are projected to be $585,000 per year. Fixed marketing and administration costs are estimated at $819,000 per year. These projections are all for the company's first…arrow_forwardYour public accounting practice is located in a city of 15,000 people. The majority of your work, conducted by you and two assistants, consistsof compiling clients’ monthly statements and preparing income tax returns for individuals from cash data and partnership returns from books and records. You have a small number of audit clients; given the current size of your practice, you generally consider it a challenge to accept new audit clients.One of your corporate clients is a retail hardware store. Your work for this client has been limited to preparing the corporate income tax return from a trial balance submitted by the bookkeeper.On December 26, you receive from the president of the corporation a letter containing the following request:We have made arrangements with First National Bank to borrow $500,000 to finance the purchase of a complete line of appliances. The bank has asked us to furnish our auditors’ certified statement as of December 31, which is the closing date of our…arrow_forwardYour answer is partially correct. As a new intern for the local branch office of a national brokerage firm, you are excited to get an assignment that allows you to use your accounting expertise. Your supervisor provides you with the spreadsheet below, which contains data for the most recent quarter for three companies that the firm has been recommending to its clients as "buys." Each of the companies' returns on assets has outperformed their industry cohorts in the past. But, given recent challenges in their markets, there is concern that the companies may experience operating challenges and lower earnings. (All numbers in millions, except return on assets.) Company Sprint Nextel Washington Mutual E* Trade Financial Fair Value of Company $36,351 11,582 Loss on Impairment Account Titles and Explanation Goodwill 1,628 eTextbook and Medial Book Value (Net Assets Including Goodwill) $51,201 23,941 4,024 Carrying Value of Goodwill $30,618 9,052 2,015 (c) Estimate the amount of goodwill…arrow_forward

- Jade Ltd is now considering how to obtain a computer software. The director of Jade Ltd has noticed that over the last 20 years, many companies have spent a great deal of money internally developing new intangible assets, such as software. You have been asked by the director to provide your advice on the accounting treatments of the two possibilities below: (i) Employ its own programmers to write software that the company will use (ii) Purchase computer software externally, including packages for payroll and general ledger. Required: In accordance with IAS 38 / AASB 138 Intangible Assets, discuss whether internally developed intangible assets should be recognised, and explain the differ in the accounting treatments for the two possible options.arrow_forwardSaina Supplies leases and sells materials, tools, and equipment and also provides add-on services such as ground maintenance and waterproofing to construction and mining sites. The company has grown rapidly over the past few years. The owner, Saina Torrance, feels that for the company to continue to scale, it needs to install a professional information system rather than relying on intuition and Excel analyses. After some research, Saina’s CFO reports back with the following data about a data warehousing and analytics system that she views as promising: ■ The system will cost $750,000. For tax purposes, it can be depreciated straight-line to a zero terminal value over a 5-year useful life. However, the CFO expects that the system will still be worth $50,000 at that time. ■ There is an additional $75,000 annual fee for software upgrades and technical support from the vendor. ■ The ability to provide better services and to target and reach more clients as a result of the new system will…arrow_forwardHarriet Moore is an accountant for New World Pharmaceuticals. Her duties include tracking research and development spending in the new product development division. Over the course of the past six months, Harriet has noticed that a great deal of funds have been spent on a particular project for a new drug. She hears “through the grapevine” that the company is about to patent the drug and expects it to be a major advance in antibiotics. Harriet believes that this new drug will greatly improve company performance and will cause the company’s stock to increase in value. Harriet decides to purchase shares of New World in order to benefit from this expected increase. Required What are Harriet’s ethical responsibilities, if any, with respect to the information she has learned through her duties as an accountant for New World Pharmaceuticals? What are the implications of her planned purchase of New World shares?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License