PRINCIPLES OF TAXATION F/BUS.+INVEST.

22nd Edition

ISBN: 9781259917097

Author: Jones

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 16QPD

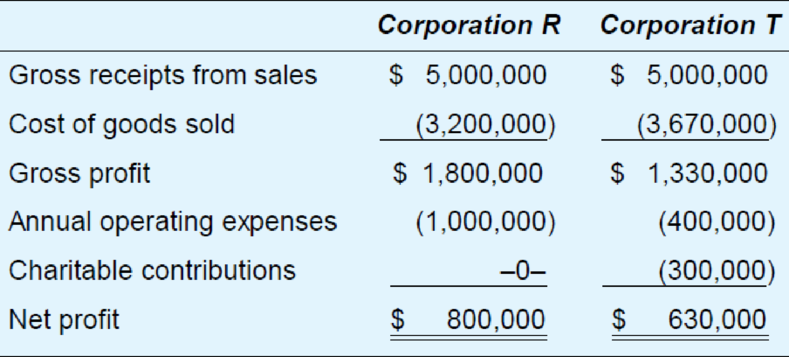

Corporation R and Corporation T conduct business in Jurisdiction Q. The corporations’ financial records for last year show the following.

Jurisdiction Q decided to enact a tax on corporations conducting business within its jurisdiction but has not decided on the tax base. Identify four different tax bases suggested by the corporations’ financial records and discuss each base in terms of horizontal equity.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Which of the following statements regarding

political contributions made by a corporation is

CORRECT?

a. Political contributions are allowed as a

deduction in the computation of taxable

income, therefore they are deducted on

Schedule 2.

b. Corporations receive a tax credit equal

to 15% of political contributions made in

the year.

O c. Political contributions are not allowed as

a deduction in the computation of

business income, therefore they are

added back on Schedule 1.

O d. The total deduction for political

contributions is limited to 75% of the

corporation's net income in the year.

A company as a tax entity will___________.

Select one:

a. pay either companies tax or secondary tax on companies

b. be exempt from value added tax if secondary tax on companies was paid in that cycle

c. be taxed according to scale based on income

d. have to register as a provisional taxpayer

How is Gross Income defined in the Tax Code

and what are the implications to individual

and business taxpayers? Name several

examples of gross income for individuals and

for corporations. Also, discuss the concept of

Adjusted Gross Income for Individuals and

provide two examples of deductions from

gross income to arrive at AGI as well as two

examples of deductions from AGI to get to

taxable income. What are the three

fundamental and general requirements in

order to deduct business expenses for tax

purposes? What is your opinion of these

general requirements and support that

opinion?

Chapter 2 Solutions

PRINCIPLES OF TAXATION F/BUS.+INVEST.

Ch. 2 - What evidence suggests that the federal tax system...Ch. 2 - Prob. 3QPDCh. 2 - National governments have the authority to print...Ch. 2 - In each of the following cases, discuss how the...Ch. 2 - Prob. 6QPDCh. 2 - Ms. V resides in a jurisdiction with a 35 percent...Ch. 2 - What nonmonetary incentives affect the amount of...Ch. 2 - Prob. 9QPDCh. 2 - Prob. 10QPDCh. 2 - Discuss the tax policy implications of the saying...

Ch. 2 - Prob. 12QPDCh. 2 - Jurisdiction E spends approximately 7 million each...Ch. 2 - Prob. 14QPDCh. 2 - Prob. 15QPDCh. 2 - Corporation R and Corporation T conduct business...Ch. 2 - Ms. P is considering investing 20,000 in a new...Ch. 2 - Country M levies a 10 percent excise tax on the...Ch. 2 - The city of Lakeland levies a 2 percent tax on the...Ch. 2 - The city of Clement levies a 5 percent tax on the...Ch. 2 - Mrs. K, a single taxpayer, earns a 42,000 annual...Ch. 2 - Prob. 5APCh. 2 - Prob. 6APCh. 2 - Prob. 7APCh. 2 - Jurisdiction B levies a flat 7 percent tax on the...Ch. 2 - Jurisdiction X levies a flat 14 percent tax on...Ch. 2 - Prob. 10APCh. 2 - Prob. 11APCh. 2 - Country A levies an individual income tax with the...Ch. 2 - Prob. 13APCh. 2 - Prob. 14APCh. 2 - Prob. 1IRPCh. 2 - Identify the tax issue or issues suggested by the...Ch. 2 - Prob. 3IRPCh. 2 - Prob. 4IRPCh. 2 - Prob. 5IRPCh. 2 - Prob. 6IRPCh. 2 - Prob. 1TPC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The S-corporation is a flow-through business entity under Subchapter S of the IRC. Go to the IRS websiteLinks to an external site. and search for a corporation's tax return (Form 1120) and an S-corporation tax return (Form 1120-S). Discuss one similarity or difference that you notice between the two returns. In that discussion, include why the similarity or difference exists.arrow_forwardShareholders in a corporation are obligated to pay income tax twice on one stream of income in a process called double taxation. Other than personal income taxes, which type of tax must shareholders pay? a) Self Employment Tax b) Corporate Dividend Tax c) Federal Income Tax d) Capital Gains Taxarrow_forwardProvide a summary of how tax levies may be imposed on C or S Corporations. Provide a rationale for your responses.arrow_forward

- Identify if statements are true for the corporate form of organization. Corporate income that is distributed to shareholders is usually taxed twice.arrow_forwardWhilst looking at the income tax returns applicable to corporate entities, Jackie was curious why there is a need for tax-exempt entities to still file for their ITR given that they are already exempted. Being a lamb to your friend, which of the following would best provide reason for such? A. for assessment of the correctness of mathematical computations made by taxpayer B. for comparison of figures reported on their financial statements C. for conversion of the supposed tax burden to filing burden D. for possible tax exposures from the conduct of unrelated activitiesarrow_forward* P5.3 (DC, RFC and NRFC) The following data were provided by Mine Corporation for 2021 taxable year: Gross sales - Philippines Cost of goods sold - Philippines Operating expenses Philippines Other income - Philippines Gross salės - USA P8,000,000 3,500,000 2,200,000 750,000 4,600,000 1,430,000 1,250,000 3,300,000 900,000 800,000 Cost of goods sold - USA Operating expenses USA Gross sales - Australia Cost of goods sold - Australia Operating expenses - Australiaarrow_forward

- When can two or more corporations file a consolidated tax return based from the tax code?arrow_forwardWith regards to the taxation year, which of the following situations is correct? a An individual taxpayer's taxation year ends on April 30th. b. A corporation's taxation is its fiscal period not exceeding 52 weeks. c. Corporations must use December 31st as the taxation year end. d. Taxation year ends must be considered for tax planning within business structures.arrow_forwardWhich of the following statements is true regarding the calculation of a C corporation's taxable income and tax liability? A. Business bad debts are allowed as an ordinary business deduction if the direct write-off method is used. B. Charitable contributions are considered a special deduction rather than part of ordinary business deductions. C. The foreign tax credit is applied to taxable income before multiplying by the tax rate to determine gross tax liability. D. The dividends received deduction is used to determine income before NOL and special deductions. 2. As the result of an IRS audit of a C corporation and its sole shareholder, the IRS agent proposes that a portion of the shareholder's salary is unreasonable. Because the corporation has significant earnings and profits, the agent has determined that the unreasonable portion of the salary is a dividend. Which of the following is correct regarding the impact of the proposed adjustment to both the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License