Loose Leaf for Financial Accounting: Information for Decisions

9th Edition

ISBN: 9781260158762

Author: John J Wild

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 15E

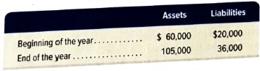

A corporation had the following assets and liabilities at the beginning and end of this year.

Determine the net income earned or net loss incurred by the business during the year for each of the following separate cases:

- Owner made no investments in the business, and no dividends were paid during the year.

- Owner made no investments in the business, but dividends were $1,250 cash per month.

- No dividends were paid during the year, but the owner did invest an additional $55,000 cash in exchange for common stock.

- Dividends were $1,250 cash per month, and the owner invested an additional $35,000 cash in exchange for common stock.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

a) Calculate the S corporation's ordinary (non-separately stated) income and indicate which items must be separately stated

b) If at the beginning of the year, Archer had a basis of 20,000 compute Archer’s basis at the end of the year.

c) Assume that Voyager reported a loss of $70,000 instead (and no separately stated items or distributions). If Janeway had a basis of 10,000 in her stock at the beginning of the year, what is the amount of loss she can report on her return?

Xavier Corporation ends the year with net income of $250,000 and long term capital gains of $30,000. How are the long term capital gains treated? What will be the tax owed by the corporation?

Write in complete sentences. Show all necessary calculations.

Assume the following year 2 income statement for Johnstone Corporation, which was a C corporation in year 1 and

elected to be taxed as an S corporation beginning in year 2. Johnstone's earnings and profits at the end of year 1 were

$11,560. Marcus is Johnstone's sole shareholder, and he has a stock basis of $46,000 at the end of year 1.

Johnstone Corporation

Income Statement

December 31, Year 2

Year 2 (S

Corporation)

$ 174,000

( 41,000)

( 66,000)

( 56,500)

(10,000)

(4,600)

12,540

Sales r evenue

Cost of goods sold

Salary to owners

Employee wages

Depreciation expense

Miscellaneous expenses

Interest income

Overall net income

$ 8,440

What is Johnstone's accumulated adjustments account at the end of year 2, and what amount of dividend income does

Marcus recognize on the year 2 distribution in each of the following alternative scenarios? (Leave no answer blank. Enter

zero if applicable.)

a. Johnstone distributed $7,200 to Marcus in year 2.

Accumulated adjustments account

Dividend income

Chapter 2 Solutions

Loose Leaf for Financial Accounting: Information for Decisions

Ch. 2 - Provide the names of two (a) asset accounts, (b)...Ch. 2 - What is the difference between a note payable and...Ch. 2 - Prob. 3DQCh. 2 - Prob. 4DQCh. 2 - Prob. 5DQCh. 2 - Should a transaction be recorded first in a...Ch. 2 - Prob. 7DQCh. 2 - Why does the recordkeeper prepare a trial balance?Ch. 2 - Prob. 9DQCh. 2 - Prob. 10DQ

Ch. 2 - Prob. 11DQCh. 2 - Prob. 12DQCh. 2 - Prob. 13DQCh. 2 - Prob. 14DQCh. 2 - Prob. 15DQCh. 2 - Review the Apple balance sheet in Appendix A....Ch. 2 - Prob. 17DQCh. 2 - Prob. 18DQCh. 2 - Identify the items from the following list that...Ch. 2 - Prob. 2QSCh. 2 - Prob. 3QSCh. 2 - Prob. 4QSCh. 2 - Prob. 5QSCh. 2 - Prob. 6QSCh. 2 - Prob. 7QSCh. 2 - Prob. 8QSCh. 2 - Prob. 9QSCh. 2 - Prob. 10QSCh. 2 - Prob. 11QSCh. 2 - In a recent year’s financial statements, Home...Ch. 2 - Prob. 13QSCh. 2 - Prob. 1ECh. 2 - Prob. 2ECh. 2 - Enter the number for the item that best completes...Ch. 2 - Prob. 4ECh. 2 - Prob. 5ECh. 2 - Prob. 6ECh. 2 - Prob. 7ECh. 2 - Prob. 8ECh. 2 - Prob. 9ECh. 2 - Prob. 10ECh. 2 - Prepare general journal entries for the following...Ch. 2 - Prob. 12ECh. 2 - Assume the following Taccounts reflect Belle Co.’s...Ch. 2 - Prob. 14ECh. 2 - A corporation had the following assets and...Ch. 2 - Prob. 16ECh. 2 - Use the information in Exercise 216 to prepare an...Ch. 2 - Prob. 18ECh. 2 - Compute the missing amount for each of the...Ch. 2 - Prob. 20ECh. 2 - You are told the column totals in a trial balance...Ch. 2 - a. Calculate the debt ratio and the return on...Ch. 2 - Prob. 23ECh. 2 - Prob. 24ECh. 2 - Prob. 1PSACh. 2 - Prob. 2PSACh. 2 - Prob. 3PSACh. 2 - Prob. 4PSACh. 2 - Prob. 5PSACh. 2 - Prob. 6PSACh. 2 - Prob. 1PSBCh. 2 - Prob. 2PSBCh. 2 - Prob. 3PSBCh. 2 - Nuncio Consulting complete the following...Ch. 2 - Prob. 5PSBCh. 2 - Prob. 6PSBCh. 2 - Prob. 2SPCh. 2 - Prob. 1GLPCh. 2 - Prob. 2GLPCh. 2 - Prob. 3GLPCh. 2 - Prob. 4GLPCh. 2 - Prob. 5GLPCh. 2 - Prob. 6GLPCh. 2 - Prob. 7GLPCh. 2 - Using transactions from the following assignments,...Ch. 2 - Prob. 1FSACh. 2 - Prob. 2FSACh. 2 - Prob. 3FSACh. 2 - Assume that you are a cashier and your manager...Ch. 2 - Prob. 2BTNCh. 2 - Access EDGAR online (SEC.gov) and locate the 2016...Ch. 2 - Prob. 5BTNCh. 2 - Prob. 6BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume the following year 2 income statement for Johnstone Corporation, which was a C corporation in year 1 and elected to be taxed as an S corporation beginning in year 2. Johnstone's earnings and profits at the end of year 1 were $11,560. Marcus is Johnstone's sole shareholder, and he has a stock basis of $46,000 at the end of year 1. Johnstone Corporation Income Statement December 31, Year 2 Year 2 (S Corporation) $ 174,000 ( 41,000) ( 66,000) (56,500) (10,000) ( 4,600) 12,540 $ 8,440 Sales revenue Cost of goods sold Salary to owners Employee wages Depreciation expense Miscellaneous expenses Interest income Overall net income What is Johnstone's accumulated adjustments account at the end of year 2, and what amount of dividend income does Marcus recognize on the year 2 distribution in each of the following alternative scenarios? (Leave no answer blank. Enter zero if applicable.) d. Johnstone distributed $27,200 to Marcus in year 2. Accumulated adjustments account Dividend incomearrow_forwardAssume the following year 2 income statement for Johnstone Corporation, which was a C corporation in year 1 and elected to be taxed as an S corporation beginning in year 2. Johnstone's earnings and profits at the end of year 1 were $11,560. Marcus is Johnstone's sole shareholder, and he has a stock basis of $46,000 at the end of year 1. Johnstone Corporation Income Statement December 31, Year 2 Year 2 (S Corporation) $ 174,000 ( 41,000) (66,000) (56,500) (10,000) ( 4,600) 12,540 $ 8,440 Sales revenue Cost of goods sold Salary to owners Employee wages Depreciation expense Miscellaneous expenses Interest income Overall net income What is Johnstone's accumulated adjustments account at the end of year 2, and what amount of dividend income does Marcus recognize on the year 2 distribution in each of the following alternative scenarios? (Leave no answer blank. Enter zero if applicable.) c. Johnstone distributed $17,200 to Marcus in year 2. Accumulated adjustments account Dividend incomearrow_forwardAssume the following year 2 income statement for Johnstone Corporation, which was a C corporation in year 1 and elected to be taxed as an S corporation beginning in year 2. Johnstone's earnings and profits at the end of year 1 were $11,560. Marcus is Johnstone's sole shareholder, and he has a stock basis of $46,000 at the end of year 1. Johnstone Corporation Income Statement December 31, Year 2 Year 2 (S Corporation) $ 174,000 ( 41,000) ( 66,000) ( 56,500) (10,000) ( 4,600) 12,540 $ 8,440 Sales r evenue Cost of goods sold Salary to owners Employee wages Depreciation expense Miscellaneous expenses Interest income Overall net income What is Johnstone's accumulated adjustments account at the end of year 2, and what amount of dividend income does Marcus recognize on the year 2 distribution in each of the following alternative scenarios? (Leave no answer blank. Enter zero if applicable.) b. Johnstone distributed $11,200 to Marcus in year 2. Accumulated adjustments account $ Dividend incomearrow_forward

- True or False: The ordinary income or loss of an S Corporation is allocated on a per day basis and per share ownership to anyone who was a shareholder during the year.arrow_forward[The following information applies to the questions displayed below.] Assume the following year 2 income statement for Johnstone Corporation, which was a C corporation in year 1 and elected to be taxed as an S corporation beginning in year 2. Johnstone's earnings and profits at the end of year 1 were $11,820. Marcus is Johnstone's sole shareholder, and he has a stock basis of $47,000 at the end of year 1. Johnstone Corporation Income Statement December 31, Year 2 Sales revenue Cost of goods sold Salary to owners Employee wages Depreciation expense Miscellaneous expenses Interest income. Overall net income Year 2 (S Corporation) $ 178,000 (42,000) (67,000) (57,500) What is Johnstone's accumulated adjustments account at the end of year 2, and what amount of dividend income does Marcus recognize on the year 2 distribution in each of the following alternative scenarios? Note: Leave no answer blank. Enter zero if applicable. Accumulated adjustments account $ Dividend income (11,000) (4,700)…arrow_forward2. January 1, John Smith formed a corporation. Record the following transactions that took place during the year ended December 31, 1990 on the attached sheet. The corporation records transactions on an accrual basis. Record contribution of $25,000 cash for Capital Stock. Leased a building at a cost of $10,000 per year on 1/1/90. Purchased inventory for resale at a cost of $20,000 payable June 15, 1991. Sold one-fourth of the inventory for $5,000 cash and $5,000 on account. Collected $2,500 on account. Paid salaries as follows: Gross Pay $954 158 Federal withholding FICA withholding Net Pay 46 $750 Paid taxes withheld and company's share of FIICA ($46) to the government. Transaction for the Year Credits Debits Cash Accounts Receivable Inventory Accounts Payable Accrued Payroll Taxes Capital Stock Retained Earning (Net Income) Sales Cost of Sales Salaries Payroll Taxes Lease Expense Income Taxes Total Transactionsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

How to Calculate your Income Tax? Step-by-Step Guide for Income Tax Calculation; Author: ETMONEY;https://www.youtube.com/watch?v=QdJKpSXCYmQ;License: Standard YouTube License, CC-BY

How to Calculate Federal Income Tax; Author: Edspira;https://www.youtube.com/watch?v=2LrvRqOEYk8;License: Standard Youtube License