Principles Of Taxation For Business And Investment Planning 2020 Edition

23rd Edition

ISBN: 9781259969546

Author: Sally Jones, Shelley C. Rhoades-Catanach, Sandra R Callaghan

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 12AP

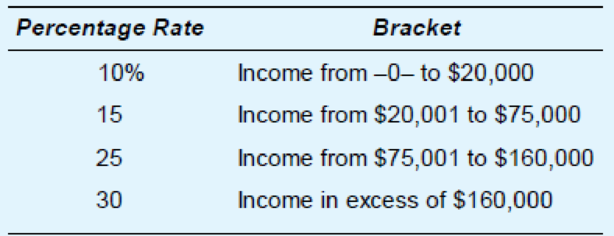

Country A levies an individual income tax with the following rate structure:

- a. Mr. LV’s taxable income is $69,200. Compute his tax and average tax rate. What is Mr. LV’s marginal tax rate?

- b. Ms. JC’s taxable income is $184,400. Compute her tax and average tax rate. What is Ms. JC’s marginal tax rate?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What would be the marginal and average tax rates for a married couple with taxable income of $89,600? For an unmarried taxpayer

with the same income? Use Table 3.7. (Do not round intermediate calculations. Enter the marginal tax rate as a percent rounded to 1

decimal place. Enter the average tax rate as a percent rounded to 1 decimal place.)

a. What would be the marginal tax rate for a married couple with income of $89,600?

Marginal tax rate for a married couple

b. What would be the average tax rate for a married couple with income of $89,600?

Average tax rate for a married couple

%

Marginal tax rate for an unmarried taxpayer

c. What would be the marginal tax rate for an unmarried taxpayer with income of $89,600?

%

Average tax rate for an unmarried taxpayer

%

d. What would be the average tax rate for an unmarried taxpayer with income of $89,600?

%

What are the tax rates for minors' unearned income?

Select one:

A.

Nil for every $1 earned up to $750, $0.66 for every $1 from $751 to $3,333 and $0.47 for every $1 over $3,333

B.

$0.66 for every $1 earned up to $750 and $0.47 for every $1 in excess

C.

All minors' unearned income is taxed at the relevant adult (non-minor) marginal tax rate

D.

Nil for every $1 earned up to $416, $0.66 for every $1 from $417 to $1,307 and $0.45 for every $1 earned if the income earned is above $1,307

es

Chuck, a single taxpayer, earns $77,800 in taxable income and $11,500 in interest from an investment in City of Heflin bonds. (Use the

U.S tax rate schedule.)

Required:

a. How much federal tax will he owe?

b. What is his average tax rate?

c. What is his effective tax rate?

d. What is his current marginal tax rate?

Complete this question by entering your answers in the tabs below.

Required A Required B

Federal tax

Required C

How much federal tax will he owe?

Note: Do not round intermediate calculations. Round "Federal tax" to nearest whole dollar amount.

$

Required D

12,424

Chapter 2 Solutions

Principles Of Taxation For Business And Investment Planning 2020 Edition

Ch. 2 - What evidence suggests that the federal tax system...Ch. 2 - Prob. 3QPDCh. 2 - National governments have the authority to print...Ch. 2 - In each of the following cases, discuss how the...Ch. 2 - Prob. 6QPDCh. 2 - Ms. V resides in a jurisdiction with a 35 percent...Ch. 2 - What nonmonetary incentives affect the amount of...Ch. 2 - Prob. 9QPDCh. 2 - Prob. 10QPDCh. 2 - Discuss the tax policy implications of the saying...

Ch. 2 - Prob. 12QPDCh. 2 - Jurisdiction E spends approximately 7 million each...Ch. 2 - Prob. 14QPDCh. 2 - Prob. 15QPDCh. 2 - Corporation R and Corporation T conduct business...Ch. 2 - Ms. P is considering investing 20,000 in a new...Ch. 2 - Country M levies a 10 percent excise tax on the...Ch. 2 - The city of Lakeland levies a 2 percent tax on the...Ch. 2 - The city of Clement levies a 5 percent tax on the...Ch. 2 - Mrs. K, a single taxpayer, earns a 42,000 annual...Ch. 2 - Prob. 5APCh. 2 - Prob. 6APCh. 2 - Prob. 7APCh. 2 - Jurisdiction B levies a flat 7 percent tax on the...Ch. 2 - Jurisdiction X levies a flat 14 percent tax on...Ch. 2 - Prob. 10APCh. 2 - Prob. 11APCh. 2 - Country A levies an individual income tax with the...Ch. 2 - Prob. 13APCh. 2 - Prob. 14APCh. 2 - Prob. 1IRPCh. 2 - Identify the tax issue or issues suggested by the...Ch. 2 - Prob. 3IRPCh. 2 - Prob. 4IRPCh. 2 - Prob. 5IRPCh. 2 - Prob. 6IRPCh. 2 - Prob. 1TPC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What are the tax rates for FICA Social Security and FICA Medicare? What are the maximum taxable earnings amounts for each of these taxes?arrow_forwardFor purposes of determining income eligibility for the premium tax credit, household AGI is AGI for the taxpayer and spouse AGI for the taxpayer, spouse, and any other household members required to file a tax return AGI for the taxpayer, spouse, and any other household members required to file a tax return plus any tax-exempt income AGI for the taxpayer, spouse, and any other household members required to file a tax return plus any tax-exempt income and untaxed Social Security benefitsarrow_forwardCalculating marginal tax rates. Lacey Hansen is single and received the items and amounts of income shown below during 2018, as shown below. Determine the marginal tax rate applicable to each item. Note that if the item is not taxable, the marginal rate is 0.arrow_forward

- Determine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the tax tables to determine tax liability. Required: Married taxpayers, taxable income of $97,763. Married taxpayers, taxable income of $67, 129. Note: For all requirements, round "Average tax rate" to 2 decimal places.arrow_forwardDetermine the average tax rate and the marginal tax rate for each of the following instances: Use the appropriate Tax Tables and Tax Rate Schedules. a. A married couple filing jointly with taxable income of $32,991. b. A married couple filing jointly with taxable income of $192,257. c. A married couple filing separately, one spouse with taxable income of $43,885 and the other with $56,218. d. A single person with taxable income of $79,436. e. A single person with taxable income of $297,784. f. A head of household with taxable income of $96,592. g. A qualifying widow with taxable income of $14,019. h. A married couple filing jointly with taxable income of $11,216. (For all requirements, when computing average tax rate, use the Tax Tables for taxpayers with taxable income under $100,000 and the Tax Rate Schedules for those with taxable income above $100,000. Round "Average tax rate" to 1 decimal place.) Complete this question by entering your answers in the tabs below. Req a and b Req c…arrow_forwardDetermine the tax liability, marginal tax rate, and average tax rate (rounded to two decimal places) in each of the following cases. Use the tax tables to determine tax liability. Case 1: Married taxpayers, taxable income of $36,162: Case 2: Single taxpayer, taxable income of $66,829:arrow_forward

- Duela Dent is single and had $181,600 in taxable income. Using the rates from Table 2.3, calculate her income taxes. What is the average tax rate? What is the marginal tax rate? Note: Do not round intermediate calculations and round your income tax answer to 2 decimal places, e.g., 32.16. Enter the average and marginal tax rate answers as a percent, rounded 2 decimal places, e.g., 32.16. Income taxes Average tax rate Marginal tax rate 39,801.50 X 22.00 × % % 32.00arrow_forwardDetermine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the Tax Tables to compute tax liability. Required: a. Married taxpayers, who file a joint return, have taxable income of $32,366. b. Single taxpayer, has taxable income of $67,342. Note: For all requirements, round "Average tax rate" to 2 decimal places. Tax liability a. $ b. $ 3,474 14,336 Marginal tax rate 15 % 25 % Average tax rate. 12.13 % 21.28 %arrow_forwardRequired: Determine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the appropriate Tax Tables and Tax Rate Schedules. a. Married taxpayers, who file a joint return, have taxable income of $39,821. b. Married taxpayers, who file a joint return, have taxable income of $63,790. (For all requirements, use the tax tables to compute tax liability. Round "Average tax rate" to 2 decimal places.) Tax liability Marginal tax rate Average tax rate a % b.arrow_forward

- Chuck , a single taxpayer earns $81,400 in taxable income and $13,600 in interest from an investment in City of Heflin bonds. a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate?arrow_forwardChuck, a single taxpayer, earns $80,200 in taxable income and $12,900 in interest from an investment in City of Heflin bonds. (Us the U.S tax rate schedule.) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D How much federal tax will he owe? Note: Do not round intermediate calculations. Round "Federal tax" to nearest whole dollar amount. Federal taxarrow_forwardFor the person below, calculate the FICA tax and income tax to obtain the total tax owed. Then find the overall tax rate on the gross income, including both FICA and income tax. Assume that the individual is single and takes the standard deduction. A man earned a salary of $27,000 and received $1250 in interest. Tax Rate Single 10% up to $9325 15% up to $37,950 25% up to $91,900 28% up to $191,650 33% up to $416,700 35% up to $418,400 39.6% above $418,400 Standard deduction $6350 Exemption (per person) $4050 Let FICA tax rates be 7.65%on the first $127,200 of income from wages, and 1.45% on any income from wages in excess of $127,200. His total FICA tax is $____.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

How to (Legally) Never Pay Taxes Again; Author: Next Level Life;https://www.youtube.com/watch?v=q63F1pBrUHA;License: Standard Youtube License