Accounting and Reporting Principles. (LO2-3) The financial statements of the Town of Fordville consist of a statement of cash receipts and a statement of cash disbursements prepared by the town treasurer for each of its three funds: the General Fund, the Road Tax Fund (special revenue fund), and the Sewer Fund (enterprise fund). As required by state law, the town submits its financial statements to the Office of the State Auditor; however, due to its small size, its financial statements have never had to be audited by an independent auditor.

Because of its growing population (nearing 20,000) and increasing financial complexity, the town has hired Emily Ramirez, who recently obtained her CPA license, to supervise all accounting and financial reporting operations. Having worked two years for a CPA firm in a nearby town, Ms. Ramirez gained limited experience auditing not-for-profit organizations, as well as compiling financial statements for small businesses. Although she has little knowledge of governmental accounting, she is confident that her foundation in business and not-for-profit accounting will enable her to handle the job.

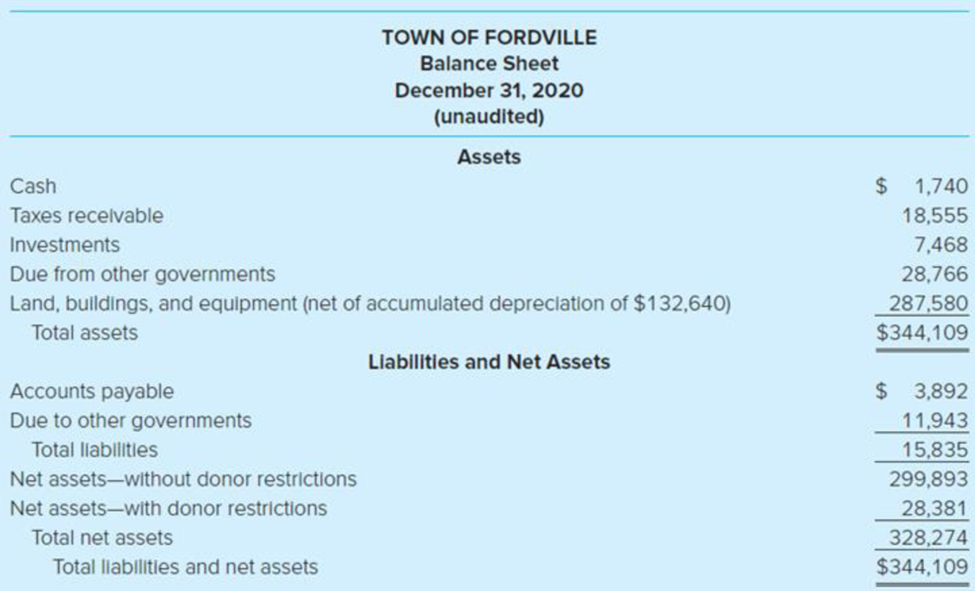

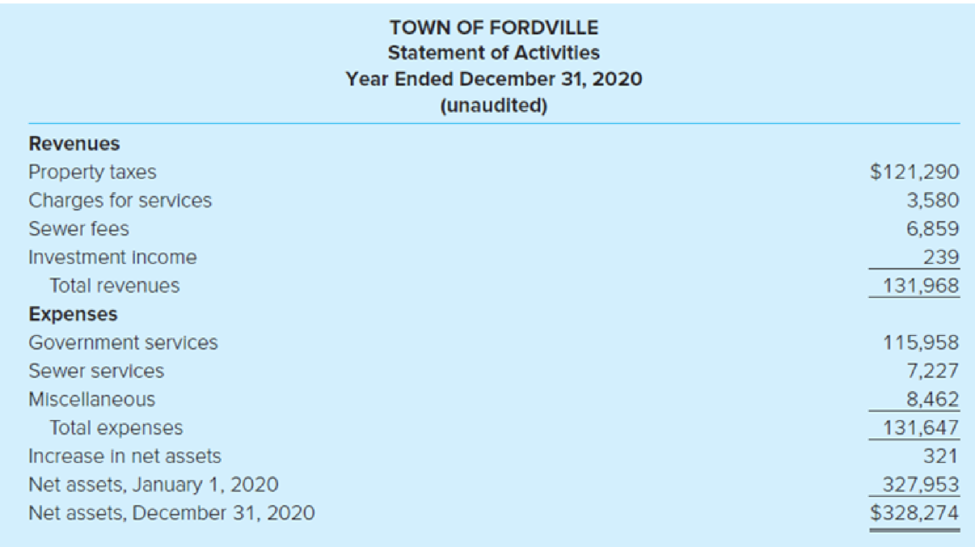

Using her experience with not-for-profit organizations, for the year ended December 31, 2020, Ms. Ramirez prepared the following unaudited financial statements for the Town of Fordville. Assuming the city wants to prepare financial statements in accordance with GASB standards, study the financial statements and answer the questions that follow.

Required

- a. What basis of accounting does it appear Ms. Ramirez has used? Explain how you arrived at your answer.

- b. Given what you know about the town’s activities, what financial statements would the town be required to prepare using GASB standards?

- c. The financial statements presented appear to be most comparable to which two financial statements prepared using GASB standards? Using the information from the Financial Reporting Model section of the text and Illustrations A2-1 and A2-2, explain what modifications would be needed to make the two financial statements conform to the format of the financial statements you have identified.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Accounting For Governmental & Nonprofit Entities

- The City of Francois, Texas, has begun the process of producing its current comprehensive annual financial report (CAFR). Several organizations that operate within the city are related in some way to the primary government. The city’s accountant is attempting to determine how these organizations should be included in the reporting process.a. What is the major criterion for inclusion in a government’s CAFR?b. How does an activity or function qualify as a special purpose government?c. How is the legal separation of a special purpose government evaluated?d. How is the fiscal independence of a special purpose government evaluated?e. What is a component unit, and how is it normally reported on government-wide financial statements?f. How does a primary government prove that it can impose its will on a component unit?g. What is meant by the blending of a component unit?arrow_forwardAn accountant is trying to determine whether the school system of the City of Abraham is fiscally independent. Which of the following is not a requirement for being deemed fiscally independent? Choose the correct.a. Holding property in its own name.b. Issuing bonded debt without outside approval.c. Passing its own budget without outside approval.d. Setting taxes or rates without outside approval.arrow_forwardIdentify the types of financial statements issued annually by federal agencies. Compare and contrast them against the financial statements issued by a state government and a for-profit business. Discuss why there is a difference between the three.arrow_forward

- The GASB identifies one of the broadest objectives of government financial reporting as: A. assisting users in assessing profitability of the government B. assisting users in making economic, social, and political decisions. C. fairly presenting government financial condition and operating results D. providing information about the inflows and outflows of cash 2. The 60-day limit on the period after the end of the fiscal year that is used for governmental fund revenue recognition cutoff purposes: A. is optional for property taxes, but required for most other governmental fund revenues B. must be applied to all revenue sources except charges for licenses and permits C. must be applied to property taxes, but cannot be applied to other governmental fund revenue sources D. must be applied to property taxes, but may also be applied to other revenue sourcesarrow_forwardIS IT AN ASSET OR A LIABILITY? During the long evolution of government accounting, many scholars have discussed its unique features. In the August 1989 issue of the Journal of Accountancy, R. K. Mautz described the reporting needs of governments and not-for-profit organizations (such as charities) in his essay “Not-For-Profit Financial Reporting: Another View.” To illustrate the governmental accounting challenges, Mautz examined the method by which a city should record a newly constructed high school building. Conventional business wisdom would say that such a property is an asset owned by the government. Thus, the cost should be capitalized and then depreciated over an estimated useful life. However, Mautz pointed to paragraph 26 of FASB Concepts Statement No. 6, which asserted that an essential characteristic of an asset is “a probable future benefit . . . to contribute directly or indirectly to future net cash inflows.” Mautz reasoned that the school building cannot be considered an…arrow_forwardForest City has recently implemented GAAP reporting and is attempting to determine which of the following special revenue funds should be classified as “major funds” and, therefore, be reported in separate columns on the balance sheet and statement of revenues, expenditures, and changes in fund balances for the governmental funds. As the city’s external auditor, you have been asked to provide a rationale for either including or excluding each of the following funds as a major fund. Determine which of the following funds should be reported as a major fund.arrow_forward

- 187. Which of the following funds should be reported as part of local government's governmental activities column in its government-wide statements? a. Debt service b. Agency c. Private-purpose trust. d. Pension trust. 188. A nongovernmental not-for-profit organization's statement of activities is similar to which of the fol- lowing for-profit financial statements? a. Balance sheet. b. Statement of cash flows. c. Statement of retained earnings. d. Income statement.arrow_forwardAn accountant is trying to determine whether the school system of the City of Abraham is fiscally independent. Which of the following is not a requirement for being deemed fiscally independent? Holding property in its own name. Issuing bonded debt without outside approval. Passing its own budget without outside approval. Setting taxes or rates without outside approval.arrow_forwardWhich of the following items are included in the governmental activities column of the government- wide financial statements through worksheet journal entries? A) General Capital Assets. B) General Long-Term Debt. C) Internal Service Funds servicing governmental departments. D) All of the choices are correct.arrow_forward

- Lacking sufficient cash for operations, a city borrows money from a bank, using as collateral the expected receipts from levied property taxes. Upon receipt of cash from the bank, the general fund would credita. Revenues. b. Other Financing Sources. c. Tax Anticipation Notes Payable. d. Taxes Receivable—Delinquent.arrow_forwardChase City uses an internal service fund for its central motor pool. The assets and liabilities account balances for this fund that are not eliminated normally should be reported in the government-wide statement of net position as: Governmental activities. OBusiness-type activities. Fiduciary activities. Note disclosures only.arrow_forward42. A certification on the availability of allotment is required before a disbursement of government funds is made. According to the GAM for NGAs, who shall issue this certification? Budget officer Chief accountant Head of the agency Requisitioning Individualarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education