Concept explainers

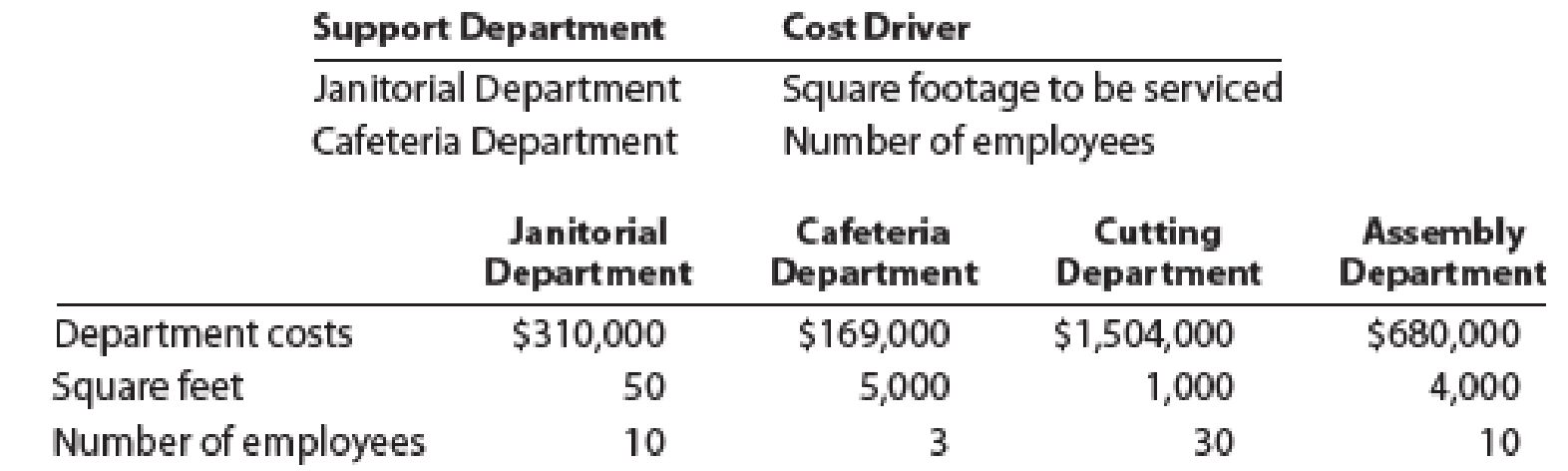

Becker Tabletops has two support departments (Janitorial and Cafeteria) and two production departments (Cutting and Assembly). Relevant details for these departments are as follows:

Allocate the support department costs to the production departments using the direct method.

EX 19-8 Support department cost allocation–sequential method Obj.3

Refer to the information provided for Becker Tabletops in Exercise 7. Allocate the support department costs to the production departments using the sequential method. Allocate the support department with the highest department cost first.

EX 19-9 Support department cost allocation–reciprocal services method Obj.3

Refer to the information provided for Becker Tabletops in Exercise 7. Allocate the support department costs to the production departments using the reciprocal services method.

Compute the total cost of each production department after allocating all support costs to the production departments.

Explanation of Solution

Cost allocation:

The cost allocation refers to the process of allocating the costs associated with the production of the products mainly indirectly and are generally ignored. The main objective of cost allocation is to ensure proper pricing of the products. This can be done by several methods.

Janitorial Department Cost to be allocated:

The total Janitorial Department costs include 20% of the Cafeteria department costs as,

Therefore, the Cafeteria Department cost is,

Cafeteria Department Cost to be allocated:

The total Cafeteria Department costs include 50% of the Janitorial department costs as,

Therefore, the Cafeteria Department cost is,

Substitute the equation for J into the C equation:

Substitute the value of C into the J equation:

Janitorial Department Cost Allocation:

Compute the allocation of costs from Janitorial Department to Cafeteria Department:

The costs allocated from Janitorial Department to Cafeteria Department is $191,000.

Compute the allocation of costs from Janitorial Department to Cutting Department:

The costs allocated from Janitorial Department to Cutting Department is $38,200.

Compute the allocation of costs from Janitorial Department to Assembly Department:

The costs allocated from Janitorial Department to Assembly Department is $152,800.

Cafeteria Department Cost Allocation:

Compute the allocation of costs from Cafeteria Department to Janitorial Department:

The costs allocated from Cafeteria Department to Janitorial Department is $72,000.

Compute the allocation of costs from Cafeteria Department to Cutting Department:

The costs allocated from Cafeteria Department to Cutting Department is $216,000.

Compute the allocation of costs from Cafeteria Department to Assembly Department:

The costs allocated from Cafeteria Department to Assembly Department is $72,000.

Want to see more full solutions like this?

Chapter 19 Solutions

FINANCIAL&MANAGERIAL ACCOUNTING(LL)W/AC

- Use the following information for Brief Exercises 4-27 and 4-28: Quillen Company manufactures a product in a factory that has two producing departments, Cutting and Sewing, and two support departments, S1 and S2. The activity driver for S1 is number of employees, and the activity driver for S2 is number of maintenance hours. The following data pertain to Quillen: Brief Exercises 4-27 (Appendix 4B) Assigning Support Department Costs by Using the Direct Method Refer to the information for Quillen Company above. Required: 1. Calculate the cost assignment ratios to be used under the direct method for Departments S1 and S2. (Note: Each support department will have two ratiosone for Cutting and the other for Sewing.) 2. Allocate the support department costs to the producing departments by using the direct method.arrow_forwardLogo Inc. has two data services departments (Systems and Facilities) that provide support to the companys three production departments (Machining, Assembly, and Finishing). The overhead costs of the Systems Department are allocated to other departments on the basis of computer usage hours. The overhead costs of the Facilities Department are allocated based on square feet occupied (in thousands). Other information pertaining to Logo is as follows. If Logo employs the direct method of allocating service department costs, the overhead of the Systems Department would be allocated by dividing the overhead amount by: a. 1,200 hours. b. 8,100 hours. c. 9,000 hours. d. 9,300 hours.arrow_forwardUse the following information for Brief Exercises 4-34 and 4-35: Sanjay Company manufactures a product in a factory that has two producing departments, Assembly and Painting, and two support departments, S1 and S2. The activity driver for S1 is square footage, and the activity driver for S2 is number of machine hours. The following data pertain to Sanjay: Brief Exercises 4-34 (Appendix 4B) Assigning Support Department Costs by Using the Direct Method Refer to the information for Sanjay Company above. Required: 1. Calculate the cost assignment ratios to be used under the direct method for Departments S1 and S2. (Note: Each support department will have two ratiosone for Assembly and the other for Painting.) 2. Allocate the support department costs to the producing departments by using the direct method.arrow_forward

- Crystal Scarves Co. produces winter scarves. The scarves are produced in the Cutting and Sewing departments. The Maintenance and Security departments support these production departments, and allocate costs based on machine hours and square feet, respectively. Information about each department is provided in the following table: Using the sequential method and allocating the support department with the highest costs first, allocate all support department costs to the production departments. Then compute the total cost of each production department.arrow_forwardA manufacturing company has two service and two production departments. Human Resources and Machine Repair are the service departments. The production departments are Grinding and Polishing. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The human resources department services all departments of the company, and its costs are allocated using the numbers of employees within each department, while machine repair costs are allocable to Grinding and Polishing on the basis of machine hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardTwo years ago, company scientists developed an alloy with all of the properties of the raw materials used in XL-D that generates no wastewater. Some prototype components using the new material were produced and tested and found to be indistinguishable from the old components in every way relating to their fitness for use. The only difference is that the new alloy is more expensive than the old raw material. The company has been test-marketing the newer version of the component, referred to as XL-C, and is currently trying to decide its fate. Manufacturing of both components begins in the Production Department and is completed in the Assembly Department. No other products are produced in the plant. The following information relates to the two components: Units produced Raw material costs per unit Direct labor-hours per unit-Production Direct labor-hours per unit-Assembly Direct labor rate per hour-all labor Machine-hours per unit-Production Machine-hours per unit-Assembly Testing hours…arrow_forward

- Ramsey SARL uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs - Security expense and Building depreciation - are allocated to three activity cost pools - Shipping, Carving, and Other - based on resource consumption. Data to perform these allocations appear below: Overhead Costs: Security expense: $105,000 Building depreciation: $70,000 Distribution of Resource Consumption across Activity Cost Pools: Overhead Cost Activity Cost Pools Shipping Carving Other Security expense 0.30 0.42 0.28 Building depreciation 0.34 0.32 0.34 The second stage of allocation is done by assigning the Shipping costs to products on the basis of orders shipped while products are assigned Carving costs based on machine hours. Costs assigned to the Other activity pool are not further assigned to products. Activity information for Ramsey's only two products is below: orders shipped machine hours Product BA-15: 6,300 1,500…arrow_forwardMeester Corporation has an activity-based costing system with three activity cost pools-Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to three activity cost pools based on resource consumption. Data used in the first stage allocations follow: Overhead costs: Equipment expense Supervisory expense Distribution of Resource Consumption Across Activity Cost Pools: Equipment expense Supervisory expense $80, 400 $ 4, 100 Product MO Product H2 Total Activity Cost Pools Machining Order Filling 0.60 0.60 MHS (Machining) 1,300 9,540 10,840 Machining costs are assigned to products using machine-hours (MHS) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow: Activity: 0.20 0.10 Orders (Order Filling) 790 1,480 2,270 Other 0.20 0.30…arrow_forwardDoede Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts-equipment depreciation and supervisory expense-to three activity cost pools-Machining. Order Filing, and Other-based on resource consumption, Data to perform these allocations appear below: Overhead costs: Equipment depreciation Supervisory expense $ 30,000 $ 14,800 Distribution of Resource Consumption Across Activity Cost Pools: Equipment depreciation Supervisory expense Activity: Product W1 Product Me Total Machining Order Filling 0.50 0.50 In the second stage, Machining costs are assigned to products using machine-hours (Ms) and Order Filing costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Product W1 Product Me Total Activity Cost Pools MHS (Machining) 5,530 17,000 22,530 0.40 0.30 Show Transcribed Text 5,530 17,000 22,530 Orders (Order Filling)…arrow_forward

- An activity based costing system is used at Haldeman, SA to assign products overhead costs. First, the two overhead costs of Equipment depreciation and Water expense are allocated to three activity cost pools - Handling, Machining, and Other - based on resource consumption. The information used to perform these allocations is below: Overhead Costs: Equipment depreciation: $50,000 Water expense: $60,000 Distribution of Resource Consumption across Activity Cost Pools: Overhead Cost Activity Cost Pools Handling Machining Other Equipment depreciation 0.28 0.34 0.38 Water expense 0.32 0.22 0.46 The second stage of allocation is done by assigning the Handling costs to products on the basis of orders filled while products are assigned Machining costs based on machine hours. Costs assigned to the Other activity pool are not further assigned to products. Activity information for Haldeman's only two products is below: orders filled machine hours Product LS-157: 3,400 3,400…arrow_forwardMeester Corporation has an activity-based costing system with three activity cost pools--Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are alloceted to three activity cost pools based on resource consumption, Data used in the first stage allocations follow Overhead costs: Equipment depreciation Supervisory expense $ 81,300 $ 2,200 Distribution of Resource Consumption Across Activity Cost Pools: Activity Cost Pools Machining Order Filling Other Equipment depreciation Supervisory expense 0.50 0.30 0. 20 e. 30 e.50 0.20 Mechining costs are assigned to products using machine-hours (MHs) and Order Filing costs are essigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity date for the companve o nroducts follaw You ae sren sharg Skop Share Activity MHs (Machining) Orders (Order Filling) Product Me 1,630 9,780 1,370…arrow_forwardSupport department cost allocation Hooligan Adventure Supply produces and sells various outdoor equipment. The Molding and Assembly production departments are supported by the Personnel and Maintenance departments. Personnel costs are allocated to the production departments based on the number of employees, and Maintenance costs are allocated based on number of service calls. Information about these departments is detailed in the following table: Line Item Description PersonnelDepartment MaintenanceDepartment MoldingDepartment AssemblyDepartment Number of employees 28 10 41 49 Number of service calls 57 41 168 112 Department cost $15,000 $11,400 $72,000 $69,000 1. Which of the following statements matches the sequential method of cost allocations?a. Support departments are often allocated in order from lowest to the highest cost with preference given to the departments that serve few support…arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning