Concept explainers

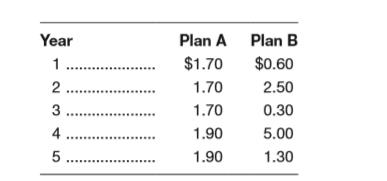

In doing a five-year analysis of future dividends, the Dawson Corporation is considering the following two plans. The values represent dividends per share.

a. How much in total dividends per share will be paid under each plan over the five years?

b. Mr. Bright, the vice president of finance, suggests that stockholders often prefer a stable dividend policy to a highly variable one. He will assume that stockholders apply a lower discount rate to dividends that are stable. The discount rate to be used for Plan A is 11 percent; the discount rate for Plan B is 14 percent. Compute the present value of future dividends. Which plan will provide the higher present value for the future dividends? (Round to two places to the right of the decimal point.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 18 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

- A financial analyst is attempting to assess the future dividend policy of Environmental Systems by examining its life cycle. She anticipates no payout of earnings in the form of cash dividends during the development stage (I). During the growth stage (II), she anticipates 15 percent of earnings will be distributed as dividends. As the firm progresses to the expansion stage (III), the payout ratio will go up to 31 percent and will eventually reach 55 percent during the maturity stage (IV). Anthe a. Assuming earnings per share will be as follows during each of the four stages, indicate the cash dividend per share (if any) during each stage. (Leave no cells blank - be certain to enter "O" wherever required. Do not round intermediate calculations and round your answers to 2 decimal places.) Stage I Stage II Stage III Stage IV Stage I Stage II Stage III Stage IV $ 0.35 1.60 2.70 3.60 Aftertax income Dividends b. Assume in Stage IV that an investor owns 310 shares and is in a 15 percent tax…arrow_forwardA financial analyst is attempting to assess the future dividend policy of Environmental Systems by examining its life cycle. She anticipates no payout of earnings in the form of cash dividends during the development stage (I). During the growth stage (II), she anticipates 14 percent of earnings will be distributed as dividends. As the firm progresses to the expansion stage (III), the payout ratio will go up to 40 percent and will eventually reach 53 percent during the maturity stage (IV). a. Assuming earnings per share will be as follows during each of the four stages, indicate the cash dividend per share (if any) during each stage. Note: Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations and round your answers to 2 decimal places. Stage I Stage II Stage III Stage IV Stage I Stage II Stage III Stage IV $ 0.25 1.65 2.40 3.90 Aftertax income Dividends b. Assume in Stage IV that an investor owns 325 shares and is in a 15 percent tax…arrow_forwardA financial analyst is attempting to assess the future dividend policy of Environmental Systems by examining its life cycle. She anticipates no payout of earnings in the form of cash dividends during the development stage (I). During the growth stage (II), she anticipates 13 percent of earnings will be distributed as dividends. As the firm progresses to the expansion stage (III), the payout ratio will go up to 37 percent and will eventually reach 59 percent during the maturity stage (IV). a. Assuming earnings per share will be as follows during each of the four stages, indicate the cash dividend per share (if any) during each stage. (Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations and round your answers to 2 decimal places.) Stage I $ 0.40 Stage II 1.80 Stage III 2.70 Stage IV 3.30 b. Assume in Stage IV that an investor owns 325 shares and is in a 15 percent tax bracket. What will be the…arrow_forward

- A financial analyst is attempting to assess the future dividend policy of Environmental Systems by examining its life cycle. She anticipates no payout of earnings in the form of cash dividends during the development stage (I). During the growth stage (II), she anticipates 15 percent of earnings will be distributed as dividends. As the firm progresses to the expansion stage (III), the payout ratio will go up to 33 percent and will eventually reach 57 percent during the maturity stage (IV). a. Assuming earnings per share will be as follows during each of the four stages, indicate the cash dividend per share (if any) during each stage. (Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations and round your answers to 2 decimal places.) Stage I Stage II Stage III Stage IV Stage I Stage II Stage III Stage IV $ 0.30 1.85 2.60 3.80 Aftertax income Dividends b. Assume in Stage IV that an investor owns 335 shares and is in a 15 percent tax…arrow_forwardAt Litchfield Chemical Corp. (LCC), a director of the company said that the use of dividend discount models by investors is “proof ” that the higher the dividend, the higher the stock price.a. Using a constant-growth dividend discount model as a basis of reference, evaluate the director’s statement.b. Explain how an increase in dividend payout would affect each of the following (holding all other factors constant):i. Sustainable growth rate.ii. Growth in book value.arrow_forwardrate of return, standard deviation, and coefficient of variation. you have heard about the great returns that some private equity funds generate and have decided to evaluate blackrock inc and kkk & co inc. the table below provides 13 months of historical prices for each company. assume that neither company paid a dividend during this period calculate the monthly rate of return for each stock a. calculate the monthly rate of return for each stock. b. calculate the average monthly return for each stock. c. calculate the standard deviation of monthly returns for each stock d. based on parts b and c, determine the coefficient of variations for each stock. month blk stock price kkk stock price may 20 $485.80 $24.37 apr 20 502.04 25.21 mar 20 436.66 23.47 feb20 459.52 28.49 jan 20 523.38…arrow_forward

- Beasley Ball Bearings paid a $4 dividend last year. The dividend is expected to grow at a constant rate of 5 percent over the next four years. The required rate of return is 12 percent (this will also serve as the discount rate in this problem). Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. e. Compute the current value of the stock. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) f. Use the formula given below to show that it will provide approximately the same answer as part e. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) P0 = D1 Ke − g g. If current EPS were equal to $5.51 and the P/E ratio is 20% higher than the industry average of 10, what would the stock price be? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) h. By what dollar amount is the stock price…arrow_forwardYou are analyzing HUE stock. You expect that the dividends over the next three years will be $1.75 in year 1, $1.90 in year 2, $2.00 in year 3 and that HUE’s stock price will be $46.32. What is the intrinsic value of HUE’s stock today if your required return is 12 percent? 2. Because P/E ratios use past earnings, they tend to _________ when an economy peaks and starts to decline. Group of answer choices Stay the same Increase Decrease We cannot tell from the information provided.arrow_forwardThe investment banking firm of Einstein & Co. will use a dividend valuation model to appraise the shares of the Modern Physics Corporation. Dividends (D₁) at the end of the current year will be $1.40. The growth rate (g) is 10 percent and the discount rate () is 14 percent. a. What should be the price of the stock to the public? (Do not round intermediate calculations and round your answer to 2 decimal places.) Price of the stock b. If there is a 5 percent total underwriting spread on the stock, how much will the issuing corporation receive? (Do not round intermediate calculations and round your answer to 2 decimal places.) Net price to the corporation c. If the issuing corporation requires a net price of $33.50 (proceeds to the corporation) and there is a 5 percent underwriting spread, what should be the price of the stock to the public? (Do not round intermediate calculations and round your answer to 2 decimal places.) Necessary public pricearrow_forward

- Your task is to find the value of the stock given the following forecasts about the dividends: The company has just paid out 8EUR per share as dividends to its investors. For the next four years, the forecasted dividends are also 8EUR each year. However, after four years, the dividends are expected to exhibit a negative growth (e.g. decline) by 4% per year. The required return, given the level of risk, from an investment into stock is 14%. Find the value of stock. If the current stock price is 60 euros, would you recommend buying this stock? Why?arrow_forwardYou are evaluating a company's stock. The stock just paid a dividend of $1.75. Dividends are expected to grow at a constant rate of 5 percent for a long time into the future. The required rate of return (Rs) on the stock is 12 percent. What is the fair present value? Please show all the steps, including the equation(s).arrow_forwardIn practice, a common way to value a share of stock when a company pays dividends is to value the dividends over the next five years or so, then find the terminal stock price using a benchmark PE ratio. Suppose a company just paid a dividend of $1.20. The dividends are expected to grow at 10 percent over the next five years. In five years, the estimated payout ratio is 25 percent and the benchmark PE ratio is 22. a. What is the target stock price in five years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the stock price today assuming a required return of 10 percent on this stock? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Stock price in 5 years b. Stock price today Iarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education