Concept explainers

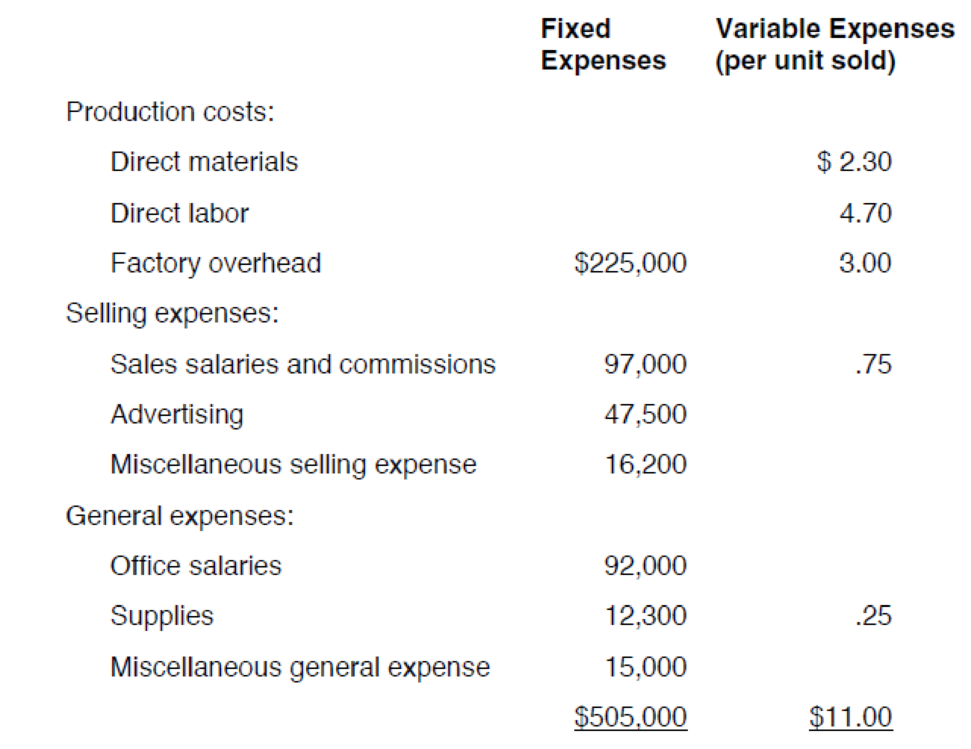

Poleski Manufacturing, which maintains the same level of inventory at the end of each year, provided the following information about expenses anticipated for next year:

The selling price of Poleskiʼs single product is $16. In recent years, profits have fallen and Poleskiʼs management is now considering a number of alternatives. Poleski wants to have a net income next year of $250,000, but expects to sell only 120,000 units unless some changes are made.

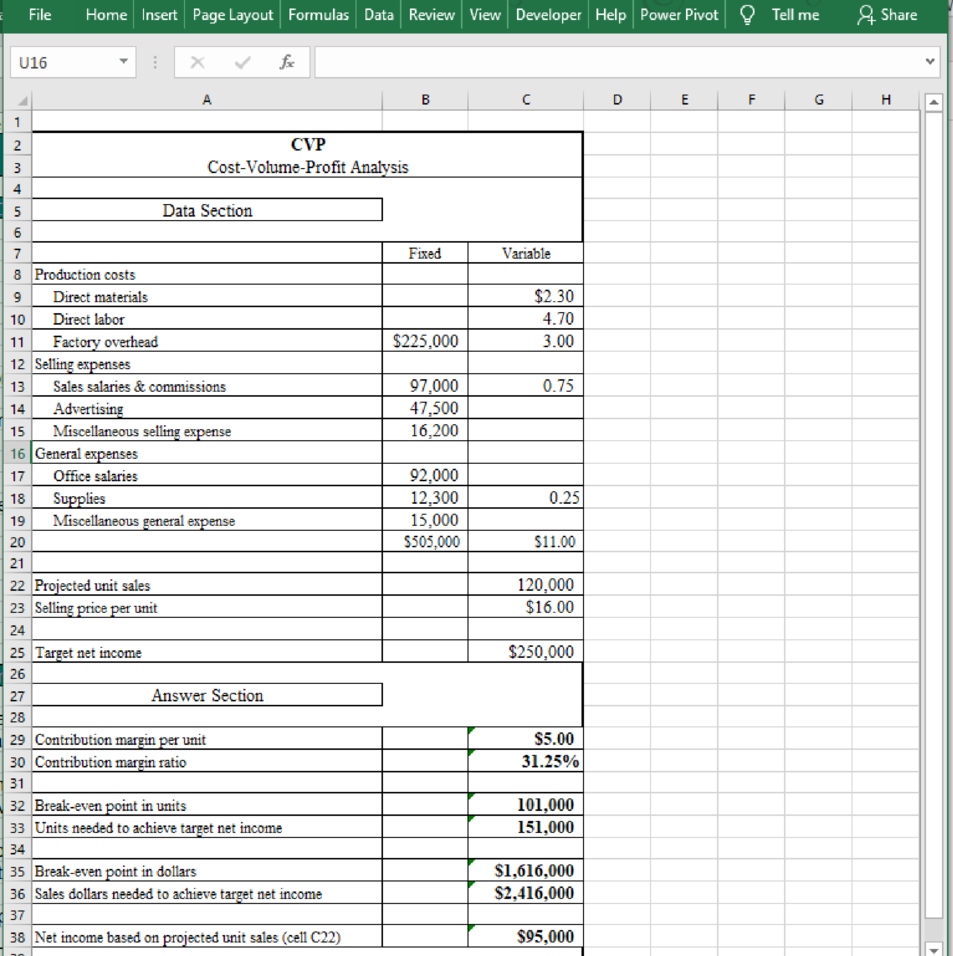

The president of Poleski has asked you to calculate the companyʼs projected net income (assuming 120,000 units are sold) and the sales needed to achieve the companyʼs net income objective for next year. Also, compute Poleskiʼs contribution margin per unit, contribution margin ratio, and break-even point for next year. The worksheet CVP has been provided to assist you. Note that the data from the problem have already been entered into the Data Section of the worksheet.

Compute the projected net income of the company and the sales required to attain the net income objective for next year. Calculate contribution margin per unit, contribution margin ratio, and break-even point for next year.

Explanation of Solution

The projected net income, sales required to attain the net income, contribution margin per unit, contribution margin ratio, and break-even pointfor next year are calculated as follows:

Table (1)

Want to see more full solutions like this?

Chapter 18 Solutions

Excel Applications for Accounting Principles

- Not use ai solution..arrow_forwardWhat role does assurance boundary definition play in attestation? a) Standard limits work always b) Boundaries never matter c) All areas need equal coverage d) Engagement scope limits determine verification responsibilities. Want answer to this accounting mcqarrow_forwardGeneral Accounting questionarrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning